Learning by Investing: entrepreneurial spillovers from venture capital

This paper studies how investing in venture capital (VC) affects the entrepreneurial outcomes of individual limited partners (LPs). Using comprehensive administrative data on entrepreneurial activities and VC fundraising and investments in China, we find that after investing in a successfully launched VC fund, individual LPs create significantly more ventures than do LPs in funds that failed to launch. These new ventures tend to be high-tech firms with better survival rates and demonstrate increased patent activity. Our results suggest that venture investments are a channel through which individual LPs learn.

The academic literature on entrepreneurial finance has largely treated investors and entrepreneurs as distinct entities. However, the lines between these two groups have become increasingly blurred, a reflection of the rising prominence of angel groups, crowdfunding platforms, and “super angel” venture funds (Bernstein, Korteweg, and Laws 2017; Lerner et al. 2018; Wallmeroth, Wirtz, and Groh 2018; Hellmann, Schure, and Vo 2021). This phenomenon is also evident in the setting of venture capital (VC) funds, where a similar trend has emerged. In particular, many investors, including individual limited partners (LPs) in VC funds, often transition to become entrepreneurs themselves, launching their own ventures. While numerous studies have highlighted how venture capitalists add value to portfolio firms, there has been relatively little scrutiny of the potential impact of LP experience on their subsequent entrepreneurial outcomes.

In our paper (Lerner, Li, and Liu 2023), we study how being an LP in a VC fund affects an individual investor’s subsequent entrepreneurial activity. It might be thought that identifying how investing in VC affects individual LPs would be empirically challenging. There are limited systematic data on the LPs of VC funds in the US and many other nations. Moreover, comprehensive information about these LPs’ entrepreneurial activities is often lacking, especially for the subset of firms that are not venture-backed.

We overcome this challenge by focusing on China, the second-largest VC market in the world. We assemble a unique dataset that covers all firm creation and domestic VC activity in China. It combines the proprietary administrative business registry data from the State Administration for Industry and Commerce (SAIC) with the VC fundraising and investment records from Zero2IPO and the Asset Management Association of China. Our data contain the entirety of firm creation activities, the shareholders of these firms, VC equity investments, and the names and financial commitments of all LPs from 1999 to 2018. Our final sample includes 70,414 individuals who committed capital to 11,120 VC funds.

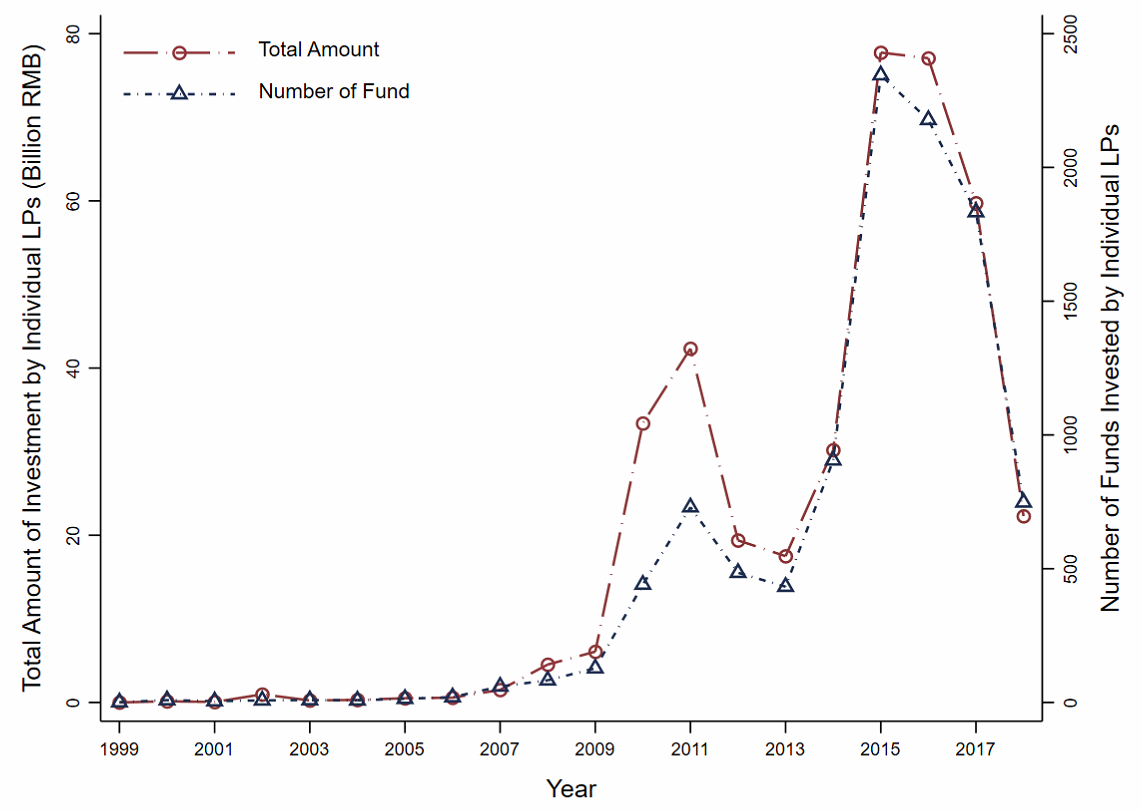

Figure 1 shows the aggregate trend of individual LPs’ investments across years. Both the total investment amounts and total number of funds invested in by individual LPs take off in 2009 and peak around 2015 and 2016. For instance, the total commitments by individual LPs in 2015 were about 80 billion RMB. In the sample, individual LPs on average committed about 50% of a fund’s capital. Each fund has around eight individual LPs on average, each of which invested about 6.4 million RMB. These tabulations indicate that individual LPs are a significant funding source in the Chinese VC market.

With the data, we wish to examine the consequences of venture investments by individual LPs on their decision to begin new businesses. But a naive analysis of this might pose a number of interpretative issues. For instance, directly estimating ordinary least squares might introduce bias due to endogeneity.

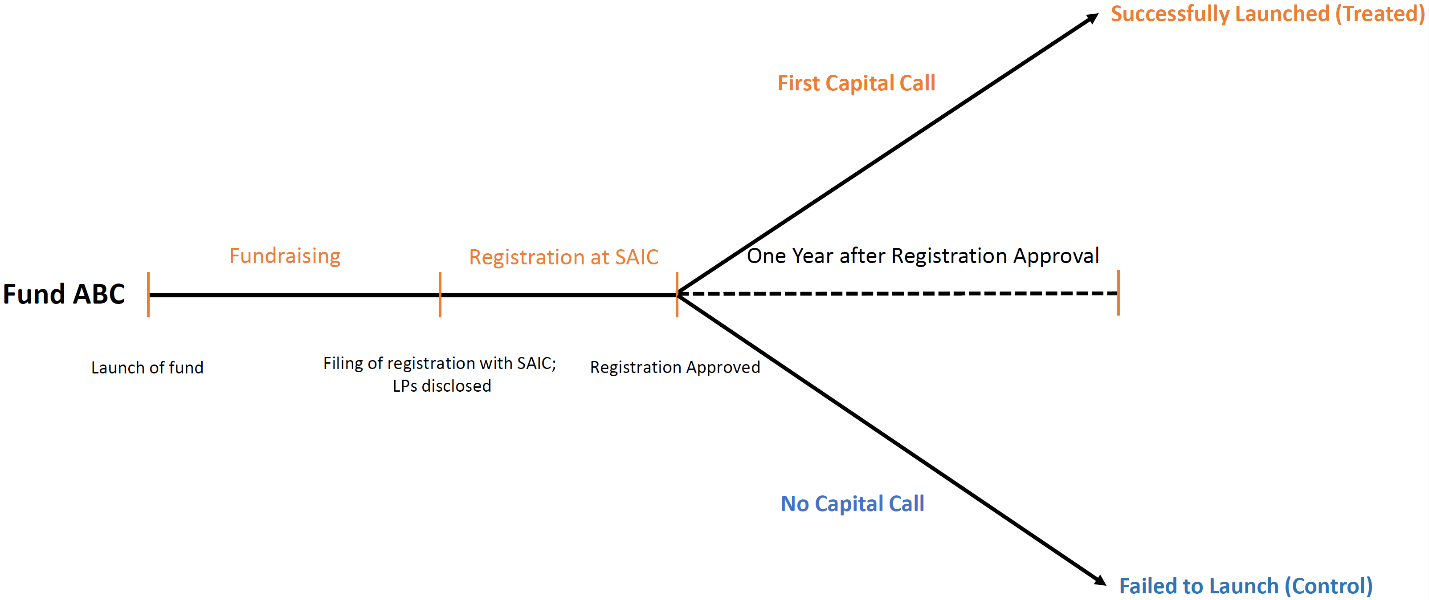

To overcome this concern, we adopt an empirical design similar to Seru (2014) and Bernstein (2015). We narrow the focus to individuals who aspired to become LPs in venture funds. In particular, we compare the entrepreneurial activity of individual LPs in funds that eventually launched with potential LPs in funds that failed to launch. In the analysis, we define a VC fund that does not invest in any portfolio companies in the year after its registration is approved by the SAIC as one that failed to launch. This echoes the fact that most VC funds in China already have a set of targets they intend to invest in when registering at the SAIC, so the very first capital call is typically made within a few months of the fund’s approval. Figure 2 illustrates our empirical design.

Figure 2. Empirical Design

We use a cross-sectional specification as follows:

where  is the average number of ventures per year (or the total number of ventures) created by invidual LP i after investing in VC fund j that received its SAIC registration approval in year t, LaunchedVCij is an indicator of whether VC fund j was successfully launched, and μj and δt represent the fund manager and fund registry-year fixed effects.

is the average number of ventures per year (or the total number of ventures) created by invidual LP i after investing in VC fund j that received its SAIC registration approval in year t, LaunchedVCij is an indicator of whether VC fund j was successfully launched, and μj and δt represent the fund manager and fund registry-year fixed effects.

However, whether a VC fund launches successfully is not entirely exogenous. We instrument for the launch success of a VC fund with the portion of total committed capital from the fund’s corporate LPs that encounter industry distress. Our instrument exploits the theory of coordination frictions (e.g., Nanda and Rhodes-Kropf 2019) between LPs. Specifically, we create an instrument for the endogenous variable LaunchedVCij in Equation (1) as follows. For fund j, we compute the sum of the share of committed capital, hjk, from corporate LP k that experienced financial distress. Let Sj denote the set of all corporate LPs in fund j. We define a corporate LP k as experiencing financial distress at time t (when the fund’s registration is approved) if the past six-month stock return of the two-digit SIC-code industry that corporate LP k is assigned to is in the bottom quintile among all two-digit SIC-code industries at time t.

We report our regression results in Table 1. Across all the specifications, our results are robust: after becoming an LP of a successfully launched VC fund, the average number of new ventures started by the individual LP per year increases by about 0.07, which is about 17% of a standard deviation. Our estimate implies that on average an individual LP will create one more startup within 14 years after investing in VC, relative to their counterparts in the failed-to-launch funds. The result also holds if we employ the total number of ventures launched after becoming an LP as a dependent variable.

Table 1. New Venture Creation of Individual LPs: Failed vs. Launched Funds

What do these newly created ventures look like? We compare the characteristics of ventures created by individual LPs after they invest in a VC fund (new venture) to those created prior to investing in any VC (old venture). We find that the new ventures are especially more likely to be in high-tech service industries, an area more popular with venture investors (as shown in Figure 3).

Figure 3. High-Tech Fraction of New Ventures vs. Old Ventures

We also observe that new ventures, on average, file more patents within three years after being founded compared to old ventures within the same period among individual LPs in the successfully launched funds relative to those in the failed-to-launch funds. However, we do not find that they hire more employees, suggesting a higher level of innovation efficiency within the new ventures.

In the final part of the paper, we explore the underlying channels explaining the entrepreneurial spillovers to individual LPs:

(1) Learning channel: Individual LPs may benefit from accessing superior information about VCs’ portfolio companies, leading to increased entrepreneurial activity.

(2) Financial constraints channel: Investments in VCs can provide substantial financial returns to LPs, potentially alleviating financial constraints faced by entrepreneurs.

(3) Network channel: Interacting with General Partners (GPs) may facilitate easier access to VC financing for LPs’ own ventures, thereby incentivizing more firm creation.

We find supporting evidence for the learning channel, as indicated by the increased similarity in industry and patent classification codes between new ventures and VCs’ portfolio companies. Additionally, the entrepreneurial spillover effect is strongest for LPs investing in funds managed by “better” quality GPs or for first-time LPs, consistent with learning. However, we find no significant evidence supporting the financial constraints channel, as there is no notable increase in LPs’ entrepreneurship after investing in VC funds with successful exits in their portfolio. Similarly, the network channel does not appear to be a significant driver of entrepreneurial spillovers, as we find no substantial increase in VC financing for new ventures created by LPs.

Our findings suggest a positive entrepreneurial spillover from investing in VC funds, implying a learning-by-investing mechanism. An interesting question is whether such spillovers can occur elsewhere in entrepreneurial finance. For instance, angel investments in startups appear to have increased sharply in recent years, as have crowdfunding and online investment groups. Understanding the relative learning from these different approaches to investing is a fertile avenue for future research.

Bernstein, Shai. 2015. “Does Going Public Affect Innovation?” Journal of Finance 70 (4): 1365–1403. https://doi.org/10.1111/jofi.12275.

Bernstein, Shai, Arthur Korteweg, and Kevin Laws. 2017. “Attracting Early-Stage Investors: Evidence from a Randomized Field Experiment.” Journal of Finance 72 (2): 509–38. https://doi.org/10.1111/jofi.12470.

Hellmann, Thomas, Paul Schure, and Dan H. Vo. 2021. “Angels and Venture Capitalists: Substitutes or Complements?” Journal of Financial Economics 141 (2): 454–78. https://doi.org/10.1016/j.jfineco.2021.04.001.

Lerner, Josh, Jinlin Li, and Tong Liu. 2023. “Learning by Investing: Entrepreneurial Spillovers from Venture Capital.” National Bureau of Economic Research Working Paper No. 31897. https://doi.org/10.3386/w31897.

Lerner, Josh, Antoinette Schoar, Stanislav Sokolinski, and Karen Wilson. 2018. “The Globalization of Angel Investments: Evidence across Countries.” Journal of Financial Economics 127 (1): 1–20. https://doi.org/10.1016/j.jfineco.2017.05.012.

Nanda, Ramana, and Matthew Rhodes-Kropf. 2019. “Coordination Frictions in Venture Capital Syndicates.” In The Oxford Handbook of Entrepreneurship and Collaboration, 351–71. Oxford, UK: Oxford University Press. https://doi.org/10.1093/oxfordhb/9780190633899.001.0001.

Seru, Amit. 2014. “Firm Boundaries Matter: Evidence from Conglomerates and R&D Activity.” Journal of Financial Economics 111 (2): 381–405. https://doi.org/10.1016/j.jfineco.2013.11.001.

Wallmeroth, Johannes, Peter Wirtz, and Alexander Peter Groh. 2018. “Venture Capital, Angel Financing, and Crowdfunding of Entrepreneurial Ventures: A Literature Review.” Foundations and Trends in Entrepreneurship 14 (1): 1–129. https://doi.org/10.1561/0300000066.

Latest

Most Popular

- VoxChina Covid-19 Forum (Second Edition): China’s Post-Lockdown Economic Recovery VoxChina, Apr 18, 2020

- China’s Great Housing Boom Kaiji Chen, Yi Wen, Oct 11, 2017

- China’s Joint Venture Policy and the International Transfer of Technology Kun Jiang, Wolfgang Keller, Larry D. Qiu, William Ridley, Feb 06, 2019

- The Dark Side of the Chinese Fiscal Stimulus: Evidence from Local Government Debt Yi Huang, Marco Pagano, Ugo Panizza, Jun 28, 2017

- Wealth Redistribution in the Chinese Stock Market: the Role of Bubbles and Crashes Li An, Jiangze Bian, Dong Lou, Donghui Shi, Jul 01, 2020

- Evaluating Risk across Chinese Housing Markets Yongheng Deng, Joseph Gyourko, Jing Wu, Aug 02, 2017

- What Is Special about China’s Housing Boom? Edward L. Glaeser, Wei Huang, Yueran Ma, Andrei Shleifer, Jun 20, 2017

- Privatization and Productivity in China Yuyu Chen, Mitsuru Igami, Masayuki Sawada, Mo Xiao, Jan 31, 2018

- How did China Move Up the Global Value Chains? Hiau Looi Kee, Heiwai Tang, Aug 30, 2017

- China’s Shadow Banking Sector: Wealth Management Products and Issuing Banks Viral V. Acharya, Jun Qian, Zhishu Yang, Aug 09, 2017

Facebook

Facebook  Twitter

Twitter  Instagram

Instagram WeChat

WeChat  Email

Email