The Value of Bankruptcy Court in Financial Distress: Evidence from Chinese Bond Market

In this paper, we find that the introduction of specialized bankruptcy courts, which are run by better-trained judges and subject to less government intervention, reduces the cost of bond financing by around 10%. By exploring bankruptcy filings associated with bond defaults, we show that the strengthening of creditor protection increases bondholders’ recovery values and shortens the time firms spend in bankruptcy proceedings, which pass-through lower bond spreads.

Legal institutions have an important effect on the financing cost for companies and households. In many developing countries, the weak protection of creditors’ rights in bankruptcy cases is an important source of market distortion (La Porta et al. 1997; Djankov, McLiesh, and Shleifer 2007). In particular, bankruptcy laws are underdeveloped and courts are slow to process cases, leading to a high bankruptcy cost, which is a barrier to firm financing and economic development (Ponticelli and Alencar 2016; Li and Ponticelli 2022; Müller 2022).

The Decline of Government Guarantees and the Rise of “Market-Oriented” Bankruptcy

The Chinese debt market has experienced booms and busts in the last two decades. During the 2008 global financial crisis, the Chinese government introduced several economic stimulus policies, which led to debt expansion and shadow banking (Chen, He, and Liu 2020), creating major overcapacity in zombie industries and firms. Since 2014, China has experienced several waves of credit market defaults. The first Chinese company ever to default on its onshore corporate bonds, Shanghai Chaori Solar, failed to meet interest payments of 89.8 million RMB on a 1 billion RMB bond issued in 2012. Previous studies provide evidence on how implicit government guarantees affect bond spreads and the state-owned enterprise (SOE) premium in China (Liu, Lyu, and Yu 2017; Geng and Pan 2022; Li et al. 2022). The recent decline of government guarantees significantly changed investors’ perception of the implicit government guarantees in corporate bonds, as it challenges the assumption that the Chinese government will bail out any Chinese corporation in event of default.

Given the surge in the number of debt defaults by private enterprises (POEs) and SOEs since 2015 (Amstad and He 2019; Jin, Wang, and Zhang 2021), efficient bankruptcy resolution is essential for creditor protection and has broader implications for the credit market. However, the Chinese court was characterized by state influence and a lack of professional judges to deal with bankruptcy cases, rendering the bankruptcy process lengthy and cumbersome, and preventing creditors from getting repaid efficiently. The recent spike in bond defaults has led to calls for bankruptcy reform to increase bondholders’ recovery values and shorten the time spent in bankruptcy proceedings. Therefore, handling default cases efficiently is of great importance not only for investors, but also for the healthy development of the bond market.

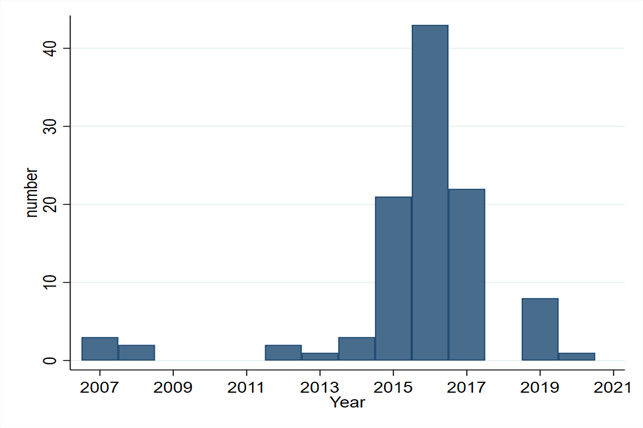

We study the impact of introducing specialized bankruptcy courts in cities across China on the financing cost of corporate bonds. Compared to traditional civil courts, specialized courts are run by better-trained judges and are part of an effort by the central government to limit intervention by local governments in bankruptcy cases (INSOL 2018). At the end of 2017, there were 97 bankruptcy tribunals in Intermediate People’s Courts across China, and each province had at least one bankruptcy tribunal (Figure 1).

Figure 1: Number of Specialized Courts Established

The Effect of Bankruptcy Courts on Bond Market and Potential Mechanisms

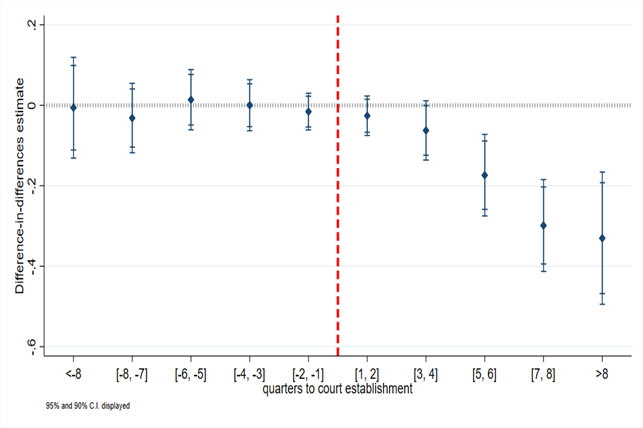

Using the sample of corporate bonds in the Chinese onshore bond market, we analyze the change in the trading spreads of bonds issued by a company before and after the establishment of specialized courts in the difference-in-differences (DID) regression (Figure 2). Given that specialized courts were introduced at different times in different cities, we exploit the staggered introduction for identification. However, cities that introduced specialized courts might be on a different economic cycle, which would also affect the type of firms going bankrupt. To deal with this challenge we exploit the fact that, even after the introduction of specialized courts, bankruptcy cases were still handled by both traditional civil courts and specialized courts within the same city, in almost equal proportions. This feature of the Chinese judicial system allows us to compare cases initiated in different courts within the same city and year.

We find that the establishment of specialized courts decreases the trading spreads of corporate bonds in the secondary market by 17.9 basis points, representing a 7.6% reduction in the average trading spreads. The baseline results indicate that corporate bond issuers ultimately gain from the bankruptcy courts with lower debt financing costs. We also provide evidence with respect to the ownership of the bond issuer: specialized courts lead to a 31.6 basis point reduction for bonds issued by POEs, in contrast to a 20.8 basis point reduction for bonds issued by SOEs and a 5.5 basis point reduction for LGFV bonds (Chengtou bonds). The reduction in bond spreads among POEs has implications for the literature on misallocation of resources and preferential lending treatment for SOEs with low productivity (Hsieh and Klenow 2009; Cong et al. 2019).

Figure 2: The Effect of Specialized Courts on Bond Yield Spread

Notes: This figure tests the parallel trend assumption of the difference-in-differences model. Red vertical line indicates the quarter t0 when a city establishes the court, and is considered as the benchmark. The inner and outer confidence interval are at significance level of 10% and 5% respectively.

Our heterogeneous tests find that the effects are much stronger when ex ante default risk is higher, consistent with the role of creditor protection in financial distress. The effect tends to be larger for risker issuers, and larger in cities with lower GDP growth rate or with pre-existing SOE default. Moreover, we exploit a critical bond default event in China’s bond market as a quasi-natural experiment to proxy the ex ante default risk. Specifically, Yongmei Group, a Henan-based coal producer, started defaulting on a series of AAA-rated bonds worth more than RMB 3 billion (USD 460 million) in November 2020. This event triggered marketwide panic among debt market investors, intensifying concerns about the absence of implicit guarantee, lack of creditor protection, and subsequent bond default waves of other companies. We show that the effect is amplified after the Yongmei event, suggesting that creditor protection becomes more important in the absence of government guarantees.

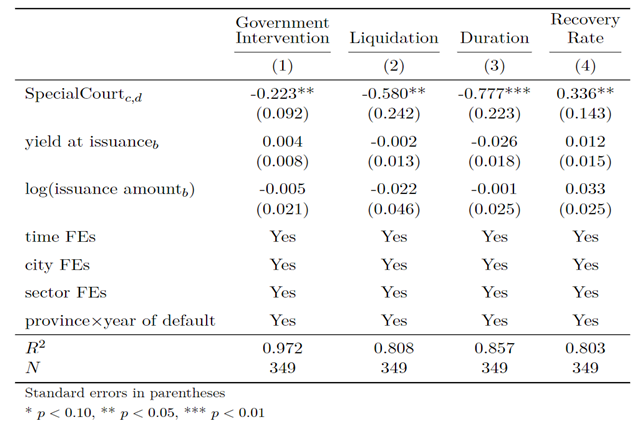

Furthermore, we study the channel through which specialized courts improve creditor protection and reduce the cost of bond financing (Table 1). Using detailed, case-level data on bankruptcy filings in which bankrupt firms suffer from bond defaults, we show that specialized courts improve efficiency in bankruptcy resolution. Reorganization is more likely to be adopted for bankruptcy resolution in specialized courts, whereas liquidation is more common in traditional civil courts. The introduction of specialized courts increases efficiency by decreasing the time firms spend in bankruptcy proceedings and increases recovery values that pass through to the lower bond spreads.

Table 1: Specialized Court and Resolution of Defaulted Bonds

Notes:This table reports the effect of the specialized court on the resolution of defaulted bonds using a sample of bond issuers that went bankrupt. Government Intervention is a dummy variable that equals one if bankruptcy procedure is subject to government intervention. Liquidation is a dummy variable that equals one if a bond defaulter ends up in liquidation. Duration is a dummy variable that equals one if it takes more than one year for a court to approve the reorganized plan since the acceptance of the bankruptcy case. Recovery rate is the repaid proportion of defaulted bond. SpecialCourtc,d equals one if city has already established a specialized court by the time of bond default.

Our study is related to the literature on the impact of bankruptcy procedures and creditor protection on corporate financing and investment, such as Von Lilienfeld-Toal, Mookherjee, and Visaria (2012), Ponticelli and Alencar (2016), Gopalan, Mukherjee, and Singh (2016), Iverson et al. (2020) and Müller (2022). Our study is closely related to the study of Li and Ponticelli (2022), which compares bankruptcy cases handled by specialized courts and traditional civil courts in China, and finds that specialized courts decrease the duration of case proceedings by 36% compared with traditional civil courts, while we further investigate the effect of the introduction of such specialized courts on corporate bond financing.

Taken together, the results in this paper suggest that the strong legal institution in investor protection, in particular a “market-oriented” bankruptcy model, reduces the cost of debt and could eventually benefit debt issuers. Our paper explores the linkages between bankruptcy reform and the development of the corporate bond market, and the evidence has great policy implications on the enhancement in bankruptcy system. The introduction of specialized bankruptcy courts across China produces great economic benefits, saving around USD 2.5 billion in annual interest payments for China’s corporate bond issuers. In many emerging economies, however, the legal institution in investor protection is underdeveloped, which further hampers corporate financing and financial development as documented in literature (Ponticelli and Alencar 2016; Müller 2022). In China, given the uncertainty of an implicit government guarantee, creditor protection in bankruptcy is important to debt issuers, and a “market-oriented” bankruptcy resolution can have great implications on bond pricing in the global debt market.

References

Amstad, Marlene, and Zhiguo He. 2019. “Chinese Bond Market and Interbank Market.” NBER Working Paper No. 25549. https://doi.org/10.3386/w25549.

Chen, Hui, Zhuo Chen, Zhiguo He, Jinyu Liu, and Rengming Xie. 2019. “Pledgeability and Asset Prices: Evidence from the Chinese Corporate Bond Markets.” SSRN Working Paper. https://dx.doi.org/10.2139/ssrn.3295202.

Chen, Zhuo, Zhiguo He, and Chun Liu. 2020. “The Financing of Local Government in China: Stimulus Loan Wanes and Shadow Banking Waxes.” Journal of Financial Economics 137 (1): 42–71. https://doi.org/10.1016/j.jfineco.2019.07.009.

Cong, Lin William, Haoyu Gao, Jacopo Ponticelli, and Xiaoguang Yang. 2019. “Credit Allocation under Economic Stimulus: Evidence from China.” Review of Financial Studies 32 (9): 3412–60. https://doi.org/10.1093/rfs/hhz008.

Djankov, Simeon, Caralee McLiesh, and Andrei Shleifer. 2007. “Private Credit in 129 Countries.” Journal of Financial Economics 84 (2): 299–329. https://doi.org/10.1016/j.jfineco.2006.03.004.

Geng, Zhe, and Jun Pan. 2022. “The SOE Premium and Government Support in China’s Credit Market.” SSRN Working Paper. https://dx.doi.org/10.2139/ssrn.3473544.

Gopalan, Radhakrishnan, Abhiroop Mukherjee, and Manpreet Singh. 2016. “Do Debt Contract Enforcement Costs Affect Financing and Asset Structure?” Review of Financial Studies 29 (10): 2774–2813. https://doi.org/10.1093/rfs/hhw042.

Hsieh, Chang-Tai, and Peter J. Klenow. 2009. “Misallocation and Manufacturing TFP in China and India.” Quarterly Journal of Economics 124 (4): 1403–48. https://doi.org/10.1162/qjec.2009.124.4.1403.

INSOL. 2018. PRC Enterprise Bankruptcy Law and Practice in China. Technical report.

Iverson, Benjamin Charles, Joshua Madsen, Wei Wang, and Qiping Xu. 2020. “Financial Costs of Judicial Inexperience: Evidence from Corporate Bankruptcies.” SSRN Working Paper. https://dx.doi.org/10.2139/ssrn.3084318.

Jin, Shuang, Wei Wang, and Zilong Zhang. 2021. “The Real Effects of Implicit Government Guarantee: Evidence from Chinese SOE Defaults.” SSRN Working Paper. https://dx.doi.org/10.2139/ssrn.2916456.

La Porta, Rafael, Florencio Lopez-de-Silanes, Andrei Shleifer, and Robert W. Vishny. 1997. “Legal Determinants of External Finance.” Journal of Finance 52 (3): 1131–50. https://doi.org/10.2307/2329518.

Li, Bo, and Jacopo Ponticelli. 2022. “Going Bankrupt in China.” Review of Finance 26 (3): 449–86. https://doi.org/10.1093/rof/rfab023.

Li, M., Liu, L. X., Liu, Q., and Zhu, N. 2022. “Collapse of Implicit Government Guarantee Versus Disorderly Default: The Impact of Bond Default in China.” Working Paper. https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2922946

Liu, Laura Xiaolei, Yuanzhen Lyu, and Fan Yu. 2017. “Implicit Government Guarantee and the Pricing of Chinese LGFV Debt.” Working Paper.

Müller, Karsten. 2022. “Busy Bankruptcy Courts and the Cost of Credit.” Journal of Financial Economics 143 (2): 824–45. https://doi.org/10.1016/j.jfineco.2021.08.010.

Ponticelli, Jacopo, and Leonardo S. Alencar. 2016. “Court Enforcement, Bank Loans, and Firm Investment: Evidence from a Bankruptcy Reform in Brazil.” Quarterly Journal of Economics 131 (3), 1365–1413. https://doi.org/10.1093/qje/qjw015.

Von Lilienfeld‐Toal, Ulf, Dilip Mookherjee, and Sujata Visaria. 2012. “The Distributive Impact of Reforms in Credit Enforcement: Evidence from Indian Debt Recovery Tribunals.” Econometrica 80 (2): 497–558. https://doi.org/10.3982/ECTA9038.

Latest

Most Popular

- VoxChina Covid-19 Forum (Second Edition): China’s Post-Lockdown Economic Recovery VoxChina, Apr 18, 2020

- China’s Great Housing Boom Kaiji Chen, Yi Wen, Oct 11, 2017

- China’s Joint Venture Policy and the International Transfer of Technology Kun Jiang, Wolfgang Keller, Larry D. Qiu, William Ridley, Feb 06, 2019

- The Dark Side of the Chinese Fiscal Stimulus: Evidence from Local Government Debt Yi Huang, Marco Pagano, Ugo Panizza, Jun 28, 2017

- Wealth Redistribution in the Chinese Stock Market: the Role of Bubbles and Crashes Li An, Jiangze Bian, Dong Lou, Donghui Shi, Jul 01, 2020

- What Is Special about China’s Housing Boom? Edward L. Glaeser, Wei Huang, Yueran Ma, Andrei Shleifer, Jun 20, 2017

- Evaluating Risk across Chinese Housing Markets Yongheng Deng, Joseph Gyourko, Jing Wu, Aug 02, 2017

- Privatization and Productivity in China Yuyu Chen, Mitsuru Igami, Masayuki Sawada, Mo Xiao, Jan 31, 2018

- How did China Move Up the Global Value Chains? Hiau Looi Kee, Heiwai Tang, Aug 30, 2017

- China’s Shadow Banking Sector: Wealth Management Products and Issuing Banks Viral V. Acharya, Jun Qian, Zhishu Yang, Aug 09, 2017

Facebook

Facebook  Twitter

Twitter  Instagram

Instagram WeChat

WeChat  Email

Email