The Real Effects of the Chinese Stock Market

In a 2019 survey jointly administered by the China Securities Regulatory Commission (CSRC) and the PBC School of Finance at Tsinghua University (Tsinghua PBCSF), more than 90% of Chinese public firms report that they closely monitor the stock market for the purposes of learning information to guide real investment decisions and of accessing external financing. These findings provide direct evidence for the wide existence of market feedback via a learning channel and a financing channel, suggesting that the Chinese stock market is not just a side show, but instead, affects the real economy.

There has been an ongoing debate about whether the stock market is just a side show or has real effects on economic activities (see the survey article by Bond, Edmans, and Goldstein, 2012). Many financial economists believe that the processes affecting prices in financial markets feed back into the real economy, either through capital provision in the primary market or through information provision in the secondary market (e.g., Chen, Goldstein, and Jiang, 2007; Brogaard, Ringgenberg, and Sovich, 2019). However, some researchers have doubts about the existence of market feedback and argue that it is difficult to test the real effects of financial-market prices due to various endogeneity considerations. For instance, the information sets of market participants and real decision makers are unobservable and hence it is particularly challenging to test the informational feedback effect. In addition, even some basic conceptual questions remain debatable. For instance, since firm managers are supposed to be the most informed players, what extra information can they learn from asset markets?

To shed light on this debate, we designed and administered a survey in 2019 to elicit the opinions of all Chinese public firms on market feedback. The results are reported in our recent study (Goldstein, Liu, and Yang, 2021), providing direct evidence that supports the existence of market feedback.

The survey

In the 2019 survey, we asked all 3,628 firms listed on the Shanghai and Shenzhen stock exchanges whether they pay close attention to their own or peer firms’ stock prices, and if they do, the reasons for which they monitor these prices. The questions aim to test the theories on market feedback more directly than what is possible from analyzing market and corporate data. Nearly all firms responded to the survey. Thus, the study does not suffer from the sampling-bias problem commonly seen in other survey studies. We believe that the opinions provided by the respondents are informative because the responses typically were provided by top executives or by teams specializing in capital market affairs, who are all highly knowledgeable about their firms’ challenges and strategies (see Figure 1). In addition, we have striven to ensure that the survey responses are unbiased. Although the questionnaire was distributed to the firms by the CSRC and the identities of the respondents were recorded, the respondents had no incentives to provide biased information to cater to the CSRC’s needs or to avoid unnecessary troubles because (1) we carefully asked plain, purely academic questions that cannot be used to directly judge a firm’s behavior (that is, there are no “correct” answers for these questions); and (2) in the survey, we formally declared that the responses and other relevant information would be used only in policy and academic research in a large sample. The respondents knew that there will be no information released or reported about individual firms.

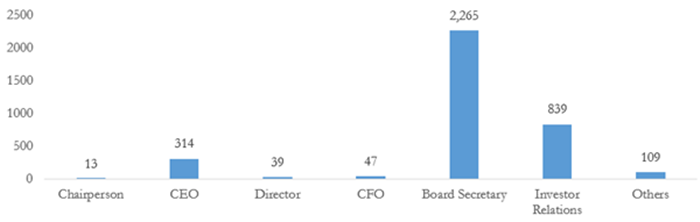

Figure 1: Distribution of the respondents’ positions in their firms

This figure plots the distribution of the positions of the respondents that are assigned by their firms to respond to our market feedback survey. Overall, 3,626 Chinese public firms listed on the Shanghai and Shenzhen Stock Exchanges responded to the survey.

The prevalence of market feedback

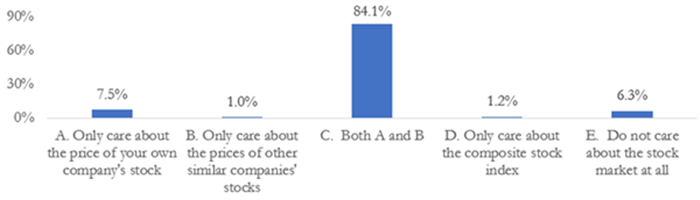

Our first survey question (“How does your company pay attention to the stock market?”) concerns the existence of the general market feedback, or whether firms monitor stock prices in the first place. We find substantial and direct support for the prevalence of market feedback (see Figure 2).

Figure 2: Responses to survey question I: “How does your company pay attention to the stock market?”

This figure plots the frequencies for each choice by the 3,626 responding firms in survey question I.

Among the 3,626 responding firms, 271 (7.5%) firms reported that they only care about their own stock prices; 36 (1.0%) firms reported that they only care about peer firms’ stock prices; and 3,049 (84.1%) firms reported that they care about both prices. Taken together, market feedback does exist in 92.6% of Chinese public firms. This effect is also prevalent across all industries, and the probability of monitoring stock prices ranges from 85.9% (non-banking finance industry) to 98.1% (defense industry).

Channels of market feedback

Our second survey question (“If you choose A or C in I: Which of the following is the reason that you CARE about the stock price of your OWN company?”) explores why the firms monitor their own stock prices. We provide the following choices about the mechanisms: (1) learning information for making investment decisions (the “learning channel”); (2) evaluating financing opportunities (the “financing channel”); (3) managerial compensation is linked to stock prices (the “compensation channel”); (4) pressure from the board (the “monitoring channel”); and (5) avoiding being merged or acquired (the “M&A” channel”).

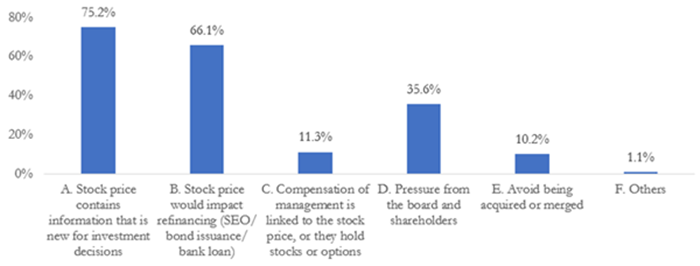

Figure 3: Responses to survey question II: “If you choose A or C in I: Which of the following is the reason that your company CAREs about the stock price of your OWN company?”

This figure plots the frequencies of each choice by the 3,320 responding firms choosing A or C in survey question II.

The 3,320 firms choosing A or C in question I were asked to respond. The results are reported in Figure 3. We find that 75.2% reported that they care about stock prices for learning new information that is relevant for real investment decisions. This information is incorporated into stock prices by various market participants via trading, which could provide additional information about proposed investments at the aggregate, sector, firm, and project levels. Consistent with the survey evidence, we replicate the main test in Chen, Goldstein, and Jiang (2007) in our context and find that Chinese public firms are more responsive to real investment opportunities when stock prices are informative. At the same time, 66.1% report that they care about stock prices because of their effect on financing channels. That is, the learning and financing channels are the most important mechanisms driving market feedback. The third important reason that firms care about stock prices is pressure from boards and shareholders, and 35.6% of the firms point to this reason. Other reasons, such as incentive pay and avoiding being acquired, are not very prevalent, which is probably because these practices are not very popular yet in the Chinese market.

Information, budgeting, and market feedback

We use the responding firms’ characteristics and behaviors, observable in the public market, to examine what factors are important in determining firms’ responses about market feedback and the learning and financing channels behind it. These firm characteristics include variables influencing price informativeness (analyst information, managerial information, and trader information), financial constraints, capital needs, and many others. We observe that a variety of firm variables have opposite effects on firms’ likelihood of choosing the learning channel versus the financing channel.

We find that firms are more likely to monitor stock prices for learning purposes and less likely to monitor prices for financing purposes when their stocks have a higher analyst coverage, their managers are less informed, and market traders are more informed. Intuitively, higher analyst coverage implies a more informative stock price either through better interpretation of existing data or through encouraging more information production by traders (Goldstein and Yang, 2015, 2019). This enhanced informativeness therefore encourages the firm to pay closer attention to stock prices and learn more information about investments. Meanwhile, a firm with higher analyst coverage receives greater attention from investors, making it easier for the firm to raise capital from the market and thereby weakening the firm’s incentive to monitor stock prices for financing purposes. Similar arguments apply to managerial information and trader information.

We also find that firms are more likely to monitor their stock prices for financing purposes when they are more financially constrained and when they have greater capital needs. By contrast, the effect of financial constraints and capital needs on firms’ tendency to select the learning channel appear to be insignificant.

(Itay Goldstein, Wharton School, University of Pennsylvania; Bibo Liu, PBC School of Finance, Tsinghua University; Liyan Yang, Rotman School of Management, University of Toronto.)

References

Bond, Philip, Alex Edmans, and Itay Goldstein, 2012. The real effects of financial markets. Annual Review of Financial Economics 4, 339–360.

Brogaard, Jonathan, Matthew C. Ringgenberg, and David Sovich, 2019. The economic impact of index investing, Review of Financial Studies 32, 3461–3499.

Chen, Qi, Itay Goldstein, and Wei Jiang, 2007. Price informativeness and sensitivity to stock price, Review of Financial Studies 20, 619–650.

Goldstein, Itay, Bibo Liu, and Liyan Yang, 2021. Market feedback: Evidence from the horse’s mouth, Working Paper.

Goldstein, Itay and Liyan Yang, 2015. Information diversity and complementarities in trading and information acquisition, Journal of Finance 70(4), 1723–1765.

Goldstein, Itay and Liyan Yang, 2019. Good disclosure, bad disclosure, Journal of Financial Economics 131(1), 118–138.

Latest

Most Popular

- VoxChina Covid-19 Forum (Second Edition): China’s Post-Lockdown Economic Recovery VoxChina, Apr 18, 2020

- China’s Great Housing Boom Kaiji Chen, Yi Wen, Oct 11, 2017

- China’s Joint Venture Policy and the International Transfer of Technology Kun Jiang, Wolfgang Keller, Larry D. Qiu, William Ridley, Feb 06, 2019

- The Dark Side of the Chinese Fiscal Stimulus: Evidence from Local Government Debt Yi Huang, Marco Pagano, Ugo Panizza, Jun 28, 2017

- Wealth Redistribution in the Chinese Stock Market: the Role of Bubbles and Crashes Li An, Jiangze Bian, Dong Lou, Donghui Shi, Jul 01, 2020

- Evaluating Risk across Chinese Housing Markets Yongheng Deng, Joseph Gyourko, Jing Wu, Aug 02, 2017

- What Is Special about China’s Housing Boom? Edward L. Glaeser, Wei Huang, Yueran Ma, Andrei Shleifer, Jun 20, 2017

- Privatization and Productivity in China Yuyu Chen, Mitsuru Igami, Masayuki Sawada, Mo Xiao, Jan 31, 2018

- How did China Move Up the Global Value Chains? Hiau Looi Kee, Heiwai Tang, Aug 30, 2017

- China’s Shadow Banking Sector: Wealth Management Products and Issuing Banks Viral V. Acharya, Jun Qian, Zhishu Yang, Aug 09, 2017

Facebook

Facebook  Twitter

Twitter  Instagram

Instagram WeChat

WeChat  Email

Email