Do Interest Rates Play a Major Role in Monetary Policy Transmission in China?

We explore the role of interest rates in monetary policy transmission in China in the context of its multiple instrument setting. In doing so, we construct a new series of monetary policy surprises using information from high frequency Chinese financial market data around major monetary policy announcements. We find that a contractionary monetary policy surprise increases interest rates and significantly reduces inflation and economic activity. Our findings provide further support to recent studies suggesting that monetary policy transmission in China has become increasingly similar to that in advanced economies.

Understanding how monetary policy works in China is important in the context of China’s growing weight in the global economy. In market economies, this assessment crucially depends on the role interest rates play in resource allocation decisions and the transmission of monetary policy. Significant literature (He and Wang, 2012, 2013; Fernald et al., 2014; Chen et al., 2017) already suggests that monetary policy transmission in China has started to resemble that of advanced economies. The actual conduct of monetary policy has also moved in this direction, as suggested by the recent removal of interest rate controls and the general reorientation of monetary policy away from the use of quantity targets to one in which the People's Bank of China (PBC) manages a key short-term interest rate. For instance, the PBC has recently stated that it would improve its liquidity management strategies by releasing timely policy signals to guide market expectations of interest rates to achieve its monetary policy objectives.

Yet, ascertaining whether an interest rate channel of monetary transmission exists in China remains challenging for several reasons. First, the PBC uses multiple instruments, including reserve requirements and implicit credit quotas, to conduct monetary policy. Researchers using standard monetary policy transmission models are therefore confronted with the problem of accurately representing the stance of monetary policy using either a price or quantity variable. Second, China's monetary policy framework is still evolving in the context of its transition to a flexible exchange rate regime. Not only is the exchange rate an important channel of monetary policy but shifts in the exchange rate regime can have a significant impact on interest rates and credit conditions more generally. Finally, any assessment of monetary policy must consider the fact that the PBC's policy instruments evolve endogenously with the state of the economy. The PBC may not only respond to incoming news about output and inflation by changing its policy stance, but shifts in its policy stance can also affect agents' expectations about the future evolution of the economy. Without isolating this systematic component of monetary policy, it is difficult to infer anything about the effectiveness of monetary policy.

In light of this situation, in a recent paper (Kamber and Mohanty, 2018), we explore the role of interest rates for monetary policy transmission in China considering its multiple instrument setting. In doing so, we exploit information from high-frequency Chinese financial market data to identify monetary policy shocks and assess their macroeconomic effects. In contrast to the approach followed in previous studies, our strategy does not require an assumption about the PBC's reaction function. Instead, we assume that while financial market participants do not have full information about the PBC's true reaction function, they can reasonably anticipate changes in its main policy instruments conditional on the state of the economy and price them in interest rates. The high-frequency financial market information then enables us to separate the “surprise” component of monetary policy from the “expected" component, which we use subsequently to identify monetary policy shocks.

Our first contribution is to construct a time series of monetary policy surprises using daily changes in interest rates during short windows around policy decisions and communications by the PBC. Specifically, we focus on movements in one-year interest rate swap (IRS) contracts based on the interbank 7-day repo rate to measure market expectations of monetary policy. The 7-day repo rate is not only considered very informative with respect to the monetary policy stance of the PBC, but it is also the most liquid among all types of IRS contracts. To account for China’s multiple-instrument setting, we compute daily changes in IRS contracts on days when lending rates and reserve requirements are changed, when quarterly monetary policy reports are published, or when there are major changes in the exchange rate regime.

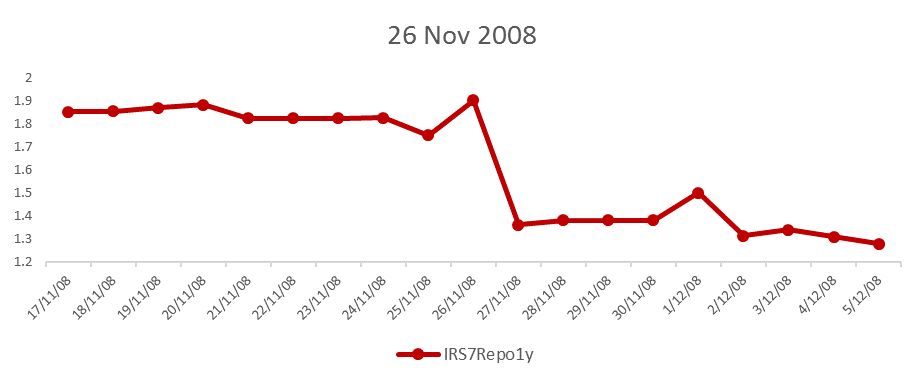

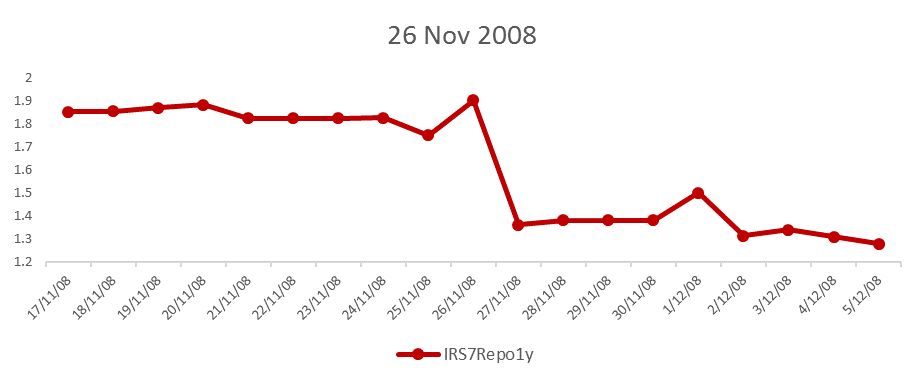

Graph 1 plots an example of our procedure and the resulting surprise measure. On 26 November 2008, the PBC lowered both lending and deposit rates by around 100 basis points and relaxed the reserve Requirement Ratio (RRR) from 17% to 16% for large banks and from 16% to 14% for small banks. Graph 1 depicts the evolution of one-year 7-day repo interest rate swaps (IRS) before and after the announcement. The IRS was stable at around 1.9% before the announcement but fell sharply to 1.35% the day after the announcement. Therefore, our estimate for the monetary policy surprise for this announcement, which involved multiple policy instruments, is 55 basis points. Considering the days on which multiple instruments have been adjusted, we repeat the same procedure for 107 announcements covering the period of 2006–2016 to construct a time series of monetary policy surprises.

Note: The figure plots the evolution of one-year 7-day repo interest rate swaps before and after the monetary policy announcements on 26 November 2008.

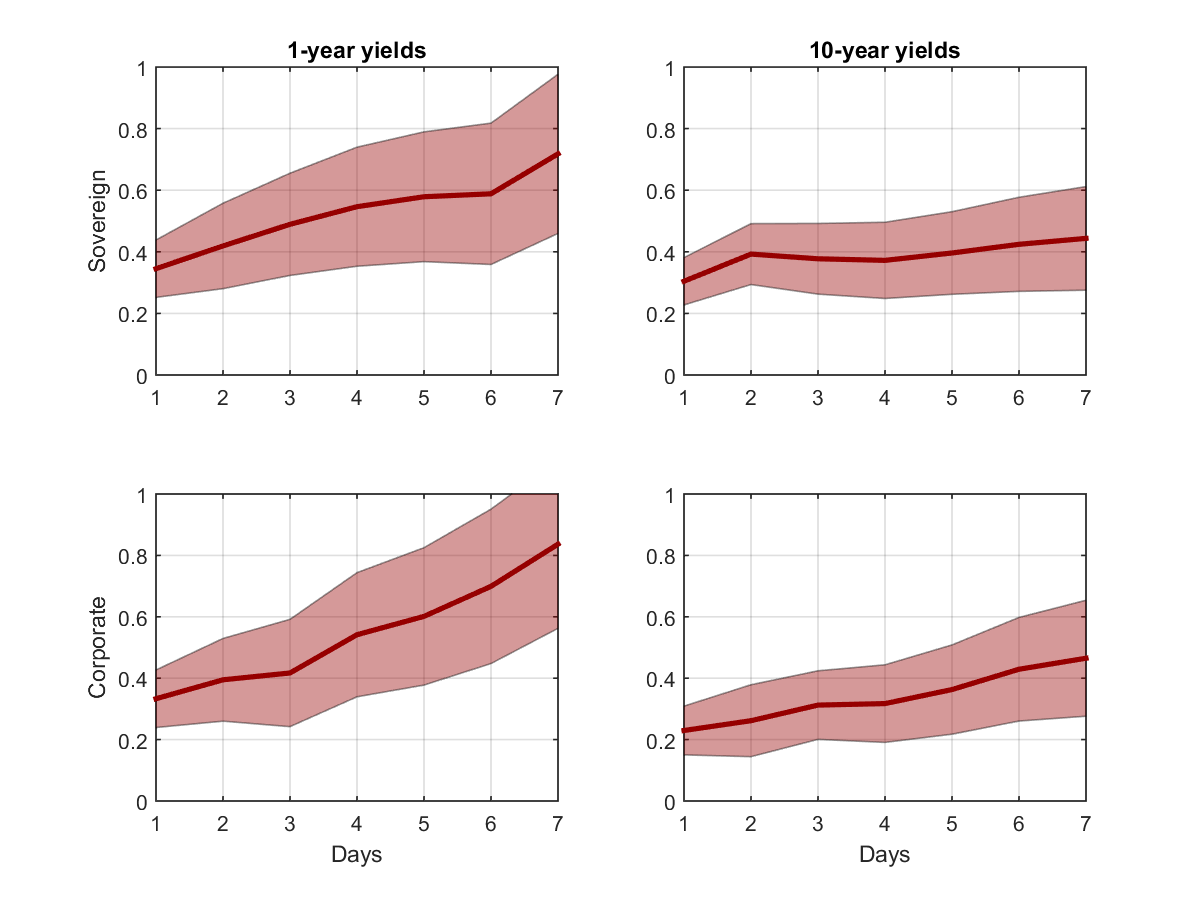

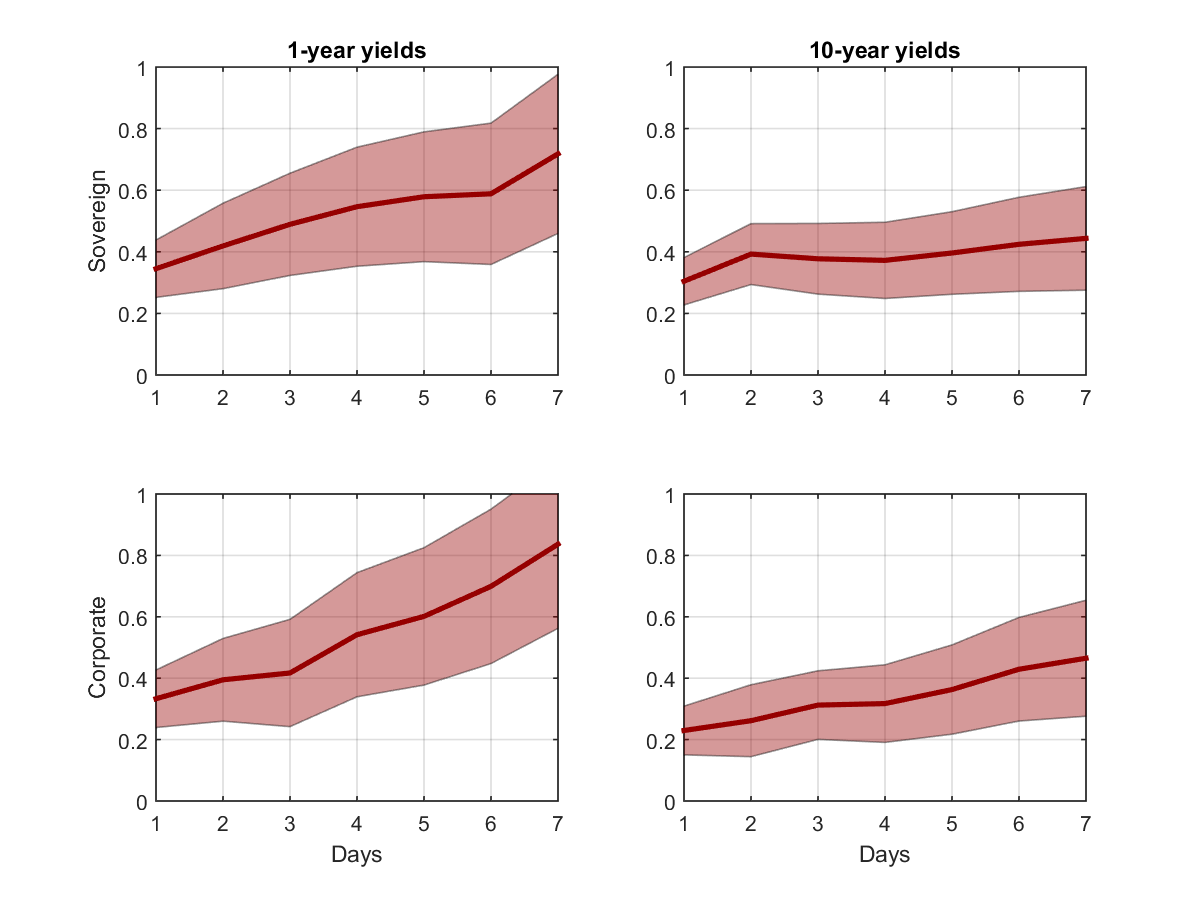

Using these surprises, we then carryout an event-study analysis to analyse the response of interest rates to monetary policy actions. Graph 2 reports the estimated effects of monetary policy actions on 1- and 10-year yields on sovereign and AAA corporate bonds over 7 days following an announcement. The thick line and shaded areas respectively represent the point estimates and the confidence bands. Clearly, monetary policy actions have a significant and persistent effect across a range of market interest rates. The confidence bands become wider over time as other market developments probably account for a larger share of movements in yields. The point estimates are also increasing slightly over time, suggesting that the effect of the monetary policy surprises are sluggishly priced in over the week following the monetary policy announcement. In terms of magnitude, a monetary policy announcement that is accompanied by an IRS increase of 100-basis-point is associated with around a 70-basis-point increase in 1-year sovereign yields and about a 40-basis-point- increase in 10-year sovereign yields after a week. The effect on corporate yields is somewhat larger for the same maturities. Moreover, as is typical in other advanced economies, the effect of the monetary policy actions is larger at the short end of the yield curve and lower but significant at the long end of the yield curve.

Note: The figure presents the impact of monetary policy surprises on sovereign and corporate yields at various maturities. Each panel depicts the response of a particular yield over the following 7 days. The solid red lines are coefficient estimates and the shaded areas represent 90% confidence intervals. See Kamber and Mohanty (2018) for details.

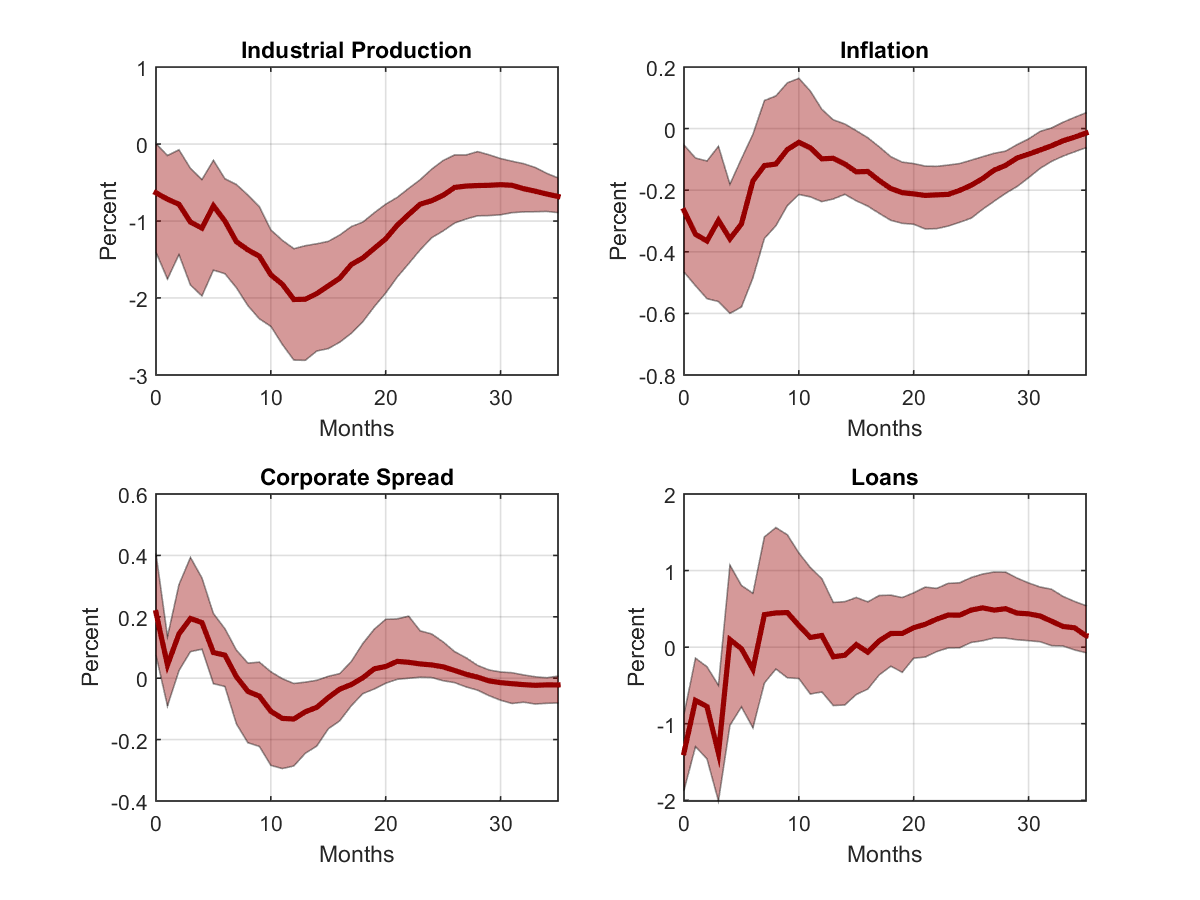

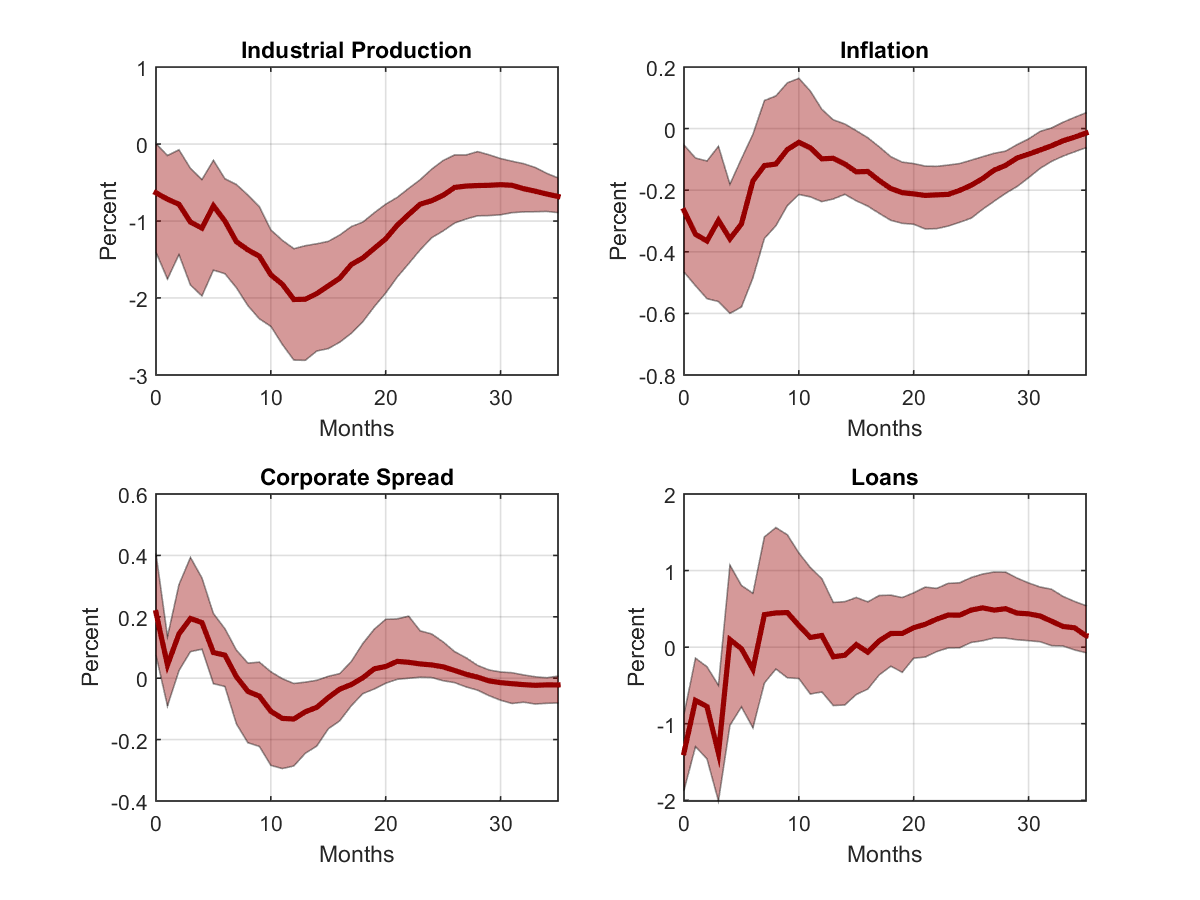

Next, we examine whether the effect of monetary policy surprises on interest rates at high frequencies translates to a broader impact on macroeconomic variables. To do so, we estimate a monthly macroeconomic model (VAR) using data on a number of monetary policy indicators, industrial production, and inflation. Within this framework, the effects of monetary policy are identified using the external instrument approach following Gertler and Karadi (2015), which uses high-frequency monetary policy surprises. Graph 3 reports the estimated transmission of a monetary policy shock to macroeconomic variables. The size of the shock is scaled to produce a 1% increase in the RRR. The impulse responses suggest that monetary policy transmission in China is surprisingly similar to that in advanced economies. A contractionary monetary policy shock has large and statistically significant effects on real activity and prices as both industrial production and inflation persistently fall. The response of output is muted in the first months, with the peak effect occurring after about a year. The maximum effect of the increase in the RRR on industrial production is estimated to be around 1.5%. The response of inflation is somewhat more front-loaded as the largest fall in inflation happens within the year after the shock. However, inflation stays below the level it would have been had the monetary policy not changed for around two-and-a-half years.

To gain further insights into monetary transmission channels in China, Graph 3 also reports the effects of monetary policy on corporate spreads and loan growth. In a world without any financial frictions, a monetary policy shock would result in a proportional increase in government bond rates and the rates on any private security of the same maturity leaving the spread between the two unchanged. However, in the presence of financial frictions, monetary policy could operate via a “credit channel,” implying fluctuations in the spread between yields on private securities and government bonds. In China, this amplification mechanism is likely to be strengthened by the fact that a large share of firms are either excluded from domestic bond markets or have only limited access to such finance. In addition, a significant share of Chinese firms have currency and maturity mismatches on their balance sheet, which can further constrain their ability to access external finance in the midst of a tightening monetary policy cycle. Indeed, we find that although relatively short-lived, corporate spreads increase substantially around 20 basis points, suggesting the existence of a credit channel in the monetary transmission mechanism in China. Finally, we examine the argument often made in the context of China that the presence of directed credit measures (“window guidance”) reduces the power of the conventional interest rate channel in exerting a meaningful impact on aggregate bank lending. However, we find that loan volumes decrease significantly by about 1% following a monetary tightening, suggesting that the use of window guidance and implicit credit quotas by the Chinese authorities to directly control bank credit does not necessarily imply that bank credit is insensitive to interest rates.

Note: The figure presents the responses of selected economic indicators to a monetary policy shock that raises the Reserve Requirement Ratio by 1% obtained from a structural VAR. The solid lines are point estimates and shaded areas represent 68% confidence intervals. See Kamber and Mohanty (2018) for details.

In conclusion, we find that monetary policy shocks tend to have persistent effects on long-term bond yields, corporate bond spreads, and aggregate bank deposits and loans. This indicates that there is an interest rate channel of monetary policy in China. Further, we find that a contractionary monetary policy shock has persistent macroeconomic effects and is followed by lower inflation and slower economic activity. Our findings provide support to recent studies suggesting that monetary policy transmission in China has become increasingly similar to that in advanced economies.

The views expressed are those of the authors and not necessarily those of the BIS.

(Gunes Kamber and Madhusudan Mohanty, Bank for International Settlements.)

Chen, H., K. Chow, and P. Tillmann (2017). The effectiveness of monetary policy in China: Evidence from a Qual VAR. China Economic Review 43, 216-231.

Fernald, J. G., M. M. Spiegel, and E. T. Swanson (2014). Monetary policy effectiveness in China: Evidence from a FAVAR model. Journal of International Money and Finance 49, 83-103.

Gertler, M. and P. Karadi (2015). Monetary policy surprises, credit costs, and economic activity. American Economic Journal: Macroeconomics 7 (1), 44-76.

He, D. and H. Wang (2012). Dual-track interest rates and the conduct of monetary policy in China. China Economic Review 23 (4), 928-947.

He, D. and H. Wang (2013). Monetary Policy and Bank Lending in China — Evidence from Loan-Level Data. Working Paper 162013, Hong Kong Institute for Monetary Research.

Understanding how monetary policy works in China is important in the context of China’s growing weight in the global economy. In market economies, this assessment crucially depends on the role interest rates play in resource allocation decisions and the transmission of monetary policy. Significant literature (He and Wang, 2012, 2013; Fernald et al., 2014; Chen et al., 2017) already suggests that monetary policy transmission in China has started to resemble that of advanced economies. The actual conduct of monetary policy has also moved in this direction, as suggested by the recent removal of interest rate controls and the general reorientation of monetary policy away from the use of quantity targets to one in which the People's Bank of China (PBC) manages a key short-term interest rate. For instance, the PBC has recently stated that it would improve its liquidity management strategies by releasing timely policy signals to guide market expectations of interest rates to achieve its monetary policy objectives.

Yet, ascertaining whether an interest rate channel of monetary transmission exists in China remains challenging for several reasons. First, the PBC uses multiple instruments, including reserve requirements and implicit credit quotas, to conduct monetary policy. Researchers using standard monetary policy transmission models are therefore confronted with the problem of accurately representing the stance of monetary policy using either a price or quantity variable. Second, China's monetary policy framework is still evolving in the context of its transition to a flexible exchange rate regime. Not only is the exchange rate an important channel of monetary policy but shifts in the exchange rate regime can have a significant impact on interest rates and credit conditions more generally. Finally, any assessment of monetary policy must consider the fact that the PBC's policy instruments evolve endogenously with the state of the economy. The PBC may not only respond to incoming news about output and inflation by changing its policy stance, but shifts in its policy stance can also affect agents' expectations about the future evolution of the economy. Without isolating this systematic component of monetary policy, it is difficult to infer anything about the effectiveness of monetary policy.

In light of this situation, in a recent paper (Kamber and Mohanty, 2018), we explore the role of interest rates for monetary policy transmission in China considering its multiple instrument setting. In doing so, we exploit information from high-frequency Chinese financial market data to identify monetary policy shocks and assess their macroeconomic effects. In contrast to the approach followed in previous studies, our strategy does not require an assumption about the PBC's reaction function. Instead, we assume that while financial market participants do not have full information about the PBC's true reaction function, they can reasonably anticipate changes in its main policy instruments conditional on the state of the economy and price them in interest rates. The high-frequency financial market information then enables us to separate the “surprise” component of monetary policy from the “expected" component, which we use subsequently to identify monetary policy shocks.

Our first contribution is to construct a time series of monetary policy surprises using daily changes in interest rates during short windows around policy decisions and communications by the PBC. Specifically, we focus on movements in one-year interest rate swap (IRS) contracts based on the interbank 7-day repo rate to measure market expectations of monetary policy. The 7-day repo rate is not only considered very informative with respect to the monetary policy stance of the PBC, but it is also the most liquid among all types of IRS contracts. To account for China’s multiple-instrument setting, we compute daily changes in IRS contracts on days when lending rates and reserve requirements are changed, when quarterly monetary policy reports are published, or when there are major changes in the exchange rate regime.

Graph 1 plots an example of our procedure and the resulting surprise measure. On 26 November 2008, the PBC lowered both lending and deposit rates by around 100 basis points and relaxed the reserve Requirement Ratio (RRR) from 17% to 16% for large banks and from 16% to 14% for small banks. Graph 1 depicts the evolution of one-year 7-day repo interest rate swaps (IRS) before and after the announcement. The IRS was stable at around 1.9% before the announcement but fell sharply to 1.35% the day after the announcement. Therefore, our estimate for the monetary policy surprise for this announcement, which involved multiple policy instruments, is 55 basis points. Considering the days on which multiple instruments have been adjusted, we repeat the same procedure for 107 announcements covering the period of 2006–2016 to construct a time series of monetary policy surprises.

Graph 1

Using these surprises, we then carryout an event-study analysis to analyse the response of interest rates to monetary policy actions. Graph 2 reports the estimated effects of monetary policy actions on 1- and 10-year yields on sovereign and AAA corporate bonds over 7 days following an announcement. The thick line and shaded areas respectively represent the point estimates and the confidence bands. Clearly, monetary policy actions have a significant and persistent effect across a range of market interest rates. The confidence bands become wider over time as other market developments probably account for a larger share of movements in yields. The point estimates are also increasing slightly over time, suggesting that the effect of the monetary policy surprises are sluggishly priced in over the week following the monetary policy announcement. In terms of magnitude, a monetary policy announcement that is accompanied by an IRS increase of 100-basis-point is associated with around a 70-basis-point increase in 1-year sovereign yields and about a 40-basis-point- increase in 10-year sovereign yields after a week. The effect on corporate yields is somewhat larger for the same maturities. Moreover, as is typical in other advanced economies, the effect of the monetary policy actions is larger at the short end of the yield curve and lower but significant at the long end of the yield curve.

Graph 2

Next, we examine whether the effect of monetary policy surprises on interest rates at high frequencies translates to a broader impact on macroeconomic variables. To do so, we estimate a monthly macroeconomic model (VAR) using data on a number of monetary policy indicators, industrial production, and inflation. Within this framework, the effects of monetary policy are identified using the external instrument approach following Gertler and Karadi (2015), which uses high-frequency monetary policy surprises. Graph 3 reports the estimated transmission of a monetary policy shock to macroeconomic variables. The size of the shock is scaled to produce a 1% increase in the RRR. The impulse responses suggest that monetary policy transmission in China is surprisingly similar to that in advanced economies. A contractionary monetary policy shock has large and statistically significant effects on real activity and prices as both industrial production and inflation persistently fall. The response of output is muted in the first months, with the peak effect occurring after about a year. The maximum effect of the increase in the RRR on industrial production is estimated to be around 1.5%. The response of inflation is somewhat more front-loaded as the largest fall in inflation happens within the year after the shock. However, inflation stays below the level it would have been had the monetary policy not changed for around two-and-a-half years.

To gain further insights into monetary transmission channels in China, Graph 3 also reports the effects of monetary policy on corporate spreads and loan growth. In a world without any financial frictions, a monetary policy shock would result in a proportional increase in government bond rates and the rates on any private security of the same maturity leaving the spread between the two unchanged. However, in the presence of financial frictions, monetary policy could operate via a “credit channel,” implying fluctuations in the spread between yields on private securities and government bonds. In China, this amplification mechanism is likely to be strengthened by the fact that a large share of firms are either excluded from domestic bond markets or have only limited access to such finance. In addition, a significant share of Chinese firms have currency and maturity mismatches on their balance sheet, which can further constrain their ability to access external finance in the midst of a tightening monetary policy cycle. Indeed, we find that although relatively short-lived, corporate spreads increase substantially around 20 basis points, suggesting the existence of a credit channel in the monetary transmission mechanism in China. Finally, we examine the argument often made in the context of China that the presence of directed credit measures (“window guidance”) reduces the power of the conventional interest rate channel in exerting a meaningful impact on aggregate bank lending. However, we find that loan volumes decrease significantly by about 1% following a monetary tightening, suggesting that the use of window guidance and implicit credit quotas by the Chinese authorities to directly control bank credit does not necessarily imply that bank credit is insensitive to interest rates.

Graph 3

In conclusion, we find that monetary policy shocks tend to have persistent effects on long-term bond yields, corporate bond spreads, and aggregate bank deposits and loans. This indicates that there is an interest rate channel of monetary policy in China. Further, we find that a contractionary monetary policy shock has persistent macroeconomic effects and is followed by lower inflation and slower economic activity. Our findings provide support to recent studies suggesting that monetary policy transmission in China has become increasingly similar to that in advanced economies.

The views expressed are those of the authors and not necessarily those of the BIS.

(Gunes Kamber and Madhusudan Mohanty, Bank for International Settlements.)

Chen, H., K. Chow, and P. Tillmann (2017). The effectiveness of monetary policy in China: Evidence from a Qual VAR. China Economic Review 43, 216-231.

Fernald, J. G., M. M. Spiegel, and E. T. Swanson (2014). Monetary policy effectiveness in China: Evidence from a FAVAR model. Journal of International Money and Finance 49, 83-103.

Gertler, M. and P. Karadi (2015). Monetary policy surprises, credit costs, and economic activity. American Economic Journal: Macroeconomics 7 (1), 44-76.

He, D. and H. Wang (2012). Dual-track interest rates and the conduct of monetary policy in China. China Economic Review 23 (4), 928-947.

He, D. and H. Wang (2013). Monetary Policy and Bank Lending in China — Evidence from Loan-Level Data. Working Paper 162013, Hong Kong Institute for Monetary Research.

Kamber, G. and M. Mohanty (2018). Do interest rates play a major role in monetary policy transmission in China?. BIS Working Paper, No 714.

Latest

Most Popular

- VoxChina Covid-19 Forum (Second Edition): China’s Post-Lockdown Economic Recovery VoxChina, Apr 18, 2020

- China’s Great Housing Boom Kaiji Chen, Yi Wen, Oct 11, 2017

- China’s Joint Venture Policy and the International Transfer of Technology Kun Jiang, Wolfgang Keller, Larry D. Qiu, William Ridley, Feb 06, 2019

- The Dark Side of the Chinese Fiscal Stimulus: Evidence from Local Government Debt Yi Huang, Marco Pagano, Ugo Panizza, Jun 28, 2017

- Wealth Redistribution in the Chinese Stock Market: the Role of Bubbles and Crashes Li An, Jiangze Bian, Dong Lou, Donghui Shi, Jul 01, 2020

- Evaluating Risk across Chinese Housing Markets Yongheng Deng, Joseph Gyourko, Jing Wu, Aug 02, 2017

- What Is Special about China’s Housing Boom? Edward L. Glaeser, Wei Huang, Yueran Ma, Andrei Shleifer, Jun 20, 2017

- Privatization and Productivity in China Yuyu Chen, Mitsuru Igami, Masayuki Sawada, Mo Xiao, Jan 31, 2018

- How did China Move Up the Global Value Chains? Hiau Looi Kee, Heiwai Tang, Aug 30, 2017

- China’s Shadow Banking Sector: Wealth Management Products and Issuing Banks Viral V. Acharya, Jun Qian, Zhishu Yang, Aug 09, 2017

Facebook

Facebook  Twitter

Twitter  Instagram

Instagram WeChat

WeChat  Email

Email