Magnification of the “China Shock” Through the U.S. Housing Market

The “China shock” operated in part through the U.S. housing market, which is one important reason the China shock was as big as it was. If housing prices had not responded at all to the China shock, then the total employment effect would have been reduced by more than one-half. Even when fully recognizing that housing prices responded to the China shock, the independent employment effect of the China shock is still reduced by around 30%.

In an influential study, Autor, Dorn, and Hanson (2013, hereafter ADH) show that rising import competition from China (the “China shock”) has caused a substantial employment decline in the United States. Furthermore, the negative effect goes beyond manufacturing and exists for nonmanufacturing workers as well. Such results, accompanied by findings in other studies such as Pierce and Schott (2015) and Acemoglu et al. (2016), have important policy implications and challenge the benign view towards globalization.

In this research, we investigate one reason for the strong impact of the China shock on the U.S. labor market, specifically, the housing market in the United States. We find it is important to control for changes in housing prices when estimating the employment effect of the China shock because during the same period when the United States faced increasing import competition from China, its domestic economy also experienced a national housing boom that started in the late 1990s and varied across regions.

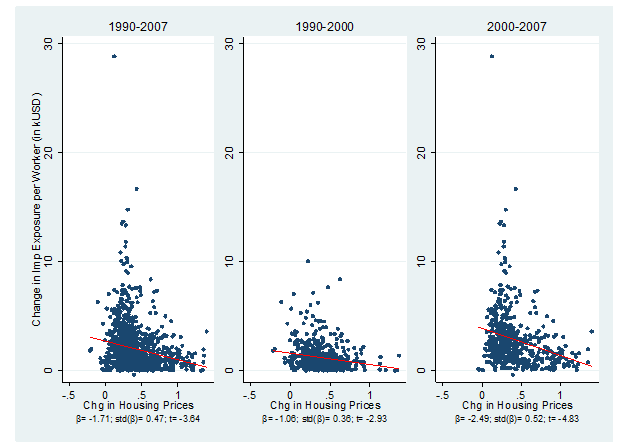

Figure 1 plots the correlation between changes in import penetration and changes in housing prices in the United States across commuting zones. There is an obvious negative correlation between the two variables of interest, especially in the 2000–2007 period. Regions that experienced larger import shocks also experienced smaller increases in housing prices. If the changes in housing prices are endogenous responses to the China shock, then omitting variables for housing demand would mean that the estimated effect of import exposure should be interpreted as a reduced form rather than structural. But to the extent that the changes in housing prices are exogenous, or partly exogenous, then leaving them out will overstate the effect of the China shock.

Our empirical approach builds on that in ADH but augments it with a housing variable. We regress local changes in employment share on local changes in import exposure and local changes in housing prices over two stacked periods, 1990–2000 and 2000–2007 (see Note 1). As in ADH, imports from China are instrumented by Chinese exports to eight other advanced economies. To isolate the exogenous part of housing price changes, we use two instrumental variables for housing. One is the estimated structural break from rapid changes in housing prices that occurred in each region. The idea relies on the emerging consensus that much of the variation in housing prices during the housing boom in the United States was from speculative activities and not from changes in fundamentals. We therefore estimate for each local area a structural break in the evolution of housing prices and treat these “sharp” breaks as exogenous to fundamental shocks (see also Ferreira and Gyourko, 2011; Charles et al. 2016).

The second instrumental variable is the land topology–based measure of housing supply elasticity introduced by Saiz (2010). Housing development is effectively constrained by geographic situations, such as the presence of steep slopes, wetlands, lakes, and so on. Saiz constructs an exact measure of land availability and estimates the housing supply elasticity for local areas. The estimated supply elasticity is exogenous to housing demand shocks and is used as an instrument for housing price change (see also Mian and Sufi 2011, 2014).

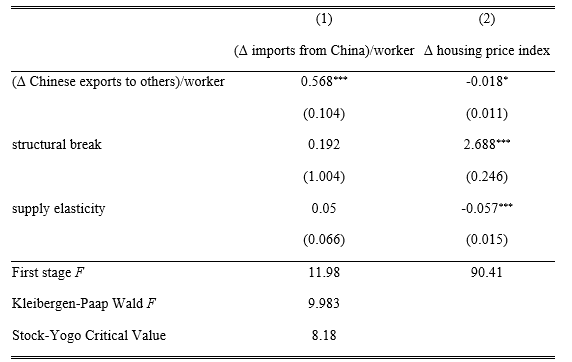

Table 1 reports the first-stage results for instruments. All instruments are relevant, with F- statistics above the critical value. The China shock does affect the U.S. housing market, with the estimated coefficient on the import instrument being statistically significant (at the 10% level) for housing price changes. Therefore, the China shock affects the U.S. labor market through at least two channels. One is the “direct” effect on employment through import competition; the other is the “indirect” effect through the magnification channel of the housing market.

Note: Robust standard errors in parentheses, clustered on state. * p < 0.10, ** p < 0.05, *** p < 0.01. Stock-Yogo critical value of two endogenous variables and three instrumental variables at the 5% significance level for a desired maximal size of 15%.

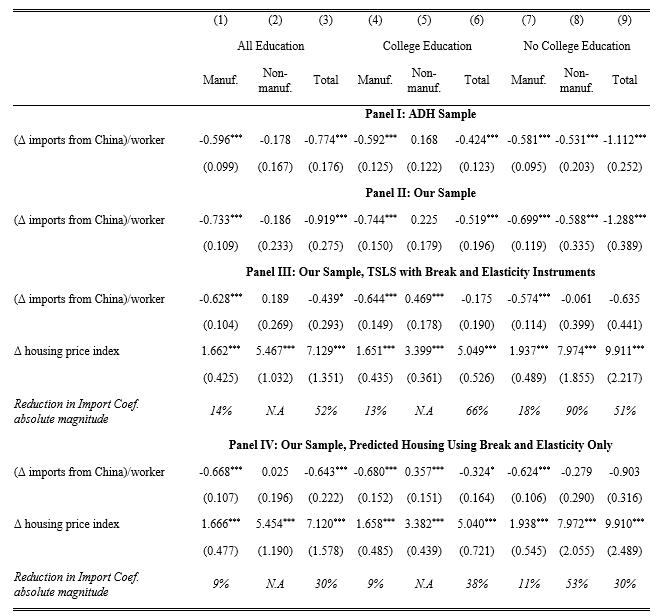

Table 2 summarizes our main findings on the employment effect. Panel I replicates the ADH results: import exposure substantially reduces the manufacturing employment rate, while it has a negative but insignificant effect on the nonmanufacturing employment rate, resulting in a significantly negative effect on total employment. Panel II confirms the findings in ADH, using our sample that has information on housing prices. In fact, the effect of the China shock in our sample is even stronger (see Note 2). Further decomposing the effect by workers’ education levels shows that import exposure from China reduces the no-college employment rate in both manufacturing and nonmanufacturing sectors, while for college workers, the negative effect happens mainly in the manufacturing sector.

The effect of import exposure, however, is widely mitigated after we control housing. Panel III reports the TSLS results. The effects on manufacturing and total employment are all reduced for all workers, with the reduction for total employment being more than one-half. The result on nonmanufacturing employment is even striking: the impact on no-college employment in the nonmanufacturing sector is reduced to close to zero (a 90% drop in the coefficient) and becomes insignificant, and the China import exposure increases college-educated workers’ employment in the nonmanufacturing sector significantly.

Panel IV goes further to shut down the endogenous response of housing to import exposure. To achieve this, we construct a predicted housing price change using only the housing instrument term from the first-stage regression, and use this predicted housing variable in the second-stage regression. The reduction of the coefficients is less, but the patterns are qualitatively similar. Now the independent effect of the China shock on total employment is reduced by around 30%, and the effect on nonmanufacturing employment for college workers remains positive and statistically significant.

Note: Robust standard errors in parentheses, clustered on state. * p < 0.10, ** p < 0.05, *** p < 0.01.

Our results indicate the importance of the housing market in “magnifying” the effect of the China shock on the U.S. labor market. If housing prices had not responded at all to the China shock, then the total employment effect of the China shock would have been reduced by more than one-half. Housing prices in the United States, however, did partly respond to the China shock. Controlling the endogenous response of housing, the independent employment effect of the China shock is still reduced by around 30%. While import competition reduces employment in the manufacturing sector, it also leads to an increase of employment in the nonmanufacturing sector, especially for college workers. Of course, for general equilibrium reasons, resources that are freed up due to import competition can be expected to be re-employed into export (or domestic) activities (see Feenstra, Ma, and Xu, 2019), and exploring this topic is an important direction for further research.

Note 1: All regressions include the full vector of economic and demographic controls as in ADH. All regressions are weighted by the start-of-period commuting zone’s share of national population.

Note 2: Our sample consists of those commuting zones that have information on high-frequency housing price and supply elasticity data. The excluded commuting zones are mainly rural regions. The sample accounts for 90 percent of the U.S. population and closely resembles the original, complete sample in the statistics of all key variables.

References

Acemoglu, Daran, David H. Autor, David Dorn, Gordon H. Hanson, and Brendan Price (2016) “Import Competition and the Great US Employment Sag of the 2000s,” Journal of Labor Economics, 34(S1), S141–S198.

Autor, David H., David Dorn, and Gordon H. Hanson (2013) “The China Syndrome: Local Labor Market Effects of Import Competition in the United States,” American Economic Review, 103(6), 2121–2168.Charles, Kerwin Kofi, Erik Hurst and Matthew J. Notowidigdo (2016) “The Masking of the Decline in Manufacturing Employment by the Housing Bubble,” Journal of Economic Perspectives, 30(2):179–200.

Feenstra, Robert C., Hong Ma, and Yuan Xu (2019) “US Exports and Employment,” Journal of International Economics, 120, 46–58.

Ferreira, Ferando and Joe Gyourko (2011) “Anatomy of the Beginning of the Housing Boom: U.S. Neighborhoods and Metropolitan Areas, 1993–2009,” NBER Working Paper 17374.

Mian, Atif and Amir Sufi (2011) “House Prices, Home Equity-Based Borrowing, and the US Household Leverage Crisis.” American Economic Review, 101:2132–2156.

Mian, Atif and Amir Sufi (2014) “What Explains the 2007–2009 Drop in Employment?” Econometrica, 82(6):2197–2223.

Pierce, Justin R. and Peter K. Schott (2016) “The Surprisingly Swift Decline of U.S. Manufacturing Employment,” American Economic Review, 106(7), 1632–1662.

Saiz, Albert (2010) “The Geographic Determinants of Housing Supply,” Quarterly Journal of Economics, 125(3):12531296.

Latest

Most Popular

- VoxChina Covid-19 Forum (Second Edition): China’s Post-Lockdown Economic Recovery VoxChina, Apr 18, 2020

- China’s Great Housing Boom Kaiji Chen, Yi Wen, Oct 11, 2017

- China’s Joint Venture Policy and the International Transfer of Technology Kun Jiang, Wolfgang Keller, Larry D. Qiu, William Ridley, Feb 06, 2019

- The Dark Side of the Chinese Fiscal Stimulus: Evidence from Local Government Debt Yi Huang, Marco Pagano, Ugo Panizza, Jun 28, 2017

- Wealth Redistribution in the Chinese Stock Market: the Role of Bubbles and Crashes Li An, Jiangze Bian, Dong Lou, Donghui Shi, Jul 01, 2020

- What Is Special about China’s Housing Boom? Edward L. Glaeser, Wei Huang, Yueran Ma, Andrei Shleifer, Jun 20, 2017

- Evaluating Risk across Chinese Housing Markets Yongheng Deng, Joseph Gyourko, Jing Wu, Aug 02, 2017

- Privatization and Productivity in China Yuyu Chen, Mitsuru Igami, Masayuki Sawada, Mo Xiao, Jan 31, 2018

- How did China Move Up the Global Value Chains? Hiau Looi Kee, Heiwai Tang, Aug 30, 2017

- China’s Shadow Banking Sector: Wealth Management Products and Issuing Banks Viral V. Acharya, Jun Qian, Zhishu Yang, Aug 09, 2017

Facebook

Facebook  Twitter

Twitter  Instagram

Instagram WeChat

WeChat  Email

Email