The Long-term Persistence of Informal Finance in China

By using data on 137 counties in north China, we find that the density of financial institutions (Qianzhuang and Diandang) in the late Qing period has a significant positive effect on the number and total assets of small loan companies, a dominant institution of informal finance today. The persistent effect of historical financial institutions can be explained by Confucian culture, which instills integrity, lineage solidarity and acquaintance networks.

Informal finance has experienced explosive growth in China in the past few decades. A variety of informal financial institutions, particularly small loan companies (Xiao’e Daikuan Gongsi), rotating savings and credit associations (ROSCAs or Hehui), pawnshops, and even (illegal) underground banks (Dixia Qianzhuang), emerged and rapidly expanded. Taking small loan companies as an example, the annual growth rate amounts to 22.1 percent in total number and 29.4 percent in total loans between 2008 and 2016. By providing micro-credits outside the state banking system, informal finance has played an important role in sustaining private enterprise growth (Allen, Qian, and Qian, 2005).

In Hu, Ma, and Zhang (2017), we attempt to examine the historical origin of the rise of informal finance in contemporary China. Specifically, we examine whether and how traditional financial institutions (Qianzhuang and Diandang) in the Qing dynasty (1644-1911) have had a persistent impact on the development of informal finance in today’s China (see Note 1). We focus on this historical era because the presence of informal financial activities in China have had a long history exceeding 2,000 years and anecdotes suggest that the business model of historical finance has manifested in contemporary times. Today’s Hehui, for instance, can find its historical prototype in the Tang dynasty (618-907) (Tsai, 2000). In the same vein, many informal financial institutions not only still use the names of their historical counterparts (e.g., Qianzhuang), their lending activities are also based on the lineage or community network that supported their historical antecedents. In provinces that were once historically prosperous in finance (e.g., Zhejiang, Fujian, Jiangsu and Shandong), we note that contemporary informal financial activities are more active than in other regions of the country.

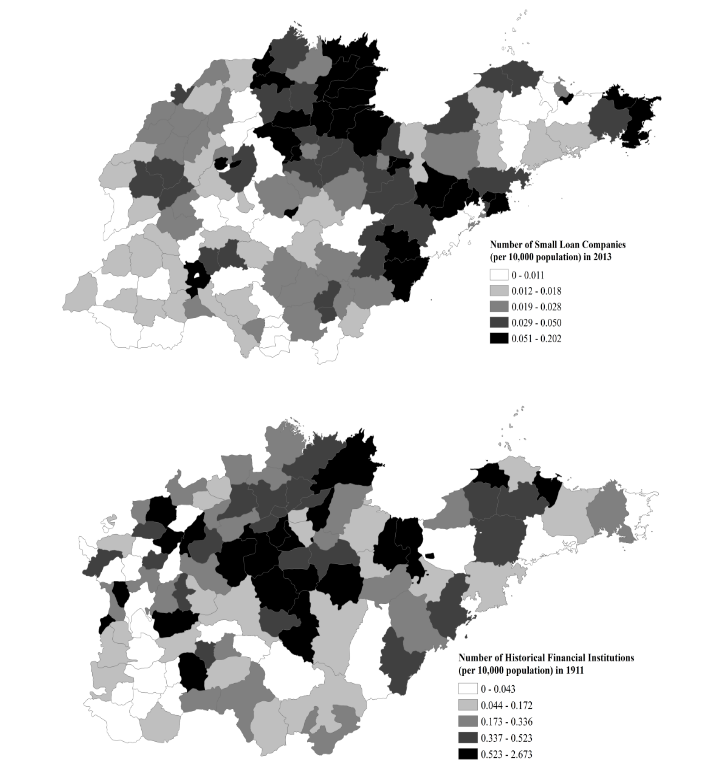

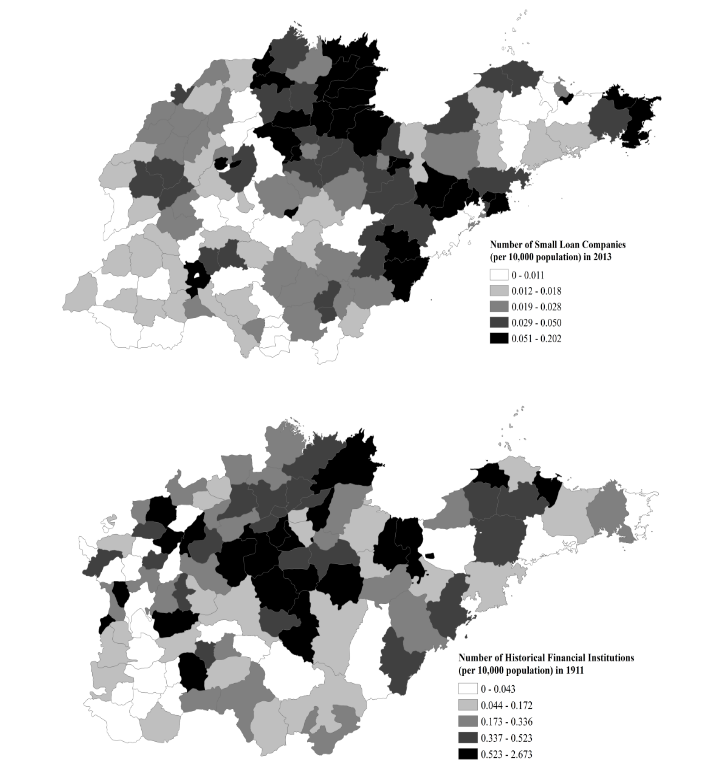

To account for the persistent effect of historical financing on the development of contemporary informal finance practices, we select the 137 counties of Shandong Province for our sample. As a representative northern China province, Shandong had not only a prosperous native financial market in the Qing period but also a fast-growing informal financial sector in the past decade. Given the dominant role of small loan companies in contemporary informal financial institutions, we employ the density of small loan companies between 2009 and 2013 to measure the development of contemporary informal finance. To measure the prosperity of historical finance, we use the density of two dominant native financial institutions, Qianzhuang (money banks) and Diandang (pawnshops) in the late Qing dynasty (circa 1911) as the proxy (see Figure 1 for the regional distribution of the small loan companies and historical financial institutions).

Note: Data on small loan companies are obtained from the Shandong Xiao’e Daikuan Qiye Xiehui (Association of Small Loan Companies of Shandong Province). Data on historical financial institutions are obtained from the Nongshang tongji biao (Statistics of Agriculture and Commerce) compiled by the government of the Republic of China in 1912.

The regression analysis reveals that the density of small loan companies is positively affected by the density of historical financial institutions. In counties where there was a prosperous native financial sector before 1911, the density of small loan companies tends to be higher today. In terms of magnitude, a 1 percent increase in the number of historical financial institutions (per 10,000 people) in the late Qing period increases 0.096 percent of the number (and 0.158 percent of total assets) of small loan companies (per 10,000 people) in 2013. These results are robust to controlling for a gamut of confounding factors including economic prosperity, industrial structure, state banks, and geography, among others.

The question in what follows is how historical Qianzhuang and Diandang can continue to affect the development of small loan companies today. We argue that, although these historical financial institutions had vanished for nearly a century, the business cultures they embodied survive to this day. The culture engendered by Confucianism, particularly the norms of integrity, lineage solidarity, and the acquaintance network that helped disseminate information and enforce the credit relationship in traditional Chinese society is still intact. For example, the deposit and loan businesses of Qianzhuang followed the principle of “integrity and righteousness” (kecun xinyi), which means that the payback guarantee depends more on a moral promise rather than physical collateral. Likewise, historical Piaohao (draft banks) also insisted on “righteousness over profits” (xianyi houli) and “from righteousness to profits” (yiyi zhili) and hence only provided services to respected credible people (Huang, 2002). In light of the fact that informal financial activities in China operate in an environment where the legal protection is relatively weak, they may still rely on the traditional business culture of integrity to sustain their growth. For example, Confucian lineage and relationship capital (guanxi) still played a key role in financing the rural industrialization in the 1990s (Peng, 2004).

To examine whether Confucian culture is a channel through which the historical finance system continues to influence contemporary small loan companies, we use the density of Confucian temples that a county had established in the Qing dynasty as the proxy for the strength of Confucianism and introduce interaction terms between the density of Confucian temples and the density of historical financial institutions. Using these parameters, we find that the effect of historical financial institutions on small loan companies is greater in counties with a stronger Confucian culture.

In conclusion, our findings suggest that the development of contemporary informal finance in China is still significantly shaped by their historical counterparts and Confucian culture is likely a channel that has sustained such long-term persistence. Our study suggests the importance of historical and cultural factors in understanding the development of informal finance in contemporary China. This coincides with both the work of Grosjean (2011), who finds that the historical Islamic rule that prohibited interest-lending resulted in an underdeveloped financial market today, and Pascali (2016), who finds that the charity-lending institutions in fifteenth century Italy still affect the performance of the contemporary Italian banking sector.

Note 1: There were three types of institutions (Qianzhuang, Piaohao, and Diandang) that dominated the native financial market in late imperial China. In Shandong province, the presence of Piaohao was almost nonexistent in 1911 and hence is not included in our analysis.

Allen, Franklin, Jun Qian, and Meijun Qian (2005), “Law, Finance, and Economic Growth in China,” Journal of Financial Economics 77(1): 57-116. http://www.sciencedirect.com/science/article/pii/S0304405X0500036X

Grosjean, Pauline (2011), “The Institutional Legacy of the Ottoman Empire: Islamic Rule and Financial Development in South Eastern Europe,” Journal of Comparative Economics 39 (1): 1-16. http://www.sciencedirect.com/science/article/pii/S0147596710000405

Hu, Jinyan, Chicheng Ma, and Bo Zhang (2017), “History, Culture, and the Rise of Informal Finance in China,” HKIMR Working Paper No. 12/2017 https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2980540.

Huang, Jianhui (2002). Shanxi Piaohao Shi (History of Shanxi Banks). Taiyuan: Shanxi Jingji Chubanshe.

Pascali, Luigi (2016), “Banks and Development: Jewish Communities in the Italian Renaissance and Current Economic Performance,” Review of Economics and Statistics 98(1): 140-158. http://www.mitpressjournals.org/doi/abs/10.1162/REST_a_00481

Peng, Yusheng (2004), “Kinship Networks and Entrepreneurs in China’s Transitional Economy,” American Journal of Sociology 109(5): 1045-1074. http://www.journals.uchicago.edu/doi/abs/10.1086/382347?journalCode=ajs

Informal finance has experienced explosive growth in China in the past few decades. A variety of informal financial institutions, particularly small loan companies (Xiao’e Daikuan Gongsi), rotating savings and credit associations (ROSCAs or Hehui), pawnshops, and even (illegal) underground banks (Dixia Qianzhuang), emerged and rapidly expanded. Taking small loan companies as an example, the annual growth rate amounts to 22.1 percent in total number and 29.4 percent in total loans between 2008 and 2016. By providing micro-credits outside the state banking system, informal finance has played an important role in sustaining private enterprise growth (Allen, Qian, and Qian, 2005).

In Hu, Ma, and Zhang (2017), we attempt to examine the historical origin of the rise of informal finance in contemporary China. Specifically, we examine whether and how traditional financial institutions (Qianzhuang and Diandang) in the Qing dynasty (1644-1911) have had a persistent impact on the development of informal finance in today’s China (see Note 1). We focus on this historical era because the presence of informal financial activities in China have had a long history exceeding 2,000 years and anecdotes suggest that the business model of historical finance has manifested in contemporary times. Today’s Hehui, for instance, can find its historical prototype in the Tang dynasty (618-907) (Tsai, 2000). In the same vein, many informal financial institutions not only still use the names of their historical counterparts (e.g., Qianzhuang), their lending activities are also based on the lineage or community network that supported their historical antecedents. In provinces that were once historically prosperous in finance (e.g., Zhejiang, Fujian, Jiangsu and Shandong), we note that contemporary informal financial activities are more active than in other regions of the country.

To account for the persistent effect of historical financing on the development of contemporary informal finance practices, we select the 137 counties of Shandong Province for our sample. As a representative northern China province, Shandong had not only a prosperous native financial market in the Qing period but also a fast-growing informal financial sector in the past decade. Given the dominant role of small loan companies in contemporary informal financial institutions, we employ the density of small loan companies between 2009 and 2013 to measure the development of contemporary informal finance. To measure the prosperity of historical finance, we use the density of two dominant native financial institutions, Qianzhuang (money banks) and Diandang (pawnshops) in the late Qing dynasty (circa 1911) as the proxy (see Figure 1 for the regional distribution of the small loan companies and historical financial institutions).

Figure 1: The Distribution of Small Loan Companies (2013) and Historical Financial Institutions (1911) in Shandong Province

The regression analysis reveals that the density of small loan companies is positively affected by the density of historical financial institutions. In counties where there was a prosperous native financial sector before 1911, the density of small loan companies tends to be higher today. In terms of magnitude, a 1 percent increase in the number of historical financial institutions (per 10,000 people) in the late Qing period increases 0.096 percent of the number (and 0.158 percent of total assets) of small loan companies (per 10,000 people) in 2013. These results are robust to controlling for a gamut of confounding factors including economic prosperity, industrial structure, state banks, and geography, among others.

The question in what follows is how historical Qianzhuang and Diandang can continue to affect the development of small loan companies today. We argue that, although these historical financial institutions had vanished for nearly a century, the business cultures they embodied survive to this day. The culture engendered by Confucianism, particularly the norms of integrity, lineage solidarity, and the acquaintance network that helped disseminate information and enforce the credit relationship in traditional Chinese society is still intact. For example, the deposit and loan businesses of Qianzhuang followed the principle of “integrity and righteousness” (kecun xinyi), which means that the payback guarantee depends more on a moral promise rather than physical collateral. Likewise, historical Piaohao (draft banks) also insisted on “righteousness over profits” (xianyi houli) and “from righteousness to profits” (yiyi zhili) and hence only provided services to respected credible people (Huang, 2002). In light of the fact that informal financial activities in China operate in an environment where the legal protection is relatively weak, they may still rely on the traditional business culture of integrity to sustain their growth. For example, Confucian lineage and relationship capital (guanxi) still played a key role in financing the rural industrialization in the 1990s (Peng, 2004).

To examine whether Confucian culture is a channel through which the historical finance system continues to influence contemporary small loan companies, we use the density of Confucian temples that a county had established in the Qing dynasty as the proxy for the strength of Confucianism and introduce interaction terms between the density of Confucian temples and the density of historical financial institutions. Using these parameters, we find that the effect of historical financial institutions on small loan companies is greater in counties with a stronger Confucian culture.

In conclusion, our findings suggest that the development of contemporary informal finance in China is still significantly shaped by their historical counterparts and Confucian culture is likely a channel that has sustained such long-term persistence. Our study suggests the importance of historical and cultural factors in understanding the development of informal finance in contemporary China. This coincides with both the work of Grosjean (2011), who finds that the historical Islamic rule that prohibited interest-lending resulted in an underdeveloped financial market today, and Pascali (2016), who finds that the charity-lending institutions in fifteenth century Italy still affect the performance of the contemporary Italian banking sector.

Note 1: There were three types of institutions (Qianzhuang, Piaohao, and Diandang) that dominated the native financial market in late imperial China. In Shandong province, the presence of Piaohao was almost nonexistent in 1911 and hence is not included in our analysis.

(Jinyan Hu, School of Economics, Shandong University; Chicheng Ma, Faculty of Business and Economics, The University of Hong Kong; Bo Zhang, School of Economics, Shandong University.)

Allen, Franklin, Jun Qian, and Meijun Qian (2005), “Law, Finance, and Economic Growth in China,” Journal of Financial Economics 77(1): 57-116. http://www.sciencedirect.com/science/article/pii/S0304405X0500036X

Grosjean, Pauline (2011), “The Institutional Legacy of the Ottoman Empire: Islamic Rule and Financial Development in South Eastern Europe,” Journal of Comparative Economics 39 (1): 1-16. http://www.sciencedirect.com/science/article/pii/S0147596710000405

Hu, Jinyan, Chicheng Ma, and Bo Zhang (2017), “History, Culture, and the Rise of Informal Finance in China,” HKIMR Working Paper No. 12/2017 https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2980540.

Huang, Jianhui (2002). Shanxi Piaohao Shi (History of Shanxi Banks). Taiyuan: Shanxi Jingji Chubanshe.

Pascali, Luigi (2016), “Banks and Development: Jewish Communities in the Italian Renaissance and Current Economic Performance,” Review of Economics and Statistics 98(1): 140-158. http://www.mitpressjournals.org/doi/abs/10.1162/REST_a_00481

Peng, Yusheng (2004), “Kinship Networks and Entrepreneurs in China’s Transitional Economy,” American Journal of Sociology 109(5): 1045-1074. http://www.journals.uchicago.edu/doi/abs/10.1086/382347?journalCode=ajs

Tsai, Kellee S. (2000), “Banquet Banking: Gender and Rotating Savings and Credit Associations in South China,” The China Quarterly 161: 142-170. https://www.cambridge.org/core/journals/china-quarterly/article/banquet-banking-gender-and-rotating-savings-and-credit-associations-in-south-china/F184FC13490E7FF6F68A5D214F4E571

Latest

Most Popular

- VoxChina Covid-19 Forum (Second Edition): China’s Post-Lockdown Economic Recovery VoxChina, Apr 18, 2020

- China’s Great Housing Boom Kaiji Chen, Yi Wen, Oct 11, 2017

- China’s Joint Venture Policy and the International Transfer of Technology Kun Jiang, Wolfgang Keller, Larry D. Qiu, William Ridley, Feb 06, 2019

- The Dark Side of the Chinese Fiscal Stimulus: Evidence from Local Government Debt Yi Huang, Marco Pagano, Ugo Panizza, Jun 28, 2017

- Wealth Redistribution in the Chinese Stock Market: the Role of Bubbles and Crashes Li An, Jiangze Bian, Dong Lou, Donghui Shi, Jul 01, 2020

- What Is Special about China’s Housing Boom? Edward L. Glaeser, Wei Huang, Yueran Ma, Andrei Shleifer, Jun 20, 2017

- Evaluating Risk across Chinese Housing Markets Yongheng Deng, Joseph Gyourko, Jing Wu, Aug 02, 2017

- Privatization and Productivity in China Yuyu Chen, Mitsuru Igami, Masayuki Sawada, Mo Xiao, Jan 31, 2018

- How did China Move Up the Global Value Chains? Hiau Looi Kee, Heiwai Tang, Aug 30, 2017

- China’s Shadow Banking Sector: Wealth Management Products and Issuing Banks Viral V. Acharya, Jun Qian, Zhishu Yang, Aug 09, 2017

Facebook

Facebook  Twitter

Twitter  Instagram

Instagram WeChat

WeChat  Email

Email