The Making of an Economic Superpower: Unlocking China’s Secret of Rapid Industrialization

This book argues that China’s rapid industrialization since 1978 can be attributed to its rediscovery of the secret recipe of the original Industrial Revolution. The secret recipe is not based on institutional changes per se but rather the sequential creation of mass markets to support mass production. Market creation requires a strong state and appropriate industrial policies because mass markets are a public good that is extremely costly to create and can only be created through stages and under enormous political stability and social trust.

China’s rapid and unstoppable rise since its economic reforms beginning around 1980 is perhaps one of the most important economic and geopolitical events since the Great Divergence several hundred years ago. The reason is simple. Since the British Industrial Revolution, less than 10% of the world’s population has become fully industrialized; if China can successfully finish its industrialization, an additional 20% of the world’s population will be entering modern civilization. Along the way, China is igniting new growth across Asia, Latin America, Africa, and even the industrial West, thanks to the country’s colossal demand for raw materials, energy, commerce, trade, and capital flows.

China’s rapid growth has puzzled many people, including economists. How could a nation with 1.4 billion people transform itself relatively suddenly from a vastly impoverished agricultural land into a formidable industrial powerhouse when so many tiny nations have been unable to do so despite their more favorable social-economic conditions?

Among the many conflicting views that have emerged to interpret China’s rise, two stand out as the most popular and provocative. The first sees China’s hypergrowth as a gigantic government-engineered bubble. It is not sustainable and will collapse because China has no democracy, no human rights, no freedom of speech, no rule of law, no Western-style legal system, no well-functioning markets, no private banking sector, no protection of intellectual property, no ability to innovate (other than copying and stealing Western technologies and business secrets), nor a host of other things that the West has possessed for centuries and have proved essential for Western prosperity and technological dominance. According to this view, the bubble will burst at the expense of China’s people and the environment (See e.g., Acemoglu and Robinson (2012) and Gordon Chang (2001).).

The second view sees China’s dramatic rise simply as destiny. China is returning to its historical position: it had been one of the richest nations and greatest civilizations (alongside India) from at least 200 BC to 1800, the dawn of the Industrial Revolution in England. It is only a matter of time for China to reclaim its historical glory and to dominate the world once again. (As Napoleon once said, “China is a sleeping giant. Let her sleep; once she wakes up, she will shake the world.” See e.g., Martin Jacques (2012).)

I dispute such Eurocentric views and naïve extrapolation of human history in my recent book, titled “The Making of an Economic Superpower—Unlocking Chia’s Secret of Rapid Industrialization.” The book provides a conceptual framework, called the New Stage Theory (NST) of economic development, to illuminate the central historical developmental logic shared by both the Industrial Revolution and China’s miraculous growth.

The NST advocates that the so called “free market” is a fundamental public good that is extremely costly to create. This public good has three pillars: political stability, social trust, and infrastructure, which determine the shape, depth, and extent of the free market, which in turn determines the degree of the division of labor and industrialization. Therefore, the NST identifies missing market-creators as the key problem of development.

The NST emphasizes that the essence of industrialization is mass production, but mass production requires a mass market to render it profitable. However, the mass market requires a sequence of distinctive stages to be created, each with its own obstacles. Thus, the creation of an industrial market cannot be accomplished either by autarkic individuals through laissez faire (the invisible hand) alone, or by the state through a one-time colossal national investment boom via foreign aid, or by a top-down approach (such as the Big Push or shock therapy).

Specifically, the NST characterizes economic development as a process of sequential market creation and structural transformation, from agrarian market structure to proto-industrial market structure, then to a light-industrial market structure and subsequently to a heavy-industrial market structure, and finally, to a service-oriented welfare-state market structure. Each earlier developmental stage or market structure provides the necessary (but not sufficient) developmental conditions for successful (and successive) market creation and industrial evolution in the later stages of development. Failure to go through the necessary developmental stages sequentially with the right industrial policies will result in developmental failures, disorders, or immature industrialization and even deindustrialization, such as the relative “poverty trap” and the “middle-income trap” symptom, regardless of political institutions. Market-facilitating institutions are largely endogenous to economic development.

In other words, the NST emphasizes that for backward agrarian nations to catch up with developed nations, repetition of the key developmental stages of the British Industrial Revolution in earlier human history is necessary and the only way to achieve successful industrialization, as China’s miraculous growth has demonstrated once again after the success of the Asian tigers, Japan, West Europe, and North America.

The British Industrial Revolution followed five key stages:

1. The proto-industrialization stage, which developed rural industries for long-distance trade;

2. The first industrial revolution, which featured labor-intensive mass production of light consumer goods (such as textiles) for the global mass market;

3. The industrial trinity boom, which involved the mass supply of energy, locomotive power, and infrastructure to facilitate mass distribution;

4. The second industrial revolution, featuring the mass production of the means of mass production, such as steel, machine tools (including agricultural machinery) and other heavy industrial goods, as well as the creation of a large credit system; and

5. The welfare state stage, which incorporates economic welfare (such as the modern service economy, unemployment insurance, equal access to health care and education, and a full-fledged social safety net) and political welfare (such as human rights, the end of the death penalty, legalization of same-sex marriage, and universal suffrage, etc.).

Along such a development path, a truly functioning democracy is the consequence instead of the prerequisite of industrialization. Democracy can reinforce political stability and social trust only in industrialized societies.

Based on the philosophy of “crossing a river by touching the stones,” under a growth-facilitating government China completed its proto-industrialization stage by relying on village-township enterprises in the first 10 years after the 1978 reforms. The same process took the U.K. and Western Europe 200 years to accomplish between 1550 and 1750. With a well-fermented domestic market and improved purchasing power in late 1980s through proto-industrialization, China kick-started its first industrial revolution in the second 10 years after the reform and finished it by late 1990s, during which China became the world’s largest producer and exporter of textile products, six years before joining the WTO. With the enormous domestic savings accumulated through these earlier two stages of development and the consequent enormous demand for more efficient energy, motive power, and transportation systems, China kick-started an Industrial Trinity Boom and consequently detonated a second industrial revolution beginning in the late 1990s, which has featured mass production of steel, coal, cement, electricity, machinery, ships, high-speed trains, robots, tunnels, bridges, highways, chemical fibers, machine tools, computers, cellphones, etc., and has made China the largest manufacturing powerhouse and industrial patent applicant in the world since 2010.

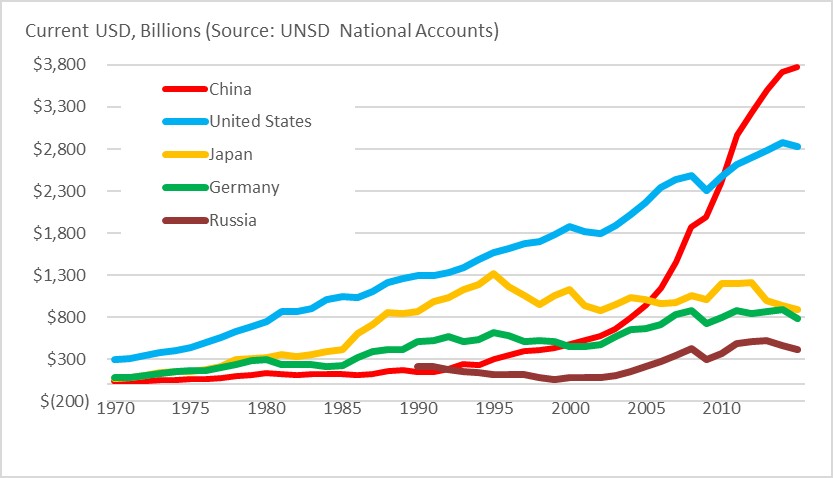

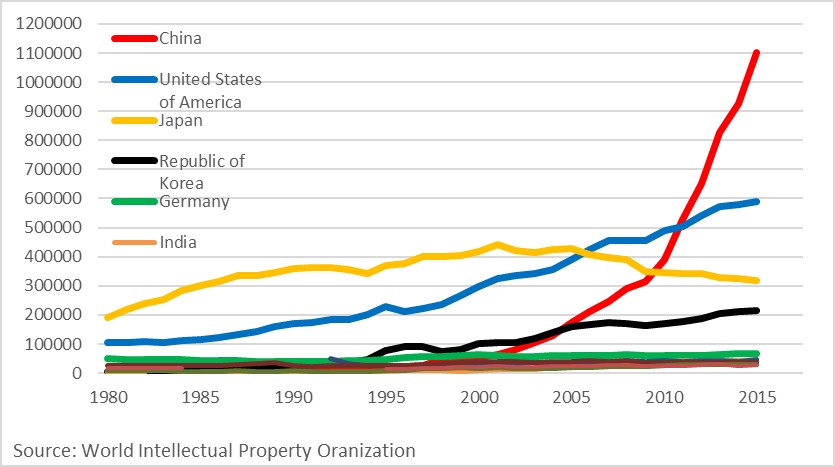

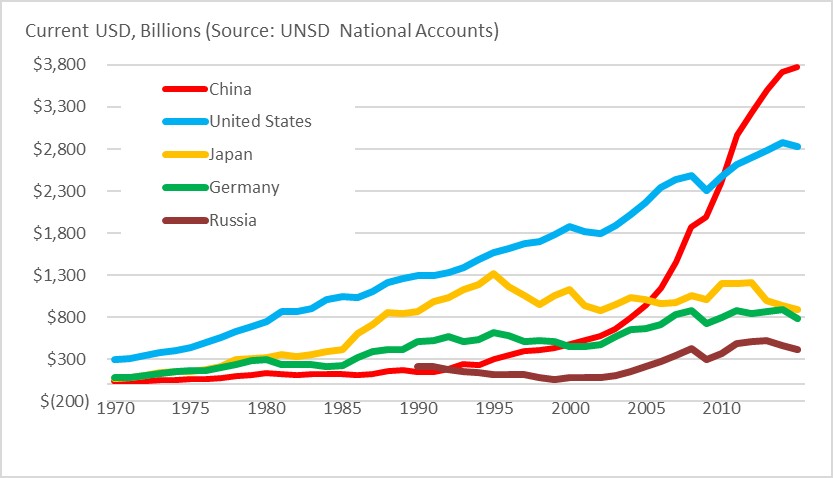

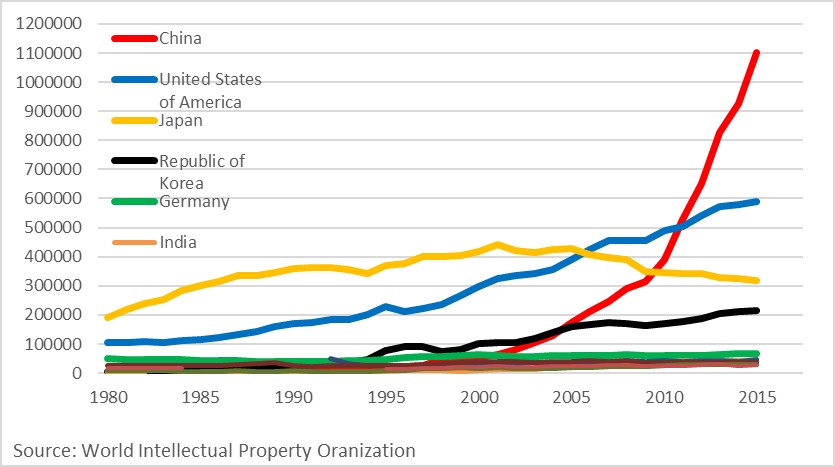

Figure 1, for example, shows the dramatic rise of China’s manufacturing output (in billions of current US dollars) since China’s economic reform. Its manufacturing capacity started at the bottom of the major industrial powers in 1970, but in less than 20 years, it quickly surpassed Russia, Germany, Japan, and the United States after 1990. Rapid industrialization pushed China toward the global frontier of technological innovation. Figure 2 shows that beginning in 2000, China entered an era of explosive technological growth, with its total number of patent applications surpassing the industrial powers one by one and eventually standing as the world’s top patent applicant every year since 2010.

Is China’s achievement the triumph of marketism? Yes and no. “Yes” for obvious reasons: Markets impose economic incentives to compete, impose discipline on management and on technology adoption, and create Darwinian “creative destruction” to eliminate losers.

But “no” for three overlooked reasons: 1) it is extremely costly for independent, anarchic, uneducated peasants to form cooperatives unless social trust and mass markets exist; 2) it is extremely costly to create a unified national mass market and a global market to support the division of labor and mass production; and 3) it is especially costly to create market regulatory institutions to prevent cheating and fraud. Russia and other Eastern European counties failed in their attempts at market-oriented economic reform in the 1990s due to a lack of understanding of these colossal costs and the lack of state capacity and correct industrial policies to overcome such costs. A similar lack of understanding and state capacity doomed the Qing dynasty and the Republic of China’s efforts to kick-start China’s industrial revolution in the 19th and early part of the 20th centuries, despite private property rights and “inclusive” political and economic institutions.

Therefore, the ongoing industrial revolution in China has been driven not by mimicking Western institutions and technology per se, but instead by continuous market creation led by a capable mercantilist government, based on correct industrial policies to sequentially create markets. Institutions are the endogenous responses and the consequence of industrialization, not its causes or preconditions.

Democracy and laissez faire do not automatically create a unified domestic market, still less a global market. Market creation requires state capacity and correct developmental strategies and industrial policies. Early European powers relied on mercantilist state governments and militarized merchants to create monopolistic global markets through colonialism, imperialism, and slave trade. In particular, since the 16th century, generations of British monarchs and militarized merchants (e.g., the British East India Co.) helped create for English rural proto-industries the world’s largest textile market, cotton supply chains, and trading networks, which kick-started the original Industrial Revolution. The Glorious Revolution was more or less a byproduct of such a developmental process.

Today, developing nations no longer have such “privilege” or centuries of time to nurture such a powerful merchant class to create mass markets for their domestic industries. Therefore, governments, especially local governments, must play a bigger role in market creation.

But market creation is a sequential process. No matter how late a nation starts its development, it must repeat earlier stages to succeed. It is like learning mathematics. Through thousands of years of development, the human race discovered math knowledge sequentially: from numbers to arithmetic to algebra to calculus, etc. Although calculus is in today’s first-year college textbooks, every generation of children must still repeat humanity’s evolutionary process to learn math. They do not jump to calculus at age 6, instead they start with learning numbers (with the help of their fingers, just like our ancestors did) and gradually move up the ladder. Most importantly, kids do not learn math in the wild forests, but in schools under the disciplines of teachers.

In contrast, modern economic theories teach poor countries to develop under laissez faire without a facilitating state, or to leap forward and start industrialization by building advanced capital-intensive industries (such as chemical, steel, and automobile industries), or by setting up modern financial systems (such as a floating exchange rate, free international capital flows, and fully fledged privatization of state-owned properties and natural resources), or by erecting modern political institutions (such as democracy and universal suffrage). But such top-down approaches violate the historical sequence of the Industrial Revolution and have led to political chaos, developmental disorders, and deformed capitalism in Africa, Latin America, Southeast Asia, and the Middle East.

Therefore, China’s rise provides a golden opportunity for us to rethink the theory of development and the mechanism of the original Industrial Revolution itself.

(This article is based on my recent book, The Making of an Economic Superpower: Unlocking China’s Secret of Rapid Industrialization. For the working paper version of the book, see my website at https://research.stlouisfed.org/econ/wen.)

Acemoglu, Daron, and Robinson, James A. Why Nations Fail. New York: Crown Publishers, 2012.

Chang, Gordon G. The Coming Collapse of China. New York: Random House, 2001.

Jacques, Martin. When China Rules the World: The Rise of the Middle Kingdom and the Birth of a New Global Order. Second Edition. London: Penguin Press, 2012.

Wen, Yi. The Making of an Economic Superpower: Unlocking China’s Secret of Rapid Industrialization. World Scientific Publishing Co. 2016. Also see St. Louis Fed Working Paper 2015-006B, 2015 (https://research.stlouisfed.org/wp/more/2015-006).

Wen, Yi. “China’s Rapid Rise.” Federal Reserve Bank of St. Louis The Regional Economist 24.2 (2016): 8-14. (http://scholar.google.com/scholar?hl=en&q=China%27s+rapid+rise&btnG=&as_sdt=1%2C26&as_sdtp=)

Wen, Yi, and George E. Fortier. “The Visible Hand: The Role of Government in China’s Long-Awaited Industrial Revolution.” Federal Reserve Bank of St. Louis Review, 2016 (https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2839193).

China’s rapid and unstoppable rise since its economic reforms beginning around 1980 is perhaps one of the most important economic and geopolitical events since the Great Divergence several hundred years ago. The reason is simple. Since the British Industrial Revolution, less than 10% of the world’s population has become fully industrialized; if China can successfully finish its industrialization, an additional 20% of the world’s population will be entering modern civilization. Along the way, China is igniting new growth across Asia, Latin America, Africa, and even the industrial West, thanks to the country’s colossal demand for raw materials, energy, commerce, trade, and capital flows.

China’s rapid growth has puzzled many people, including economists. How could a nation with 1.4 billion people transform itself relatively suddenly from a vastly impoverished agricultural land into a formidable industrial powerhouse when so many tiny nations have been unable to do so despite their more favorable social-economic conditions?

Among the many conflicting views that have emerged to interpret China’s rise, two stand out as the most popular and provocative. The first sees China’s hypergrowth as a gigantic government-engineered bubble. It is not sustainable and will collapse because China has no democracy, no human rights, no freedom of speech, no rule of law, no Western-style legal system, no well-functioning markets, no private banking sector, no protection of intellectual property, no ability to innovate (other than copying and stealing Western technologies and business secrets), nor a host of other things that the West has possessed for centuries and have proved essential for Western prosperity and technological dominance. According to this view, the bubble will burst at the expense of China’s people and the environment (See e.g., Acemoglu and Robinson (2012) and Gordon Chang (2001).).

The second view sees China’s dramatic rise simply as destiny. China is returning to its historical position: it had been one of the richest nations and greatest civilizations (alongside India) from at least 200 BC to 1800, the dawn of the Industrial Revolution in England. It is only a matter of time for China to reclaim its historical glory and to dominate the world once again. (As Napoleon once said, “China is a sleeping giant. Let her sleep; once she wakes up, she will shake the world.” See e.g., Martin Jacques (2012).)

I dispute such Eurocentric views and naïve extrapolation of human history in my recent book, titled “The Making of an Economic Superpower—Unlocking Chia’s Secret of Rapid Industrialization.” The book provides a conceptual framework, called the New Stage Theory (NST) of economic development, to illuminate the central historical developmental logic shared by both the Industrial Revolution and China’s miraculous growth.

The NST advocates that the so called “free market” is a fundamental public good that is extremely costly to create. This public good has three pillars: political stability, social trust, and infrastructure, which determine the shape, depth, and extent of the free market, which in turn determines the degree of the division of labor and industrialization. Therefore, the NST identifies missing market-creators as the key problem of development.

The NST emphasizes that the essence of industrialization is mass production, but mass production requires a mass market to render it profitable. However, the mass market requires a sequence of distinctive stages to be created, each with its own obstacles. Thus, the creation of an industrial market cannot be accomplished either by autarkic individuals through laissez faire (the invisible hand) alone, or by the state through a one-time colossal national investment boom via foreign aid, or by a top-down approach (such as the Big Push or shock therapy).

Specifically, the NST characterizes economic development as a process of sequential market creation and structural transformation, from agrarian market structure to proto-industrial market structure, then to a light-industrial market structure and subsequently to a heavy-industrial market structure, and finally, to a service-oriented welfare-state market structure. Each earlier developmental stage or market structure provides the necessary (but not sufficient) developmental conditions for successful (and successive) market creation and industrial evolution in the later stages of development. Failure to go through the necessary developmental stages sequentially with the right industrial policies will result in developmental failures, disorders, or immature industrialization and even deindustrialization, such as the relative “poverty trap” and the “middle-income trap” symptom, regardless of political institutions. Market-facilitating institutions are largely endogenous to economic development.

In other words, the NST emphasizes that for backward agrarian nations to catch up with developed nations, repetition of the key developmental stages of the British Industrial Revolution in earlier human history is necessary and the only way to achieve successful industrialization, as China’s miraculous growth has demonstrated once again after the success of the Asian tigers, Japan, West Europe, and North America.

The British Industrial Revolution followed five key stages:

1. The proto-industrialization stage, which developed rural industries for long-distance trade;

2. The first industrial revolution, which featured labor-intensive mass production of light consumer goods (such as textiles) for the global mass market;

3. The industrial trinity boom, which involved the mass supply of energy, locomotive power, and infrastructure to facilitate mass distribution;

4. The second industrial revolution, featuring the mass production of the means of mass production, such as steel, machine tools (including agricultural machinery) and other heavy industrial goods, as well as the creation of a large credit system; and

5. The welfare state stage, which incorporates economic welfare (such as the modern service economy, unemployment insurance, equal access to health care and education, and a full-fledged social safety net) and political welfare (such as human rights, the end of the death penalty, legalization of same-sex marriage, and universal suffrage, etc.).

Along such a development path, a truly functioning democracy is the consequence instead of the prerequisite of industrialization. Democracy can reinforce political stability and social trust only in industrialized societies.

Based on the philosophy of “crossing a river by touching the stones,” under a growth-facilitating government China completed its proto-industrialization stage by relying on village-township enterprises in the first 10 years after the 1978 reforms. The same process took the U.K. and Western Europe 200 years to accomplish between 1550 and 1750. With a well-fermented domestic market and improved purchasing power in late 1980s through proto-industrialization, China kick-started its first industrial revolution in the second 10 years after the reform and finished it by late 1990s, during which China became the world’s largest producer and exporter of textile products, six years before joining the WTO. With the enormous domestic savings accumulated through these earlier two stages of development and the consequent enormous demand for more efficient energy, motive power, and transportation systems, China kick-started an Industrial Trinity Boom and consequently detonated a second industrial revolution beginning in the late 1990s, which has featured mass production of steel, coal, cement, electricity, machinery, ships, high-speed trains, robots, tunnels, bridges, highways, chemical fibers, machine tools, computers, cellphones, etc., and has made China the largest manufacturing powerhouse and industrial patent applicant in the world since 2010.

Figure 1, for example, shows the dramatic rise of China’s manufacturing output (in billions of current US dollars) since China’s economic reform. Its manufacturing capacity started at the bottom of the major industrial powers in 1970, but in less than 20 years, it quickly surpassed Russia, Germany, Japan, and the United States after 1990. Rapid industrialization pushed China toward the global frontier of technological innovation. Figure 2 shows that beginning in 2000, China entered an era of explosive technological growth, with its total number of patent applications surpassing the industrial powers one by one and eventually standing as the world’s top patent applicant every year since 2010.

Figure 1: Manufacturing Output for Top 5 Countries in 2015

Figure 2: Patent Applications in 2015

Is China’s achievement the triumph of marketism? Yes and no. “Yes” for obvious reasons: Markets impose economic incentives to compete, impose discipline on management and on technology adoption, and create Darwinian “creative destruction” to eliminate losers.

But “no” for three overlooked reasons: 1) it is extremely costly for independent, anarchic, uneducated peasants to form cooperatives unless social trust and mass markets exist; 2) it is extremely costly to create a unified national mass market and a global market to support the division of labor and mass production; and 3) it is especially costly to create market regulatory institutions to prevent cheating and fraud. Russia and other Eastern European counties failed in their attempts at market-oriented economic reform in the 1990s due to a lack of understanding of these colossal costs and the lack of state capacity and correct industrial policies to overcome such costs. A similar lack of understanding and state capacity doomed the Qing dynasty and the Republic of China’s efforts to kick-start China’s industrial revolution in the 19th and early part of the 20th centuries, despite private property rights and “inclusive” political and economic institutions.

Therefore, the ongoing industrial revolution in China has been driven not by mimicking Western institutions and technology per se, but instead by continuous market creation led by a capable mercantilist government, based on correct industrial policies to sequentially create markets. Institutions are the endogenous responses and the consequence of industrialization, not its causes or preconditions.

Democracy and laissez faire do not automatically create a unified domestic market, still less a global market. Market creation requires state capacity and correct developmental strategies and industrial policies. Early European powers relied on mercantilist state governments and militarized merchants to create monopolistic global markets through colonialism, imperialism, and slave trade. In particular, since the 16th century, generations of British monarchs and militarized merchants (e.g., the British East India Co.) helped create for English rural proto-industries the world’s largest textile market, cotton supply chains, and trading networks, which kick-started the original Industrial Revolution. The Glorious Revolution was more or less a byproduct of such a developmental process.

Today, developing nations no longer have such “privilege” or centuries of time to nurture such a powerful merchant class to create mass markets for their domestic industries. Therefore, governments, especially local governments, must play a bigger role in market creation.

But market creation is a sequential process. No matter how late a nation starts its development, it must repeat earlier stages to succeed. It is like learning mathematics. Through thousands of years of development, the human race discovered math knowledge sequentially: from numbers to arithmetic to algebra to calculus, etc. Although calculus is in today’s first-year college textbooks, every generation of children must still repeat humanity’s evolutionary process to learn math. They do not jump to calculus at age 6, instead they start with learning numbers (with the help of their fingers, just like our ancestors did) and gradually move up the ladder. Most importantly, kids do not learn math in the wild forests, but in schools under the disciplines of teachers.

In contrast, modern economic theories teach poor countries to develop under laissez faire without a facilitating state, or to leap forward and start industrialization by building advanced capital-intensive industries (such as chemical, steel, and automobile industries), or by setting up modern financial systems (such as a floating exchange rate, free international capital flows, and fully fledged privatization of state-owned properties and natural resources), or by erecting modern political institutions (such as democracy and universal suffrage). But such top-down approaches violate the historical sequence of the Industrial Revolution and have led to political chaos, developmental disorders, and deformed capitalism in Africa, Latin America, Southeast Asia, and the Middle East.

Therefore, China’s rise provides a golden opportunity for us to rethink the theory of development and the mechanism of the original Industrial Revolution itself.

(This article is based on my recent book, The Making of an Economic Superpower: Unlocking China’s Secret of Rapid Industrialization. For the working paper version of the book, see my website at https://research.stlouisfed.org/econ/wen.)

(Yi Wen is Assistant Vice President of the Economic Research Department at the Federal Reserve Bank of St. Louis)

Acemoglu, Daron, and Robinson, James A. Why Nations Fail. New York: Crown Publishers, 2012.

Chang, Gordon G. The Coming Collapse of China. New York: Random House, 2001.

Jacques, Martin. When China Rules the World: The Rise of the Middle Kingdom and the Birth of a New Global Order. Second Edition. London: Penguin Press, 2012.

Wen, Yi. The Making of an Economic Superpower: Unlocking China’s Secret of Rapid Industrialization. World Scientific Publishing Co. 2016. Also see St. Louis Fed Working Paper 2015-006B, 2015 (https://research.stlouisfed.org/wp/more/2015-006).

Wen, Yi. “China’s Rapid Rise.” Federal Reserve Bank of St. Louis The Regional Economist 24.2 (2016): 8-14. (http://scholar.google.com/scholar?hl=en&q=China%27s+rapid+rise&btnG=&as_sdt=1%2C26&as_sdtp=)

Wen, Yi, and George E. Fortier. “The Visible Hand: The Role of Government in China’s Long-Awaited Industrial Revolution.” Federal Reserve Bank of St. Louis Review, 2016 (https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2839193).

Latest

Most Popular

- VoxChina Covid-19 Forum (Second Edition): China’s Post-Lockdown Economic Recovery VoxChina, Apr 18, 2020

- China’s Great Housing Boom Kaiji Chen, Yi Wen, Oct 11, 2017

- China’s Joint Venture Policy and the International Transfer of Technology Kun Jiang, Wolfgang Keller, Larry D. Qiu, William Ridley, Feb 06, 2019

- The Dark Side of the Chinese Fiscal Stimulus: Evidence from Local Government Debt Yi Huang, Marco Pagano, Ugo Panizza, Jun 28, 2017

- Wealth Redistribution in the Chinese Stock Market: the Role of Bubbles and Crashes Li An, Jiangze Bian, Dong Lou, Donghui Shi, Jul 01, 2020

- What Is Special about China’s Housing Boom? Edward L. Glaeser, Wei Huang, Yueran Ma, Andrei Shleifer, Jun 20, 2017

- Evaluating Risk across Chinese Housing Markets Yongheng Deng, Joseph Gyourko, Jing Wu, Aug 02, 2017

- Privatization and Productivity in China Yuyu Chen, Mitsuru Igami, Masayuki Sawada, Mo Xiao, Jan 31, 2018

- How did China Move Up the Global Value Chains? Hiau Looi Kee, Heiwai Tang, Aug 30, 2017

- China’s Shadow Banking Sector: Wealth Management Products and Issuing Banks Viral V. Acharya, Jun Qian, Zhishu Yang, Aug 09, 2017

Facebook

Facebook  Twitter

Twitter  Instagram

Instagram WeChat

WeChat  Email

Email