E vs. G: Environmental Policy and Earnings Management in China

We examine the conflict between environmental and governance issues arising from China’s automatic air pollutant monitoring system, introduced in 2012. Our findings suggest that polluting firms engage in downward earnings management to potentially minimize regulatory attention, with factors such as firm size, profitability, and market conditions influencing the extent of this behavior. This study highlights the unintended consequences of environmental policies.

The concept of environmental, social, and governance (ESG) has gained significant traction in recent years, particularly following the release of a pivotal report by the United Nations in 2004. While the overall ESG performance of firms has generally improved, conflicts among the E, S, and G dimensions can arise, leading to unintended consequences. A striking example is the 2015 Volkswagen scandal, where the company used software to cheat emissions tests, revealing a stark conflict between environmental commitments and governance integrity. Despite the growing interest in ESG, empirical evidence directly documenting these conflicts remains limited. We provide systematic evidence of a conflict between environmental and governance issues by examining the impact of the automatic air pollutant monitoring system implemented in China.

Policy Background

In 2012, as part of its “War on Pollution,” the Chinese government established an automatic air pollutant monitoring system that aimed to enhance transparency and accountability in environmental reporting. Previous research by Greenstone et al. (2022) and Barwick et al. (2024) has demonstrated the effectiveness of this automatic monitoring system: it significantly increased public awareness of pollution and improved data accuracy. However, the system places significant pressure on polluting firms, as local governments are incentivized to meet strict pollution reduction targets, which are tied to their officials’ career advancements. Consequently, polluting firms face heightened scrutiny regarding their environmental performance. Choi, Mukherjee, and Zheng (2024) show that stock prices of less sustainable firms dropped more than those of sustainable firms after the introduction of the monitoring system, suggesting that the market anticipates a larger negative impact on polluting firms.

In light of heightened regulatory scrutiny and negative public perception, polluting firms may engage in dishonest behavior, such as earnings management. On the one hand, since the government might target larger and more profitable firms, polluting firms have an incentive to engage in downward earnings management to avoid attracting regulatory attention and to align with public expectations of scaling down the polluting industries. On the other hand, these firms might inflate profits to prevent alarming stakeholders and to appear financially robust, which could lead managers to engage in upward earnings management. The choice of earnings management direction would depend on the specific pressures a firm faces. Ultimately, this behavior leads to potential conflicts between genuine environmental responsibility and governance practices.

Research Findings

Our study, Choi and Lai (2025), uses a difference-in-differences (DiD) analysis to investigate the behavior of firms in polluting industries in response to the monitoring system. We define polluting industries as those listed in the Directory of Classified Management of Environmental Protection Verification issued by the Chinese government in 2008; the list contains 16 industry categories, including thermal power, steel, cement, electrolytic aluminum, coal, and metallurgy. Our findings reveal that these firms significantly increased their use of discretionary accruals—indicating earnings management—following the policy change. Specifically, in 2012, polluting firms’ absolute discretionary accruals rose by 1.63%, and the likelihood of negative adjustments in their earnings increased by over 10%, compared to nonpolluting firms. The findings suggest that downward earnings management is more prevalent than upward earnings management among polluting firms.

One caveat is that we did not directly observe managers’ dishonest earnings distortion behavior. We follow the accounting literature (Dechow et al. 1995, Jones 1991) and use discretionary accruals as a proxy for accrual-based earnings management, a technique adopted by companies to manipulate their financial statements by adjusting accruals. Discretionary accruals are the difference between firms’ actual accruals and the normal level of accruals; the latter is estimated using the modified Jones (1991) model. As Kothari et al. (2005) point out, these are joint tests of the researcher’s model of discretionary accruals and earnings management. In our context, the model misspecification concern is mitigated because our DiD approach focuses on the discretionary accruals related to the event of interest.

We also show that polluting firms’ managed earnings became less informative for investors, as measured by the drop in long-window earnings response coefficients (following the approach by Chaney and Jeter, 1992). The decline in informativeness is consistent with the notion that managers report distorted earnings rather than reveal truly negative information arising from the pollution crackdowns. Our overall results align with those of Zang (2012), who demonstrates that real activities manipulation and accrual-based earnings management serve as substitutes. The introduction of the automatic monitoring system increases costs associated with manipulating air pollutant data, thereby raising the likelihood that firms will engage in earnings management.

To further analyze the timing of these effects, we observe that there is no significant pre-trend in earnings management behavior prior to the implementation of the monitoring system, which supports the validity of our DiD analysis. The increase in earnings management persists after the policy change, from 2012 to the end of sample period in 2014. The results suggest that the pressure from the new monitoring system had a long-term impact on the financial reporting practices of polluting firms, as these firms continued to face regulatory scrutiny after 2012.

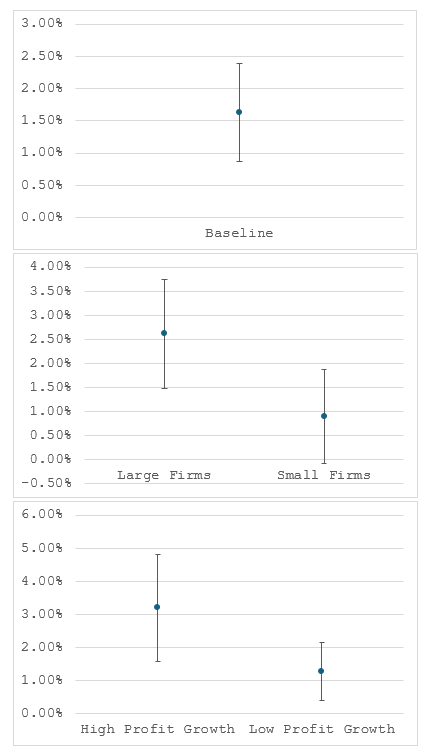

We then take into account firms' exposure to regulatory risks. First, the political cost hypothesis proposed by Watts and Zimmerman (1978) argues that larger and more profitable firms are more susceptible to regulatory scrutiny, which drives them to engage in greater earnings management. Consistent with this hypothesis, Figure 1 shows that firms with greater total assets and higher profitability growth exhibited more significant earnings management.

Figure 1. Polluting Firms’ Discretionary Accruals in 2012, Relative to Nonpolluting Firms

Notes: This figure presents the results of a difference-in-differences analysis comparing absolute discretionary accruals of polluting firms versus nonpolluting firms before and after the 2012 policy change. The reported estimates represent the coefficients from a regression of absolute discretionary accruals on a dummy variable that indicates both polluting firms and the post-policy period. Ninety-five percent confidence intervals are also shown. The regression includes firm-level control variables and year and province fixed-effects. The top graph shows the baseline result, while the bottom two graphs show the subsamples based on firms’ total assets and net profit growth.

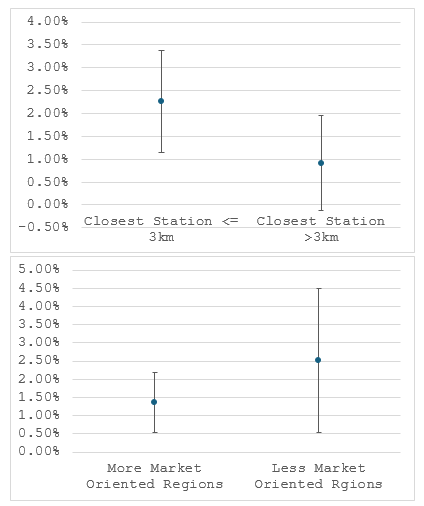

Moreover, we explore the geographical aspect of regulatory risk, revealing that firms located near monitoring stations are more likely to manage earnings. This aligns with findings from Yang et al. (2024), which show that areas close to automated monitors experience a 3.2% reduction in PM2.5 concentrations due to increased regulatory actions. As seen in Figure 2, polluting firms within a three-kilometer radius of monitoring stations demonstrated heightened earnings management behavior, indicating that proximity to monitoring increases the perceived risk of regulatory intervention.

Then we highlight the role of market orientation in influencing earnings management behavior. Firms situated in less market-oriented regions displayed a larger magnitude of earnings management, as local governments in these areas tend to have stronger interventionist policies. Taken together, the findings in Figures 1 and 2 suggest that firms perceiving themselves as prime targets for regulatory attention are more likely to manage earnings to avoid scrutiny.

Figure 2. Subsample Analysis Based on Firm Headquarters’ Locations

Notes: The reported estimates represent the coefficients from a regression of absolute discretionary accruals on a dummy variable that indicates both polluting firms and the post-policy period. Ninety-five percent confidence intervals are also shown. The regression includes firm-level control variables and year and province fixed-effects. The top graph shows the subsamples based on the distance from the closest monitoring station. The bottom graph shows the subsamples based on the province-level marketization index constructed by Fan et al. (2011).

Interestingly, we also find that strong customer-supplier relationships can mitigate earnings management. Polluting firms that relied heavily on major customers exhibited less significant changes in their earnings management practices post-policy implementation. This finding aligns with research by Kim and Luo (2022), which suggests that large customers can play a monitoring role, reducing the likelihood of earnings manipulation. Conversely, heightened market competition exacerbated the tendency for earnings management among polluting firms, indicating that competitive pressures could lead to increased unethical financial reporting practices.

Conclusion and Implications for ESG and Governance

Our work contributes to the ongoing discourse on ESG by illustrating the potential conflicts between environmental policies and corporate governance. While firms may strive to appear environmentally responsible, the pressures of regulatory scrutiny can incentivize them to engage in deceptive practices, undermining the very goals of environmental reforms. Our findings suggest that policymakers should consider these unintended consequences when designing and implementing environmental regulations. A nuanced approach to environmental governance is essential, balancing the demands of sustainability with ethical corporate practices to enhance overall welfare.

(Darwin Choi is at the Hong Kong University of Science and Technology. Feifei Lai is at the Chinese University of Hong Kong.)

References

Barwick, Panle Jia, Shanjun Li, Liguo Lin, and Eric Yongchen Zou. 2024. “From Fog to Smog: The Value of Pollution Information.” American Economic Review 114 (5): 1338–81. https://doi.org/10.1257/aer.20200956.

Chaney, Paul K., and Debra C. Jeter. 1992. “The Effect of Size on the Magnitude of Long-Window Earnings Response Coefficients.” Contemporary Accounting Research 8 (2), 540–60. https://doi.org/10.1111/j.1911-3846.1992.tb00860.x.

Choi, Darwin, and Feifei Lai. 2025. “E vs. G: Environmental Policy and Earnings Management in China.” Working paper. https://dx.doi.org/10.2139/ssrn.4995886.

Choi, Darwin, Abhiroop Mukherjee, and Zexin Zheng. 2024. “ESG News and Firm Value: Evidence from China’s Automation of Pollution Monitoring.” Working paper. https://drive.google.com/file/d/1w_6th4IohW4RGm2fVt25-_JJPaxrFS4p/view.

Dechow, Patricia M., Richard G. Sloan, and Amy P. Sweeney. 1995. “Detecting Earnings Management.” Accounting Review 70 (2): 193–225. https://www.jstor.org/stable/248303.

Fan, Gang, Xiaolu Wang, and Hengpeng Zhu. 2011. NERI Index of Marketization of China’s Provinces: The Report on the Relative Process of Marketization of Each Region in China. Economic Science Press.

Greenstone, Michael, Guojun He, Ruixue Jia, and Tong Liu. 2022. “Can Technology Solve the Principal-Agent Problem? Evidence from China’s War on Air Pollution.” American Economic Review: Insights 4 (1): 54–70. https://doi.org/10.1257/aeri.20200373.

Jones, Jennifer J. 1991. “Earnings Management during Import Relief Investigations.” Journal of Accounting Research 29 (2): 193–228. https://doi.org/10.2307/2491047.

Kim, Ryoonhee, and Weiqing Luo. 2021. “Customer Concentration and Earnings Management: Evidence from the Sarbanes-Oxley Act.” European Accounting Review 31 (4): 905–36. https://doi.org/10.1080/09638180.2020.1858915.

Kothari, S. P., Andrew J. Leone, and Charles E. Wasley. 2005. “Performance Matched Discretionary Accrual Measures.” Journal of Accounting and Economics 39 (1): 163–97. https://doi.org/10.1016/j.jacceco.2004.11.002.

Watts, Ross L., and Jerold L. Zimmerman. 1978. “Towards a Positive Theory of the Determination of Accounting Standards.” Accounting Review 53 (1): 112–34. https://www.jstor.org/stable/245729.

Yang, Lin, Yatang Lin, Jin Wang, and Fangyuan Peng. 2024. “Achieving Air Pollution Control Targets with Technology-Aided Monitoring: Better Enforcement or Localized Efforts?” American Economic Journal: Economic Policy 16 (4): 280–315. https://doi.org/10.1257/pol.20220810.

Zang, Amy Y. 2012. “Evidence on the Trade-Off between Real Activities Manipulation and Accrual-Based Earnings Management.” Accounting Review 87 (2): 675–703. https://www.jstor.org/stable/23245619.

Latest

Most Popular

- VoxChina Covid-19 Forum (Second Edition): China’s Post-Lockdown Economic Recovery VoxChina, Apr 18, 2020

- China’s Great Housing Boom Kaiji Chen, Yi Wen, Oct 11, 2017

- China’s Joint Venture Policy and the International Transfer of Technology Kun Jiang, Wolfgang Keller, Larry D. Qiu, William Ridley, Feb 06, 2019

- The Dark Side of the Chinese Fiscal Stimulus: Evidence from Local Government Debt Yi Huang, Marco Pagano, Ugo Panizza, Jun 28, 2017

- Wealth Redistribution in the Chinese Stock Market: the Role of Bubbles and Crashes Li An, Jiangze Bian, Dong Lou, Donghui Shi, Jul 01, 2020

- Evaluating Risk across Chinese Housing Markets Yongheng Deng, Joseph Gyourko, Jing Wu, Aug 02, 2017

- What Is Special about China’s Housing Boom? Edward L. Glaeser, Wei Huang, Yueran Ma, Andrei Shleifer, Jun 20, 2017

- Privatization and Productivity in China Yuyu Chen, Mitsuru Igami, Masayuki Sawada, Mo Xiao, Jan 31, 2018

- How did China Move Up the Global Value Chains? Hiau Looi Kee, Heiwai Tang, Aug 30, 2017

- China’s Shadow Banking Sector: Wealth Management Products and Issuing Banks Viral V. Acharya, Jun Qian, Zhishu Yang, Aug 09, 2017

Facebook

Facebook  Twitter

Twitter  Instagram

Instagram WeChat

WeChat  Email

Email