Chinese Corporate Credit Ratings: Comparing Global and Domestic Agencies

When comparing the credit ratings of domestic and global agencies on Chinese corporations, because of the differences in ratings scales, it is best to focus on the domestic and global agency orderings of relative credit risk. Testing for differences in the determinants of ratings, we find that asset size is weighed more heavily as a positive factor by domestic agencies, while profitability and state-ownership are weighed more positively by global rating agencies, which also weigh leverage more heavily as a negative factor. In spite of these differences, both domestic and global ratings appear to be priced into the market values of rated bonds.

It is widely reported that the credit ratings on Chinese firms issued by domestic rating agencies tend to be much higher than those issued by global rating agencies such as Moody’s and Standard & Poor’s. For instance, at the beginning of 2017, the latest credit rating assigned by Standard and Poor’s to the China Petroleum and Chemical Corporation was A+, while a number of Chinese domestic rating agencies had assigned a AAA rating, four notches higher. As a result of large differences such as these, journalists and practitioners often downplay the value of Chinese domestic agency ratings (Law, 2015; Wilson, 2006).

It is important to keep in mind, however, that if domestic agency ratings are consistently higher than those issued by global agencies, the relative rank order of the domestic ratings will likely contain more information than the simple difference with the global agency rating. To continue with the above example, the fact that a Chinese rating agency rates China Petroleum and Chemical Corporation AAA is more likely to matter because the same agency rates some other Chinese firms lower at AA+ or AA.

Actually, in bond markets around the world, it is more the norm than the exception that domestic agencies rate domestic firms higher than do the global agencies. Japanese and Korean corporate bond markets also show discrepancies in ratings scales between domestic and global agencies (Packer 2002; GlobalCapital 2013). Though the difference in scales is particularly large in China, the existence of a difference in scales between domestic and global agencies is by no means exceptional.

Academic research on credit ratings in China has tended to focus on the ratings of domestic agencies (Dhawan and Yu, 2015; Livingston, Naranjo, and Zhou, 2007). Earlier this year, the Chinese government agreed with the US government on a plan to open further the Chinese domestic credit rating market to foreign participation (Groppe, 2017). How the ratings of domestic and global agencies on Chinese credits should be compared is thus a topic of increasing interest, and our work is, to our knowledge, the first to address this issue (Jiang and Packer, 2017).

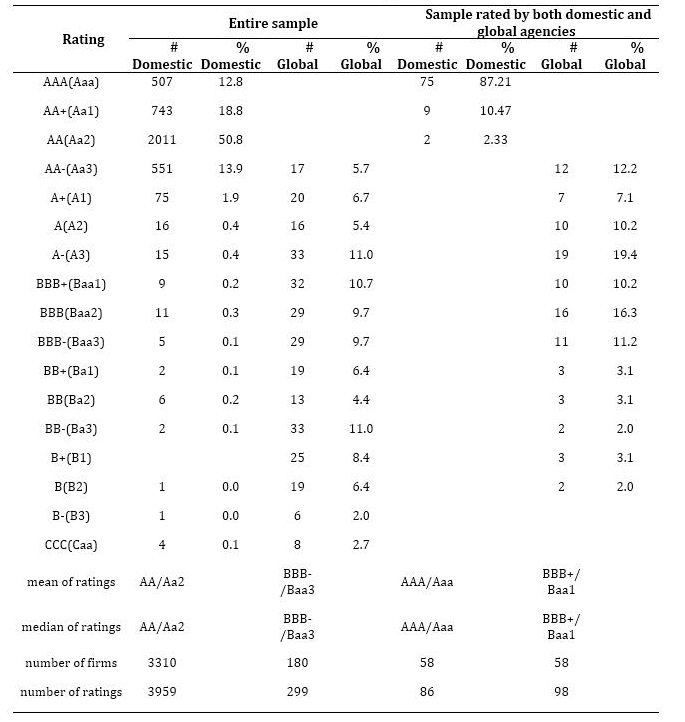

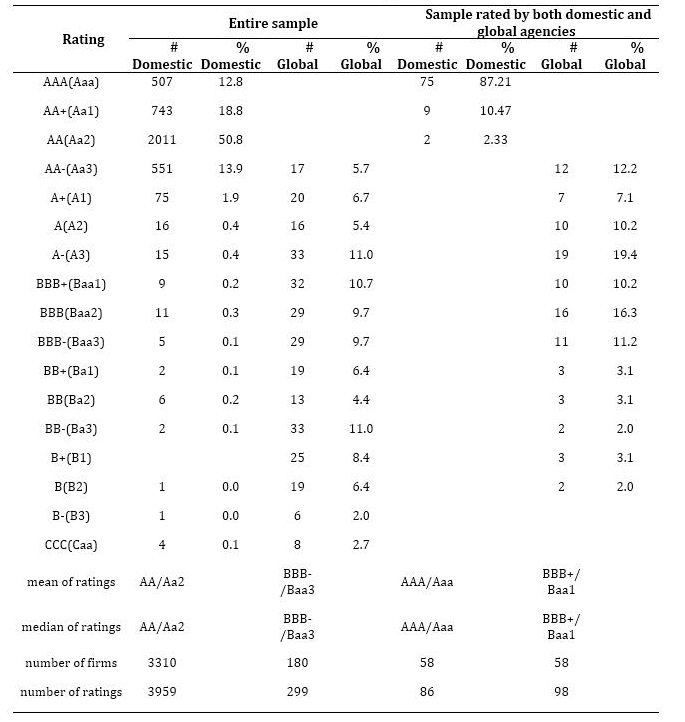

We collect ratings data as follows. We focus on the long-term issuer ratings, both of domestic and global rating agencies, for non-financial Chinese firms where 2015 is the benchmark year. When we observe multiple rating assignments in 2015 from a single agency, we choose the first one of those assigned in 2015. If there was no rating assignment in 2015, but there was one in 2013 or 2014, we take the latest one assigned (and assume it was still valid in 2015). We do not consider rating assignments before 2013. The Moody’s ratings were taken from www.moodys.com; Standard and Poor’s ratings from www.capitaliq.com, and domestic ratings from Wind. There are 3959 domestic and 299 global agency ratings in total.

Notes: Moody’s uses different symbols than S&P and the Chinese rating agencies, yet there is a widely known one-to-one correspondence between the symbols used by Moody’s and the others. To take three examples, in place of BBB+, BBB and BBB-, the corresponding Moody’s symbols are Baa1, Baa2, and Baa3. The mean of a ratings distribution is calculated by first assigning a numeric value to each rating as follows: AAA/Aaa=17, AA+/Aa1=16, AA/Aa2=15, AA-/Aa3=14, A+/A1=13, and so forth.

We report the distribution of our final ratings sample—both number and percent—in Table 1. The distribution of the domestic ratings is clearly centered at higher levels than global ratings; both the median and average for the domestic ratings are higher than global ratings by seven notches (AA/Aa2 vs. BBB-/Baa3). When only ratings on firms assessed by both domestic and global ratings are considered, though the overall credit quality tends to be higher, the gap between the average and median of the two samples remains at seven notches (AAA/Aaa vs. BBB+/Baa1). In Livingston et al (2017), distinction is made between the domestic agencies that are affiliated with (have minority ownership) global agencies and those that are not. The differences between the average ratings of the different types of domestic rating agencies are quite small relative to the differences documented here between domestic and global agencies. The study does not examine the actual rating assigned by global (foreign) rating agencies.

As discussed at the outset, the direct comparisons of the ratings distributions of domestic and global agency ratings may overlook an important meaning of ratings. Ratings serve the function of expressing the agency’s view of the relative credit risk of various entities. Although the domestic rating agencies adopt rating symbols that correspond to those in use by global rating agencies, given the stark difference in the distributions of global and domestic ratings, it may make more sense to compare the rank-ordering of various risks by domestic and global agencies. In theory it is possible to observe vastly different distributions of ratings of global versus domestic agencies, even if the rank-ordering of risks remains virtually the same.

For firms jointly rated by both domestic and global agencies, we adjust the global agency ratings to make them directly comparable to domestic agency ratings. The domestic ratings of firms jointly rated by domestic and global agencies all fall in the ratings categories of AAA, AA+, and AA. We rank-order the global ratings, and then assign them to one of three rating categories so as to achieve similar proportions as the domestic ratings while weakly preserving a rank-ordering that corresponds to the original ratings. For instance, the original global ratings that are in the highest rating categories are transformed to an adjusted global rating of AAA; those that are immediately lower are changed to an adjusted global rating of AA+, and the remaining global ratings receive an adjusted global rating of AA. The resulting adjusted global ratings are now comparable to domestic ratings though they are much less granular than before, with a trimodal distribution resembling that of domestic ratings (by construction).

An important outcome of the adjustment is that it clarifies that the global and domestic ratings comprise different rank-orderings of credit risk. While most firms have the same adjusted global and domestic ratings, about 24 percent do not. These differences may be the result of random noise, or different rating functions.

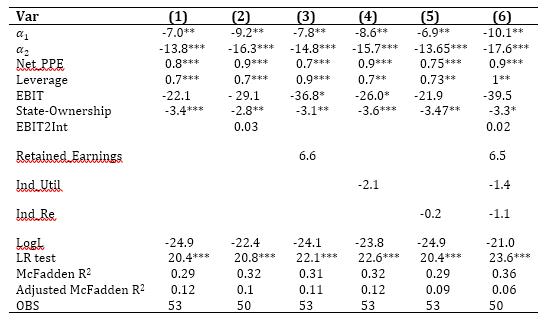

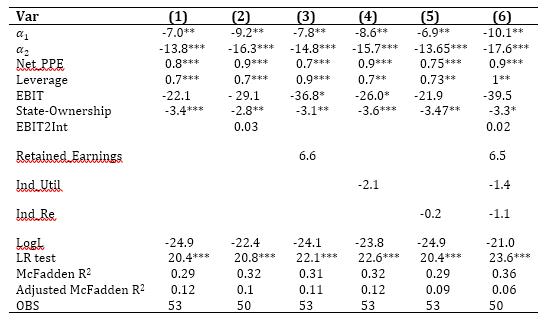

Employing a cumulative logistic model that associates different firm variables with the probability of the domestic rating being higher, the same, or lower than the (adjusted) global rating, we find that higher asset size and higher leverage tend to result in firms receiving higher domestic ratings than adjusted global ratings. By contrast, higher profitability or state-ownership are more likely to result in firms receiving higher adjusted global ratings than domestic ratings (Table 2). This surprising result suggests that it may be global agencies that tend to place higher weight on the implicit guarantees associated with state ownership than domestic agencies, at least when assessing relative risks. These effects are stable even after we control for other financial variables, as well as key industry fixed effects. It will be interesting in future work to see if there is any distinction in the result based on the type of state ownership, similar to what Chen, Firth, and Xu (2009) find for corporate profitability and productivity.

Notes: Net_PPE is the natural logarithm of total fixed assets; Leverage is the ratio of total assets in book value to total equity in book value; EBIT is earnings before interest and taxes; State_Ownership is a dummy variable indicating whether or not the issuer is state owned; Retained_Earnings is the ratio of retained earnings to total assets in book value; Ind_Util and Ind_Re are dummy variables for the utilities and real estate industries, respectively. α_1,α_2 are intercepts estimated for the trinomial logistic model. The non-rating data are from Wind. The statistical tests for the coefficients are approximated by the normal distribution. ***, **, * indicate statistical significance at the 1%, 5%, and 10%levels, respectively. Although there are nearly 300 global ratings, there are only about 50 cases of joint domestic and global agency rated firms available for the regressions. This is both because we have combined the global ratings into an average global rating on a firm-wise basis, and because the financial data are not available for every rated firm.

We also estimate separate domestic and global agency regressions to shed further light on reasons for the differences in rank-ordering between domestic and global agencies. We find that asset size is weighed more as a positive factor by domestic agencies, and that leverage is weighed more as a negative factor by global agencies. By contrast, profitability and state-ownership are weighed more positively by global rating agencies. The economic significance of the effects, in terms of the impact of a one standard deviation change in the explanatory variable (or a simple switch from 0 to 1 in the case of the dummies), appears to be greatest for asset size and state ownership.

The above-stated impacts are robust to the inclusion of numerous control variables such as retained earnings, interest coverage, and various industry dummy variables. They are also basically robust to variations in the choice of global ratings, in the alignment procedure used to transform global ratings, and whether the sample is extended to include firms that are not jointly rated by domestic and global agencies.

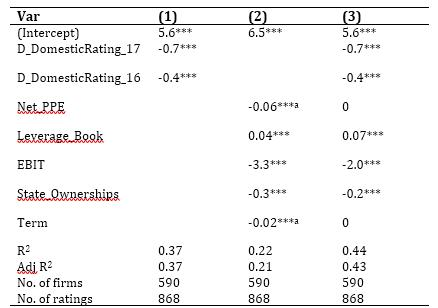

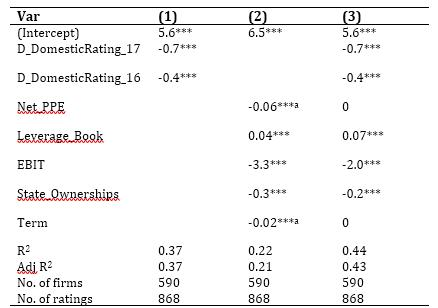

We also provide an initial exploration of the market impact of domestic and global agency ratings. In simple regressions of the logged credit spreads of more than 800 Chinese corporate bonds on domestic ratings and publicly available corporate financial variables (Table 3), domestic ratings appear indeed to add explanatory power beyond those provided by financial statements and issue variables only. They also explain more of the variation in credit spreads at issuance on their own than do the non-ratings variables alone. In (unreported) regressions with a much smaller sample, global ratings also appear to add value at the margin, though the sample size of jointly rated firms with complete financial statement data is too small (25) to definitively compare the information content of domestic versus global agency ratings.

Notes: The Variable "term" is the maturity in unit of years. The variables D_DomesticRating_17", "D_DomesticRating_16" are dummy variables for domestic ratings being AAA and AA+ respectively. ***, **, * indicate statistically significance at the 1%, 5%, and 10% levels, respectively. The coefficients for Net_PPE and Term in regression (3) are 0.001 and -0.003, respectively after rounding at three digits.

In sum, we have documented that the domestic rating agencies rate Chinese companies at much higher levels, on average, than do global rating agencies. Ratings differences can be driven by differences in ratings scales (i.e., the probabilities of default associated with any rating grade). But ratings differences can also be driven by different rank-orderings of credit risk. Our results suggest that, beyond the simple differences in the ratings scales, global and domestic agencies have systematic differences of opinion that reflect different weights attached to the factors underlying the default risk of Chinese firms.

In future research, expanding the size of the sample both cross-sectionally and longitudinally to include more bonds and more ratings will help to confirm the robustness of the results. It will be of further interest to see how the ratings of domestic and global agencies line up with corporate bond defaults in China, which have increased more recently.

The views expressed here are those of the authors and do not necessarily represent the views of the People’s Bank of China or the Bank for International Settlements. This note draws heavily on the authors’ BIS working paper, No. 648, Credit ratings of domestic and global agencies: What drives the differences in China and how are they priced? June 2017.)

Chen, Gongmeng, Michael Firth, and Liping Xu (2009). “Does the Type of Ownership Control Matter? Evidence from China’s Listed Companies.” Journal of Banking and Finance, 33, 171-181. Available at https://www.sciencedirect.com/science/article/pii/S0378426607004244

Dhawan, Raghav, and Fan Yu (2015). “Are Credit Ratings Relevant in China’s Corporate Bond Market?” The Chinese Economy 48 (3): 235–50. Available at http://www.tandfonline.com/doi/full/10.1080/10971475.2015.1031614.

GlobalCapital (2013). “Korean Rating Agencies Overrated.” May 15, 2013. Available at http://www.globalcapital.com/article/k32v3x0kfrz0/korean-credit-rating-agencies-overrated-opinion.

Groppe, Maureen (2017). “U.S. announces trade progress with China in 10 key areas.” Retrieved on May 13, 2017 at https://www.usatoday.com/story/news/politics/2017/05/11/us-announces-trade-progress-china-10-key-areas/101571580/.

Jiang, Xianfeng, and Frank Packer (2017). “Credit ratings of domestic and global agencies: What drives the differences in China and how are they priced?” BIS working paper, No. 648. Available at https://www.bis.org/publ/work648.htm.

Law, Fiona (2015). “Can All Chinese Debt Be Rated Top Quality?” The Wall Street Journal, July 26, 2015. Available at http://www.wsj.com/articles/can-all-chinese-debt-be-rated-a-1437942674.

Livingston, Miles, Winnie P.H. Poon, and Lei Zhou (2017). “Are Chinese Credit Ratings Relevant? A Study of the Chinese Bond Market and Credit Rating Industry.” January 4. Available at SSRN: https://ssrn.com/abstract=2893776 or http://dx.doi.org/10.2139/ssrn.2893776.

Livingston, Miles, Andy Naranjo, and Lei Zhou (2007). “Asset Opaqueness and Split Bond Ratings.” Financial Management 36 (3): 49–62. Available at http://onlinelibrary.wiley.com/doi/10.1111/j.1755-053X.2007.tb00080.x/abstract.

Packer, Frank (2002). “Credit Ratings and the Japanese Corporate Bond Market.” In Ratings, Rating Agencies and the Global Financial System, edited by Richard M. Levich, Giovanni Majnoni, and Carmen Reinhart, 139–58. Springer. Available at https://link.springer.com/content/pdf/10.1007/978-1-4615-0999-8_9.pdf.

It is widely reported that the credit ratings on Chinese firms issued by domestic rating agencies tend to be much higher than those issued by global rating agencies such as Moody’s and Standard & Poor’s. For instance, at the beginning of 2017, the latest credit rating assigned by Standard and Poor’s to the China Petroleum and Chemical Corporation was A+, while a number of Chinese domestic rating agencies had assigned a AAA rating, four notches higher. As a result of large differences such as these, journalists and practitioners often downplay the value of Chinese domestic agency ratings (Law, 2015; Wilson, 2006).

It is important to keep in mind, however, that if domestic agency ratings are consistently higher than those issued by global agencies, the relative rank order of the domestic ratings will likely contain more information than the simple difference with the global agency rating. To continue with the above example, the fact that a Chinese rating agency rates China Petroleum and Chemical Corporation AAA is more likely to matter because the same agency rates some other Chinese firms lower at AA+ or AA.

Actually, in bond markets around the world, it is more the norm than the exception that domestic agencies rate domestic firms higher than do the global agencies. Japanese and Korean corporate bond markets also show discrepancies in ratings scales between domestic and global agencies (Packer 2002; GlobalCapital 2013). Though the difference in scales is particularly large in China, the existence of a difference in scales between domestic and global agencies is by no means exceptional.

Academic research on credit ratings in China has tended to focus on the ratings of domestic agencies (Dhawan and Yu, 2015; Livingston, Naranjo, and Zhou, 2007). Earlier this year, the Chinese government agreed with the US government on a plan to open further the Chinese domestic credit rating market to foreign participation (Groppe, 2017). How the ratings of domestic and global agencies on Chinese credits should be compared is thus a topic of increasing interest, and our work is, to our knowledge, the first to address this issue (Jiang and Packer, 2017).

We collect ratings data as follows. We focus on the long-term issuer ratings, both of domestic and global rating agencies, for non-financial Chinese firms where 2015 is the benchmark year. When we observe multiple rating assignments in 2015 from a single agency, we choose the first one of those assigned in 2015. If there was no rating assignment in 2015, but there was one in 2013 or 2014, we take the latest one assigned (and assume it was still valid in 2015). We do not consider rating assignments before 2013. The Moody’s ratings were taken from www.moodys.com; Standard and Poor’s ratings from www.capitaliq.com, and domestic ratings from Wind. There are 3959 domestic and 299 global agency ratings in total.

Table 1: Distribution of Credit Ratings on Chinese Firms

We report the distribution of our final ratings sample—both number and percent—in Table 1. The distribution of the domestic ratings is clearly centered at higher levels than global ratings; both the median and average for the domestic ratings are higher than global ratings by seven notches (AA/Aa2 vs. BBB-/Baa3). When only ratings on firms assessed by both domestic and global ratings are considered, though the overall credit quality tends to be higher, the gap between the average and median of the two samples remains at seven notches (AAA/Aaa vs. BBB+/Baa1). In Livingston et al (2017), distinction is made between the domestic agencies that are affiliated with (have minority ownership) global agencies and those that are not. The differences between the average ratings of the different types of domestic rating agencies are quite small relative to the differences documented here between domestic and global agencies. The study does not examine the actual rating assigned by global (foreign) rating agencies.

As discussed at the outset, the direct comparisons of the ratings distributions of domestic and global agency ratings may overlook an important meaning of ratings. Ratings serve the function of expressing the agency’s view of the relative credit risk of various entities. Although the domestic rating agencies adopt rating symbols that correspond to those in use by global rating agencies, given the stark difference in the distributions of global and domestic ratings, it may make more sense to compare the rank-ordering of various risks by domestic and global agencies. In theory it is possible to observe vastly different distributions of ratings of global versus domestic agencies, even if the rank-ordering of risks remains virtually the same.

For firms jointly rated by both domestic and global agencies, we adjust the global agency ratings to make them directly comparable to domestic agency ratings. The domestic ratings of firms jointly rated by domestic and global agencies all fall in the ratings categories of AAA, AA+, and AA. We rank-order the global ratings, and then assign them to one of three rating categories so as to achieve similar proportions as the domestic ratings while weakly preserving a rank-ordering that corresponds to the original ratings. For instance, the original global ratings that are in the highest rating categories are transformed to an adjusted global rating of AAA; those that are immediately lower are changed to an adjusted global rating of AA+, and the remaining global ratings receive an adjusted global rating of AA. The resulting adjusted global ratings are now comparable to domestic ratings though they are much less granular than before, with a trimodal distribution resembling that of domestic ratings (by construction).

An important outcome of the adjustment is that it clarifies that the global and domestic ratings comprise different rank-orderings of credit risk. While most firms have the same adjusted global and domestic ratings, about 24 percent do not. These differences may be the result of random noise, or different rating functions.

Employing a cumulative logistic model that associates different firm variables with the probability of the domestic rating being higher, the same, or lower than the (adjusted) global rating, we find that higher asset size and higher leverage tend to result in firms receiving higher domestic ratings than adjusted global ratings. By contrast, higher profitability or state-ownership are more likely to result in firms receiving higher adjusted global ratings than domestic ratings (Table 2). This surprising result suggests that it may be global agencies that tend to place higher weight on the implicit guarantees associated with state ownership than domestic agencies, at least when assessing relative risks. These effects are stable even after we control for other financial variables, as well as key industry fixed effects. It will be interesting in future work to see if there is any distinction in the result based on the type of state ownership, similar to what Chen, Firth, and Xu (2009) find for corporate profitability and productivity.

Table 2: Determinants of the likelihood of the average domestic rating being higher, the same or lower than the (adjusted) average global rating

Notes: Net_PPE is the natural logarithm of total fixed assets; Leverage is the ratio of total assets in book value to total equity in book value; EBIT is earnings before interest and taxes; State_Ownership is a dummy variable indicating whether or not the issuer is state owned; Retained_Earnings is the ratio of retained earnings to total assets in book value; Ind_Util and Ind_Re are dummy variables for the utilities and real estate industries, respectively. α_1,α_2 are intercepts estimated for the trinomial logistic model. The non-rating data are from Wind. The statistical tests for the coefficients are approximated by the normal distribution. ***, **, * indicate statistical significance at the 1%, 5%, and 10%levels, respectively. Although there are nearly 300 global ratings, there are only about 50 cases of joint domestic and global agency rated firms available for the regressions. This is both because we have combined the global ratings into an average global rating on a firm-wise basis, and because the financial data are not available for every rated firm.

We also estimate separate domestic and global agency regressions to shed further light on reasons for the differences in rank-ordering between domestic and global agencies. We find that asset size is weighed more as a positive factor by domestic agencies, and that leverage is weighed more as a negative factor by global agencies. By contrast, profitability and state-ownership are weighed more positively by global rating agencies. The economic significance of the effects, in terms of the impact of a one standard deviation change in the explanatory variable (or a simple switch from 0 to 1 in the case of the dummies), appears to be greatest for asset size and state ownership.

The above-stated impacts are robust to the inclusion of numerous control variables such as retained earnings, interest coverage, and various industry dummy variables. They are also basically robust to variations in the choice of global ratings, in the alignment procedure used to transform global ratings, and whether the sample is extended to include firms that are not jointly rated by domestic and global agencies.

We also provide an initial exploration of the market impact of domestic and global agency ratings. In simple regressions of the logged credit spreads of more than 800 Chinese corporate bonds on domestic ratings and publicly available corporate financial variables (Table 3), domestic ratings appear indeed to add explanatory power beyond those provided by financial statements and issue variables only. They also explain more of the variation in credit spreads at issuance on their own than do the non-ratings variables alone. In (unreported) regressions with a much smaller sample, global ratings also appear to add value at the margin, though the sample size of jointly rated firms with complete financial statement data is too small (25) to definitively compare the information content of domestic versus global agency ratings.

Table 3: Market pricing of domestic ratings

In sum, we have documented that the domestic rating agencies rate Chinese companies at much higher levels, on average, than do global rating agencies. Ratings differences can be driven by differences in ratings scales (i.e., the probabilities of default associated with any rating grade). But ratings differences can also be driven by different rank-orderings of credit risk. Our results suggest that, beyond the simple differences in the ratings scales, global and domestic agencies have systematic differences of opinion that reflect different weights attached to the factors underlying the default risk of Chinese firms.

In future research, expanding the size of the sample both cross-sectionally and longitudinally to include more bonds and more ratings will help to confirm the robustness of the results. It will be of further interest to see how the ratings of domestic and global agencies line up with corporate bond defaults in China, which have increased more recently.

The views expressed here are those of the authors and do not necessarily represent the views of the People’s Bank of China or the Bank for International Settlements. This note draws heavily on the authors’ BIS working paper, No. 648, Credit ratings of domestic and global agencies: What drives the differences in China and how are they priced? June 2017.)

(Xianfeng Jiang, Research Institute of the People’s Bank of China; Frank Packer, Bank for International Settlements.)

Chen, Gongmeng, Michael Firth, and Liping Xu (2009). “Does the Type of Ownership Control Matter? Evidence from China’s Listed Companies.” Journal of Banking and Finance, 33, 171-181. Available at https://www.sciencedirect.com/science/article/pii/S0378426607004244

Dhawan, Raghav, and Fan Yu (2015). “Are Credit Ratings Relevant in China’s Corporate Bond Market?” The Chinese Economy 48 (3): 235–50. Available at http://www.tandfonline.com/doi/full/10.1080/10971475.2015.1031614.

GlobalCapital (2013). “Korean Rating Agencies Overrated.” May 15, 2013. Available at http://www.globalcapital.com/article/k32v3x0kfrz0/korean-credit-rating-agencies-overrated-opinion.

Groppe, Maureen (2017). “U.S. announces trade progress with China in 10 key areas.” Retrieved on May 13, 2017 at https://www.usatoday.com/story/news/politics/2017/05/11/us-announces-trade-progress-china-10-key-areas/101571580/.

Jiang, Xianfeng, and Frank Packer (2017). “Credit ratings of domestic and global agencies: What drives the differences in China and how are they priced?” BIS working paper, No. 648. Available at https://www.bis.org/publ/work648.htm.

Law, Fiona (2015). “Can All Chinese Debt Be Rated Top Quality?” The Wall Street Journal, July 26, 2015. Available at http://www.wsj.com/articles/can-all-chinese-debt-be-rated-a-1437942674.

Livingston, Miles, Winnie P.H. Poon, and Lei Zhou (2017). “Are Chinese Credit Ratings Relevant? A Study of the Chinese Bond Market and Credit Rating Industry.” January 4. Available at SSRN: https://ssrn.com/abstract=2893776 or http://dx.doi.org/10.2139/ssrn.2893776.

Livingston, Miles, Andy Naranjo, and Lei Zhou (2007). “Asset Opaqueness and Split Bond Ratings.” Financial Management 36 (3): 49–62. Available at http://onlinelibrary.wiley.com/doi/10.1111/j.1755-053X.2007.tb00080.x/abstract.

Packer, Frank (2002). “Credit Ratings and the Japanese Corporate Bond Market.” In Ratings, Rating Agencies and the Global Financial System, edited by Richard M. Levich, Giovanni Majnoni, and Carmen Reinhart, 139–58. Springer. Available at https://link.springer.com/content/pdf/10.1007/978-1-4615-0999-8_9.pdf.

Wilson, Elliot (2006). “X-Rated: The Dirty World of Chinese Debt.” Asiamoney 17 (3): 20–22. Available at http://www.globalcapital.com/article/kbxvklk31f0b/x-rated-the-dirty-world-of-chinese-debt.

Latest

Most Popular

- VoxChina Covid-19 Forum (Second Edition): China’s Post-Lockdown Economic Recovery VoxChina, Apr 18, 2020

- China’s Great Housing Boom Kaiji Chen, Yi Wen, Oct 11, 2017

- China’s Joint Venture Policy and the International Transfer of Technology Kun Jiang, Wolfgang Keller, Larry D. Qiu, William Ridley, Feb 06, 2019

- The Dark Side of the Chinese Fiscal Stimulus: Evidence from Local Government Debt Yi Huang, Marco Pagano, Ugo Panizza, Jun 28, 2017

- Wealth Redistribution in the Chinese Stock Market: the Role of Bubbles and Crashes Li An, Jiangze Bian, Dong Lou, Donghui Shi, Jul 01, 2020

- What Is Special about China’s Housing Boom? Edward L. Glaeser, Wei Huang, Yueran Ma, Andrei Shleifer, Jun 20, 2017

- Evaluating Risk across Chinese Housing Markets Yongheng Deng, Joseph Gyourko, Jing Wu, Aug 02, 2017

- Privatization and Productivity in China Yuyu Chen, Mitsuru Igami, Masayuki Sawada, Mo Xiao, Jan 31, 2018

- How did China Move Up the Global Value Chains? Hiau Looi Kee, Heiwai Tang, Aug 30, 2017

- China’s Shadow Banking Sector: Wealth Management Products and Issuing Banks Viral V. Acharya, Jun Qian, Zhishu Yang, Aug 09, 2017

Facebook

Facebook  Twitter

Twitter  Instagram

Instagram WeChat

WeChat  Email

Email