Government as Venture Capitalists in AI

Venture capital plays an important role in funding and shaping technological progress and innovation outcomes around the world (see, among others, Kortum and Lerner 2000; Samila and Sorenson 2011; Puri and Zarutskie 2012; Bernstein, Giroud, and Townsend 2016; Nicholas 2019; and Akcigit et al. 2022). Venture capitalists are characterized by their deep knowledge of the technology, industry, and institutions, as well as their long-running relationships with the entrepreneurship and innovation community. In its pursuit of global leadership in innovation and frontier technology, such as the artificial intelligence sector, China has set up government venture capital funds at both the national and local government levels.

Government venture capital (VC) funds combine features of private VC and government innovation policies. Compared to more conventional government innovation policies and industrial policies more generally, government VC funds may leverage virtues of traditional VC. For example, government VC funds may possess expertise to improve the investment targeting of specific sectors and firms, aided by the funds’ long-term relationship with the firms. Such expertise may be reinforced by the aligned interests between firms and fund owners/managers, as the government acts as residual claimant of firms’ growth and revenue (though this alignment may become a vehicle for corruption as well). Moreover, government VC funds may create a virtuous cycle as funds’ positive performance could feed into government’s fiscal revenue and thus enhance the business environment in which firms operate (further stimulating firm performance, etc.).

Compared to private VC funds, government VC funds may have different objectives as they may weigh funds’ financial return against their ability to generate local economic spillovers, prioritize strategic objectives of the government, or undercut innovation output due to corruption opportunities. Government VC funds may also have different time horizons from their private counterparts, different information sets when choosing investment portfolios (e.g., explicit signals that could resolve policy uncertainty), and geographic dispersion (e.g., away from cities and major innovation and financial hubs where private VC funds tend to be concentrated).

In a recent paper (Beraja al. 2024), we provide descriptive facts about Chinese government VC funds and their role in financing the artificial intelligence (AI) sector. We enumerate the distinctions between government and private VC, and examine their interactions and differences empirically.

To do so, we collect comprehensive data on government VC funds and their investment portfolios. In particular, because government VC funds make a significant portion of their investments in other government and private VC funds (rather than investing directly in firms), we delve four layers deep into the equity investment tree until more than 90% of the investments can be traced to specific firms. We cover 1,863 government VC funds, 6,514 intermediate funds, 45,419 firms as investees. Together, these government VC funds invested in 912 billion USD in the decade leading up to the second quarter of 2023, with yearly investments comparable in magnitude with the annual spending on all industrial policies initiated by the United States during the same period, and nearly double the spending on EU industrial policies (see Hufbauer and Jung 2021 and Landesmann and Stöllinger 2020, respectively).

We focus on investments in 1.4 million firms identified as AI firms in China’s official firm registration records. These account for 24% of the total investment transactions and 23% of the total investment amount of the government VC funds. The AI sector makes up a similar share of the private VC funds investment portfolio as well: 22% of their total investment transactions, and 21% of the total investment amount.

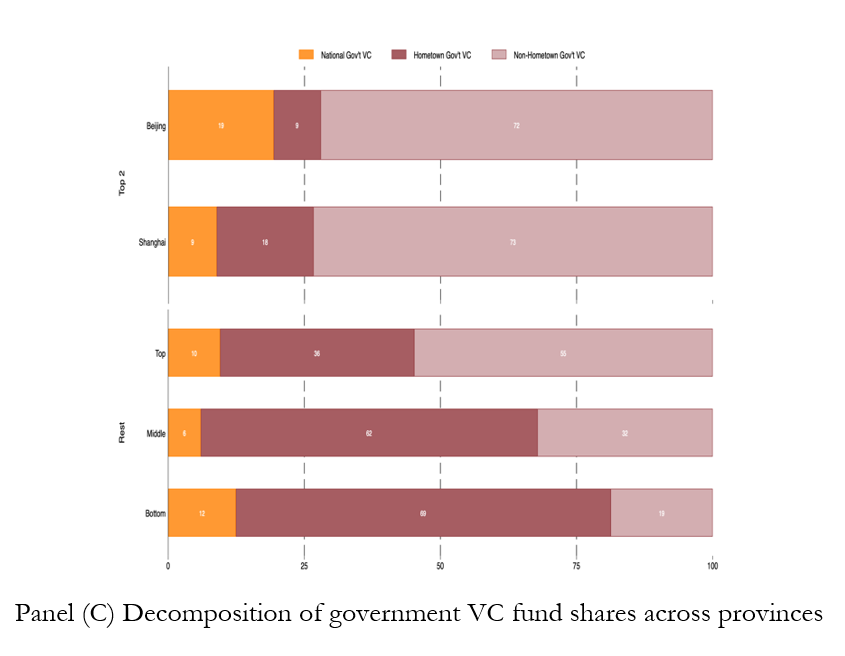

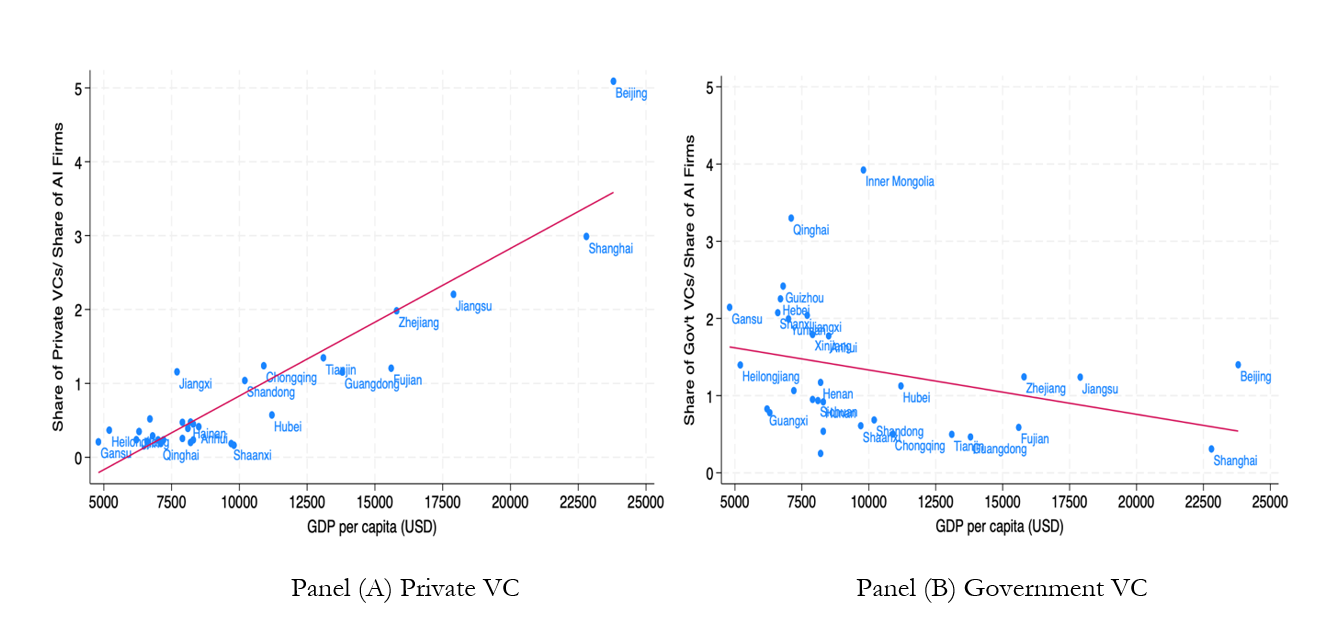

We begin by examining VC funds’ geographic dispersion. Government VC funds may help address a key market friction in China due to spatial mobility constraints that potentially undermine private VC activities. China’s mobility restriction entails that not all entrepreneurs can move to high-tech centers where private VC funds are clustered, making it less likely for private VC funds to identify high potential firms in China’s periphery. In this regard, more spatially dispersed government VC funds substitute for private VC funds in those regions. Indeed, we find that while private VC funds are headquartered primarily in China’s coastal regions, which are disproportionally more developed, government VC funds represent a more even geographic spread where inland, less developed regions also have sizable investment activity. Importantly, as we compare the geographic distribution of funds with the distribution of AI firms across the country, as shown in Panel (A) of Figure 1, we find that private VC funds are overrepresented, relative to the presence of AI firms, in regions with high GDP per capita, and underrepresented, relative to the share of AI firms, in regions with low GDP per capita. The reverse is true for government VC funds: they are overrepresented, relative to the share of AI firms, in low GDP per capita regions. Consistent with government VC funds acting in place of “missing” private VC funds in less developed regions (where matching frictions may be greatest), we observe that “hometown” government VC funds play a greater role in AI investment in less developed regions, as shown in Panel (C) of Figure 1.

Figure 1. Geographic distribution of VC funds relative to AI firms

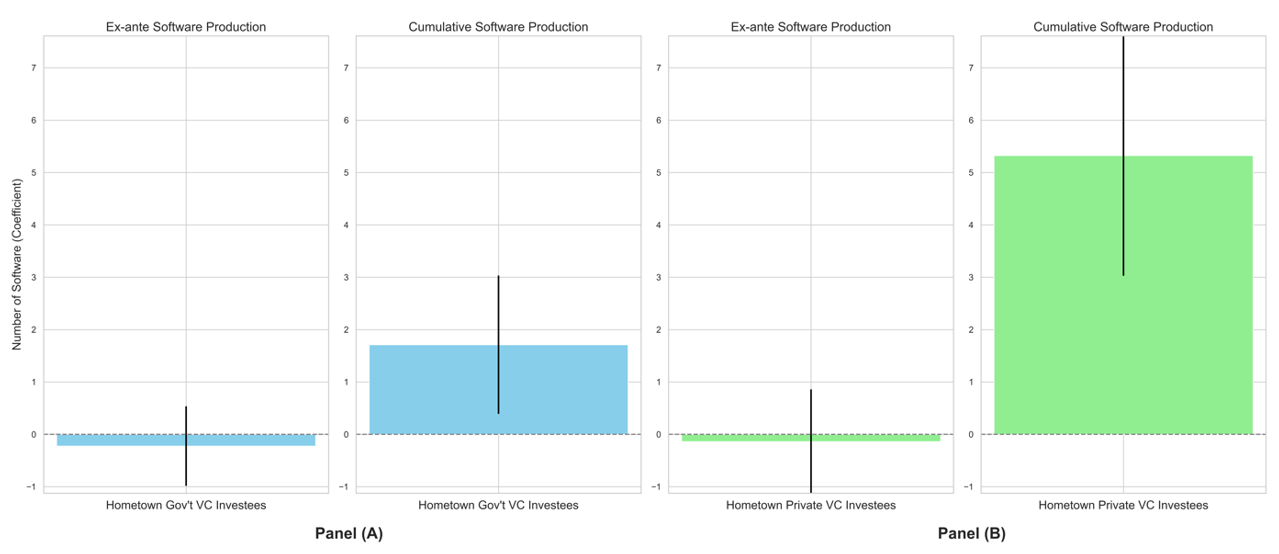

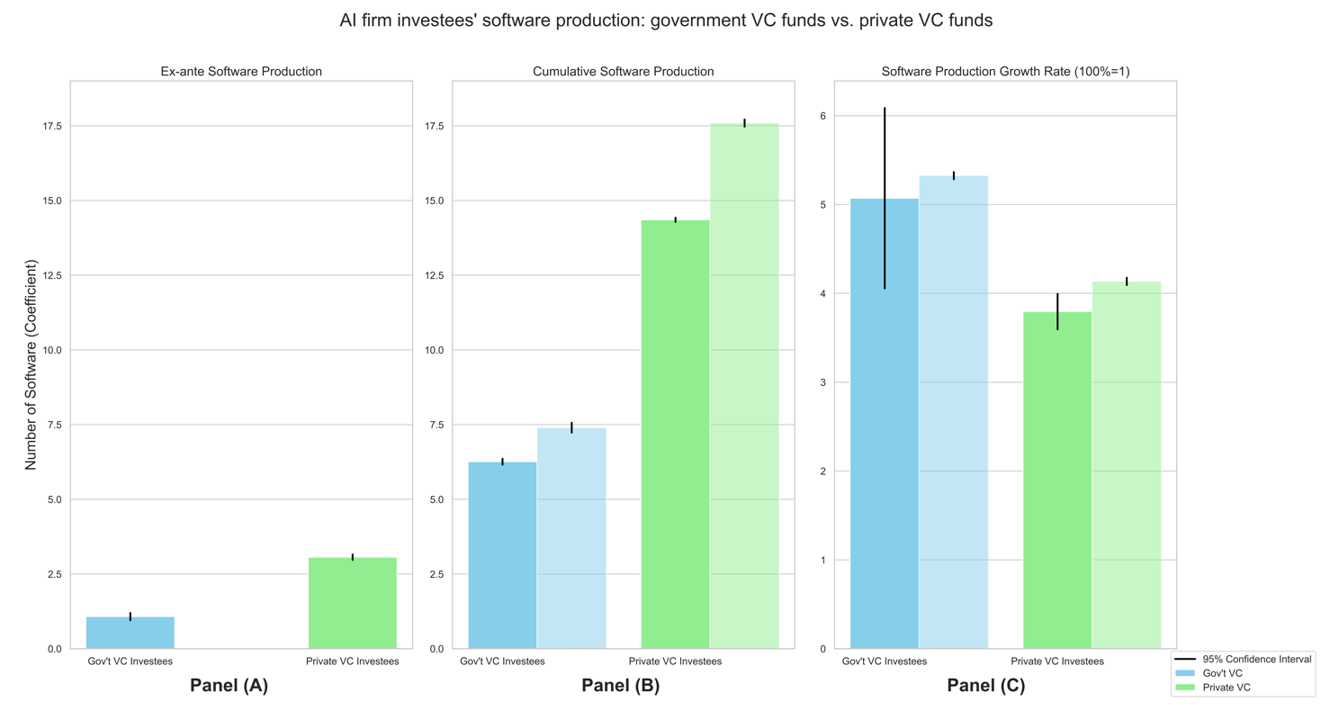

Next, we investigate the portfolio composition of government and private VC funds. At the sector level, we find that government and private VC funds’ investment portfolio composition exhibit a high degree of similarity: among the top five sectors (at HS-2 digit level) that receive investment, four are identical across government and private VC funds. Moving to investees in the AI sector, we find that government VC funds are more likely to invest in firms with weaker ex-ante productivity signals (measured as the number of major AI software products prior to investment) than their private counterparts, as shown in Figure 2. However, AI firms invested in by government VC funds significantly outperform AI firms not receiving such investments (even accounting for ex-ante differences) and even exhibit higher software production growth rates than AI firms receiving funds from private VC funds.

Figure 2. Investment in AI firms: government VC funds vs. private VC funds

Notes: This figure plots the coefficients comparing software production between AI firms that received different types of VC investments (e.g., government VC or private VC) and those that received no VC investment. In Panel (A), we compare the ex-ante software production of AI firms receiving different types of VC investment with firms that received no VC investment. For firms with investments, the ex-ante software production is measured before receiving their first investment. For firms with no investment (the omitted baseline group), the ex-ante software production is measured from the third year after the firm’s establishment, as firms with investments typically receive their first investment in the third year. In Panels (B) and (C), we focus on cumulative software production and growth rate; these are cross-sectional comparisons by aggregating the software production up to the end of our study period in 2023. For bars in darker blue and green, we plot the coefficients where we control for firm age and ex-ante software production. For all regressions, we control for entry year fixed effects and location fixed effects. Standard errors are clustered at the province level.

We next examine whether VC funds possess an advantage in choosing high performing AI firms located in the region of the funds’ headquarters, separately examining government and private VC funds. As shown in Figure 3, we find little difference in the ex-ante software production of firms receiving funds from a “hometown” VC compared to an “out-of-town” VC, and this is true for both government and private VC funds. Yet, we find that firms receiving investments from hometown VC funds (whether government or private) produce significantly more software by 2023 than firms receiving investments from out-of-town funds. This suggests an ability for hometown funds to select high potential investment opportunities among local firms.

Figure 3. Hometown advantage in choosing high-performing AI firms based on unobservables

Notes: This figure plots the coefficients comparing ex-ante and ex-post software production between AI firms that received hometown government VC investment (or hometown private VC investment) and those that received out-of-town government VC investment (or out-of-town private VC investment). In Panel (A), we compare the software production of AI firms that received hometown government VC investment to those that received out-of-town government VC investment. In Panel (B), we compare the software production of AI firms that received hometown private VC investment to those that received out-of-town private VC investment. For cumulative software production comparisons, we control for firm age and ex-ante software production. All regressions control for firms' entry year fixed effects and firm location fixed effects. Standard errors are clustered at the provincial level.

Finally, we study how government and private VC funds interact in making investment choices. We focus on the substantial share of AI firms (4,115 out of 9,623) that receive investment from both government and private VC funds. The presence of frictions due to policy uncertainty in China may undermine private VC funds’ activities: these frictions make the growth of sectors and firms highly dependent on the government policy environment and its evolution, which may be uncertain and opaque to private VC funds. In this regard, government VC funds’ investments could carry information to private VC funds, crowding in their investments.

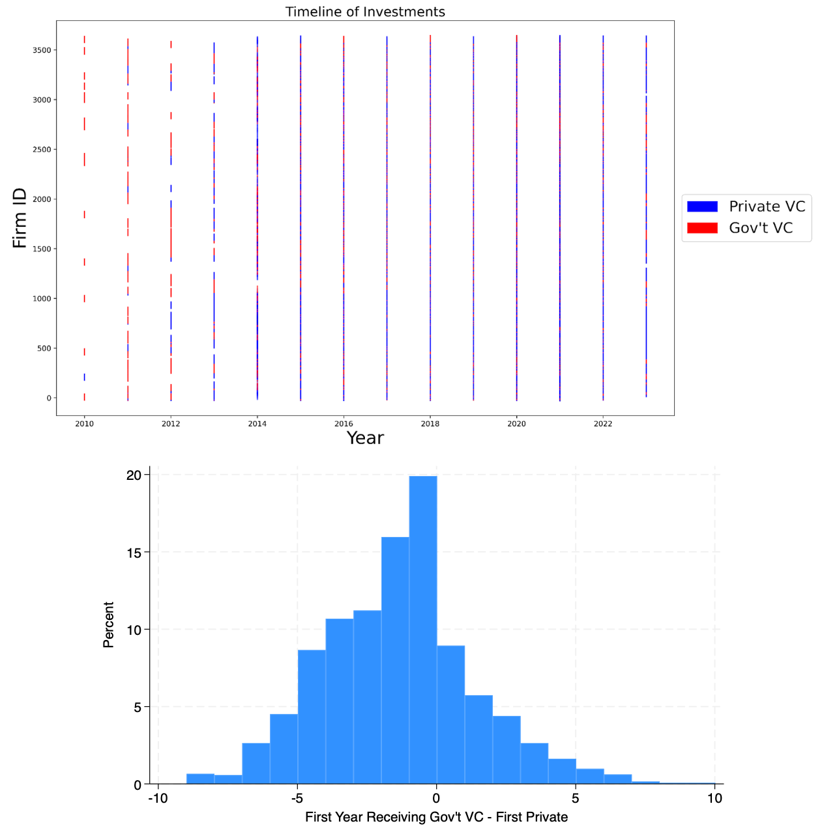

Figure 4. Government vs. private VC: who is leading whom in AI investment?

Notes: Panel (A) demonstrates the investment timeline by VC type (e.g., government vs. private) for 3,600 AI firms established after 2010 and receiving investments from both government and private VC. Each horizontal line represents an AI firm investee; red dots indicate investments from government VC, while blue dots indicate private VC investment. Panel (B) plots the distribution of the timing difference between the firms’ first government investment and private investment.

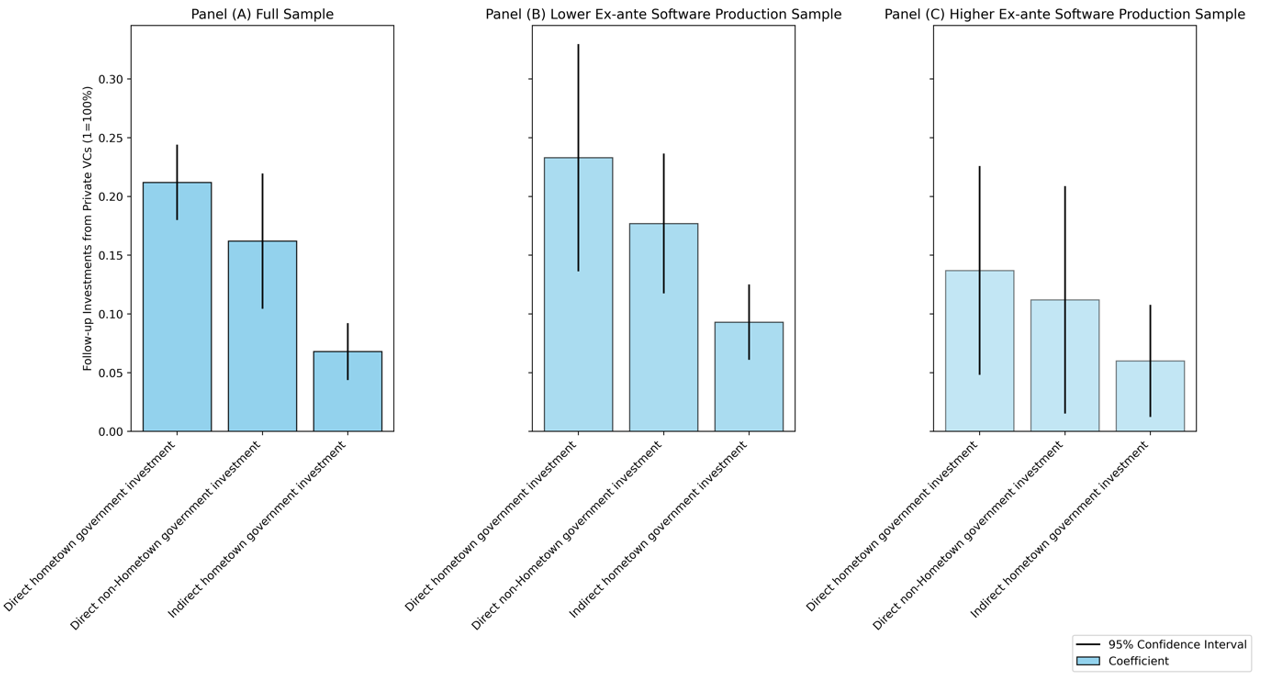

To examine the relationship between government and private VC investments, we first consider the order in which funds invest in the same firm. An indication that government VC funds’ choices are valued by the private market is that, in the vast majority of cases in which both government and private VC funds invest in the same firm, private VC investments follow government VC investments (rather than vice versa), as shown in Figure 4. We then investigate which government VC funds’ investment decisions prompt more private VC follow-up investments. As shown in Figure 5, we find that government VC funds’ direct investment in specific firms are much more likely to induce subsequent private VC investments in those firms, as compared to government funds’ indirect investments through other funds. This suggests that it is not government money per se that private VC funds interpret as a valuable signal, but rather the explicit government choices of specific firms. Among direct investment choices, those made by hometown government are associated with slightly greater likelihood of prompting subsequent private VC investments, as compared to those made by out-of-town government funds. Finally, direct government investments—either by hometown or out-of-town funds—are differentially more likely to be followed by private investments among firms with weaker ex-ante signals of productivity (i.e., less pre-investment software production). Our findings suggest that government investment induces private VC sector investment by identifying promising local firms that are better matched with the policy environment, especially when alternative signals are lacking.

Figure 5. Which government VC funds' investment decisions prompt more private VC follow-up investments?

This figure examines which types of government VC funds’ investment decisions prompt more follow-up investments from private VC firms, focusing on AI firms that have received at least one government VC investment. In Panel (A), we analyze all AI firms with at least one government VC investment, comparing the effect on follow-up investments from private VC funds across four types of government VC funds’ investment decisions: (a) direct investment from hometown government VC funds; (b) direct investment from out-of-town government VC funds; (c) indirect investment from hometown government VC funds; and (d) indirect investment from out-of-town government VC funds (omitted group). In Panels (B) and (C), we focus on subsamples of AI firms with lower (below mean) ex-ante software production and higher (above mean) ex-ante software production, respectively. The firms’ ex-ante software production is measured before receiving their first investment. All regressions control for firms’ entry year fixed effects and location fixed effects. Standard errors are clustered at the province level.

Taken together, we find that on one hand, China’s government VC funds act like private VC funds, investing in high potential firms and resolving information uncertainty in early stages of sectoral and firm development. On the other hand, government VC funds are also distinct from their private counterparts: as such, their acts to invest convey distinct information from that which is otherwise available, and these important signals affect other market actors. Government VC funds may turn out to be a new and effective vehicle to carry innovation policies. In an environment such as China where there exist frictions and a role for government to extract informational rents, government VC funds can shape (or indeed, “guide”) private market investment activities and even address some of the informational asymmetries between the public and private actors.

Our findings suggest that government VC funds may enhance the efficiency of capital allocation and contribute positively to the combination of government innovation policies and market incentives. However, caution is needed when drawing general policy lessons from this research. First, many economies may not exhibit the market and political economy frictions that China embodies, thus limiting the extent to which government VC could contribute to the innovation investment landscape. Second, even in China, more evidence is needed to determine whether the innovation return of government VC funds justifies the investments, and exceeds that from other government industrial and innovation policies. Finally, the details of institutional design matter: as government VC funds grant a high degree of discretion to officials and bureaucrats, there exists a risk of corruption and political capture that must be mitigated with complementary institutions to ensure the effectiveness of government VC funds as an investment and policy vehicle.

References

Akcigit, Ufuk, Emin Dinlersoz, Jeremy Greenwood, and Veronika Penciakova. 2022. “Synergizing Ventures.” Journal of Economic Dynamics and Control 143: 104427. https://doi.org/10.1016/j.jedc.2022.104427.

Beraja, Martin, Wenwei Peng, David Y. Yang, and Noam Yuchtman. 2024. “Government as Venture Capitalists in AI.” National Bureau of Economic Research Working Paper No. 32701. https://doi.org/10.3386/w32701.

Bernstein, Shai, Xavier Giroud, and Richard R. Townsend. 2016. “The Impact of Venture Capital Monitoring.” Journal of Finance 71 (4): 1591–1622. https://doi.org/10.1111/jofi.12370.

Hufbauer, Gary Clyde, and Euijin Jung. 2021. “Scoring 50 Years of US Industrial Policy, 1970–2020.” Peterson Institute for International Economics. https://www.piie.com/publications/piie-briefings/2021/scoring-50-years-us-industrial-policy-1970-2020.

Kortum, Samuel, and Josh Lerner. 2000. “Assessing the Impact of Venture Capital to Innovation.” Rand Journal of Economics 31 (4): 674–92. https://www.hbs.edu/faculty/Pages/item.aspx?num=5857#:~:text=We%20find%20that%20increases%20in,industrial%20innovations%20in%20that%20period.

Landesmann, Michael, and Roman Stöllinger. 2020. “The European Union’s Industrial Policy: What Are the Main Challenges?” Vienna Institute for International Economic Studies. https://hdl.handle.net/10419/224164.

Nicholas, Tom. 2019. VC: An American History. Cambridge: Harvard University Press.

Puri, Manju, and Rebecca Zarutskie. 2012. “On the Life Cycle Dynamics of Venture-Capital- and Non-Venture-Capital-Financed Firms.” Journal of Finance 67 (6): 2247–93. https://doi.org/10.1111/j.1540-6261.2012.01786.x.

Samila, Sampsa, and Olav Sorenson. 2011. “Venture Capital, Entrepreneurship, and Economic Growth.” Review of Economics and Statistics 93 (1): 338–49. https://doi.org/10.1162/REST_a_00066.

Latest

Most Popular

- VoxChina Covid-19 Forum (Second Edition): China’s Post-Lockdown Economic Recovery VoxChina, Apr 18, 2020

- China’s Great Housing Boom Kaiji Chen, Yi Wen, Oct 11, 2017

- China’s Joint Venture Policy and the International Transfer of Technology Kun Jiang, Wolfgang Keller, Larry D. Qiu, William Ridley, Feb 06, 2019

- The Dark Side of the Chinese Fiscal Stimulus: Evidence from Local Government Debt Yi Huang, Marco Pagano, Ugo Panizza, Jun 28, 2017

- Wealth Redistribution in the Chinese Stock Market: the Role of Bubbles and Crashes Li An, Jiangze Bian, Dong Lou, Donghui Shi, Jul 01, 2020

- Evaluating Risk across Chinese Housing Markets Yongheng Deng, Joseph Gyourko, Jing Wu, Aug 02, 2017

- What Is Special about China’s Housing Boom? Edward L. Glaeser, Wei Huang, Yueran Ma, Andrei Shleifer, Jun 20, 2017

- Privatization and Productivity in China Yuyu Chen, Mitsuru Igami, Masayuki Sawada, Mo Xiao, Jan 31, 2018

- How did China Move Up the Global Value Chains? Hiau Looi Kee, Heiwai Tang, Aug 30, 2017

- China’s Shadow Banking Sector: Wealth Management Products and Issuing Banks Viral V. Acharya, Jun Qian, Zhishu Yang, Aug 09, 2017

Facebook

Facebook  Twitter

Twitter  Instagram

Instagram WeChat

WeChat  Email

Email