Latest

The Narrowing Path: Trade and Development in a New Era

Pinelopi Koujianou Goldberg, Michele Ruta, Feb 11,

2026

International trade will continue to be important for economic performance..

Robots as Guardians: How Automation Has Made Chinese Workplaces Safer

Wei Luo, Lixin Tang, Yaxin Yang, Xianqiang Zou, Feb 03,

2026

Industrial robots are often discussed primarily in terms of their employment effects. New evidence from China shows that automation has also delivered substantial improvements in workplace safety, with sharp reductions in accidents and fatalities.

When Industrial Policy Meets Comparative Advantage: Lessons from “Made in China 2025”

Xiuping Hua, Yong Wang, Junjie Xia, Haochen Zhang, Jan 28,

2026

In this paper, the authors contribute to this debate through the lens of a novel perspective: the congruence between firm’s factor input structures and local endowment structures.

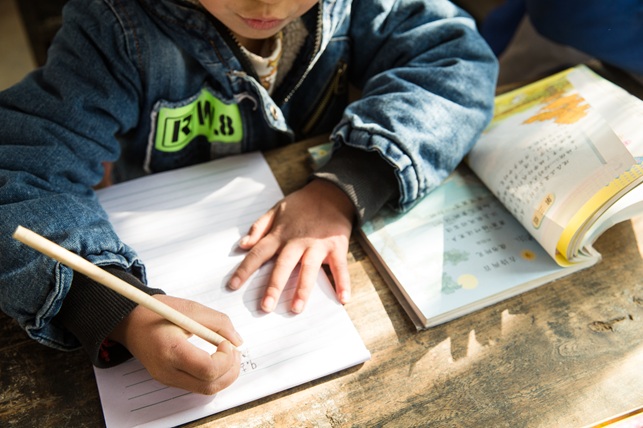

From Rural Schools to City Factories: Assessing the Quality of Chinese Rural Schools

Eric A. Hanushek, Le Kang, Xueying Li, Lei Zhang, Jan 21,

2026

Rural school quality is low and varies significantly across provinces. We estimate provincial variations in school quality from the labor market returns to years of schooling of interprovincial rural migrants educated in different home provinces but working in the same urban labor market. School quality is higher and provincial variation is lower for younger cohorts, indicating at least partial effectiveness of recent policies aimed at improving the quality of rural schools.

Learning by Trading: How Reforming Trade Policy Boosted Firm Productivity in China

Yunong Li, Yi Lu, Jianguo Wang, Jan 14,

2026

In China, granting firms the right to trade internationally boosted productivity, with gains growing over time and shared with workers through higher wages.

High-Speed Rail and Local Agricultural Development

Xiaoguang Chen, Binlei Gong, Zhilong Qin, Xiaoli Wang, Jan 07,

2026

We study China’s extensive high-speed rail (HSR) expansions to address a key policy concern that large-scale transport infrastructure may undermine agriculture and food security. We find that HSR expansion facilitates the outflow of labor and land from agriculture, yet does not reduce agricultural output because productivity rises.

How Rural Pensions Boosted China's Economy

Qingen Gai, Naijia Guo, Bingjing Li, Qinghua Shi, Xiaodong Zhu, Dec 31,

2025

China’s New Rural Pension Scheme unexpectedly lowered the high cost of migration by freeing younger workers from household duties – boosting migration, wages, household welfare, and even national GDP.

Integrating Jurisdictions, Dividing Workers: Consolidation, Labor Markets, and the Migrant-Local Wage Gap in China

Shiyu Bo, Yi Wang, Dec 24,

2025

We examine how China’s recent wave of city-county mergers reshaped local labor markets. Using individual-level data from the China Migrants Dynamic Survey and a staggered difference-in-differences approach, we find that the reform boosted wages by strengthening local economies and improving governance...

The Rise of China as an International Lender

Zhengyang Jiang, Dec 16,

2025

In the past decade, China has become the largest creditor to developing countries, surpassing the IMF, World Bank, and Paris Club countries. This column discusses how China's overseas lending interacts with US monetary policy – another key driver of the global financial cycle. It finds that Chinese and US policies jointly influence the level and the distribution of risk exposures in developing countries. As a result of China's expanding role in international lending, the architecture of global financial intermediation is also undergoing a fundamental transformation, carrying important implications for the stability and functioning of the international monetary system.

How Do New Firms Shape Regional Economic Growth in China?

Loren Brandt, Gueorgui Kambourov, Kjetil Storesletten, Dec 09,

2025

Barriers to entry facing new firms are a major source of regional economic differences. Removing these barriers can play an important role in economic convergence and growth.

Recent

How Liberalizing Trade with China Led to a Boom in International Students in the US

Gaurav Khanna, Kevin Shih, Ariel Weinberger, Mingzhi Xu, Miaojie Yu, Aug 16,

2023

Focusing on China’s accession to the World Trade Organization, we show that Chinese cities with more exposure to trade liberalization sent more students to US universities.

Regional Variation of GDP per Head within China, 1080–1850: Implications for the Great Divergence Debate

Stephen Broadberry, Hanhui Guan, Sep 28,

2022

We provide the first regional breakdown of GDP per head for China from the Song dynasty to the Qing, so that regions of similar size can be compared between Europe and Asia to establish the timing of the Great Divergence of living standards.

Combating Cross-Border Externalities

Shiyi Chen, Joshua Graff-Zivin, Huanhuan Wang, Jiaxin Xiong, Sep 21,

2022

China implemented a pioneering policy in 2011, the Ecological Compensation Initiative (ECI), which establishes side payments between upstream and downstream provinces in the Xin’an River Basin.

Assessing and Addressing the Coronavirus-Induced Economic Crisis: Evidence from 1.5 Billion Sales Invoice

Zhuo Chen, Pengfei Li, Li Liao, Zhengwei Wang, Aug 31,

2022

We probe the effects of the COVID-19 pandemic and the subsequent containment policies on business activities in China by exploiting big data on 1.5 billion sales invoices. The average drop in sales was between 23% and 35%, depending on firm size, for the 12-week period after the Wuhan lockdown.

Industrial Land Discount in China: A Public Finance Perspective

Zhiguo He, Scott Nelson, Yang Su, Anthony Lee Zhang, Fudong Zhang, Jul 25,

2022

Local governments, which serve as monopolistic land sellers in China, face a trade-off when deciding to supply residential land versus industrial land. This trade-off is determined by the different time profiles of revenues from industrial and residential land sales, local governments’ financial constraints, and the extent of local governments’ tax revenue sharing with other levels of government.

Dollar Funding Stresses in China

Laura Kodres, Leslie Sheng Shen, Darrell Duffie, Jul 13,

2022

The need for US dollar funding during the financial stresses of March 2020, as the COVID-19 pandemic shocked markets, was evident in a number of countries (Avdjiev, Eren, and McGuire 2020; Bahaj and Reis 2020).

Serial Entrepreneurship in China

Loren Brandt, Ruochen Dai, Gueorgui Kambourov, Kjetil Storesletten, Xiaobo Zhang, Jul 06,

2022

New firms have been an important engine of growth in the Chinese economy (Brandt, Van Biesebroeck, and Zhang 2012). Drawing on data on the universe of all firms in China, we study entrepreneurship and the creation of new firms in China through the lens of entrepreneurs who operate a series of firms over their lifetime, i.e., serial entrepreneurs (SE).

An Empirical Overview of Chinese Capital Market

Grace Xing Hu, Jun Pan, Jiang Wang, Jun 29,

2022

We provide an empirical review of the Chinese capital market, focusing on the basic return and risk characteristics of its major asset classes, as well as a comparison to the US market. All major asset classes in China have significant higher volatilities than their counterparts in the US market, but they do not always yield larger returns. Small-company stocks, short-, medium-, and long-term treasury bonds outperform their US counterparts, while large stocks underperform and long-term enterprise bonds yield similar returns.

Mapping U.S.-China Technology Decoupling, Innovation, and Firm Performance

Pengfei Han, Wei Jiang, Danqing Mei, Dec 01,

2021

We develop measures for technology decoupling and dependence between the U.S. and China based on combined patent data. The first two decades of the century witnessed a steady increase in technology integration (or less decoupling), but China’s dependence on the U.S. increased (decreased) during the first (second) decade. Decoupling in a technology field predicts China’s growing dependence on U.S. technology, which, in turn, predicts less decoupling further down the road...

School Enrollment Restriction on Migrant Children and Human Capital Losses

Zibin Huang, Nov 24,

2021

In China, migrant children are at a disadvantaged and sometimes cannot enroll in public schools in migration destinations due to policy restrictions. Some migrant workers then have to leave their children behind in their hometowns, which causes the left-behind children problem. This study finds that if the enrollment restriction on migrant children is relaxed, migration of parents and children will increase, and the average human capital in the society will also increase. Low-skill families from small cities benefit most.

Institutional Sponsors

Executive Committee

Advisory Board

Editorial Board

- Laura Alfaro

- Chong-En Bai

- Panle Jia Barwick

- Thorsten Beck

- Loren Brandt

- Markus Brunnermeier

- Hongbin Cai

- Chun Chang

- Hui Chen

- Kaiji Chen

- Xilu Chen

- Lin William Cong

- Yongheng Deng

- Jun Du

- Li Gan

- Cathy Ge Bao

- Joseph Gyourko

- Zhiguo He

- Harrison Hong

- Junjie Hong

- Yongmiao Hong

- Chang-Tai Hsieh

- Dashan Huang

- Yi Huang

- Yiping Huang

- Wenxi Jiang

- Keyu Jin

- Jiandong Ju

- Andrew Karolyi

- Laura Kodres

- Hongbin Li

- Shu Lin

- Jane Yu Liu

- Laura Xiaolei Liu

- Zheng Liu

- Prakash Loungani

- Xin Meng

- Jianjun Miao

- Albert Park

- Guangyu Pei

- Lin Peng

- Nancy Qian

- Yingyi Qian

- Leslie Sheng Shen

- Kang Shi

- Yushui Shi

- Zheng Song

- Mark M. Spiegel

- Avanidhar Subrahmanyam

- Guoqiang Tian

- Cong Wang

- Jiang Wang

- Neng Wang

- Pengfei Wang

- Bin Wei

- Yi Wen

- Junjie Xia

- Danyang Xie

- Daniel Yi Xu

- Lixin Colin Xu

- Zhigang Yuan

- Vivian Yue

- Tao Zha

- Bohui Zhang

- Huacheng Zhang

- Jun Zhang

- Junsen Zhang

- Tianyu Zhang

- Xiaobo Zhang

- Yongsheng Zhang

- Yaohui Zhao

- Li-An Zhou

- Ning Zhu

- Xiaodong Zhu

Facebook

Facebook  Twitter

Twitter  Instagram

Instagram WeChat

WeChat  Email

Email