The Price of Growing Like China: Higher Income Risks and Less Consumption Insurance

Widening income inequality in China has prompted President Xi Jinping to shift focus and to emphasize the fostering of balanced, high-quality development. But how exactly did income inequality evolve over China’s growth process and what was its impact on consumption and welfare? Using a long panel of income and consumption data from thousands of rural and urban households, we document that the increasing income inequality in China mainly reflects increasing permanent income risk, against which it became harder and harder to insure consumption, over the period of rapid income growth from 1989 to 2009. In other words, as household income grew, so did income fluctuations. These income fluctuations had an increasingly direct impact on consumption. For rural households, the welfare cost from increasing income risk and increasing exposure of consumption to income risk can almost cancel out the welfare gain from accelerated income growth over those twenty years.

Widening income inequality is a much anticipated and well-known by-product of the economic reforms that began in China in the 1970s. At the beginning of these reforms, when egalitarianism was still the socialist norm, the prospect of growing inequality needed endorsement from the highest authority, epitomized in Deng’s pragmatic slogan, “Let some get rich first.” Forty years later, Xi’s government vows to tackle the mounting income inequality as a top priority. How has increasing income inequality affected the Chinese citizenry’s consumption and welfare during this growth process?

The rising level of income inequality during China’s economic transformation is well documented (Khan and Riskin, 1998; Ravallion and Chen, 2007; Benjamin, Brandt, Giles, and Wang, 2008). More recent work by Cai, Chen and Zhou (2010) and Ding and He (2018) also documents the evolution of consumption inequality over time. However, to understand how income inequality affects consumption, one would need to observe income and consumption of the same household repeatedly over an extended period of time. Exploiting a unique data opportunity, we build a panel of household income and consumption data from 1989 to 2009 from the China Health and Nutrition Survey (CHNS). This long panel allows us to characterize the joint dynamics of household income and consumption, wherein lies the answer to the question we asked at the beginning of this article.

New Facts on household income risks and their impacts on consumption

Fact 1: For both rural and urban China, cross-sectional income and consumption inequality largely reflect the residual (within-group) income inequality.

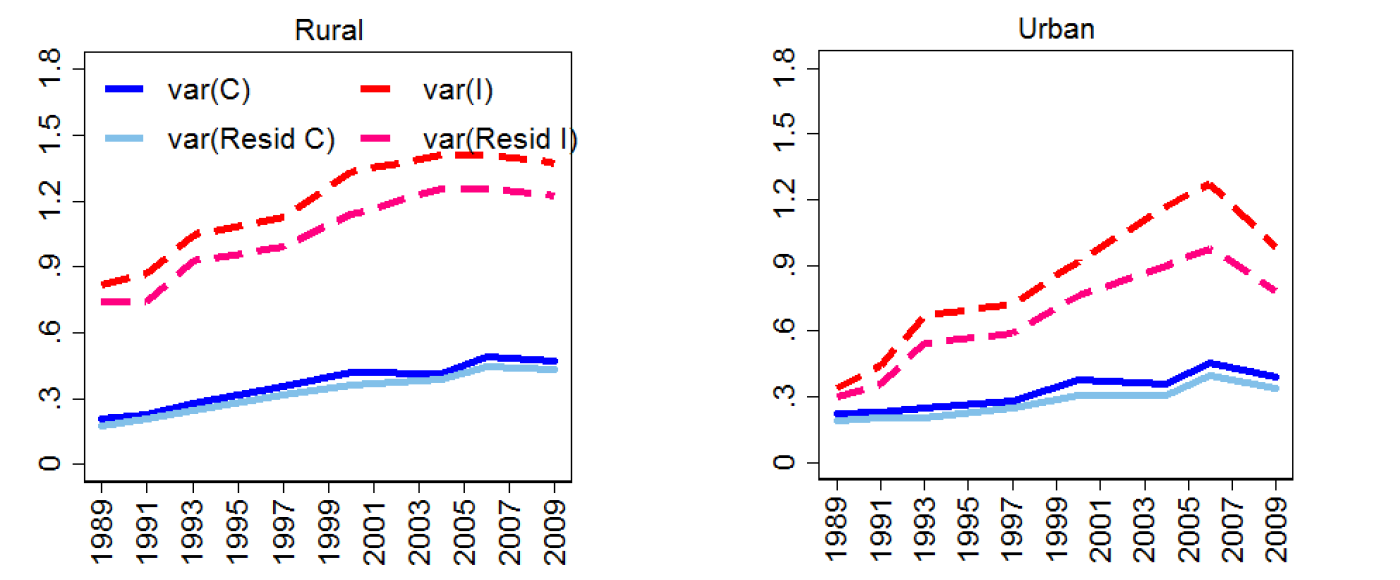

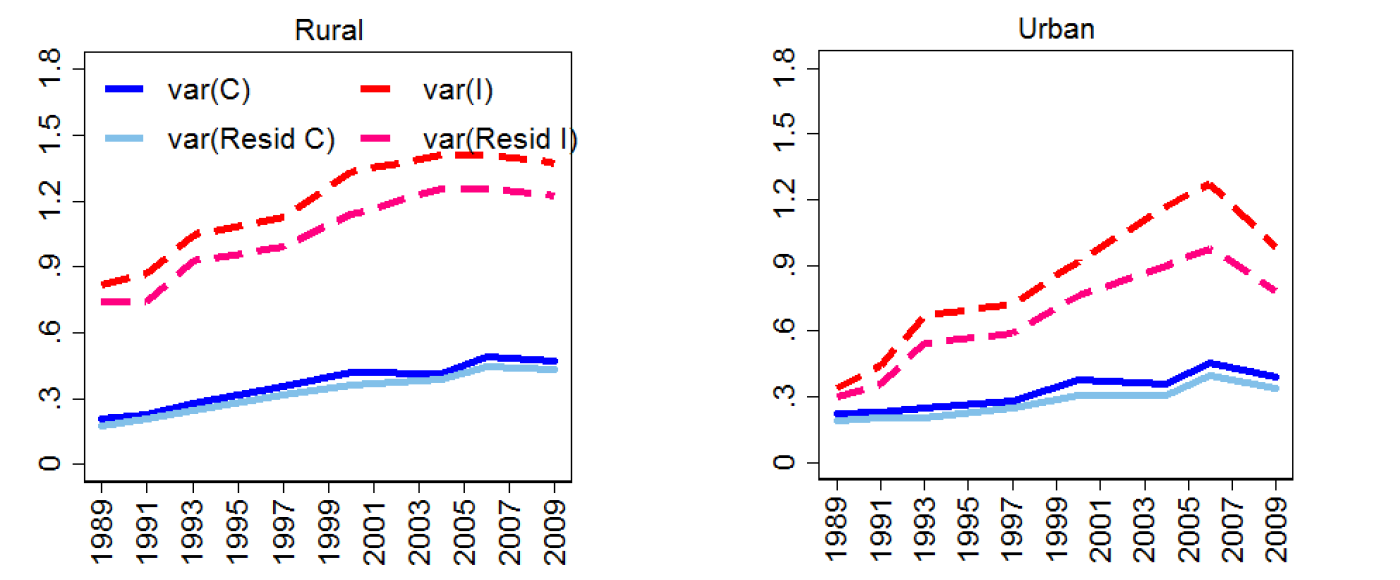

We decompose the income (consumption) inequality, as measured by the variance of log adult-equivalent household income (consumption), into a between-group component and a within-group component. The group is defined by observed household characteristics such as gender, age, ethnicity, education, and area of residence. Figure 1 plots the total inequality of income and consumption (i.e. denoted by var(C) and var(I)) together with the within-group (residual) inequality of income and consumption (i.e. denoted by var(Resid C) and var(Resid I)) for each year and for rural and urban households separately. Clearly, the majority of income and consumption inequality in China cannot be explained by observed differences across households. This highlights the importance of the residual inequality, which is interpreted as income or consumption risk. Both income and consumption risks increased over the twenty-year sample period.

Source: CHNS and author’s calculations (Santaeulàlia-Llopis and Zheng, forthcoming).

Fact 2: A decomposition of residual income reveals that the permanent component of income risk increased substantially for both rural and urban China along the growth process.

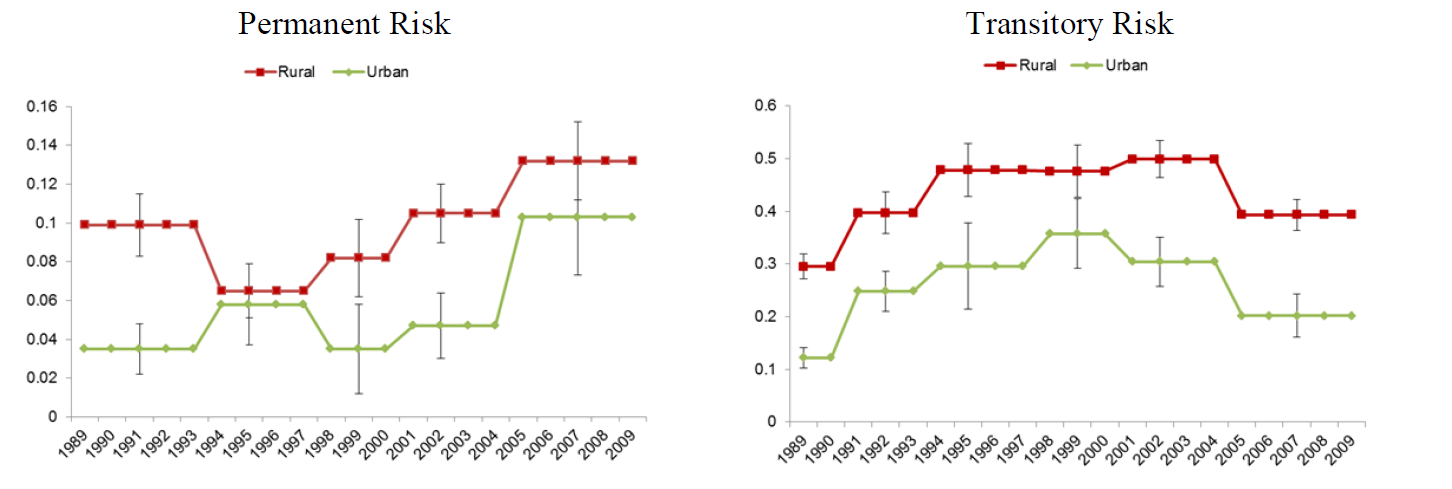

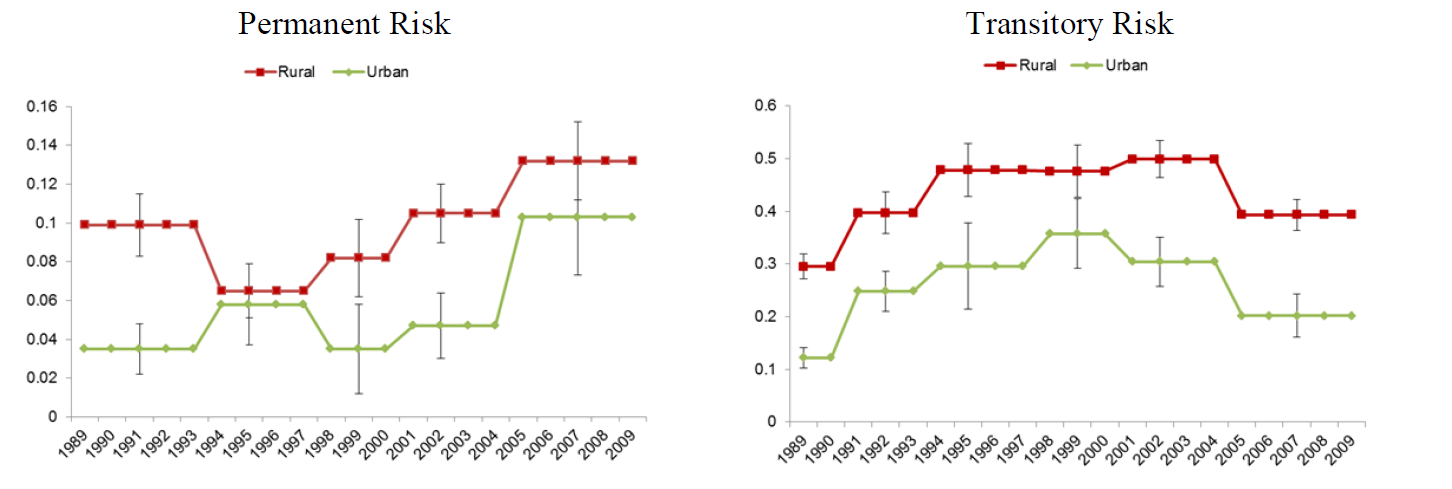

Following previous empirical work (Meghir and Pistaferri, 2004), we decompose the household income residuals into a permanent and a transitory component. Heuristically, a model of income process is posited, where residual income is the sum of a permanent or random walk component, which reflects income deviations that persist over time, and a transitory or serially uncorrelated component, which reflects temporary income deviations that revert to zero shortly. The variances of these components are then estimated by matching the model implied autocovariance structure with its data counterpart. Figure 2 plots the evolution of these two components of income risk for rural and urban households separately. Over time, the permanent income risk increased, especially in urban China: the point estimate of the permanent risk by the end of the sample period is 60% (130%) higher than the average of those for the 1989-1997 period, for rural (urban) China. In comparison, the transitory income risk evolves along an inverted U shape, with the risk heightened around the turn of the century, the timing of which coincides with major economic reforms (e.g., the State-Owned Enterprise Reform and the entry into the WTO).

Source: CHNS and author’s calculations (Santaeulàlia-Llopis and Zheng, forthcoming). The bars denote the 95% confidence interval around the estimated risk.

Fact 3: Consumption insurance, measured by the transmission of income shocks to consumption, significantly deteriorates along the growth process in China. This is the case for both rural and urban areas.

Once it is established that permanent income risk increased significantly over time, we estimate a time-varying parameter that measures how much of the income risk is passed through onto consumption to measure the impact of income risk on consumption. This is a nonstationary version of Blundell, Pistaferri and Preston (2008). We find that in the earlier half of our sample period (1989-1997), neither permanent nor transitory income risk affects consumption in any significant way, indicating a very high ability of Chinese households to protect their consumption stream from income fluctuations. This result is consistent with the socio-economic environment in the early 1990s, where the state ensured consumption via rationing and secure employment. In the second half of our sample period (1998-2009), the transmission of permanent income risk to consumption is significantly higher and above zero, suggesting a limited ability to smooth consumption in the face of increasing permanent income risk.

Implications for the welfare assessment of the Chinese growth process

As Chinese households’ incomes grew from 1989 to 2009, the risk environment and its impact on consumption changed dramatically as well. To the extent that higher income risk and higher transmission to consumption lead to a more volatile consumption path, there will be a negative impact on welfare. Based on Lucas (1987), we calculate the relative contributions coming from changes in average income growth, changes in income risk, and changes in the transmission onto consumption, to the overall welfare gain from China’s growth process. For rural households, the welfare cost of increased income risk and higher transmission on consumption from the 1990s to the 2000s is of a similar magnitude to the welfare gain from higher income growth over the same period. Under some realistic assumption of risk aversion, rural households would actually prefer living in the economic environment of the 1990s rather than that of the 2000s, despite more growth in the latter period! For urban households, the positive effect of income growth on welfare dominates and they would unambiguously prefer the 2000s.

Broader lessons to other developing economies

Using a long panel of Chinese household income and consumption data, we document the first direct empirical evidence of a negative relationship between consumption insurance and growth. It is an open question whether this negative relationship is more general and/or applies to other countries. Relatedly, De Magalhaes and Santaeulàlia-Llopis (forthcoming) also find a negative relationship between accumulation and insurance in some poor African countries. A more systematic analysis needs to be done to establish whether this relation holds (or changes) across time and across space. And this is important given the potential first-order implications for the welfare assessment of economic growth that we have found for China. Ultimately, if this negative relationship between growth and insurance is indeed a trade-off, we need to find the barriers that the need for consumption insurance creates for economic growth. Only then can we assess policies that can overcome those barriers. This is currently missing in the economic growth literature.

Benjamin, Dwayne, Loren Brandt, John Giles, and Sangui Wang (2008). “Income Inequality during China’s Economic Transition.” In Brandt, L. and Rawski, T.G., ed., China’s Great Economic Transformation, Chapter 18, Cambridge University Press.

http://www.cambridge.org/hk/academic/subjects/economics/economic-development-and-growth/chinas-great-economic-transformation?format=PB&isbn=9780521712903#eAjFLdjwKO73jqHl.97

Blundell, Richard, Luigi Pistaferri, and Ian Preston (2008). “Consumption Inequality and Partial Insurance.” American Economic Review, 98(5): 1887-1921.

https://www.aeaweb.org/articles?id=10.1257/aer.98.5.1887

Cai, Hongbin, Yuyu Chen, and Li-An, Zhou (2010). “Income and Consumption Inequality in Urban China: 1992-2003.” Economic Development and Cultural Change, 58(3): 385-413.

https://www.journals.uchicago.edu/doi/abs/10.1086/650423

De Magalhaes, Leandro and Raül Santaeulàlia-Llopis (Forthcoming). “The Consumption, Income and Wealth of the Poorest: An Empirical Analysis of Economic Inequality in Rural and Urban Sub-Saharan Africa for Macroeconomists.” Journal of Development Economics.

https://www.barcelonagse.eu/research/working-papers/consumption-income-and-wealth-poorest-empirical-analysis-economic-inequality

Ding, Haiyan and Hui He (2018). “A Tale of Transition: An Empirical Analysis of Economic Inequality in Urban China, 1986-2009.” Review of Economic Dynamics, 29: 106-137.

https://www.sciencedirect.com/science/article/pii/S1094202517301242

Khan, Azizur Rahman and Carl Riskin (1998). “Income and Inequality in China: Composition, Distribution and Growth of Household Income, 1988 to 1995.” The China Quarterly, 154: 221-253.

https://www.cambridge.org/core/journals/china-quarterly/article/income-and-inequality-in-china-composition-distribution-and-growth-of-household-income-1988-to-1995/8BB145A51A888CAFAAC756025494CD80

Lucas, Robert E. Jr. (1987). Models of Business Cycles. New York: Basil Blackwell.

https://www.wiley.com/en-us/Models+of+Business+Cycles-p-9780631147916

Meghir, Costas, and Luigi Pistaferri (2004). “Income Variance Dynamics and Heterogeneity.” Econometrica, 72(1): 1-32.

https://onlinelibrary.wiley.com/doi/abs/10.1111/j.1468-0262.2004.00476.x

Ravallion, Martin. and Shaohua Chen (2007). “China’s (Uneven) Progress against Poverty.” Journal of Development Economics, 82: 1-42.

https://www.sciencedirect.com/science/article/pii/S0304387805001185

Santaeulàlia-Llopis, Raül and Yu Zheng (Forthcoming). “The Price of Growth: Consumption Insurance in China 1989-2009.” American Economic Journal: Macroeconomics.

Widening income inequality is a much anticipated and well-known by-product of the economic reforms that began in China in the 1970s. At the beginning of these reforms, when egalitarianism was still the socialist norm, the prospect of growing inequality needed endorsement from the highest authority, epitomized in Deng’s pragmatic slogan, “Let some get rich first.” Forty years later, Xi’s government vows to tackle the mounting income inequality as a top priority. How has increasing income inequality affected the Chinese citizenry’s consumption and welfare during this growth process?

The rising level of income inequality during China’s economic transformation is well documented (Khan and Riskin, 1998; Ravallion and Chen, 2007; Benjamin, Brandt, Giles, and Wang, 2008). More recent work by Cai, Chen and Zhou (2010) and Ding and He (2018) also documents the evolution of consumption inequality over time. However, to understand how income inequality affects consumption, one would need to observe income and consumption of the same household repeatedly over an extended period of time. Exploiting a unique data opportunity, we build a panel of household income and consumption data from 1989 to 2009 from the China Health and Nutrition Survey (CHNS). This long panel allows us to characterize the joint dynamics of household income and consumption, wherein lies the answer to the question we asked at the beginning of this article.

New Facts on household income risks and their impacts on consumption

Fact 1: For both rural and urban China, cross-sectional income and consumption inequality largely reflect the residual (within-group) income inequality.

We decompose the income (consumption) inequality, as measured by the variance of log adult-equivalent household income (consumption), into a between-group component and a within-group component. The group is defined by observed household characteristics such as gender, age, ethnicity, education, and area of residence. Figure 1 plots the total inequality of income and consumption (i.e. denoted by var(C) and var(I)) together with the within-group (residual) inequality of income and consumption (i.e. denoted by var(Resid C) and var(Resid I)) for each year and for rural and urban households separately. Clearly, the majority of income and consumption inequality in China cannot be explained by observed differences across households. This highlights the importance of the residual inequality, which is interpreted as income or consumption risk. Both income and consumption risks increased over the twenty-year sample period.

Figure 1: Raw and residual income inequality in rural and urban China, 1989-2009

Fact 2: A decomposition of residual income reveals that the permanent component of income risk increased substantially for both rural and urban China along the growth process.

Following previous empirical work (Meghir and Pistaferri, 2004), we decompose the household income residuals into a permanent and a transitory component. Heuristically, a model of income process is posited, where residual income is the sum of a permanent or random walk component, which reflects income deviations that persist over time, and a transitory or serially uncorrelated component, which reflects temporary income deviations that revert to zero shortly. The variances of these components are then estimated by matching the model implied autocovariance structure with its data counterpart. Figure 2 plots the evolution of these two components of income risk for rural and urban households separately. Over time, the permanent income risk increased, especially in urban China: the point estimate of the permanent risk by the end of the sample period is 60% (130%) higher than the average of those for the 1989-1997 period, for rural (urban) China. In comparison, the transitory income risk evolves along an inverted U shape, with the risk heightened around the turn of the century, the timing of which coincides with major economic reforms (e.g., the State-Owned Enterprise Reform and the entry into the WTO).

Figure 2: Evolution of permanent income risk and transitory income risk in rural and urban China, 1989-2009

Source: CHNS and author’s calculations (Santaeulàlia-Llopis and Zheng, forthcoming). The bars denote the 95% confidence interval around the estimated risk.

Fact 3: Consumption insurance, measured by the transmission of income shocks to consumption, significantly deteriorates along the growth process in China. This is the case for both rural and urban areas.

Once it is established that permanent income risk increased significantly over time, we estimate a time-varying parameter that measures how much of the income risk is passed through onto consumption to measure the impact of income risk on consumption. This is a nonstationary version of Blundell, Pistaferri and Preston (2008). We find that in the earlier half of our sample period (1989-1997), neither permanent nor transitory income risk affects consumption in any significant way, indicating a very high ability of Chinese households to protect their consumption stream from income fluctuations. This result is consistent with the socio-economic environment in the early 1990s, where the state ensured consumption via rationing and secure employment. In the second half of our sample period (1998-2009), the transmission of permanent income risk to consumption is significantly higher and above zero, suggesting a limited ability to smooth consumption in the face of increasing permanent income risk.

Implications for the welfare assessment of the Chinese growth process

As Chinese households’ incomes grew from 1989 to 2009, the risk environment and its impact on consumption changed dramatically as well. To the extent that higher income risk and higher transmission to consumption lead to a more volatile consumption path, there will be a negative impact on welfare. Based on Lucas (1987), we calculate the relative contributions coming from changes in average income growth, changes in income risk, and changes in the transmission onto consumption, to the overall welfare gain from China’s growth process. For rural households, the welfare cost of increased income risk and higher transmission on consumption from the 1990s to the 2000s is of a similar magnitude to the welfare gain from higher income growth over the same period. Under some realistic assumption of risk aversion, rural households would actually prefer living in the economic environment of the 1990s rather than that of the 2000s, despite more growth in the latter period! For urban households, the positive effect of income growth on welfare dominates and they would unambiguously prefer the 2000s.

Broader lessons to other developing economies

Using a long panel of Chinese household income and consumption data, we document the first direct empirical evidence of a negative relationship between consumption insurance and growth. It is an open question whether this negative relationship is more general and/or applies to other countries. Relatedly, De Magalhaes and Santaeulàlia-Llopis (forthcoming) also find a negative relationship between accumulation and insurance in some poor African countries. A more systematic analysis needs to be done to establish whether this relation holds (or changes) across time and across space. And this is important given the potential first-order implications for the welfare assessment of economic growth that we have found for China. Ultimately, if this negative relationship between growth and insurance is indeed a trade-off, we need to find the barriers that the need for consumption insurance creates for economic growth. Only then can we assess policies that can overcome those barriers. This is currently missing in the economic growth literature.

(Raül Santaeulàlia-Llopis is a research fellow at MOVE and UAB and an affiliated research professor of the Barcelona GSE; Yu Zheng is an assistant professor at the City University of Hong Kong.)

Benjamin, Dwayne, Loren Brandt, John Giles, and Sangui Wang (2008). “Income Inequality during China’s Economic Transition.” In Brandt, L. and Rawski, T.G., ed., China’s Great Economic Transformation, Chapter 18, Cambridge University Press.

http://www.cambridge.org/hk/academic/subjects/economics/economic-development-and-growth/chinas-great-economic-transformation?format=PB&isbn=9780521712903#eAjFLdjwKO73jqHl.97

Blundell, Richard, Luigi Pistaferri, and Ian Preston (2008). “Consumption Inequality and Partial Insurance.” American Economic Review, 98(5): 1887-1921.

https://www.aeaweb.org/articles?id=10.1257/aer.98.5.1887

Cai, Hongbin, Yuyu Chen, and Li-An, Zhou (2010). “Income and Consumption Inequality in Urban China: 1992-2003.” Economic Development and Cultural Change, 58(3): 385-413.

https://www.journals.uchicago.edu/doi/abs/10.1086/650423

De Magalhaes, Leandro and Raül Santaeulàlia-Llopis (Forthcoming). “The Consumption, Income and Wealth of the Poorest: An Empirical Analysis of Economic Inequality in Rural and Urban Sub-Saharan Africa for Macroeconomists.” Journal of Development Economics.

https://www.barcelonagse.eu/research/working-papers/consumption-income-and-wealth-poorest-empirical-analysis-economic-inequality

Ding, Haiyan and Hui He (2018). “A Tale of Transition: An Empirical Analysis of Economic Inequality in Urban China, 1986-2009.” Review of Economic Dynamics, 29: 106-137.

https://www.sciencedirect.com/science/article/pii/S1094202517301242

Khan, Azizur Rahman and Carl Riskin (1998). “Income and Inequality in China: Composition, Distribution and Growth of Household Income, 1988 to 1995.” The China Quarterly, 154: 221-253.

https://www.cambridge.org/core/journals/china-quarterly/article/income-and-inequality-in-china-composition-distribution-and-growth-of-household-income-1988-to-1995/8BB145A51A888CAFAAC756025494CD80

Lucas, Robert E. Jr. (1987). Models of Business Cycles. New York: Basil Blackwell.

https://www.wiley.com/en-us/Models+of+Business+Cycles-p-9780631147916

Meghir, Costas, and Luigi Pistaferri (2004). “Income Variance Dynamics and Heterogeneity.” Econometrica, 72(1): 1-32.

https://onlinelibrary.wiley.com/doi/abs/10.1111/j.1468-0262.2004.00476.x

Ravallion, Martin. and Shaohua Chen (2007). “China’s (Uneven) Progress against Poverty.” Journal of Development Economics, 82: 1-42.

https://www.sciencedirect.com/science/article/pii/S0304387805001185

Santaeulàlia-Llopis, Raül and Yu Zheng (Forthcoming). “The Price of Growth: Consumption Insurance in China 1989-2009.” American Economic Journal: Macroeconomics.

https://www.aeaweb.org/articles?id=10.1257/mac.20160250&&from=f

Latest

Most Popular

- VoxChina Covid-19 Forum (Second Edition): China’s Post-Lockdown Economic Recovery VoxChina, Apr 18, 2020

- China’s Great Housing Boom Kaiji Chen, Yi Wen, Oct 11, 2017

- China’s Joint Venture Policy and the International Transfer of Technology Kun Jiang, Wolfgang Keller, Larry D. Qiu, William Ridley, Feb 06, 2019

- The Dark Side of the Chinese Fiscal Stimulus: Evidence from Local Government Debt Yi Huang, Marco Pagano, Ugo Panizza, Jun 28, 2017

- Wealth Redistribution in the Chinese Stock Market: the Role of Bubbles and Crashes Li An, Jiangze Bian, Dong Lou, Donghui Shi, Jul 01, 2020

- Evaluating Risk across Chinese Housing Markets Yongheng Deng, Joseph Gyourko, Jing Wu, Aug 02, 2017

- What Is Special about China’s Housing Boom? Edward L. Glaeser, Wei Huang, Yueran Ma, Andrei Shleifer, Jun 20, 2017

- Privatization and Productivity in China Yuyu Chen, Mitsuru Igami, Masayuki Sawada, Mo Xiao, Jan 31, 2018

- How did China Move Up the Global Value Chains? Hiau Looi Kee, Heiwai Tang, Aug 30, 2017

- China’s Shadow Banking Sector: Wealth Management Products and Issuing Banks Viral V. Acharya, Jun Qian, Zhishu Yang, Aug 09, 2017

Facebook

Facebook  Twitter

Twitter  Instagram

Instagram WeChat

WeChat  Email

Email