China’s Growing Presence in Tax Havens: Implications for Policy and Research

Chinese firms are increasingly utilizing tax havens like the Cayman Islands, Bermuda, and the British Virgin Islands to raise large sums of capital from foreign investors, accounting for over 60% of total offshore equities by 2020. This trend presents challenges to global financial stability and efforts to regulate tax havens, raising issues concerning regulatory oversight, corporate governance, and transparency, particularly as these firms often use complex legal structures to circumvent domestic restrictions on foreign ownership.

As the world scrutinizes tax havens and offshore financial centers (Clausing 2020; Tørsløv, Wier, and Zucman 2023), the role of Chinese firms in these jurisdictions is coming under increasing focus. Emerging market firms, particularly from China, are raising large sums of capital from foreign investors through offshore affiliates by issuing equities and bonds. Despite the scale of these activities, they have received limited attention in academia and policy due to the complex web of financing subsidiaries and shell companies involved. This article examines the role of the Chinese government, state-owned enterprises, and corporates in attracting foreign portfolio investment, both onshore and offshore, based on the work of Clayton et al. (2022) and Coppola et al. (2023).

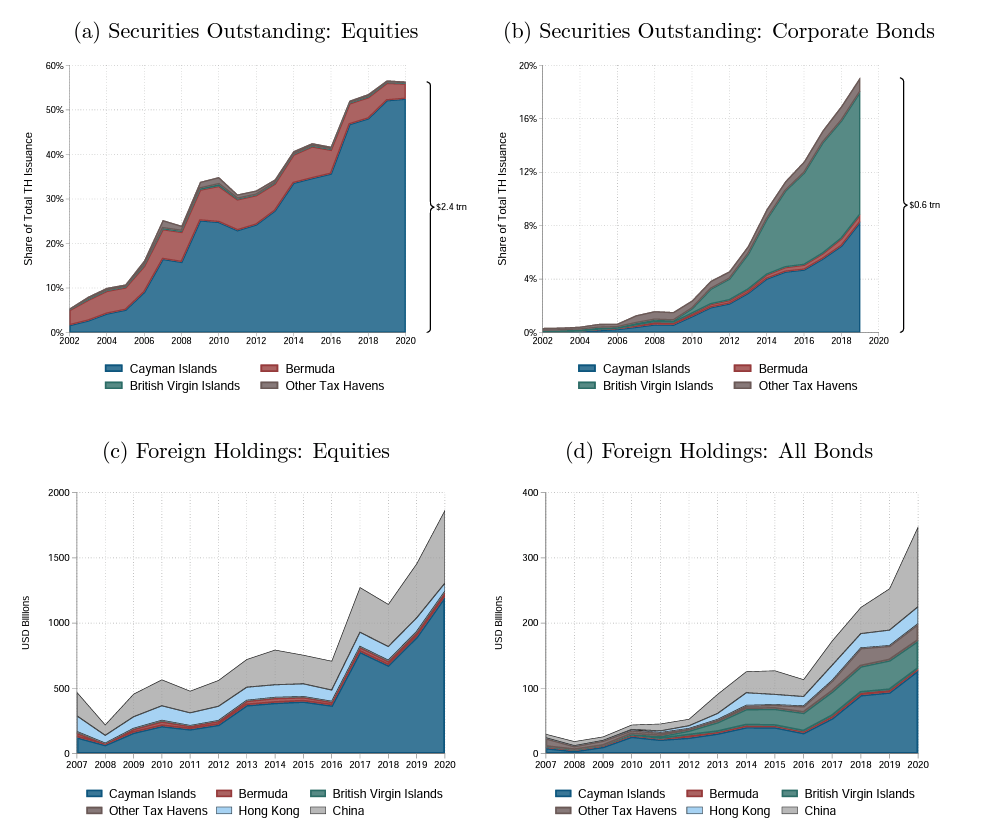

China has quickly become one of the largest issuers of securities in offshore centers. By the end of 2020, Chinese firms accounted for more than 60% of the total value outstanding for equities and nearly 20% for corporate bonds—as shown in Figure 1a-b. The Cayman Islands, Bermuda, and the British Virgin Islands are the preferred tax havens for these firms.

Figure 1. The Rise of China in Offshore Asset Markets. Panels (a) and (b) plot the share of total outstanding securities issued by entities resident in tax havens that are Chinese by nationality. Panels (c) and (d) plot foreign portfolio holdings of Chinese assets estimated by nationality and the breakdown by original residency.

Conversely, offshore jurisdictions play a significant role in attracting foreign portfolio investment for Chinese entities: around 70% of foreign portfolio equity investment in China by nationality is through tax haven affiliates (Figure 1c). Major Chinese tech companies such as Alibaba, Tencent, and Baidu receive most of their capital from developed countries through offshore subsidiaries, using variable interest entity (VIE) structures that circumvent Chinese restrictions on foreign ownership in strategic industries. However, VIE structures pose legal and enforceability risks, which have prompted proposals for increased oversight and regulation in both China and the US.

These VIE structures are established to circumvent Chinese law, which restricts foreign investors from owning equity in companies operating in strategic industries, including the tech sector. To comply with Chinese law while still attracting foreign equity investment, some Chinese firms establish shell companies in offshore tax havens—primarily the Cayman Islands—that are listed publicly on global stock exchanges, such as the New York Stock Exchange.

The offshore shell company in a VIE structure subsequently enters a series of bilateral contracts with the operating company and its Chinese owners, none of which are formal equity contracts. These agreements aim to replicate equity ownership by granting control and a claim to the residual profits of the operating company to the offshore shell company’s shareholders. According to international accounting standards, these contracts are sufficient for the offshore shell company to represent them to foreign investors as equivalent to equity and report on a consolidated worldwide group basis. Simultaneously, the operating firm in China adopts an opposing view of these contracts, asserting to local regulators that it is entirely owned by Chinese residents.

Although Chinese tech companies are the most prominent Chinese issuers in tax havens, they are not the only ones. For instance, State Grid Corporation of China, China National Offshore Oil Corporation, and Sinopec all issue bonds through their British Virgin Islands subsidiaries. The rationale behind these state-owned firms’ offshore presence is less apparent and could be related to foreign investors, regulators, and rating agencies being uneasy about bankruptcy procedures and bondholder rights in Chinese courts. Meanwhile, foreign investors also hold onshore Chinese renminbi bonds, but these holdings are concentrated in government and policy banks bonds.

The growing Chinese presence in tax havens has implications for financial stability, global efforts to regulate tax havens, the worldwide supply of investable assets, and China’s role in the international financial system. The uncertain future of VIE structures and the treatment of tax-haven-issued corporate debt in bankruptcy further exacerbate these concerns. To reform offshore capital markets, cooperation between the US and China is crucial, but geopolitical tensions make it difficult.

Some Chinese companies have already faced controversies due to their offshore activities. A primary concern is whether these complex offshore structures offer sufficient investor protection. Alibaba in 2011 faced a legal battle with Yahoo, one of its equity investors, over the spinoff of Alipay. The battle focused on the extent to which Yahoo could exercise the rights normally associated with equity holdings. Luckin Coffee, a Chinese coffee chain once hailed as a potential rival to Starbucks, was found to have fabricated its sales figures in 2020, leading to its delisting from the Nasdaq stock exchange. The company’s offshore registration in the Cayman Islands complicated the investigation and subsequent legal proceedings against it, highlighting concerns about the transparency and accountability of Chinese firms domiciled in tax havens. The Securities and Exchange Commission in the US has increased regulatory pressure on these offshore firms in terms of disclosures and reporting standards.

Altogether, the rise of Chinese companies in offshore securities issuance has been a significant development in the global financial landscape over the past two decades. While this phenomenon has provided new opportunities for Chinese firms to access international capital and fuel their growth, it has also raised concerns about regulatory challenges and corporate governance. Policymakers, regulators, and market participants must collaborate to address these issues and ensure the stability and integrity of the global financial system. This involves harmonizing regulations, improving transparency, and promoting adherence to international standards and best practices. As China continues to liberalize its financial system and encourage foreign investment, it remains to be seen whether its reliance on tax haven–based intermediation will persist or fade over time.

References

Clausing, Kimberly. 2020. “Taxing Multinational Companies in the 21st Century.” Brookings Institution. www.brookings.edu/research/taxing-multinational-companies-in-the-21st-century/.

Clayton, Christopher, Antonio Coppola, Amanda Dos Santos, Matteo Maggiori, and Jesse Schreger. 2023. “China in Tax Havens.” NBER Working Paper No. w30865. http://dx.doi.org/10.2139/ssrn.4334944.

Clayton, Christopher, Amanda Dos Santos, Matteo Maggiori, and Jesse Schreger. 2022. “Internationalizing Like China.” SSRN Working Paper. http://dx.doi.org/10.2139/ssrn.4055583.

Tørsløv, Thomas, Ludvig Wier, and Gabriel Zucman. 2023. “The Missing Profits of Nations.” Review of Economic Studies 90 (3): 1499–1534. https://doi.org/10.1093/restud/rdac049.

Latest

Most Popular

- VoxChina Covid-19 Forum (Second Edition): China’s Post-Lockdown Economic Recovery VoxChina, Apr 18, 2020

- China’s Great Housing Boom Kaiji Chen, Yi Wen, Oct 11, 2017

- China’s Joint Venture Policy and the International Transfer of Technology Kun Jiang, Wolfgang Keller, Larry D. Qiu, William Ridley, Feb 06, 2019

- The Dark Side of the Chinese Fiscal Stimulus: Evidence from Local Government Debt Yi Huang, Marco Pagano, Ugo Panizza, Jun 28, 2017

- Wealth Redistribution in the Chinese Stock Market: the Role of Bubbles and Crashes Li An, Jiangze Bian, Dong Lou, Donghui Shi, Jul 01, 2020

- What Is Special about China’s Housing Boom? Edward L. Glaeser, Wei Huang, Yueran Ma, Andrei Shleifer, Jun 20, 2017

- Evaluating Risk across Chinese Housing Markets Yongheng Deng, Joseph Gyourko, Jing Wu, Aug 02, 2017

- Privatization and Productivity in China Yuyu Chen, Mitsuru Igami, Masayuki Sawada, Mo Xiao, Jan 31, 2018

- How did China Move Up the Global Value Chains? Hiau Looi Kee, Heiwai Tang, Aug 30, 2017

- China’s Shadow Banking Sector: Wealth Management Products and Issuing Banks Viral V. Acharya, Jun Qian, Zhishu Yang, Aug 09, 2017

Facebook

Facebook  Twitter

Twitter  Instagram

Instagram WeChat

WeChat  Email

Email