Mortgage Prepayment in China

During the 2019–2024 monetary easing cycle, Chinese households used their savings to prepay unprecedented amounts of mortgage loans. Because refinancing was restricted, mortgage rates remained rigid, while savings returns quickly adjusted to rate cuts. The widening gap between borrowing costs and savings returns encouraged prepayment (deleveraging) and reduced consumption. Our findings suggest that the rigid mortgage rates have rendered China’s monetary easing counterproductive.

As China’s economic growth slowed in recent years, the central bank initiated a series of interest rate cuts beginning in 2019, alongside other monetary easing policies, to stimulate lending and revive the real economy. Despite these efforts, Chinese households responded to lower loan rates by rushing to prepay their mortgage loans. Media reports indicate that this wave of prepayments was primarily financed by households’ own savings rather than through mortgage refinancing. This behavior suggests voluntary deleveraging by households, contrary to the intended goal of expansionary monetary policy, which aims to encourage borrowing and spending. The scale of mortgage prepayments has been remarkable. Market estimates suggest that total prepayments in 2022 reached 4.7 trillion RMB (approximately 700 billion USD), accounting for 12% of all outstanding mortgage loans. This trend continued into the first half of 2024.

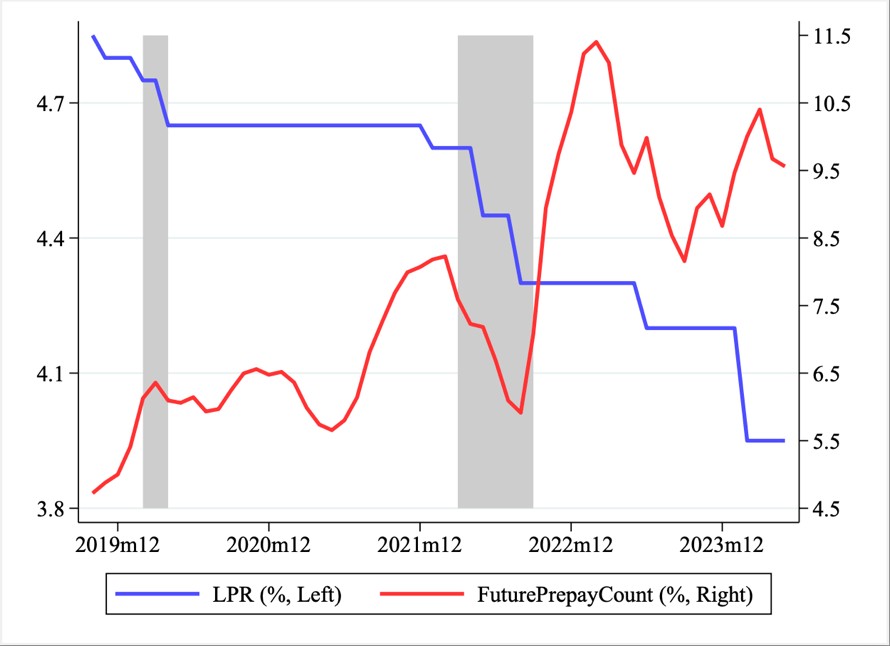

Between 2019 and 2024, the People’s Bank of China (PBOC) repeatedly reduced borrowing costs, lowering the 5-year Loan Prime Rate (LPR)—the benchmark for mortgage loans—from 4.85% in October 2019 to 3.95% by May 2024, as shown in Figure 1 (blue line). The red line in Figure 1 illustrates the corresponding 6-month prepayment count ratio, defined as the number of borrowers prepaying loans divided by the total number of outstanding mortgages. As the LPR declined, the prepayment count ratio rose steadily, reaching 4.3% by the end of 2021 and exhibiting several waves thereafter. Prepayments temporarily stalled in mid-2022 due to nationwide lockdowns during the Omicron wave of COVID-19 (indicated by the right shaded grey area in the figure). However, prepayments surged to a peak of 11.5% by early 2023 following the reopening of the economy. The observed negative correlation between interest rates and mortgage prepayments suggests that monetary easing had counterproductive effects. Instead of spurring borrowing and consumption, households opted to deleverage by prepaying their mortgage loans.

This unprecedented and puzzling phenomenon has sparked debate among regulators and economists. Why do households choose to prepay their mortgages—effectively deleveraging—following rate cuts? More importantly, what are the broader macroeconomic implications of prepayments, and how does it reshape the transmission of monetary policy? In this study, we address these questions by analyzing loan-level data from one of China’s major banks. Our findings highlight how interest rate pass-through operates in China’s household sector, revealing a mechanism influenced by refinancing restriction and mortgage rate rigidity. These frictions arise from unique institutional arrangements in China’s mortgage market.

Figure 1: The LPR and Mortgage Prepayment Ratio

Source: Gao, Jiang, Ren, Wang, and Wu (2025)

Why prepay?

A key element of our explanation lies in the rigidity of mortgage rates in China. The mortgage rate is typically set as the LPR plus a fixed local margin. The LPR is floating but adjusted only once per year, whereas the local margin---determined at the time of loan issuance---remains fixed throughout the loan term. The local margin reflects city-level home purchase policies and exhibits significant cross-sectional heterogeneity, but as one of the PBOC’s complementary monetary tools, its national average generally co-moves with the benchmark interest rate. Consequently, interest rates on outstanding mortgages adjust only partially, and often with substantial delays, to monetary easing, in contrast to new mortgage loans.

Moreover, mortgage refinancing is highly restricted in China due to regulatory barriers, preventing households from resetting their mortgage rates to reflect lower rates. These frictions—driven largely by the market power of state-owned banks and their influence over regulatory policymaking—render mortgage rates downwardly rigid in the face of monetary easing.

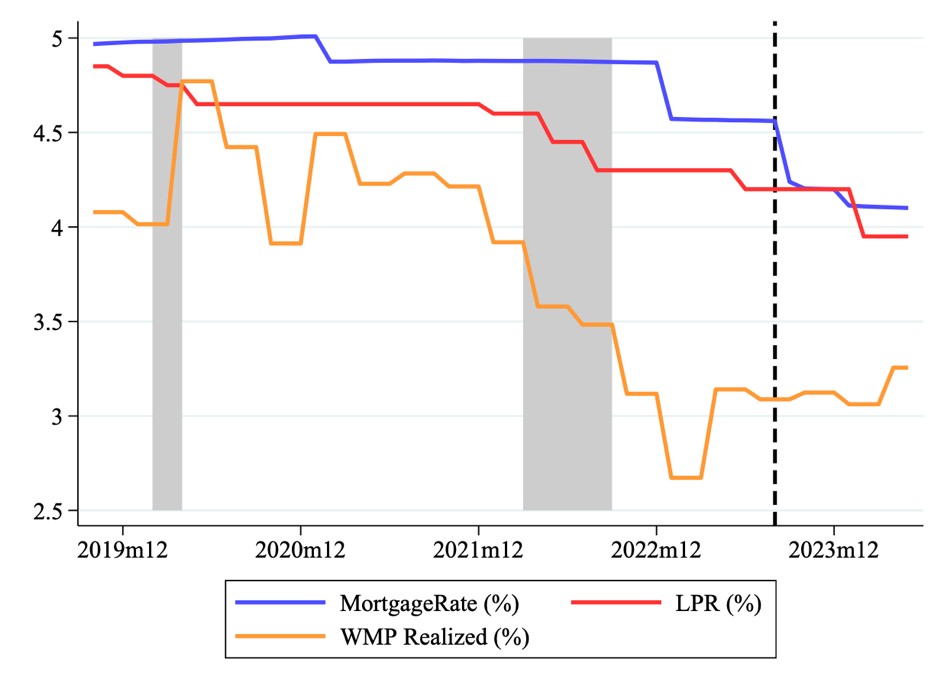

Figure 2 illustrates the pattern clearly: the blue line represents the average interest rate on the bank's existing mortgage loans, while the red line shows the Loan Prime Rate (LPR). As depicted, the average rate of existing mortgages remained significantly higher than the LPR, with the gap widening from 0.12% in October 2019 to a peak of 0.57% in 2022. This gap only began to narrow after the PBOC intervened in September 2023.

At the same time, Chinese households often hold substantial savings in wealth management products (WMPs), which are liquid and offer higher returns than traditional deposits. WMPs typically invest in short-term bonds and money market instruments, with returns that adjust quickly—and often amplify—in response to benchmark rate cuts. This creates an asymmetric rate pass-through on household balance sheets: while mortgage rates remain rigid, WMP returns fall rapidly. Borrowers in our sample have on average 16,714 yuan (about 2,337 USD) in deposits and 20,186 yuan (2,882 USD) in total assets at this bank, which are much higher than their monthly repayment 2,992 yuan (approximately 418 USD).

The orange line in Figure 2 illustrates the average realized returns of WMPs. The gap between average mortgage rates and WMP returns widened from 0.75% in 2019–2020 to 1.90% in early 2023.

Before 2019, when the rate gap was relatively small, households were willing to accept it as the premium of maintaining precautionary liquidity. However, as the gap widened, households began to reassess their financial decisions, finding it increasingly expensive to carry mortgage debt. In response, many shifted their behavior by reducing borrowing and prepaying mortgages. This deleveraging behavior, however, had unintended consequences, as it contributed to a contraction in household consumption.

This deleveraging, in turn, can lead to a contraction in household consumption. Borrowers may find it optimal to reallocate income away from both current consumption and savings to accelerate mortgage repayment, thereby avoiding future interest expenses when mortgage rates exceed the returns on savings.

Figure 2: Average Mortgage Rate, LPR, and WMP Returns

Source: Gao, Jiang, Ren, Wang, and Wu (2025)

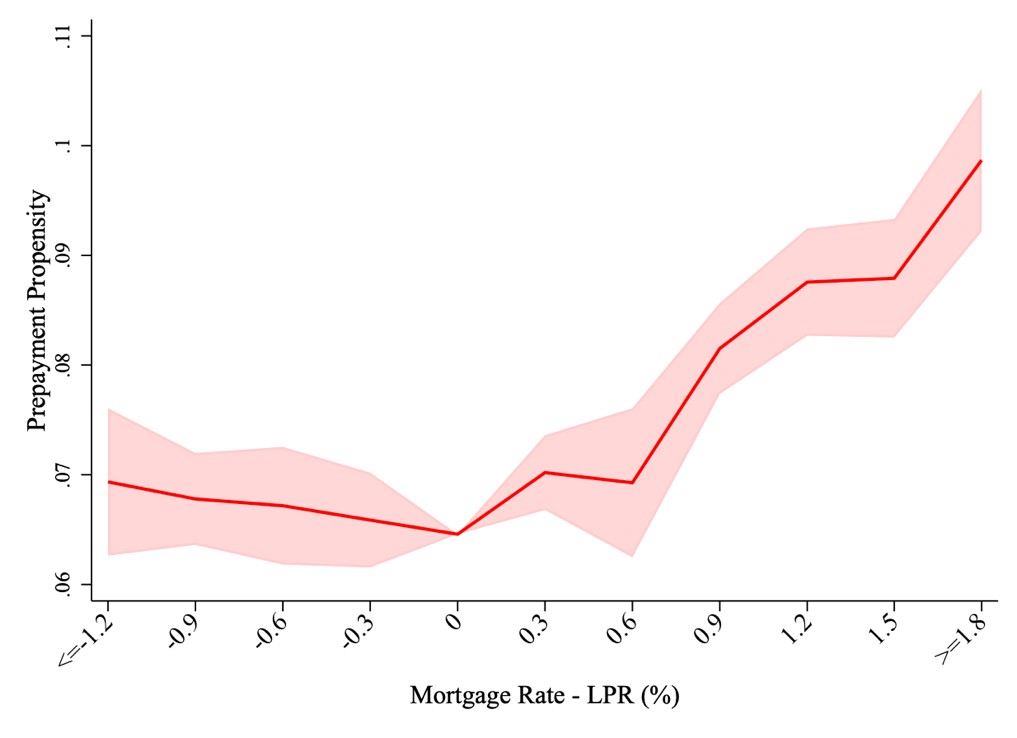

Our analysis provides loan-level evidence supporting this hypothesis. Specifically, we calculate the interest rate gap, denoted as RateGap, which measures the difference between a household’s current mortgage rate and the LPR. Because mortgage rates adjust only partially and with delays to changes in the benchmark rate, RateGap increases as the LPR decreases. Our findings show that as RateGap becomes positive and increases, borrowers are significantly more likely to prepay their mortgages. Notably, this effect is non-linear: when RateGap is negative, prepayment behavior is insignificant. This relationship is illustrated in Figure 3.

We rule out the potential impacts from other economic conditions by including time fixed effect, and also allowing the economic conditions to vary by cities. Our identification relies on the heterogeneity in mortgage loans’ local margin, which is set at mortgage issuance, and its distance to the threshold at which households are likely to begin prepaying their loans. We control for local economic variables, including GDP growth and housing price. Our findings are robust to control for city by year-month by purchase-year fixed effects, which rule out the effects from any changes in local economic condition since mortgage issuance, such as housing price collapse.

Additionally, we find that households with greater wealth, higher levels of education, and better credit scores are more responsive to increases in RateGap and more likely to prepay their mortgages. This finding aligns with our hypothesis, as prepayment requires sufficient savings in the absence of mortgage refinancing options. In contrast, evidence from the U.S. highlights a different dynamic: it is predominantly low-income households that engage in prepayment, driven by financial constraints and a greater need to reduce interest expenses (Berger et al., 2021).

Figure 3: RateGap and Propensity to Prepay

Source: Gao, Jiang, Ren, Wang, and Wu (2025)

Macroeconomic impact

How does mortgage prepayment shape the effectiveness of monetary policy in China? We address this question by examining household saving and consumption behavior before and after mortgage prepayment. Our analysis reveals that prepaying households experience a substantial and sustained reduction in savings and total assets, ranging from 72% to 78%. This finding aligns with our conjecture—and anecdotal evidence from media reports—that mortgage prepayments are predominantly financed by households’ own savings.

More importantly, from the perspective of monetary policy transmission, we find that household consumption decreases by approximately 2.3% following prepayment. This decline reflects households’ preference to accelerate mortgage repayments and avoid future interest expenses, particularly when the RateGap becomes significantly large.

Next, we find evidence that this effect also extends to the city level. We show that cities with higher fraction of borrowers whose mortgage rates exceed the current LPR (labelled as Frac>0) tend to experience more mortgage prepayment. We further find that for these cities, the consumption growth is likely to be low. The economic magnitude of this effect is substantial: a one-standard-deviation increase in the fraction of prepayments is associated with a 5.09% decline in aggregate consumption growth. Moreover, the reduction in consumption is particularly pronounced in discretionary spending.

The city-level evidence uncovers a potentially counterproductive effect of monetary easing: through the mortgage prepayment channel, cutting rates may inadvertently suppress household consumption.

Policy implication

How can this issue be addressed to improve the effectiveness of monetary policy? To answer this question, we first examine the impact of a 2023 policy initiative introduced by Chinese regulators. On August 31, 2023, the PBOC, in collaboration with local governments, announced a policy allowing certain borrowers to reset the local margin of their existing mortgage loans to the lower "first-home" margin, even if they were not classified as first-home borrowers at the time of purchase. The center piece of this policy was a redefinition of the “first home” criteria. Approximately one-quarter of the households in our sample qualified for this adjustment, resulting in an average mortgage rate reduction of 50 basis points.

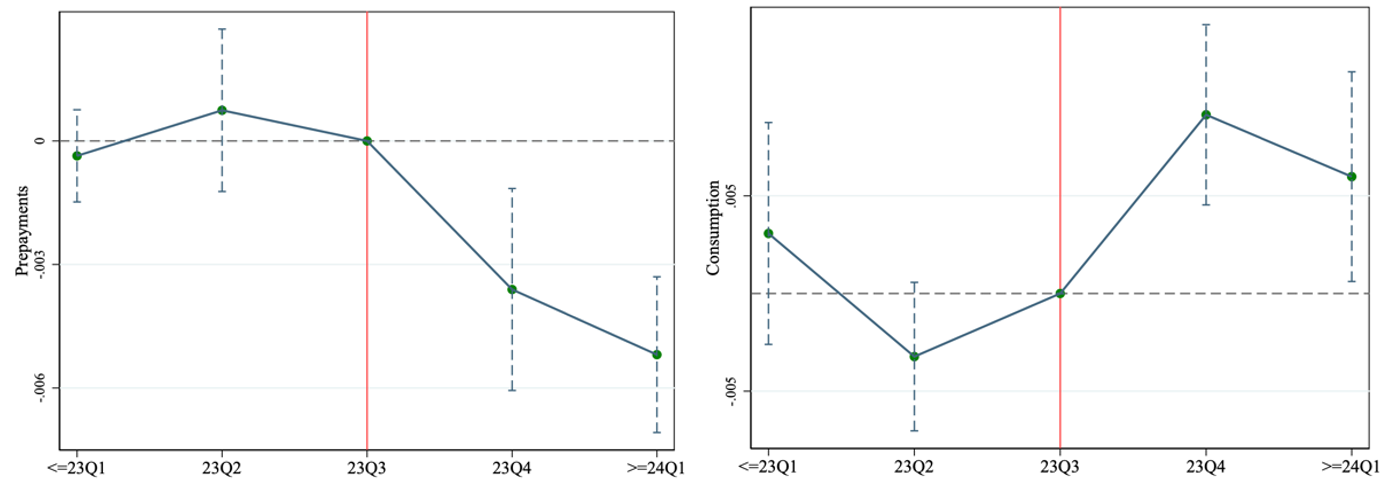

Using a difference-in-differences design, we find that treated households were significantly less likely to prepay their mortgages after the policy change and exhibited an increase in consumption relative to the control group. Figure 4 illustrates the clear effects of the policy. These results suggest that policies that directly address mortgage rate rigidity can mitigate frictions in rate pass-through and enhance monetary policy transmission.

Figure 4: Prepayment and Consumption around the 2023 Policy Intervention

Source: Gao, Jiang, Ren, Wang, and Wu (2025)

This insight aligns with the PBOC’s most recent policy initiative, introduced on September 29, 2024, which aims to further strengthen monetary policy transmission through the household channel. The policy initiative features a new mortgage rate pricing scheme, which includes two key measures: (1) allowing local margins to adjust to market conditions and (2) shortening the LPR adjustment period from one year to as little as one quarter. Both measures enable the interest rates on outstanding mortgage loans to respond more quickly to changes in the benchmark rate, reducing rigidities in the system. Indeed, mortgage prepayment activity has slowed markedly since September 2024.

Reference

Berger, D., Milbradt, K., Tourre, F., Vavra, J., 2021. Mortgage Prepayment and Path-Dependent Effects of Monetary Policy. American Economic Review 111, 2829–2878

Gao, Zhenyu, Wenxi Jiang, Haohan Ren, Kemin Wang, and Yuezhi Wu. "Rigid Mortgage Prepayment in China and Monetary Policy Transmission." Working Paper (2025).

Latest

Most Popular

- VoxChina Covid-19 Forum (Second Edition): China’s Post-Lockdown Economic Recovery VoxChina, Apr 18, 2020

- China’s Great Housing Boom Kaiji Chen, Yi Wen, Oct 11, 2017

- China’s Joint Venture Policy and the International Transfer of Technology Kun Jiang, Wolfgang Keller, Larry D. Qiu, William Ridley, Feb 06, 2019

- The Dark Side of the Chinese Fiscal Stimulus: Evidence from Local Government Debt Yi Huang, Marco Pagano, Ugo Panizza, Jun 28, 2017

- Wealth Redistribution in the Chinese Stock Market: the Role of Bubbles and Crashes Li An, Jiangze Bian, Dong Lou, Donghui Shi, Jul 01, 2020

- Evaluating Risk across Chinese Housing Markets Yongheng Deng, Joseph Gyourko, Jing Wu, Aug 02, 2017

- What Is Special about China’s Housing Boom? Edward L. Glaeser, Wei Huang, Yueran Ma, Andrei Shleifer, Jun 20, 2017

- Privatization and Productivity in China Yuyu Chen, Mitsuru Igami, Masayuki Sawada, Mo Xiao, Jan 31, 2018

- How did China Move Up the Global Value Chains? Hiau Looi Kee, Heiwai Tang, Aug 30, 2017

- China’s Shadow Banking Sector: Wealth Management Products and Issuing Banks Viral V. Acharya, Jun Qian, Zhishu Yang, Aug 09, 2017

Facebook

Facebook  Twitter

Twitter  Instagram

Instagram WeChat

WeChat  Email

Email