Rising Intergenerational Income Persistence in China

Although studies on economic inequality and intergenerational mobility have gained traction in the last decade, little is known about the temporal changes in the intergenerational association of economic status, especially in developing and transitional economies. We find an increasing pattern in intergenerational income persistence across China’s transitional period. To promote intergenerational mobility, the Chinese government should continue to remove rural-urban migration barriers and initiate various programs to subsidize the education of children from disadvantaged families, known as the “left-behind” children.

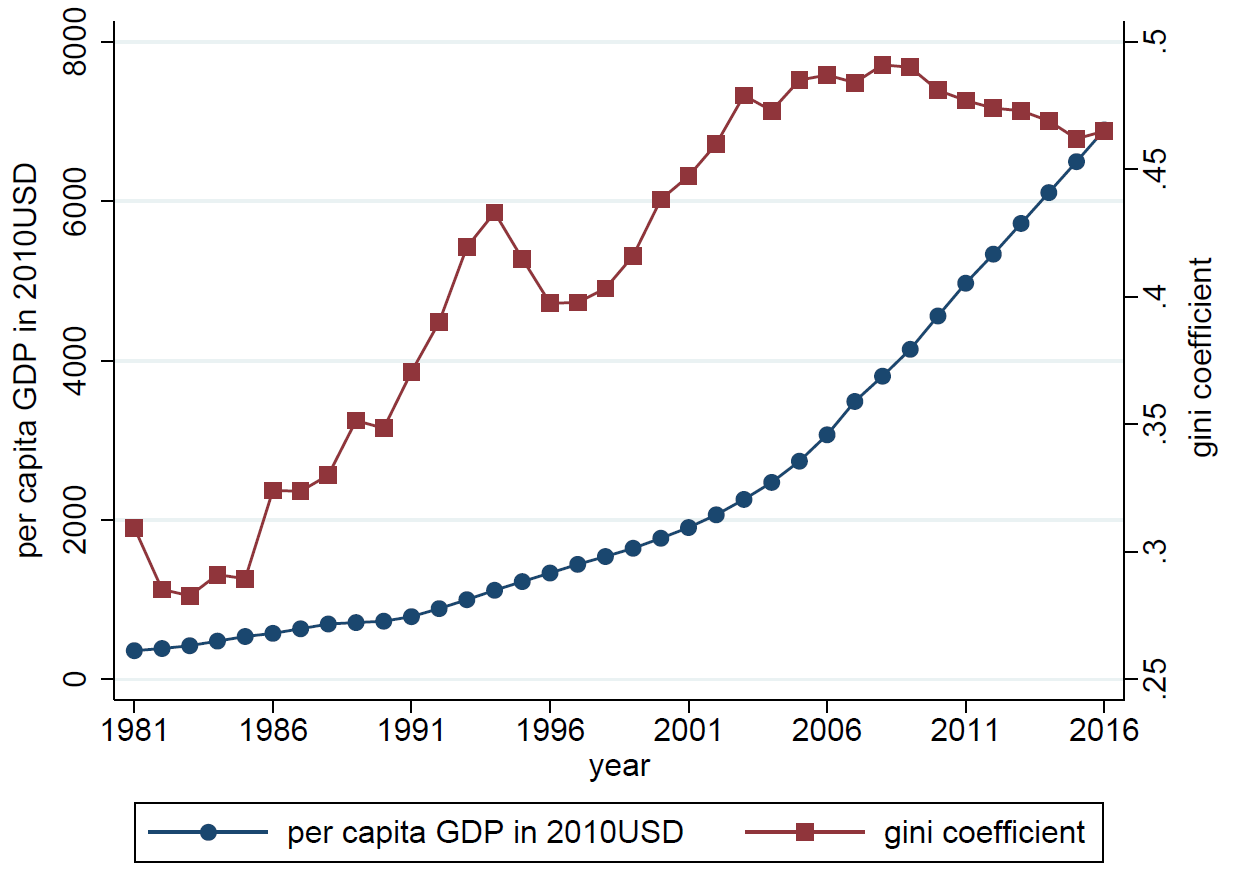

China has experienced remarkable economic growth since its market-oriented reform in the late 1970s. Its rising income inequality, as evident in the rocketing Gini coefficient between 1981 and 2016 in Figure 1, is equally impressive but less understood. We investigate two questions in our working paper (Fan et al., 2018): To what extent does inequality persist across generations in China? What are the institutional and policy factors driving the changes in intergenerational income persistence? Understanding the changing intergenerational income persistence in China over the last 40 years of economic reform may provide interesting insights for the economics literature and yield policy implications for other countries at a similar stage of economic transition and development.

Data source: The per capita GDP is from World Bank. The Gini coefficients for 1981-2001 are from Ravallion and Chen (2007); the one for 2002 is from Li (2018); and those in 2003-2016 are from the National Bureau of Statistics of China.

During China’s transitional period, intergenerational income persistence and influencing factors are undergoing rapid change, in contrast to the gradual patterns seen in the U.S. (Lee and Solon, 2009; Chetty et al., 2014). On the one hand, the institutional reforms have sharply reduced poverty and changed China from a planned and agricultural economy to a market and industrial economy. The relaxation of the Household Registration (hukou) System has induced domestic temporary migration in a historically unprecedented scale. The declining poverty rate and agricultural sector share, as well as the rising rural-to-urban migration rate, likely reduce intergenerational income persistence. On the other hand, a rising return to schooling in urban China, as well as a sharp increase in educational costs, have emerged during this transitional period in China (Zhang and Zhao, 2007). The drastic expansion of higher education, which is intended by policy makers to provide more educational opportunities for the children of the poor and improve mobility across generations, appears to disproportionately benefit the children of the rich (Li et al., 2013). These forces likely enhance intergenerational income persistence. Thus, the changing pattern of intergenerational income persistence during China’s transitional period remains an empirical question.

Using data from four waves of the China Family Panel Studies (CFPS) in 2010, 2012, 2014, and 2016, we find an increasing pattern in intergenerational income persistence during the economic transition. The intergenerational elasticity of income (IGE) increases from 0.390 for the 1970-1980 birth cohorts to 0.442 for the 1981-1988 birth cohorts. In the early cohort, about 39 percent of the parental income position is transmitted to the next generation, while this value rises to 44.2 percent in the late cohort. This pattern of rising intergenerational income persistence is consistent under alternative measures of the intergenerational log correlation estimate, rank correlation estimate, and transition matrix, and remains robust under a series of sensitivity analyses. We further find that the pattern of rising intergenerational income persistence is more evident for sons as well as residents of urban and coastal regions.

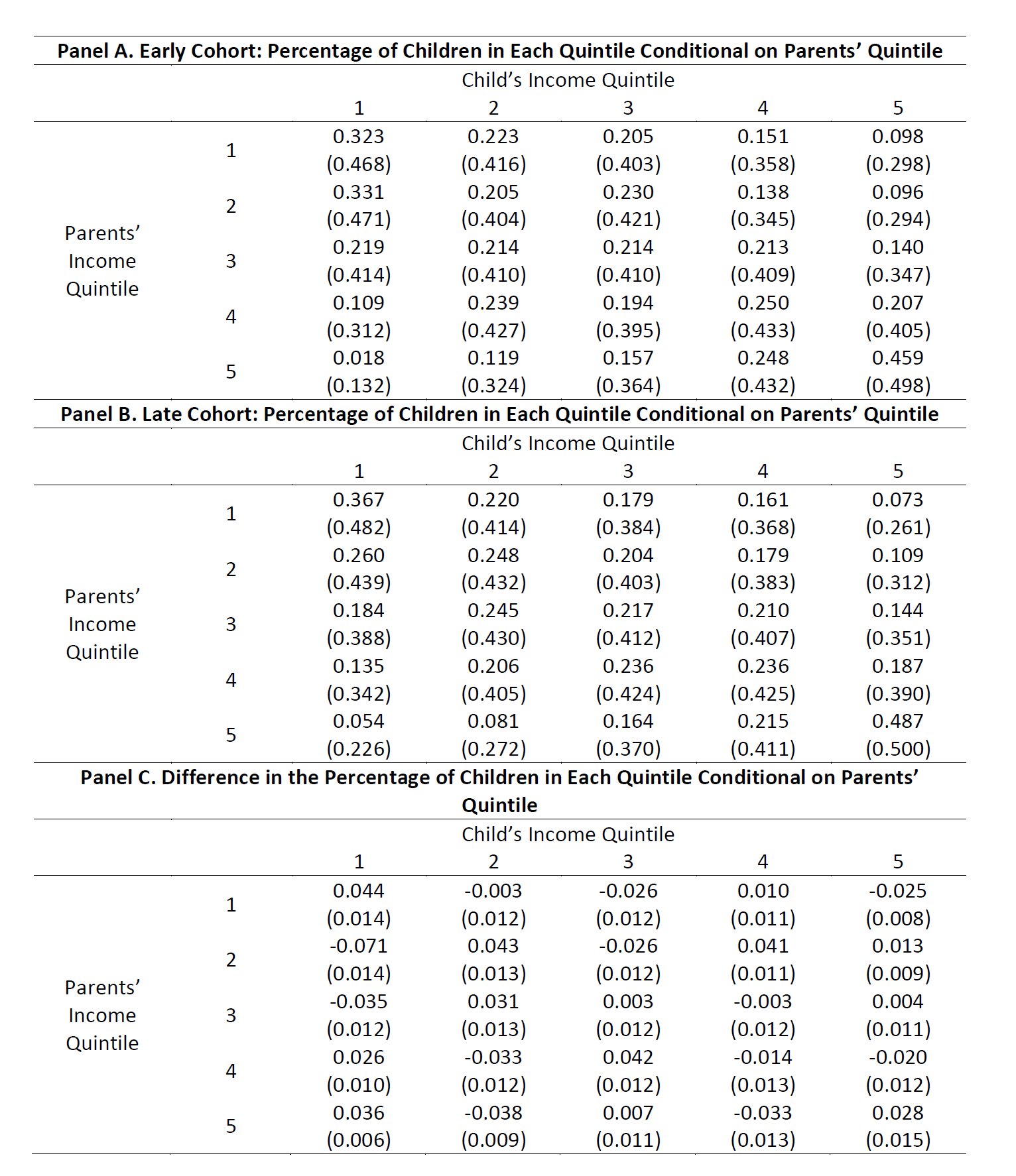

The increase in intergenerational income persistence seems to be particularly pronounced in the lower end of the income distribution, which implies an increasing intergenerational poverty trap. Table 1 shows that the proportion of children whose parents are in the bottom quintile of income distribution but who themselves move into the top quintile in adulthood decreases from 9.8 percent in the early cohort to 7.3 percent in the later cohort. The proportion of children trapped in the bottom quintile in adulthood increases from 32.3 percent to 36.7 percent and the proportion of children who remain in the top quintile increases from 45.9 percent to 48.7 percent.

We further study the fraction of children who earn equal to or beyond 150 percent of their parents’ income, conditional on parents’ income in each quintile in their generation. On the one hand, for children from bottom-quintile families, 66.1 percent of them from the early cohort later earn 1.5 times their parents’ income or more. In the later cohort, the fraction decreases to 59.1 percent. On the other hand, for children from the top-quintile families, there is a similar drop from 6.7 percent to 3.1 percent between the early and later cohorts, respectively. The rate also falls across cohorts for other quintiles. This result again confirms that intergenerational income persistence has risen significantly during China’s transitional period.

Note: Each cell in Panels A and B report the percentage of children in the quintile (as given by the column), conditional on parents’ income in the quintile (as given by the row). Standard deviations are reported in parentheses. Panel C displays the difference between Panel A and Panel B.

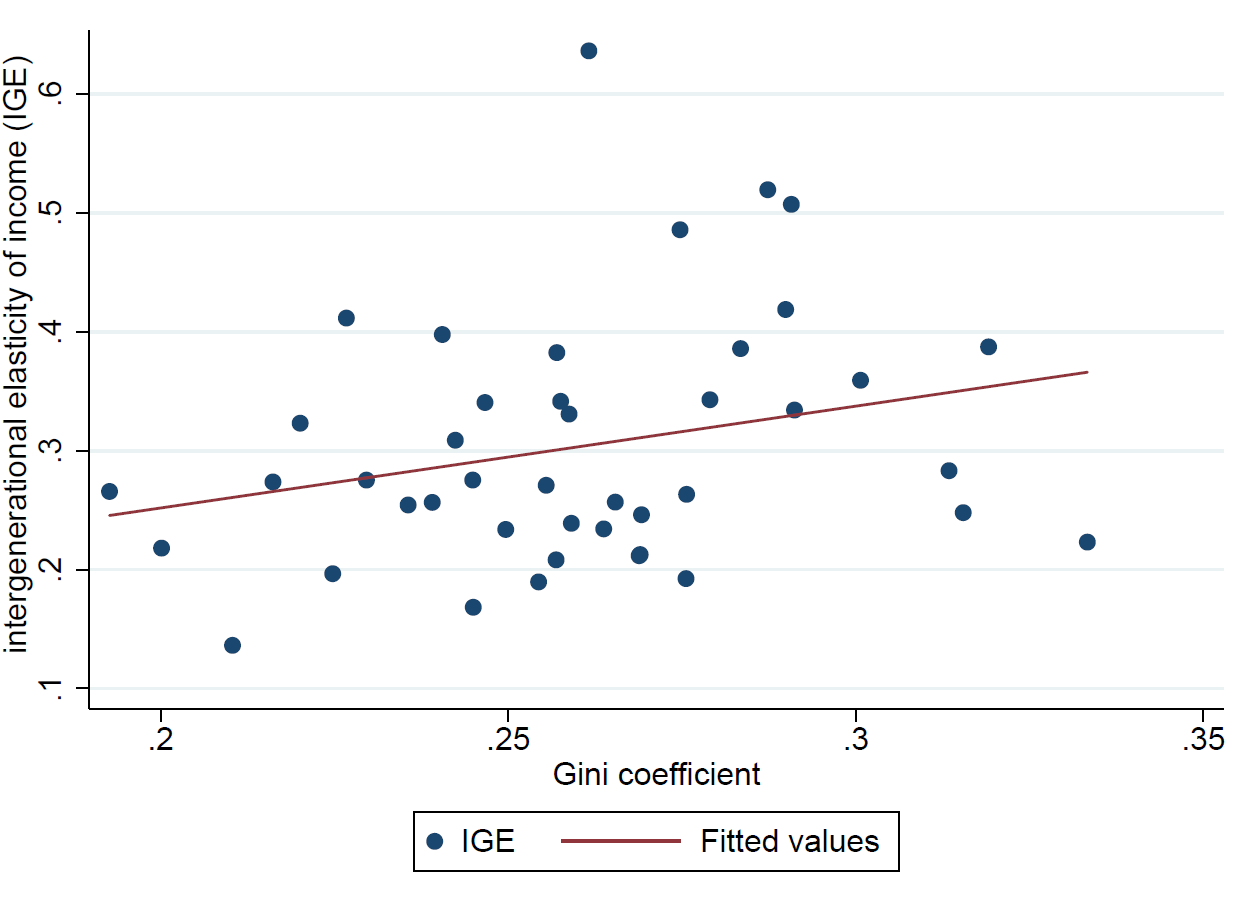

Based on our estimates, we then draw the first Great Gatsby Curve in China to explore the correlation between intergenerational income persistence and inequality. Existing literature provides evidence of a positive correlation between inequality and intergenerational income persistence across developed countries (Corak, 2004; Björklund and Jäntti, 2011). Krueger (2012) first used the term “The Great Gatsby Curve” to describe such a relationship during a presentation at the Center for American Progress. We add to the literature by investigating the correlation between temporal changes in inequality and intergenerational income persistence across successive cohorts amid China’s rapid economic growth and structural transformation. In particular, we plot our estimated IGE across cohorts against the Gini coefficients for 1990 and 1999 as proxies for inequality during the teen years of children in the early and later cohorts, respectively, as presented in Figure 2. Similar to the pattern revealed from developed countries, we find a positive association between the Gini coefficient and IGE, which implies that intergenerational income persistence has risen when inequality has increased.

Note: The Gini coefficient is calculated by province, cohort, and urban and rural areas.

What factors explain the change in intergenerational income persistence? Corak (2013) attributes the variation in intergenerational income mobility across countries to the influence of the family, labor market conditions, and public policy. In the context of economic transition in China, we classify three categories of factors correlated with intergenerational income persistence: market-oriented structural changes, economic development, and public policies. We find that the rising outflow of migrants is negatively associated with intergenerational income persistence. This suggests that the Chinese government should continue to remove rural-urban migration barriers. However, increases in the share of private enterprises; public expenditure on education, science, culture, and public health per capita; and university enrollment rates are positively correlated with intergenerational income persistence. The increasing intergenerational income persistence in tandem with the rise in government educational expenditure possibly occurs because the allocation of such expenditure is not means-tested (Li et al., 2013). Loans and scholarships are probably misallocated in the expansion of tertiary education. Therefore, the Chinese government should initiate various programs to subsidize the education of children from disadvantaged families, known as the “left-behind” children. In addition, the efficacy of loan and scholarship programs at the tertiary level should be improved.

Lastly, we compare the change in intergenerational income persistence in China to that of the United States. Income inequality has increased in both countries over the past decades. Similar to the rising Gini coefficient found in China (Figure 1), the Gini index in the U.S. has also increased from 0.346 in 1979 to 0.415 in 2016 (See Note 1). However, different from the rising intergenerational income persistence in China, empirical studies on the U.S. do not reveal major changes in intergenerational income mobility (Lee and Solon, 2009; Chetty et al., 2014). The absence of evidence on rising intergenerational income persistence in the U.S. is possibly due to various means-tested programs that have been implemented since the 1970s to alleviate credit constraints on disadvantaged families. Interestingly, the changing pattern in intergenerational income persistence we found in China is similar to that in the U.S. in the late nineteenth and early twentieth centuries (Olivetti and Paserman, 2015). At that time, the U.S. underwent drastic structural changes, such as migration from both outside and within the country, growing regional economic disparity, and rising returns to human capital and income inequality. These changes are similar to those experienced in China in recent decades.

It is beyond the scope of our study to establish causality between a specific institutional, policy, or socioeconomic change and intergenerational income persistence. We robustly document the statistical fact on rising intergenerational income persistence in China. We further propose a set of explanatory factors as baseline evidence for future studies to identify causality and mechanisms for changes in intergenerational income mobility, especially in developing countries and transitional economies.

Note 1: World Bank Estimate in Gini index (https://data.worldbank.org/indicator/SI.POV.GINI?end=2016&locations=US&start=1979&view=chart)

(Yi Fan, Department of Real Estate at the National University of Singapore; Junjian Yi, Department of Economics at the National University of Singapore; Junsen Zhang, Department of Economics at the Chinese University of Hong Kong.)

Björklund, Anders, and Markus Jäntti. 2011. “Intergenerational Income Mobility and the Role of Family Background.” In Oxford Handbook of Economic Inequality. Edited by Wiemer Salverda, Brian Nolan, and Timothy M. Smeeding. Oxford, UK: Oxford University Press. http://www.oxfordhandbooks.com/view/10.1093/oxfordhb/9780199606061.001.0001/oxfordhb-9780199606061-e-20

Chetty, Raj, Nathaniel Hendren, Patrick Kline, Emmanuel Saez, and Nicholas Turner. 2014. “Is the United States Still a Land of Opportunity? Recent Trends in Intergenerational Mobility,” American Economic Review: Papers & Proceedings 104(5), 141–147. https://www.aeaweb.org/articles?id=10.1257/aer.104.5.141

Corak, Miles. 2013. “Income Inequality, Equality of Opportunity, and Intergenerational Mobility,” Journal of Economic Perspectives 27(3), 79–102. https://www.aeaweb.org/articles?id=10.1257/jep.27.3.79

Fan, Yi, Junjian Yi and Junsen Zhang. 2018. “Rising Intergenerational Income Persistence in China.” Working Paper.

Krueger, Alan. 2012. “The Rise and Consequences of Inequality in the United States.” Presentation made to the Center for American Progress, January 12, 2012.

https://cdn.americanprogress.org/wp-content/uploads/events/2012/01/pdf/krueger.pdf

Lee, Chul-In, and Gary Solon. 2009. “Trends in Intergenerational Income Mobility,” Review of Economics and Statistics 91(4), 766–772. https://www.mitpressjournals.org/doi/abs/10.1162/rest.91.4.766

Li, Hongbin, Lingsheng Meng, Xinzheng Shi, and Binzhen Wu. 2013. “Poverty in China’s Colleges and the Targeting of Financial Aid,” China Quarterly 216, 970–992. https://www.cambridge.org/core/journals/china-quarterly/article/poverty-in-chinas-colleges-and-the-targeting-of-financial-aid/819C80693F1A780A6E513E710ED42728

Li, Shi. 2018. “The Current Income Distribution in China.” In Chinese. Academics 3, 5-20. http://kns.cnki.net/kcms/detail/detail.aspx?dbcode=CJFD&filename=SSJI201803002&dbname=CJFDLAST2018&uid=WEEvREcwSlJHSldRa1FhdkJkVWI3b1lWYTVqaHJFWXE2Y3VuMDdaQW1kaz0=$9A4hF_YAuvQ5obgVAqNKPCYcEjKensW4IQMovwHtwkF4VYPoHbKxJw!!

Olivetti, Claudia, and M. Daniele Paserman. 2015. “In the Name of the Son (and the Daughter): Intergenerational Mobility in the United States, 1850–1940,” American Economic Review 105(8), 2695–2724. https://www.aeaweb.org/articles?id=10.1257/aer.20130821

Ravallion, Martin, and Shaohua Chen. 2007. “China’s (Uneven) Progress Against Poverty,” Journal of Development Economics 82, 1-42. https://www.sciencedirect.com/science/article/pii/S0304387805001185

Zhang, Junsen, and Yaohui Zhao. 2007. “Rising Returns to Schooling in Urban China,” In Education and Reform in China. Edited by Emily Hannum and Albert Park. London, UK: Routledge, 248-259.

https://www.taylorfrancis.com/books/e/9781135984717

Latest

Most Popular

- VoxChina Covid-19 Forum (Second Edition): China’s Post-Lockdown Economic Recovery VoxChina, Apr 18, 2020

- China’s Great Housing Boom Kaiji Chen, Yi Wen, Oct 11, 2017

- China’s Joint Venture Policy and the International Transfer of Technology Kun Jiang, Wolfgang Keller, Larry D. Qiu, William Ridley, Feb 06, 2019

- The Dark Side of the Chinese Fiscal Stimulus: Evidence from Local Government Debt Yi Huang, Marco Pagano, Ugo Panizza, Jun 28, 2017

- Wealth Redistribution in the Chinese Stock Market: the Role of Bubbles and Crashes Li An, Jiangze Bian, Dong Lou, Donghui Shi, Jul 01, 2020

- What Is Special about China’s Housing Boom? Edward L. Glaeser, Wei Huang, Yueran Ma, Andrei Shleifer, Jun 20, 2017

- Evaluating Risk across Chinese Housing Markets Yongheng Deng, Joseph Gyourko, Jing Wu, Aug 02, 2017

- Privatization and Productivity in China Yuyu Chen, Mitsuru Igami, Masayuki Sawada, Mo Xiao, Jan 31, 2018

- How did China Move Up the Global Value Chains? Hiau Looi Kee, Heiwai Tang, Aug 30, 2017

- China’s Shadow Banking Sector: Wealth Management Products and Issuing Banks Viral V. Acharya, Jun Qian, Zhishu Yang, Aug 09, 2017

Facebook

Facebook  Twitter

Twitter  Instagram

Instagram WeChat

WeChat  Email

Email