Rural Road Stimulus and the Role of Matching Mandates on Economic Recovery in China

This paper examines the impact of a rural road stimulus program in China, focusing on the suspension of local matching mandates. The findings show that the temporary cost share exemption boosts short-term income growth, increases local investment in infrastructure, and promotes entrepreneurial activities, particularly among returning migrants.

In response to the global financial crisis (GFC), governments worldwide implemented large-scale fiscal stimulus packages aimed at reviving their economies. In China, one such intervention was the 2009–2010 Economic Stimulus Package (ESP), which included substantial investments in rural road infrastructure. A unique aspect of this package was the temporary suspension of local matching mandates, a policy usually requiring local governments to fund a portion of infrastructure projects. This paper investigates the economic implications of this policy shift, particularly its effect on income growth and local investment in rural China.

According to early public finance theories, the main rationale for matching mandates is to discourage crowding-out of local spending, prevent wasteful spending on nonviable projects, and curb abuse of the transfer process. Concerns related to the ESP indicate that suspending matching requirements crowded out local spending and increased rent-seeking opportunities, delaying economic recovery (Cong et al. 2019). On the other hand, limited fiscal capacity and other investment barriers play a key role in explaining why developing countries face grossly undeveloped transportation networks (Thacker et al. 2019; Fay, Martimort, and Straub 2021).

In China, local governments are typically required to cover 25–35% of the costs of infrastructure projects to receive central funding. This matching requirement is intended to ensure local commitment and prevent misuse of funds. However, with the onset of the GFC, the Chinese government temporarily relaxed this requirement, allowing projects to be fully funded by the central level of government. Howell (2024) employs a staggered difference-in-differences approach, combined with inverse propensity score matching, to compare villages exempt from matching mandates with those that were not. Using data from over 700 villages and 7,000 households involved in road upgrade projects during the ESP rollout, the study isolates the policy’s impact on local incomes, village spending, and household-level labor reallocation.

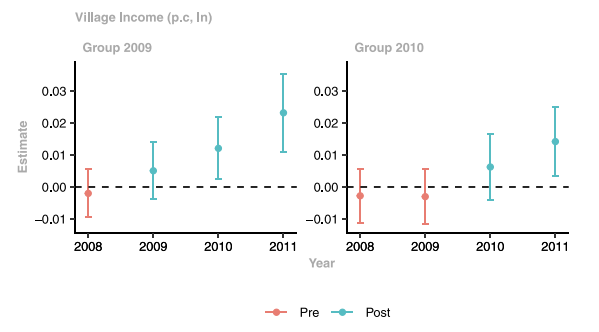

The main results show villages that benefited from the cost share exemption experienced a 1.2% higher increase in average income compared to their counterparts that were still subject to matching requirements. The size of the effects gradually increases over the three-year time period following the suspension of matching mandates (Figure 1).

Figure 1: Effect of a Cost Share Road Exemption on Rural Income. This figure reports DR-ATT(g,t) treatment effects for each group-time comparison on village per capita income, in logarithm. Red lines give point estimates and uniform 95 percent confidence bands for pre-treatment periods. Under the null hypothesis of the parallel trends assumption holding in all periods, these should be equal to 0. Blue lines show point estimates and uniform 95 percent confidence bands for the group-time treatment effect of a new cost share-exempt road upgrade allowing for clustering at the village level.

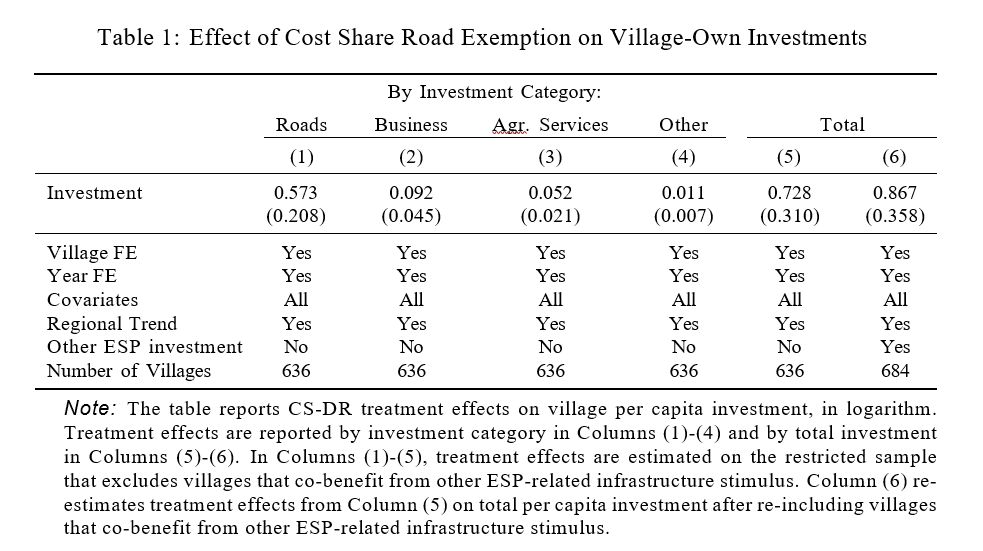

The observed positive income effect is primarily attributed to the crowding-in of local investment, where freed-up local funds are redirected toward allied infrastructure improvements, rural enterprise development, and agricultural services (Table 1). Results from a heterogeneity analysis indicate that the benefits of the policy were not evenly distributed, however. Observed income gains were more pronounced in villages with higher initial fiscal capacity and better market access, but were otherwise statistically indistinguishable from a typical control village.

The analysis further reveals that the cost share exemption facilitated a significant reallocation of labor within these villages. Households in treated villages were more likely to transit from agricultural work to nonfarm wage labor or self-employment. Additionally, there was a notable increase in the return of urban migrants to rural areas, where they engaged in entrepreneurial activities. These shifts suggest that the policy not only stimulated economic activity in the short-term, but also promoted structural transformation and longer-term effects on local labor market dynamics.

In summary, the main results show that the suspension of cost share mandates facilitated short-term income growth and stimulated local investment, underscoring the potential of targeted fiscal interventions to boost local economies during economic crises. These findings have broader implications for fiscal policy design in developing countries, where limited local fiscal capacity often constrains infrastructure development. As policymakers consider similar interventions in future crises, the study emphasizes balancing fiscal discipline with the flexibility needed to address local economic constraints, ensuring that infrastructure spending promotes recovery and equitable growth.

References

Cong, Lin William, Haoyu Gao, Jacopo Ponticelli, and Xiaoguang Yang. 2019. “Credit Allocation Under Economic Stimulus: Evidence from China.” Review of Financial Studies 32 (9): 3412–60. https://doi.org/10.1093/rfs/hhz008.

Fay, Marianne, David Martimort, and Stéphane Straub. 2021. “Funding and Financing Infrastructure: The Joint-Use of Public and Private Finance.” Journal of Development Economics 150: 102629. https://doi.org/10.1016/j.jdeveco.2021.102629.

Howell, Anthony. 2024. “Rural Road Stimulus and the Role of Matching Mandates on Economic Recovery in China.” Journal of Development Economics 166: 103211. https://doi.org/10.1016/j.jdeveco.2023.103211.

Thacker, Scott, Daniel Adshead, Marianne Fay, Stéphane Hallegatte, Mark Harvey, Hendrik Meller, Nicholas O’Regan, Julie Rozenberg, Graham Watkins, and Jim W Hall. 2019. “Infrastructure for Sustainable Development.” Nature Sustainability 2 (4): 324–31. https://doi.org/10.1038/s41893-019-0256-8.

Latest

Most Popular

- VoxChina Covid-19 Forum (Second Edition): China’s Post-Lockdown Economic Recovery VoxChina, Apr 18, 2020

- China’s Great Housing Boom Kaiji Chen, Yi Wen, Oct 11, 2017

- China’s Joint Venture Policy and the International Transfer of Technology Kun Jiang, Wolfgang Keller, Larry D. Qiu, William Ridley, Feb 06, 2019

- The Dark Side of the Chinese Fiscal Stimulus: Evidence from Local Government Debt Yi Huang, Marco Pagano, Ugo Panizza, Jun 28, 2017

- Wealth Redistribution in the Chinese Stock Market: the Role of Bubbles and Crashes Li An, Jiangze Bian, Dong Lou, Donghui Shi, Jul 01, 2020

- What Is Special about China’s Housing Boom? Edward L. Glaeser, Wei Huang, Yueran Ma, Andrei Shleifer, Jun 20, 2017

- Evaluating Risk across Chinese Housing Markets Yongheng Deng, Joseph Gyourko, Jing Wu, Aug 02, 2017

- Privatization and Productivity in China Yuyu Chen, Mitsuru Igami, Masayuki Sawada, Mo Xiao, Jan 31, 2018

- How did China Move Up the Global Value Chains? Hiau Looi Kee, Heiwai Tang, Aug 30, 2017

- China’s Shadow Banking Sector: Wealth Management Products and Issuing Banks Viral V. Acharya, Jun Qian, Zhishu Yang, Aug 09, 2017

Facebook

Facebook  Twitter

Twitter  Instagram

Instagram WeChat

WeChat  Email

Email