Horizon Risk in Rental Housing: Evidence from a PropTech Rental Platform

Rental contracts are often short-term, creating uncertainty regarding rental stability and sometimes leading to involuntary moves by tenants. We find that housing market conditions significantly impact the rental supply horizon: Landlords in neighborhoods with higher housing price growth offer shorter contracts and are less likely to renew expiring ones, after controlling for local rent growth and property characteristics.

Rental housing plays an important role in providing living space to households, especially in large cities with severe housing affordability issues. However, renters live under substantial uncertainty when their rental contract is short. In many countries, including the US, the UK, Canada, and China, most rental contracts are just one year long. If a household needs to rent an apartment for five years but the landlord offers only one-year contracts, then the household faces uncertainty regarding contract renewal every year. While long-term rental contracts have the potential to reduce horizon risk and provide an affordable and stable housing option that closely resembles homeownership, we rarely see them in practice. Why are there so few long-term rental housing contracts?

The shortage of long-term rental housing appears to be a pivotal friction to consider when studying the risks and trade-offs surrounding people’s housing decisions. However, the existing literature does not offer clear evidence on the determinants of landlords’ willingness to supply long-term rental contracts. Prior studies have examined several sources of uncertainty regarding housing decisions, such as price, inflation, and rent risks (see Sinai and Souleles 2005; Fuster and Zafar 2016; Malmendier and Wellsjo 2023; Kuchler et al. 2023).

In this working paper (Hu et al. 2022) we study an important yet underexplored risk in renting: horizon risk, defined as the uncertainty under which renters may not be able to stay in their rented homes for the desired duration due to reasons on the landlord’s side. We focus on the horizon risk brought by short-term contracts while recognizing that other factors, such as the early termination of a long-term contract that effectively shortens the contract duration, also lead to involuntary moves by tenants and contribute to horizon risk.

We use a unique dataset that contains approximately 93,000 rental housing contracts signed between individual landlords and a large rental platform in Beijing between 2015 and 2019. The PropTech platform performs an intermediary role by taking in rental properties from individual landlords, renovating and remodeling the space into standardized rooms, and leasing the units to tenants. The PropTech platform always accommodates tenants’ renewal requests given the availability of rental units. Therefore, the platform’s business model helps address the horizon risk problem faced by tenants to the extent that it secures rental housing supply from landlords. By matching rental contracts with housing transaction data in the neighborhood, we are able to analyze the impact of local housing price fluctuations on the term structure of rental housing supply.

Figure 1. Spatial Distribution of Rental and Housing Market Transactions. This figure shows the spatial distribution of our sample transactions between 2015 and 2019 in Beijing. Panel A contains 92,948 rental contracts signed between individual landlords and the PropTech platform. Panel B contains 463,590 secondhand home purchase transactions collected from a major real estate broker’s website. Both panels demonstrate similar spatial patterns, indicating the geographical overlap of the rental and housing markets in our sample and justifying the spillover impact across markets.

Local housing price growth and rental supply horizon

We measure the local housing price growth as the annual growth rate of average housing prices (per square meter) in the neighborhood within a two-kilometer radius of the subject rental property. Our primary finding is that local housing price growth reduces the duration of rental contracts supplied by individual landlords, even after controlling for rent growth and other housing and landlord characteristics. Specifically, a one-standard-deviation increase in housing price growth in the neighborhoods of the subject rental properties reduces contract duration by approximately one month.

Additionally, landlords experiencing local housing price growth are significantly less likely to renew expiring contracts with the rental platform. Local housing price growth also tilts the term structure of rent counterclockwise, consistent with our arguments that housing price growth reduces the supply of long-term contracts relative to short-term contracts and therefore increases long-term rental prices by a larger extent.

These results are consistent with our hypothesis that landlords form expectations based on local housing and rental market conditions. Higher house price growth experienced by individual landlords in the neighborhoods shortens the duration of their leasing contracts signed with the rental platform as their perceived value of resale opportunities increases. Therefore, the landlord becomes less willing to sign a long-term rental contract when housing market conditions become more favorable.

Establishing causality

We establish causality by exploiting a housing market regulation policy that disproportionately impacts the marketability of certain types of properties. In early 2017, the Beijing municipal government implemented the Home Purchase Restriction (HPR) policy, which substantially raised the down payment rate for nonordinary units (i.e., those housing units with areas above a policy threshold of 140 square meters) while having a lesser impact on ordinary units (i.e., those with areas below 140 square meters). As a result, the marketability of nonordinary units has unexpectedly deteriorated relative to ordinary units since the HPR policy took effect.

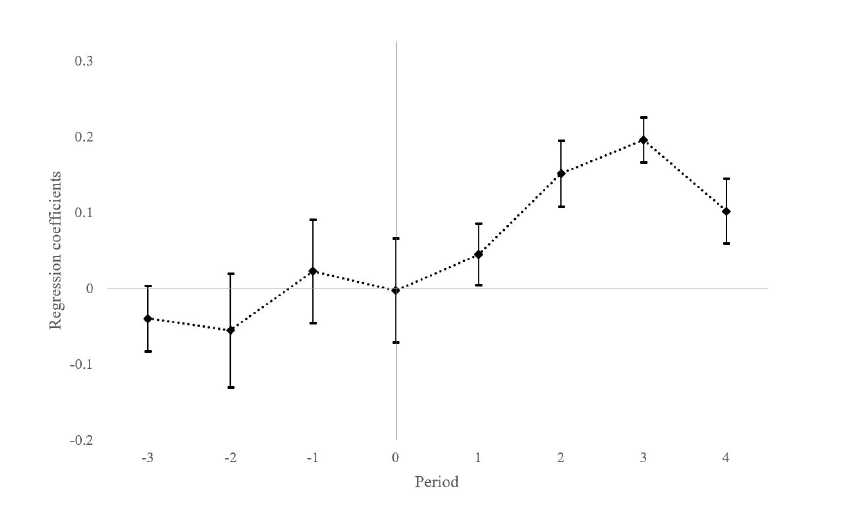

Utilizing this policy change, we conduct a difference-in-differences analysis, with nonordinary units being the treatment group and ordinary units being the control group. Our results support the hypothesis that landlords with nonordinary units perceive lower returns from selling their properties in the near future and thus become more willing to offer long-term rental contracts since the unfavorable policy change.

Figure 2. The HPR Policy and Rental Contract Duration. This figure plots the regression coefficients on the interaction terms between semiannual period dummies (taking the value of one for periods in or after the HPR policy rolled out in 2016Q4-2017Q1, and zero otherwise) and the nonordinary unit dummy (taking the value of one if the area size of the housing unit is above the policy threshold of 140 square meters, and zero otherwise), where the dependent variable is the landlord-platform contract duration. Housing units more affected by the HPR policy (i.e., less favorable housing market conditions) show a larger increase in rental contract duration supplied by individual landlords to the PropTech platform.

Heterogeneity tests

Furthermore, the negative spillover effect of local housing market growth is more substantial for landlords who are more likely to be speculative investors, defined as those owning multiple rental units similar to the definition in Mian and Sufi (2022). The effect is also more pronounced for units that can be sold more easily, such as those with one instead of multiple tenants occupying the house. These findings all align with our model predictions featuring extrapolative expectations whereby housing booms improve individual landlords’ expected resale opportunities. Hence, landlords do not want to be locked in at the current rent level by long-term contracts and would like to enjoy greater flexibility in home sale timing.

We also find that given local housing price growth, older landlords are less likely to reduce rental supply than younger landlords, implying that older generations are more conservative in investment and that they rely more on rental housing to generate income, as evidenced by Gargano, Giacoletti, and Jarnecic (2022). Additionally, we find a more pronounced effect of more recent price growth on the reduction in rental supply duration, consistent with the extrapolation decay pattern proposed by Glaeser and Nathanson (2017), Malmendier and Nagel (2016), and Bordalo, Gennaioli, and Shleifer (2018).

The real impact of rental supply duration

Does the landlord-platform contract duration have a real impact on rental housing stability? We answer this question by showing the maturity matching between the duration of landlord-agency and tenant-agency contracts. Renters with a long-term rental demand tend to opt for units that offer long-term availability, demonstrating a “horizon-matching” pattern. Importantly, tenants’ desired rental duration, as proxied by their renewal rate, increases with local housing price growth.

These findings suggest that the availability of long-term rental supply falls short precisely when renters need them the most, which helps rule out an alternative explanation based on decreased demand for long-term contracts following housing price appreciation, supporting the notion that the shortened contract duration is driven by supply-side factors. Overall, our findings shed light on the role of local housing price growth, extrapolative expectations, and PropTech platforms in shaping rental supply horizon.

Future discussions

The concept of horizon risk is of both academic and practical value, especially in light of the prevailing housing affordability crisis. To the extent that long-term rental housing provides housing stability, or peace of mind, similar to homeownership, the variations in the long-term rental markets could potentially shed light on the disparities in homeownership rates across different regions. A stable supply of long-term rental housing has important implications for housing affordability and social welfare (e.g., Favilukis and Van Nieuwerburgh 2021).

Our paper also contributes to the understanding of an emerging PropTech business model in the rental housing market, which can be dubbed “iRenters,” borrowing from the concept of “iBuyers” in deal intermediation in the residential real estate market (Buchak et al., 2020). This “iRenter” type of online platforms are relavant to other tech-enabled platforms, such as Zillow, which specializes in residential property sales (Fu et al., 2022) and Airbnb, which mainly provides very short-term or temporary rental housing (Li et al., 2022).

The interplay between the housing and rental markets also suggests a new potential mechanism for housing market momentum and the boom-bust cycle. For example, to what extent does the feedback loop between price growth and long-term rental supply deterioration fuel momentum in the housing market? Can the variation in long-term rental supply help explain demographic differences such as marriage and birth rates? In the case of China, the government is actively exploring and experimenting with various policies to avoid a housing crisis (Fang et al. 2016; Glaeser et al. 2017; Xiong 2023), including governments and state-owned enterprises buying houses for long-term rental purposes. We believe that some of these implications deserve further research.

References

Adelino, Manuel, Antoinette Schoar, and Felipe Severino. 2018. “Perception of House Price Risk and Homeownership.” National Bureau of Economic Research Working Paper No. 25090. https://doi.org/10.3386/w25090.

Armona, Luis, Andreas Fuster, and Basit Zafar. 2019. “Home Price Expectations and Behaviour: Evidence from a Randomized Information Experiment.” Review of Economic Studies 86 (4): 1371–1410. https://doi.org/10.1093/restud/rdy038.

Bordalo, Pedro, Nicola Gennaioli, and Andrei Shleifer. 2018. “Diagnostic Expectations and Credit Cycles.” Journal of Finance 73 (1): 199–227. https://doi.org/10.1111/jofi.12586.

Buchak, Greg, Gregor Matvos, Tomasz Piskorski, and Amit Seru. 2020. “Why Is Intermediating Houses so Difficult? Evidence from iBuyers.” National Bureau of Economic Research Working Paper No. 28252. https://doi.org/10.3386/w28252.

Fang, Hanming, Quanlin Gu, Wei Xiong, and Li-An Zhou. 2016. “Demystifying the Chinese Housing Boom.” National Bureau of Economic Research Macroeconomics Annual 30: 105–166. https://doi.org/10.1086/685953.

Favilukis, Jack Y., and Stijn Van Nieuwerburgh. 2021. “Out-of-Town Home Buyers and City Welfare.” Journal of Finance 76 (5): 2577–2638. https://doi.org/10.1111/jofi.13057.

Favilukis, Jack Y., Pierre Mabille, and Stijn Van Nieuwerburgh. 2023. “Affordable Housing and City Welfare.” Review of Economic Studies 90 (1): 293–330. https://doi.org/10.1093/restud/rdac024.

Fu, Runshan, Ginger Zhe Jin, and Meng Liu. 2022. “Does Human-Algorithm Feedback Loop Lead to Error Propagation? Evidence from Zillow’s Zestimate.” National Bureau of Economic Research Working Paper No. 29880. https://doi.org/10.3386/w29880.

Fuster, Andreas, and Basit Zafar. 2016. “To Buy or Not to Buy: Consumer Constraints in the Housing Market.” American Economic Review 106 (5): 636–40. https://doi.org/10.1257/aer.p20161086.

Gargano, Antonio, Marco Giacoletti, and Elvis Jarnecic. 2023. “Local Experiences, Search, and Spillovers in the Housing Market.” Journal of Finance 78 (2): 1015–53. https://doi.org/10.1111/jofi.13208.

Glaeser, Edward, Wei Huang, Yueran Ma, and Andrei Shleifer. 2017. “A Real Estate Boom with Chinese Characteristics.” Journal of Economic Perspectives 31 (1): 93–116. https://doi.org/10.1257/jep.31.1.93.

Glaeser, Edward L., and Charles G. Nathanson. 2017. “An Extrapolative Model of House Price Dynamics.” Journal of Financial Economics 126 (1): 147–70. https://doi.org/10.1016/j.jfineco.2017.06.012.

Hu, Jiayin, Maggie Hu, Shangchen Li, Yingguang (Conson) Zhang, and Zheng Zhang. 2022. “Horizon Risk in Renting: Evidence from a PropTech Rental Platform.” Social Science Research Network Working Paper No. 4060219. https://doi.org/10.2139/ssrn.4060219.

Kuchler, Theresa, Monika Piazzesi, and Johannes Stroebel. 2023. “Housing Market Expectations.” In Handbook of Economic Expectations, edited by Rüdiger Bachmann, Giorgio Topa, and Wilbert van der Klaauw, 163–91. Cambridge, Mass.: Academic Press.

Kuchler, Theresa, and Basit Zafar. 2019. “Personal Experiences and Expectations about Aggregate Outcomes.” Journal of Finance 74 (5): 2491–2542. https://doi.org/10.1111/jofi.12819.

Li, Hui, Yijin Kim, and Kannan Srinivasan. 2022. “Market Shifts in the Sharing Economy: The Impact of Airbnb on Housing Rentals.” Management Science 68 (11): 8015–44. https://doi.org/10.1287/mnsc.2021.4288.

Malmendier, Ulrike, and Stefan Nagel. 2016. “Learning from Inflation Experiences.” Quarterly Journal of Economics 131 (1): 53–87. https://doi.org/10.1093/qje/qjv037.

Malmendier, Ulrike, and Alexandra Wellsjo. 2020. “Rent or Buy? The Role of Lifetime Experiences on Homeownership within and across Countries.” Centre for Economic Policy Research Discussion Paper No. 14935. https://cepr.org/publications/dp14935.

Mian, Atif, and Amir Sufi. 2022. “Credit Supply and Housing Speculation.” Review of Financial Studies 35 (2): 680–719. https://doi.org/10.1093/rfs/hhab034.

Reher, Michael. 2021. “Finance and the Supply of Housing Quality.” Journal of Financial Economics 142 (1): 357–76. https://doi.org/10.1016/j.jfineco.2021.04.022.

Sinai, Todd, and Nicholas S. Souleles. 2005. “Owner-Occupied Housing as a Hedge against Rent Risk.” Quarterly Journal of Economics 120 (2): 763–89. https://doi.org/10.1093/qje/120.2.763.

Xiong, Wei. 2023. “Derisking Real Estate in China’s Hybrid Economy.” National Bureau of Economic Research Working Paper No. 31118. https://doi.org/10.3386/w31118.

Latest

Most Popular

- VoxChina Covid-19 Forum (Second Edition): China’s Post-Lockdown Economic Recovery VoxChina, Apr 18, 2020

- China’s Great Housing Boom Kaiji Chen, Yi Wen, Oct 11, 2017

- China’s Joint Venture Policy and the International Transfer of Technology Kun Jiang, Wolfgang Keller, Larry D. Qiu, William Ridley, Feb 06, 2019

- The Dark Side of the Chinese Fiscal Stimulus: Evidence from Local Government Debt Yi Huang, Marco Pagano, Ugo Panizza, Jun 28, 2017

- Wealth Redistribution in the Chinese Stock Market: the Role of Bubbles and Crashes Li An, Jiangze Bian, Dong Lou, Donghui Shi, Jul 01, 2020

- Evaluating Risk across Chinese Housing Markets Yongheng Deng, Joseph Gyourko, Jing Wu, Aug 02, 2017

- What Is Special about China’s Housing Boom? Edward L. Glaeser, Wei Huang, Yueran Ma, Andrei Shleifer, Jun 20, 2017

- Privatization and Productivity in China Yuyu Chen, Mitsuru Igami, Masayuki Sawada, Mo Xiao, Jan 31, 2018

- How did China Move Up the Global Value Chains? Hiau Looi Kee, Heiwai Tang, Aug 30, 2017

- China’s Shadow Banking Sector: Wealth Management Products and Issuing Banks Viral V. Acharya, Jun Qian, Zhishu Yang, Aug 09, 2017

Facebook

Facebook  Twitter

Twitter  Instagram

Instagram WeChat

WeChat  Email

Email