The “Trusted-assistant” Loan in Nineteenth Century China

In this paper, we analyze “trusted-assistant loans,” which were loans issued (typically) by Shanxi Banks during the Qing period to finance newly appointed scholar-officials. Even though creditors lacked legal rights and, in fact, lacked every repayment enforcement mechanism advanced by economic contract theory, repayment rates on these loans were relatively high and they constituted a large and profitable portion of many banks’ loan portfolios. This paper develops a theory of “resource-based” debt contract enforcement that rationalizes repayment and tests the hypothesis of this theory using data from scholar-officials’ diaries and nineteenth century Chinese bank records.

In a recent paper, Miao, Niu, and Noe (2017) consider a novel and pervasive financing mechanism developed by banks in nineteenth century Qing China — the trusted-assistant loan. These loans funded the acquisition of imperial administrative positions by scholars who passed the Imperial Civil Service (Keju) examinations and were offered administrative appointments. The loans were large as, under the Qing’s “single-man rule” system, the appointed scholars were the only officials in each jurisdiction on the imperial payroll. The scholar was responsible for hiring the rest of the administrative cadre and they were his personal employees. Thus, to take up his appointment, a scholar had to fund his travel and the travel of his assistants to the assigned jurisdiction, which was sometimes thousands of kilometers from Beijing. Trusted-assistant loans, typically issued by Chinese lending institutions, especially by Shanxi banks, provided appointed scholars with financing but stipulated that the scholar-official employ a specific “trusted-assistant.” This trusted-assistant was typically a bank employee

This nineteenth century financing mechanism is relevant to twenty-first century finance because it effectively enforced flexible loan repayment in a setting that completely lacked all of the desiderata for contract enforcement posited by standard Western contract theories. Having spent years or decades studying for the Keju examinations, scholars were typically impoverished and thus could not post collateral. Many came from modest backgrounds and thus did not have a social network that could furnish wealthy guarantors. Legal enforcement was impossible because scholar-loans were illegal. Creditors could not apply extra-judicial coercion because the official, as head of the local government, had far better access to coercive power than the creditor. Moreover, the trusted-assistant, in contrast to, for example, a director added to a corporate board at the request of a bank, had no legal right to participate in provincial governance and could be terminated at will by the scholar-official.

Contract theory demonstrates that the need to maintain a reputation with the lender can motivate repayment; i.e., the failure to repay one loan might limit the ability to borrow in the future from that lender. However, appointment to provincial administration vastly reduced a scholar's need for future creditor funding. Based on historical sources, we estimate that, because of large official salaries and gray income from tax collection and corruption, an appointment greatly increased a scholar’s income; Counting both official salary and grey income from tax collection and corruption, on average, a scholar benefited from a 600-fold income increase. Thus, if the scholar was successful in his first appointment, it is doubtful whether he would require financing for future appointments. If the scholar failed in his first appointment, he would not receive another and thus not need additional financing. Moreover, a good reputation with the local population was far more important to scholar-officials than a good reputation with bankers. If anything, because scholar-loans were associated with high taxes and excessive demands for bribes, making the failure to repay the loan public knowledge would have enhanced the scholar’s provincial reputation.

Our paper considers how a flourishing market for trusted-assistant loans could be sustained in an environment that lacked all standard mechanisms of contract enforcement. Based on data from officials’ diaries, bank account books, and secondary source materials, we identify a novel “resource-based” mechanism that exploited a scholar-official’s inexperience. In order to pass the civil service exam, scholars mastered essay writing, memorized Confucian classics, and studied neo-Confucian philosophy. However, they did not develop the practical knowledge required to govern provinces and collect revenue. Thus, they were initially dependent on the assistants' aid. Moreover, they had little or no information about the quality (i.e., loyalty and competence) of potential assistants. In contrast, trusted-assistants, typically bankers, were quite experienced in financial and administrative matters. Therefore, at least initially, trusted-assistants could provide a resource — expert aid from an agent with known loyalties — essential for administering and extracting rents from the province. The use of trusted-assistants provided by a lending bank provided leverage for the repayment of scholar loans. Threatening to withhold this resource enabled assistants to direct some of the rents from provincial administration toward loan repayment.

Assistant leverage, although a necessary condition for loan enforcement, was not in itself sufficient. Two other obstacles had to be surmounted. First, the assistant's leverage was transitory. As time passed, the scholar-official became more familiar with local conditions, the loyalties of local officials, and the mechanics of administration. The transitory nature of the assistant's advantage would have favored short-maturity loans. However, the rents that officials could extract without triggering social unrest, and thus their likely impeachment, were uncertain and dependent on local economic conditions, especially agricultural yields. Some repayment flexibility was therefore required based on local conditions — conditions that the bank could not observe given the distance between the bank and an official’s jurisdiction and the limitations of information technology in nineteenth century China. Second, the dependence of the bank on the trusted-assistant’s actions, actions the bank could not monitor, produced an agency conflict between the assistant and the bank. The assistant could use his bargaining power to enforce loan repayment or use it to simply extract rents for himself.

Some Chinese banks overcame these obstacles through a unique agent-bonding mechanism which enabled them to profit from trusted assistant lending. The mechanism combined very traditional reputation-based bonding (e.g., only hiring bankers with family origins from a particular province who received recommendations from current employees) with very “modern” high-powered financial incentives. “Expertise-shares” were granted to bank employees as rewards for successful loan collection. So many expertise shares were offered that, in many cases, the total dividends to expertise shares exceeded the dividends received by the bank’s founders. The combination of large rewards for the successful collection of loans and reputational sanctions for perceived disloyalty, which included shaming the assistant's family and excluding his descendants from bank employment, appear to have typically engendered assistant loyalty.

The Shanxi banks had a comparative advantage over other domestic banks in the offering trusted assistant financing. These banks had a long-established tradition of offering stock bonus compensation in the form of expertise shares. In addition, because the Shanxi banks traditionally focused on providing banking services to the government such as handling provincial tax remittances, they had superior information about provincial finances. For these reasons, they dominated the trusted-assistant lending market.

These strong incentives for loan collection could have resulted in overzealous collection: bank employees, anxious for bonus shares, might have enticed the officials to aggressively extract rents even when economic conditions made such extractions likely to produce unrest. However, bargaining over provincial rents was conducted period-by-period and assistants could not commit in a given period to concede future rents to officials. Our theoretical analysis shows that the huge assistant rent concessions required to induce scholar-officials to engage in risky rent extraction in difficult economic times were not feasible given this no-commitment period-by-period bargaining.

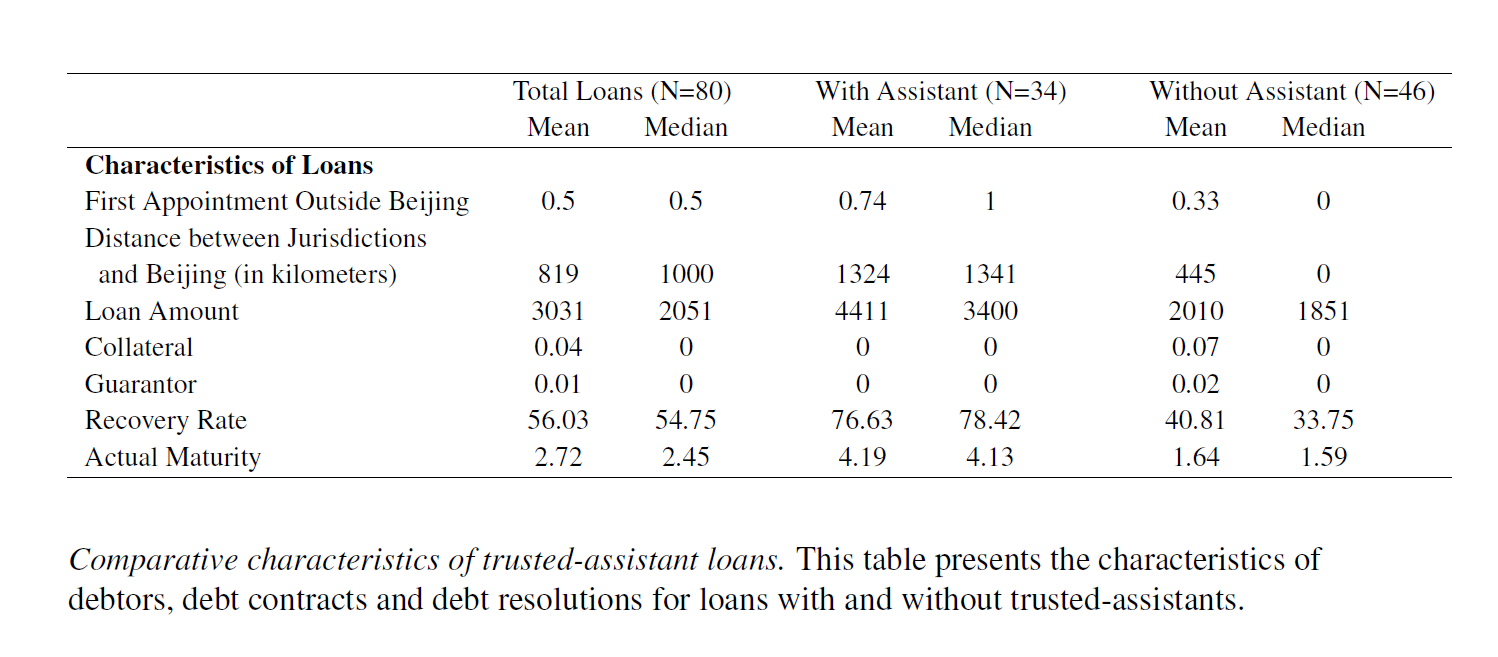

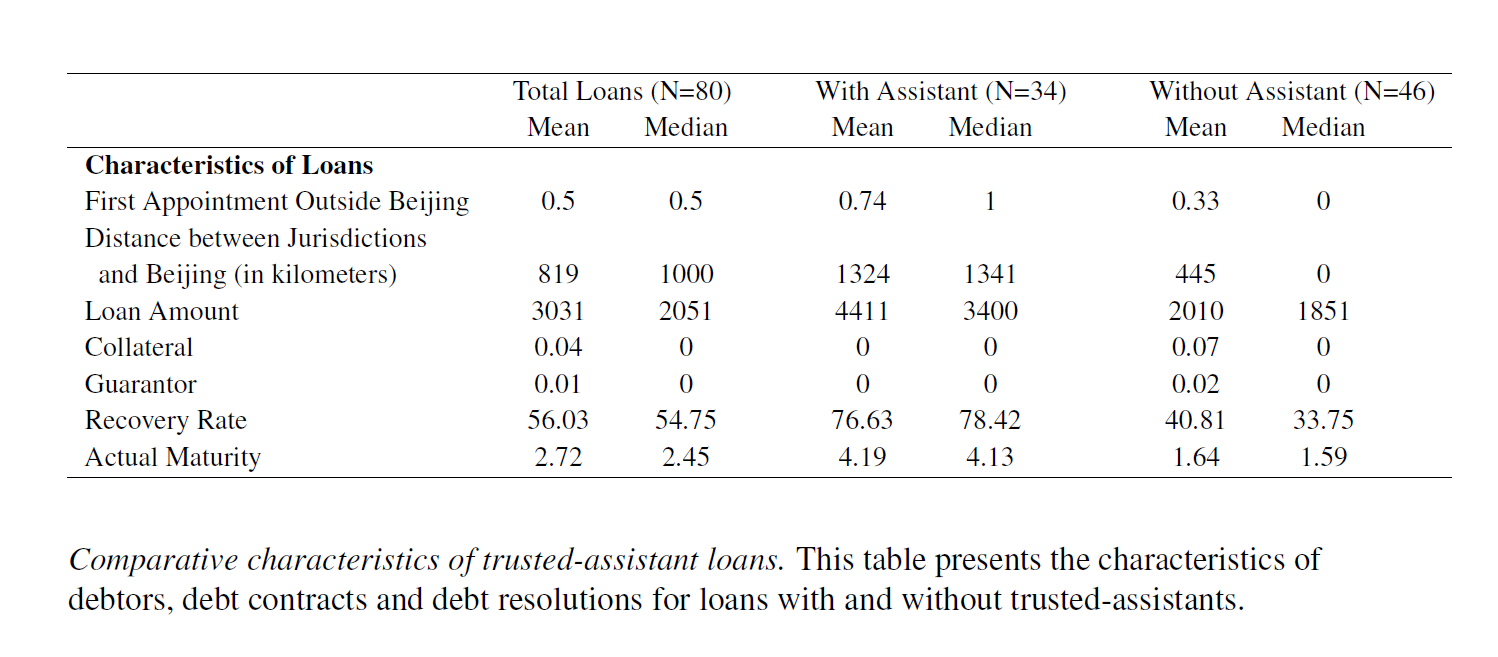

Thus, our analysis shows that trusted-assistant loans enforced flexible loan repayment based on provincial conditions. Our data support this conclusion. While the maturity of trusted-assistant loans was not long by modern standards (on average, approximately 4 years), it was much longer than non-trusted-assistant loans (approximately 1 year). Also, the recovery rate on trusted-assistant loans was much higher (approximately 80 percent) than on non-trusted-assistant loans (approximately 50 percent). Typically, the stated interest rate on trusted-assistant loans was 20 percent and the actual principal lent to the borrower was no greater than 70 percent of the loan’s notional principal. Frequently, the principal was advanced in the form of substandard silver. Thus, the effective yield to maturity on these loans was quite high. Given the high effective interest rates on the loans, these recovery rates are consistent with our supposition that trusted-assistant lending was a very profitable line of business for banks. Thus, it is not surprising that many banks, especially Shanxi banks, specialized in this form of financing.

Our analysis documents an example of a highly profitable project — acquiring imperial administrative positions — funded by debt financing in the absence of both legal enforcement technology and a reputational bond between the creditor and debtor. Enforcement was implemented by inserting a bonded creditor agent into a crucial position in the debtor’s organization. The insights from this example appear to be relevant to many financing contexts where enforcement of contract rights is problematic. For instance, joint ventures and minority equity alliances between firms typically transfer the employees of at least one of the partners to the newly founded alliance entity. Frequently, the know-how of these employees is the key resource sought by the other partner. Since close cooperation involves a knowledge transfer, the comparative advantage of the partner in providing this know-how is likely to be evanescent. Contracting Contract development in alliances that involve joint production is usually quite incomplete either because of the complexity of formulating a complete set of contingencies ex ante or because the enforceability of the contracts is problematic. Our evidence and analysis suggest that such ventures can be viable even in the absence of effective legal regimes provided that the bargaining power of the parties is sufficiently balanced and the incentives of the agents transferred to the venture are appropriately designed.

In a recent paper, Miao, Niu, and Noe (2017) consider a novel and pervasive financing mechanism developed by banks in nineteenth century Qing China — the trusted-assistant loan. These loans funded the acquisition of imperial administrative positions by scholars who passed the Imperial Civil Service (Keju) examinations and were offered administrative appointments. The loans were large as, under the Qing’s “single-man rule” system, the appointed scholars were the only officials in each jurisdiction on the imperial payroll. The scholar was responsible for hiring the rest of the administrative cadre and they were his personal employees. Thus, to take up his appointment, a scholar had to fund his travel and the travel of his assistants to the assigned jurisdiction, which was sometimes thousands of kilometers from Beijing. Trusted-assistant loans, typically issued by Chinese lending institutions, especially by Shanxi banks, provided appointed scholars with financing but stipulated that the scholar-official employ a specific “trusted-assistant.” This trusted-assistant was typically a bank employee

This nineteenth century financing mechanism is relevant to twenty-first century finance because it effectively enforced flexible loan repayment in a setting that completely lacked all of the desiderata for contract enforcement posited by standard Western contract theories. Having spent years or decades studying for the Keju examinations, scholars were typically impoverished and thus could not post collateral. Many came from modest backgrounds and thus did not have a social network that could furnish wealthy guarantors. Legal enforcement was impossible because scholar-loans were illegal. Creditors could not apply extra-judicial coercion because the official, as head of the local government, had far better access to coercive power than the creditor. Moreover, the trusted-assistant, in contrast to, for example, a director added to a corporate board at the request of a bank, had no legal right to participate in provincial governance and could be terminated at will by the scholar-official.

Contract theory demonstrates that the need to maintain a reputation with the lender can motivate repayment; i.e., the failure to repay one loan might limit the ability to borrow in the future from that lender. However, appointment to provincial administration vastly reduced a scholar's need for future creditor funding. Based on historical sources, we estimate that, because of large official salaries and gray income from tax collection and corruption, an appointment greatly increased a scholar’s income; Counting both official salary and grey income from tax collection and corruption, on average, a scholar benefited from a 600-fold income increase. Thus, if the scholar was successful in his first appointment, it is doubtful whether he would require financing for future appointments. If the scholar failed in his first appointment, he would not receive another and thus not need additional financing. Moreover, a good reputation with the local population was far more important to scholar-officials than a good reputation with bankers. If anything, because scholar-loans were associated with high taxes and excessive demands for bribes, making the failure to repay the loan public knowledge would have enhanced the scholar’s provincial reputation.

Our paper considers how a flourishing market for trusted-assistant loans could be sustained in an environment that lacked all standard mechanisms of contract enforcement. Based on data from officials’ diaries, bank account books, and secondary source materials, we identify a novel “resource-based” mechanism that exploited a scholar-official’s inexperience. In order to pass the civil service exam, scholars mastered essay writing, memorized Confucian classics, and studied neo-Confucian philosophy. However, they did not develop the practical knowledge required to govern provinces and collect revenue. Thus, they were initially dependent on the assistants' aid. Moreover, they had little or no information about the quality (i.e., loyalty and competence) of potential assistants. In contrast, trusted-assistants, typically bankers, were quite experienced in financial and administrative matters. Therefore, at least initially, trusted-assistants could provide a resource — expert aid from an agent with known loyalties — essential for administering and extracting rents from the province. The use of trusted-assistants provided by a lending bank provided leverage for the repayment of scholar loans. Threatening to withhold this resource enabled assistants to direct some of the rents from provincial administration toward loan repayment.

Assistant leverage, although a necessary condition for loan enforcement, was not in itself sufficient. Two other obstacles had to be surmounted. First, the assistant's leverage was transitory. As time passed, the scholar-official became more familiar with local conditions, the loyalties of local officials, and the mechanics of administration. The transitory nature of the assistant's advantage would have favored short-maturity loans. However, the rents that officials could extract without triggering social unrest, and thus their likely impeachment, were uncertain and dependent on local economic conditions, especially agricultural yields. Some repayment flexibility was therefore required based on local conditions — conditions that the bank could not observe given the distance between the bank and an official’s jurisdiction and the limitations of information technology in nineteenth century China. Second, the dependence of the bank on the trusted-assistant’s actions, actions the bank could not monitor, produced an agency conflict between the assistant and the bank. The assistant could use his bargaining power to enforce loan repayment or use it to simply extract rents for himself.

Some Chinese banks overcame these obstacles through a unique agent-bonding mechanism which enabled them to profit from trusted assistant lending. The mechanism combined very traditional reputation-based bonding (e.g., only hiring bankers with family origins from a particular province who received recommendations from current employees) with very “modern” high-powered financial incentives. “Expertise-shares” were granted to bank employees as rewards for successful loan collection. So many expertise shares were offered that, in many cases, the total dividends to expertise shares exceeded the dividends received by the bank’s founders. The combination of large rewards for the successful collection of loans and reputational sanctions for perceived disloyalty, which included shaming the assistant's family and excluding his descendants from bank employment, appear to have typically engendered assistant loyalty.

The Shanxi banks had a comparative advantage over other domestic banks in the offering trusted assistant financing. These banks had a long-established tradition of offering stock bonus compensation in the form of expertise shares. In addition, because the Shanxi banks traditionally focused on providing banking services to the government such as handling provincial tax remittances, they had superior information about provincial finances. For these reasons, they dominated the trusted-assistant lending market.

These strong incentives for loan collection could have resulted in overzealous collection: bank employees, anxious for bonus shares, might have enticed the officials to aggressively extract rents even when economic conditions made such extractions likely to produce unrest. However, bargaining over provincial rents was conducted period-by-period and assistants could not commit in a given period to concede future rents to officials. Our theoretical analysis shows that the huge assistant rent concessions required to induce scholar-officials to engage in risky rent extraction in difficult economic times were not feasible given this no-commitment period-by-period bargaining.

Our analysis documents an example of a highly profitable project — acquiring imperial administrative positions — funded by debt financing in the absence of both legal enforcement technology and a reputational bond between the creditor and debtor. Enforcement was implemented by inserting a bonded creditor agent into a crucial position in the debtor’s organization. The insights from this example appear to be relevant to many financing contexts where enforcement of contract rights is problematic. For instance, joint ventures and minority equity alliances between firms typically transfer the employees of at least one of the partners to the newly founded alliance entity. Frequently, the know-how of these employees is the key resource sought by the other partner. Since close cooperation involves a knowledge transfer, the comparative advantage of the partner in providing this know-how is likely to be evanescent. Contracting Contract development in alliances that involve joint production is usually quite incomplete either because of the complexity of formulating a complete set of contingencies ex ante or because the enforceability of the contracts is problematic. Our evidence and analysis suggest that such ventures can be viable even in the absence of effective legal regimes provided that the bargaining power of the parties is sufficiently balanced and the incentives of the agents transferred to the venture are appropriately designed.

(Meng Miao, Hanqing Institute, Renmin University; Guanjie Niu, History Department, Renmin University; Thomas Noe, Saïd Business School and Balliol College, Oxford University.)

Miao, Meng, Guanjie Niu, and Thomas Noe (2017), “Lending without Creditor Rights, Collateral, or Reputation: The ‘Trusted-assistant’ Loan in Nineteenth Century China,” BOFIT Discussion Paper, https://helda.helsinki.fi/bof/bitstream/handle/123456789/14908/dp1317.pdf;jsessionid=5B1EBF201F824B16C44F31CDCE9814E5?sequence=1.

Latest

Most Popular

- VoxChina Covid-19 Forum (Second Edition): China’s Post-Lockdown Economic Recovery VoxChina, Apr 18, 2020

- China’s Great Housing Boom Kaiji Chen, Yi Wen, Oct 11, 2017

- China’s Joint Venture Policy and the International Transfer of Technology Kun Jiang, Wolfgang Keller, Larry D. Qiu, William Ridley, Feb 06, 2019

- The Dark Side of the Chinese Fiscal Stimulus: Evidence from Local Government Debt Yi Huang, Marco Pagano, Ugo Panizza, Jun 28, 2017

- Wealth Redistribution in the Chinese Stock Market: the Role of Bubbles and Crashes Li An, Jiangze Bian, Dong Lou, Donghui Shi, Jul 01, 2020

- Evaluating Risk across Chinese Housing Markets Yongheng Deng, Joseph Gyourko, Jing Wu, Aug 02, 2017

- What Is Special about China’s Housing Boom? Edward L. Glaeser, Wei Huang, Yueran Ma, Andrei Shleifer, Jun 20, 2017

- Privatization and Productivity in China Yuyu Chen, Mitsuru Igami, Masayuki Sawada, Mo Xiao, Jan 31, 2018

- How did China Move Up the Global Value Chains? Hiau Looi Kee, Heiwai Tang, Aug 30, 2017

- China’s Shadow Banking Sector: Wealth Management Products and Issuing Banks Viral V. Acharya, Jun Qian, Zhishu Yang, Aug 09, 2017

Facebook

Facebook  Twitter

Twitter  Instagram

Instagram WeChat

WeChat  Email

Email