Bilateral Economies of Scope in International Trade

This paper presents evidence that firms’ export and import decisions within the same foreign market are complementary, due to bilateral economies of scope that allow substantial cost savings when engaging in both activities. By quantifying these savings through a structural model, we show that bilateral economies of scope significantly enhance firms’ participation in international trade and amplify the effects of trade liberalization, offering new insights for policymakers and researchers.

In the wake of the seminal work of Melitz (2003) economists have been convinced that international trade involves increasing returns to scale. Firms that engage in trade by either exporting or importing face substantial fixed costs that must be incurred before goods cross borders. The huge volume of research that seeks to measure the fixed cost of exporting and importing in the wake of the Melitz paper highlights how important an understanding of these costs is for policymakers and economists. In our recent paper (2024), we provide evidence that the size of fixed costs of exporting and importing to individual foreign countries cannot be inferred independently from one another. There exist what we call “bilateral economies of scope”: exporting fixed costs and importing fixed costs overlap substantially so that they need be incurred only once by an individual firm trading with a specific country. We identify and quantify the extent of these bilateral economies of scope and show that this source of interconnectedness in trading decisions has important implications for trade policy, especially considering China’s early trade liberalization.

Bilateral Economies of Scope: Concept and Evidence

The basic idea of bilateral economies of scope is simple. Consider a Chinese firm that is exporting to customers in Japan and simultaneously sourcing inputs from Japanese suppliers. This firm can share resources—such as legal expertise, logistics infrastructure, or local language skills—across both activities. These shared resources lower overall fixed costs and enable the firm to enter that market in both directions.

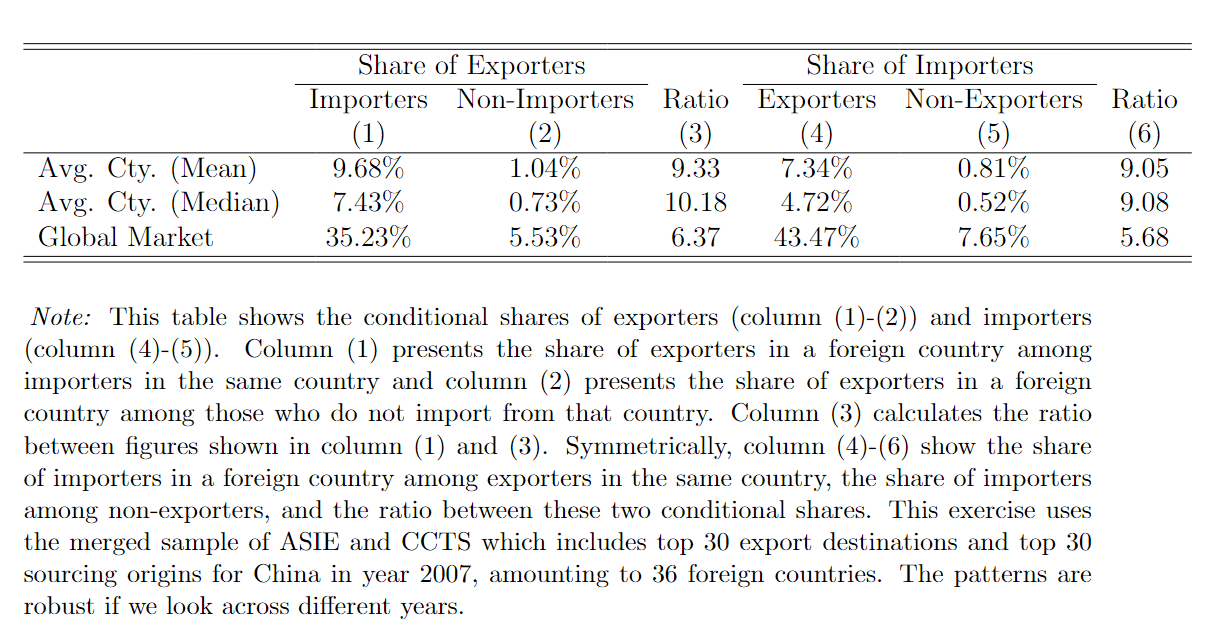

An implication of bilateral economies of scope is that firms that have been induced to export to a market will be significantly more likely to import from that market and vice versa. Using firm-level data on Chinese exporters and importers from 2000 to 2015, we document that the probability of a firm exporting to a market is an order of magnitude higher if it already imports from that market, and vice versa. Specifically, Table 1 shows that within a single foreign country, the share of exporters among importers is about 9.3 times higher than local non-importers (column 3), while the share of importers among exporters is about 9.1 times higher than local non-exporters (column 6). More importantly, for the entire global market, these ratios are significantly lower, highlighting the role of market-specific factors in driving the large conditional ratios for a specific foreign country. This finding is supported by an extensive set of descriptive and regression analysis using the micro-level data.

Table 1. Conditional Shares of Exporters and Importers

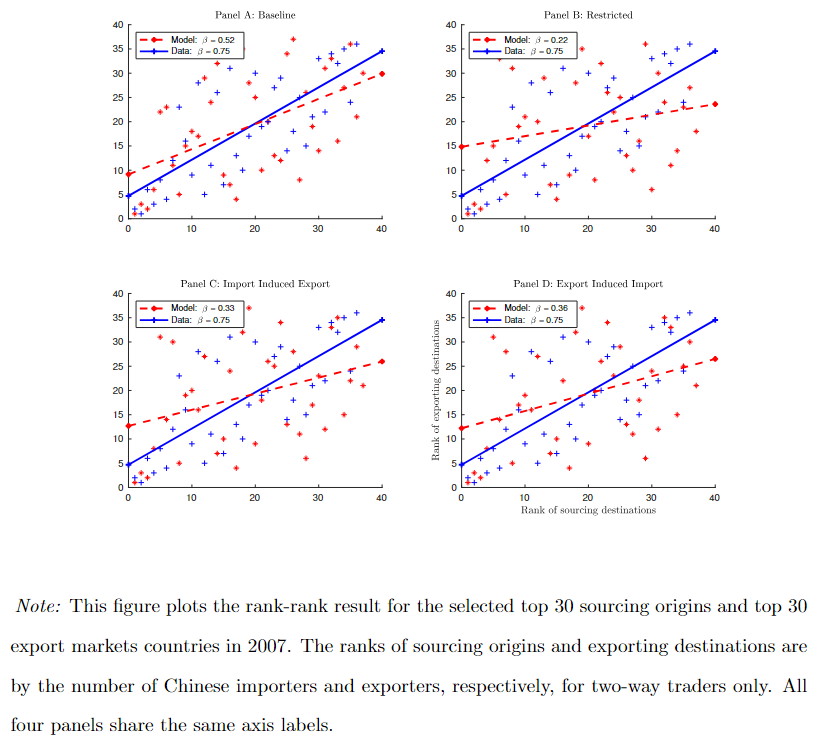

At the aggregate level, we also observe that the most popular destination markets for Chinese exporters are often the sourcing origins that attract more Chinese importers, leading to a positive correlation between a country’s export rank and its import rank from China’s perspective. This rank-rank correlation is also consistent with the idea of bilateral economies of scope.

Quantifying the Bilateral Economies of Scope: A Structural Model

To assess the size of these economies of scope, we developed a structural model extending the framework of Antràs, Fort, and Tintelnot (2017), which allows us to measure the fixed cost reductions achieved through simultaneous export and import within the same places. By estimating the model using method of simulated moments, we find that bilateral trade activities within the same country reduce export fixed costs by around 42% and import fixed costs by about 35%. Our estimates provide quantitative support for the notion that two sides of trade activities are complementary and highlight the magnitude of savings achievable when firms bundle their trade activities within the same locations. As shown in Figure 1, the cost-saving mechanism is crucial in fitting the rank-rank correlation observed in the data. A restricted model that lacks our mechanism but has been calibrated to the same data would predict a much lower rank-rank correlation.

Figure 1. Rank-Rank Correlation

Our model demonstrates that these cost savings significantly affect firms’ decisions to enter foreign markets. Firms that can reduce costs through bilateral economies of scope are more likely to participate in international trade and achieve greater competitive advantages, suggesting that interdependent trade strategies are not only beneficial, but also may be a strategic necessity in competitive markets.

Policy Implications: Amplified Effects of Trade Liberalization

The concept of bilateral economies of scope has important implications for trade policy, particularly in the context of China’s accession to the World Trade Organization. When China reduced import tariffs and foreign markets reciprocated by reducing tariffs on Chinese exports, firms experienced compounded benefits. Our analysis shows that China’s import liberalization promoted China’s export growth by lowering entry barriers, creating a reinforcing cycle that enhanced Chinese firms' global market participation.

This effect suggests that policymakers should consider the complementary nature of import and export activities when designing policies. Rather than treating import and export policies as separate domains, an integrated approach could yield broader and more significant economic benefits. For instance, policies that facilitate both import and export activities, such as those supporting logistics, compliance services, or local institutional partnerships, could significantly amplify the effects of changes in trade policy.

Contributions to the Trade Literature

Our study builds on and contributes to the literature on firm-level trade behavior and the costs associated with international market participation. While previous studies, such as Chaney (2008) and Morales, Sheu, and Zahler (2019), have examined export decisions, and Antràs, Fort, and Tintelnot (2017) have modeled import behavior, our paper provides a unified approach to understanding how these decisions interact within specific foreign markets. By quantifying the savings from bilateral economies of scope, our research emphasizes that trade policies should account for this underexplored aspect of trade behavior. Failing to account for bilateral economies of scope can lead to unanticipated consequences because import policy affects firms’ export decisions and vice versa.

In sum, our study highlights the importance of recognizing the interconnected nature of exporting and importing in today’s global economy. Bilateral economies of scope reduce trade costs, enhance firms' competitiveness, and amplify the benefits of trade liberalization policies. As international trade continues to expand, understanding these dynamics will be essential for crafting effective policies that support firms' entry and growth in global markets.

References

Antràs, Pol, Teresa C. Fort, and Felix Tintelnot. 2017. “The Margins of Global Sourcing: Theory and Evidence from US Firms.” American Economic Review 107 (9): 2514–64. https://doi.org/10.1257/aer.20141685.

Antràs, Pol, Teresa C. Fort, and Felix Tintelnot. 2017. “The Margins of Global Sourcing: Theory and Evidence from US Firms.” American Economic Review 107 (9): 2514–64. https://doi.org/10.1257/aer.20141685.

Chaney, Thomas. 2008. “Distorted Gravity: The Intensive and Extensive Margins of International Trade.” American Economic Review 98 (4): 1707–21. https://doi.org/10.1257/aer.98.4.1707.

Li, Yao Amber, Sichuang Xu, Stephen R. Yeaple, and Tengyu Zhao. 2024. “Bilateral Economies of Scope.” Review of Economics and Statistics 1–45, https://doi.org/10.1162/rest_a_01543.

Melitz, Marc J. 2003. “The Impact of Trade on Intra-Industry Reallocations and Aggregate Industry Productivity.” Econometrica 71 (6): 1695–1725. https://www.jstor.org/stable/1555536.

Morales, Eduardo, Gloria Sheu, and Andrés Zahler. 2019. “Extended Gravity.” Review of Economic Studies 86 (6): 2668–2712. https://doi.org/10.1093/restud/rdz007.

Latest

Most Popular

- VoxChina Covid-19 Forum (Second Edition): China’s Post-Lockdown Economic Recovery VoxChina, Apr 18, 2020

- China’s Great Housing Boom Kaiji Chen, Yi Wen, Oct 11, 2017

- China’s Joint Venture Policy and the International Transfer of Technology Kun Jiang, Wolfgang Keller, Larry D. Qiu, William Ridley, Feb 06, 2019

- The Dark Side of the Chinese Fiscal Stimulus: Evidence from Local Government Debt Yi Huang, Marco Pagano, Ugo Panizza, Jun 28, 2017

- Wealth Redistribution in the Chinese Stock Market: the Role of Bubbles and Crashes Li An, Jiangze Bian, Dong Lou, Donghui Shi, Jul 01, 2020

- Evaluating Risk across Chinese Housing Markets Yongheng Deng, Joseph Gyourko, Jing Wu, Aug 02, 2017

- What Is Special about China’s Housing Boom? Edward L. Glaeser, Wei Huang, Yueran Ma, Andrei Shleifer, Jun 20, 2017

- Privatization and Productivity in China Yuyu Chen, Mitsuru Igami, Masayuki Sawada, Mo Xiao, Jan 31, 2018

- How did China Move Up the Global Value Chains? Hiau Looi Kee, Heiwai Tang, Aug 30, 2017

- China’s Shadow Banking Sector: Wealth Management Products and Issuing Banks Viral V. Acharya, Jun Qian, Zhishu Yang, Aug 09, 2017

Facebook

Facebook  Twitter

Twitter  Instagram

Instagram WeChat

WeChat  Email

Email