Decoupling of Incomes and CO₂ Emissions in China and the US

Johns Hopkins University (The views expressed are those of the authors and should not be attributed to Johns Hopkins University.)

Carbon emissions and incomes generally move in tandem; when they move in opposite directions, the phenomenon is often referred to as “decoupling” of income and emissions. This column provides evidence on the extent of decoupling of CO₂ emissions from incomes in two countries,China and the United States, through the lens of the standard trend-cycle decomposition analysis commonly used by macroeconomists. By applying statistical techniques to separate long-term structural trends from short-term fluctuations, we can identify whether observed emission reductions represent durable decoupling of emissions and income or merely reflect cyclical downturns in the economy. This methodological approach is crucial because conventional analyses in the media and blogosphere often conflate temporary changes —driven by economic recessions, changes in political parties and policies, or external shocks—with the sustained structural transformations needed for genuine decoupling.

Our analysis shows that China and the United States have both made progress in reducing CO₂ emissions relative to GDP. The United States has shown steady decline in CO₂ emissions per unit of GDP since 1990, while China had high levels of CO₂ intensity of income until around 2012, but has also been showing a declining trend since then.

To understand whether declines in the carbon intensity of income reflect genuine structural decoupling and not cyclical fluctuations, we apply the popular Hodrik–Prescott (HP) filter to decompose the log of emissions and GDP into long-run trends and short-run cycles. By removing short-term fluctuations, the HP trend captures longer-term structural shifts in the CO₂ intensity of emissions relative to growth. The HP filter is the most common procedure used in macroeconomics to separate series into trend and cycle components. It is derived by minimizing a loss function that penalizes excessive fluctuations in the trend component, thud delivering a smooth series. A linear trend can be obtained as a special case of the HP filter.

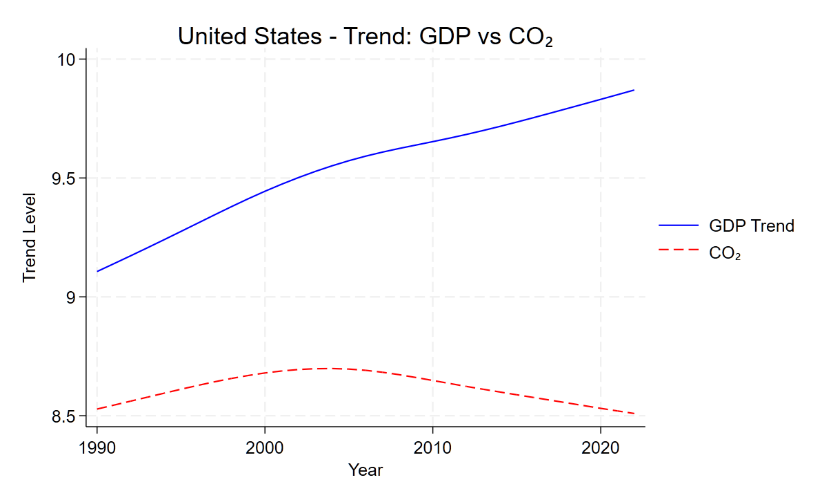

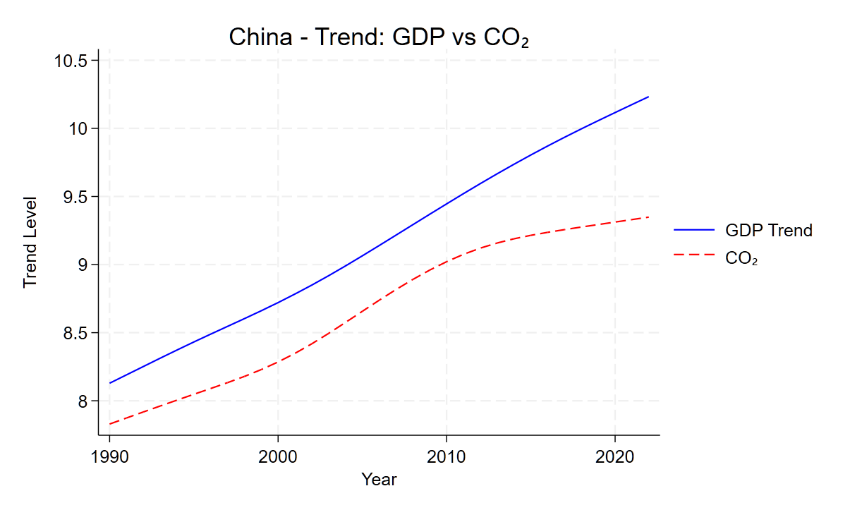

Figure 1 displays HP-filtered trends for GDP and CO₂ emissions in China and the United States. The data are annual from 1990 to the present. Data sources are given in Cohen et al (2019). In both countries, GDP has followed a steady upward trajectory. However, the behavior of the trend in emissions diverges. In the United States, emissions began to flatten in the early 2000s, indicating a fairly early onset of trend decoupling. It is noteworthy that political transitions in the mid-2010s did not disrupt this trend, suggesting that it was driven more by structural factors than by short-term political cycles. One important structural factor, identified in IMF research, was the sharp reduction in fossil fuel usage in the US electricity sector starting in the mid-2000s.

Figure 1. Trends in GDP and CO₂ emissions in the United States and China: Same Direction, Different timing And Speed

The x-axis shows the log of income or emissions. In China, emissions initially grew in line with GDP but began to decelerate around 2012, suggesting a more recent shift toward decoupling between emissions and income than in the United States. This timing coincides with the start of a new national leadership that placed stronger emphasis on green development, low-carbon transition, and ecological modernization, which may have contributed to the observed structural shift.

Conclusion

The statistical evidence thus suggests that the progress on trend decoupling has been fairly steady in both countries, despite concerns expressed in media sources that green policies may be unduly affected by political transitions or shifting priorities of governments. Despite differences in timing and pace, both China and the United States show clear signs of decoupling of CO₂ emissions from income. The US demonstrates earlier onset of trend decoupling, while China shows a pronounced shift beginning around 2012.The published academic papers on which this column is based (listed in the References below) provide additional details and show the robustness of these results to alternate methods of trend/cycle decomposition.

Reference

Hodrick, Robert J., and Edward C. Prescott (1997). "Postwar U.S. Business Cycles: An Empirical Investigation." Journal of Money, Credit and Banking, 29(1): 1-16.

Cohen, G., Jalles, J. T., Loungani, P., Marto, R., & Wang, G. (2019). Decoupling of emissions and GDP: Evidence from aggregate and provincial Chinese data. Energy Economics, 77, 105-118.

Cohen, G and Loungani, P., (2018). Decoupling of emissions and incomes: It’s happening. Vox, 223 October 2018.

Latest

Most Popular

- VoxChina Covid-19 Forum (Second Edition): China’s Post-Lockdown Economic Recovery VoxChina, Apr 18, 2020

- China’s Great Housing Boom Kaiji Chen, Yi Wen, Oct 11, 2017

- China’s Joint Venture Policy and the International Transfer of Technology Kun Jiang, Wolfgang Keller, Larry D. Qiu, William Ridley, Feb 06, 2019

- The Dark Side of the Chinese Fiscal Stimulus: Evidence from Local Government Debt Yi Huang, Marco Pagano, Ugo Panizza, Jun 28, 2017

- Wealth Redistribution in the Chinese Stock Market: the Role of Bubbles and Crashes Li An, Jiangze Bian, Dong Lou, Donghui Shi, Jul 01, 2020

- What Is Special about China’s Housing Boom? Edward L. Glaeser, Wei Huang, Yueran Ma, Andrei Shleifer, Jun 20, 2017

- Evaluating Risk across Chinese Housing Markets Yongheng Deng, Joseph Gyourko, Jing Wu, Aug 02, 2017

- Privatization and Productivity in China Yuyu Chen, Mitsuru Igami, Masayuki Sawada, Mo Xiao, Jan 31, 2018

- How did China Move Up the Global Value Chains? Hiau Looi Kee, Heiwai Tang, Aug 30, 2017

- China’s Shadow Banking Sector: Wealth Management Products and Issuing Banks Viral V. Acharya, Jun Qian, Zhishu Yang, Aug 09, 2017

Facebook

Facebook  Twitter

Twitter  Instagram

Instagram WeChat

WeChat  Email

Email