Financial Reporting and Disclosure Practices in China

This paper studies financial reporting and disclosure practices in China using survey methods similar to prior studies of US firms. Comparing earnings features, motives to manage and smooth earnings, and voluntary disclosure practices between the two countries, we reveal several differences. We explain and reconcile these differences as resulting from some unique institutional features of China. Our study provides novel field evidence that contributes to, expands, and directly corroborates existing empirical studies.

China’s ascent as a global economic powerhouse has drawn increasing attention to its capital market practices. Despite efforts to align its financial markets with Western shareholder-driven practices, institutional differences, grounded in cultural norms and socioeconomic structures, continue to exert a substantial influence on the Chinese capital market. For instance, it has been shown that connections among many non-arm’s length stakeholders contribute to the functioning of capital markets in China (e.g., Ball, Robin, and Wu 2000; Wong 2020). This survey-based study delves into the intricacies of these variations, shedding light on how institutional factors shape financial reporting and disclosure practices in China.

We survey board secretaries, who are mainly responsible for financial disclosure-related practices, of public companies in China. While prior research has largely relied on archival studies to infer the determinant factors of public companies’ financial reporting and disclosure practices in China, our field-based survey approach provides an opportunity to understand the decision process behind these practices directly. While a series of surveys of CFOs at US public firms have allowed academics to validate and reconcile findings on financial reporting and disclosure practices in the accounting and finance literature (e.g., Graham and Harvey 2001; Graham, Harvey, and Rajgopal 2005; Dichev et al. 2013), those survey findings primarily reflect the financial reporting incentives of arm’s length shareholders. Our paper offers direct evidence of how information demand is shaped by various stakeholders who are non-arm’s length (i.e., stakeholders related to the firm, such as lenders, customers, and suppliers) and provides insights into coordination efforts and private communication channels among stakeholders, which were previously unobservable.

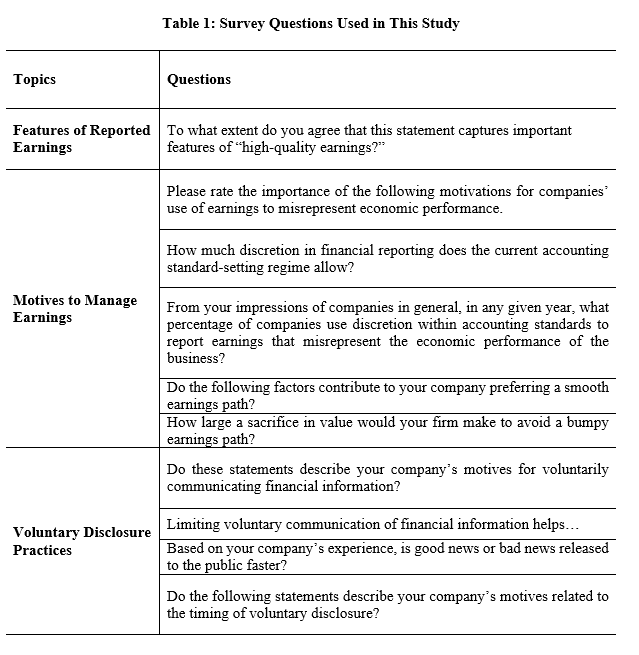

To distribute the survey, we worked with New Fortune Magazine, which created a web-based survey link exclusively open to eligible board secretaries considered for the “Golden Board Secretary” annual ranking. The weblink containing our survey questions was sent to 2,094 board secretaries of public companies, with 207 valid responses (a follow-up survey with 595 responses shows our results are robust and is reported in an online appendix). To highlight the differences between our survey findings and those based on US firms, we adopt survey questions in Graham, Harvey, and Rajgopal (2005) and Dichev et al. (2013), which are based on a review of voluntary disclosure, earnings management, and earnings quality literature. We organize our survey questions into three categories: (1) features of reported earnings, (2) motives to manage and smooth earnings, and (3) voluntary disclosure practices. Table 1 provides a summary of questions used in our survey.

This research findings unveil three notable discrepancies between China and the US in terms of financial reporting and disclosure practices. Firstly, Chinese firms prioritize signaling stable firm performance in their reported earnings figures, aligning with the stakeholder-driven governance model prevalent in China. Chinese firms consider the needs of various stakeholders other than arm’s length investors, such as the government, employees, suppliers, and customers.

In contrast, US firms, under the shareholder-driven governance model, emphasize attributes like justifiability and verifiability, allowing investors to use justifiable and verifiable financial information to make investment decisions. When asked how executives in China perceive the desirability of different earnings characteristics, the preference for predictive and smooth earnings attributes in China reflects a substantial demand for stable firm performance, which signals stability to a diverse set of stakeholders, e.g., job security for employees, continued business opportunities for suppliers, better reputation among its customers, and stability of tax revenue sources for the government. Maintaining firm stability also facilitates the maintenance of long-term contractual relationships with important stakeholders and signaling of firms’ strong capability to coordinate among stakeholders to maintain stable firm performance (Ball et al., 2003).

Secondly, the study reveals that motives and channels for earnings management and smoothing in China differ significantly from international empirical studies, indicating a unique influence of non-arm’s length stakeholders. Unlike in the shareholder-driven economy of the US, where firms’ disclosure practices primarily cater to investor demands, Chinese firms target a broader audience with their financial reporting. Smooth earnings not only satisfy investors, but also signal stability to all stakeholders, which can be achieved through coordination among key players, such as the government, banks, customers, and suppliers. Consequently, Chinese firms find engaging in earnings management using discretion within accounting standards less appealing. This finding does not contradict prior literature that earnings distribution is truncated at zero in China due to requirements to maintain public status (Chen and Yuan 2004; Liu and Lu 2007). Our results do not preclude the possibility that Chinese firms engage in real earnings management or other forms of earnings management that are beyond accounting standards (e.g., related party transactions). The possibility of other legitimate ways to misrepresent economic performance is especially high in China due to the reliance on non-arm’s length transactions and connected stakeholders. That is, Chinese companies may engage in real earnings management behaviors through their long-term stakeholders. In addition, private communication channels among powerful stakeholders further diminish the effectiveness of earnings management within accounting standards.

Thirdly, Chinese firms consider public voluntary disclosure to be less relevant in the reduction of cost of capital when asked for motivations for voluntary financial information disclosure. Different from their US counterparts, less than 17% of Chinese firms agree that voluntary disclosure of financial information will reduce the cost of capital (relative to 39.3% in the US). With access to private communication channels, such as in-person meetings, discussions in non-public settings with major stakeholders (i.e., government and banks), Chinese firms rely less on public disclosures to reduce the cost of capital. Twenty-seven percent of firms in a follow-up survey acknowledge that they rely on informal channels when communicating with key stakeholders about financial and other important information. Additionally, a significant portion of Chinese firms are more willing to disclose good news faster than bad news, diverging from the conservative disclosure policies often adopted in the US. The lower demand for conservative accounting practices aligns with the low litigation risk and weak legal system in China and the prevalence of private communication channels, which diminish firms’ incentives to publicly disclose accounting information in a timely manner.

The survey instrument employed in this research closely mirrors those used in US studies, facilitating a comparative analysis between the two different markets. We also use open-ended questionnaires, on-site field visits, and interviews ranging from 2017 to 2020, allowing us to unravel the institutional factors that prompt the three main discrepancies between survey results in China and the US documented above. These institutional factors relate to the network of connected stakeholders, the dominance of retail investors, and concentrated ownership structures. They also relate to weak legal systems in China, which prevent public information disclosures from playing an effective role in the mitigation of shareholder agency conflicts as in the US.

Our study offers three significant contributions to the understanding of financial reporting practices in China. Firstly, by opening the “black box” of Chinese firms’ financial reporting practices, we provide novel field evidence of these practices and offer direct insights into practitioners’ motives and how they are influenced by institutional factors. This fills a gap left by prior research, which has mainly relied on indirect explanations based on observable institutional factors. Secondly, we corroborate existing empirical research on timely loss recognition in the Chinese market and highlight the importance of smooth earnings paths, which signal firms’ ability to maintain sustainable earnings through strong stakeholder networks. Additionally, our study distinguishes between earnings management within accounting standards and earnings smoothness, providing valuable insights into Chinese executives’ perceptions. Lastly, our study makes an important theoretical contribution by reconciling the differences in financial reporting and disclosures within an overarching framework of connected stakeholders. This reconciliation not only complements existing archival findings, but also lays the groundwork for future research on financial reporting and disclosure in China.

In conclusion, this research sheds light on the intricacies of financial reporting in China, emphasizing how institutional factors, especially the role of non-arm’s length stakeholders, significantly shape practices. These findings offer valuable insights for academics, practitioners, and policymakers seeking to navigate the complex dynamics of China’s evolving capital market. Understanding the nuances in financial reporting and disclosure practices is crucial for stakeholders aiming to engage effectively in the Chinese economic landscap

Reference

Ball, Ray, Ashok Robin, and Joanna Shuang Wu. 2000. “Accounting Standards, the Institutional Environment, and Issuer Incentives: Effect on Timely Loss Recognition in China.” Asia-Pacific Journal of Accounting and Economics 7 (2): 71–96. https://doi.org/10.1080/16081625.2000.10510579.

Ball, Ray, Ashok Robin, and Joanna Shuang Wu. 2003. Incentives versus standards: properties of accounting income in four East Asian countries. Journal of Accounting and Economics 36 (1-3), 235-270. https://doi.org/10.1016/j.jacceco.2003.10.003.

Chen, Hanwen, Jeff Zeyun Chen, Gerald J. Lobo, and Yanyan Wang. 2011. “Effects of Audit Quality on Earnings Management and Cost of Equity Capital: Evidence from China.” Contemporary Accounting Research 28 (3): 892–925. https://doi.org/10.1111/j.1911-3846.2011.01088.x.

Chen, Kevin CW, Hongqi, Yuan. 2004. Earnings management and capital resource allocation: Evidence from China's accounting-based regulation of rights issues. The Accounting Review 79 (3), 645-665. https://www.jstor.org/stable/3203273.

Dichev, Ilia D., John R. Graham, Campbell R. Harvey, and Shiva Rajgopal. 2013. “Earnings Quality: Evidence from the Field.” Journal of Accounting and Economics 56 (2–3): 1–33. https://doi.org/10.1016/j.jacceco.2013.05.004.

Graham, John R., and Campbell R. Harvey. 2001. “The Theory and Practice of Corporate Finance: Evidence from the Field.” Journal of Financial Economics 60 (2–3): 187–243. https://doi.org/10.1016/S0304-405X(01)00044-7.

Graham, John R., Campbell R. Harvey, and Shiva Rajgopal. 2005. “The Economic Implications of Corporate Financial Reporting.” Journal of Accounting and Economics 40 (1–3): 3–73. https://doi.org/10.1016/j.jacceco.2005.01.002.

Liu, Qiao, and Zhou (Joe) Lu. 2007. “Corporate Governance and Earnings Management in the Chinese Listed Companies: A Tunneling Perspective.” Journal of Corporate Finance 13 (5): 881–906. https://doi.org/10.1016/j.jcorpfin.2007.07.003.

Lu, Hai, Jee-Eun Shin, and Mingyue Zhang. 2023. “Financial Reporting and Disclosure Practices.” Journal of Accounting and Economics 76 (1): 101598. https://doi.org/10.1016/j.jacceco.2023.101598.

Wong, T. J., 2020. “Bridging Relational Networks and Markets: Corporate Governance, Accounting Information and Relational Contracts.” Unpublished working paper, University of Southern California. https://www.tjwong.org/_files/ugd/605f31_8bb3f13231a74a9488172819bc15f017.pdf.

Latest

Most Popular

- VoxChina Covid-19 Forum (Second Edition): China’s Post-Lockdown Economic Recovery VoxChina, Apr 18, 2020

- China’s Great Housing Boom Kaiji Chen, Yi Wen, Oct 11, 2017

- China’s Joint Venture Policy and the International Transfer of Technology Kun Jiang, Wolfgang Keller, Larry D. Qiu, William Ridley, Feb 06, 2019

- The Dark Side of the Chinese Fiscal Stimulus: Evidence from Local Government Debt Yi Huang, Marco Pagano, Ugo Panizza, Jun 28, 2017

- Wealth Redistribution in the Chinese Stock Market: the Role of Bubbles and Crashes Li An, Jiangze Bian, Dong Lou, Donghui Shi, Jul 01, 2020

- Evaluating Risk across Chinese Housing Markets Yongheng Deng, Joseph Gyourko, Jing Wu, Aug 02, 2017

- What Is Special about China’s Housing Boom? Edward L. Glaeser, Wei Huang, Yueran Ma, Andrei Shleifer, Jun 20, 2017

- Privatization and Productivity in China Yuyu Chen, Mitsuru Igami, Masayuki Sawada, Mo Xiao, Jan 31, 2018

- How did China Move Up the Global Value Chains? Hiau Looi Kee, Heiwai Tang, Aug 30, 2017

- China’s Shadow Banking Sector: Wealth Management Products and Issuing Banks Viral V. Acharya, Jun Qian, Zhishu Yang, Aug 09, 2017

Facebook

Facebook  Twitter

Twitter  Instagram

Instagram WeChat

WeChat  Email

Email