Government Deleveraging and Non-SOE Liquidity Squeeze: Evidence from Subnational Debt and Government Contractors

We show that government deleveraging causes liquidity squeeze among non-state-owned-enterprise (non-SOE) contractors, an unintended consequence of containing subnational debts. Our empirical analysis exploits China’s 2017 top-down deleveraging policy, which restricts local governments’ borrowing capacity, and a purpose-built dataset of listed firms matched with government procurement contracts. Non-SOE contractors experience larger accounts receivable increases, larger cash holding reductions, more share-pledging activities, worse operating performance, and higher probabilities of ownership change than non-contractors. Effects are muted among SOEs, implying that local governments selectively delay payments.

A World of Public Debt

Governments worldwide have become increasingly indebted. A United Nations report shows that global public debt reached a record 92 trillion USD in 2022, and a total of 52 countries (almost 40% of the developing world) are in “serious debt trouble.” The International Monetary Fund projected global public debt to rise again in 2023, with emerging market economies and low-income countries especially affected by the elevated debt vulnerabilities. To the extent that an indebted government entails significant risks to economic development and financial stability, understanding the complexity of government deleveraging and potential spillover mechanisms is of great value to both scholars and policymakers.

China has a market-based economy with a heavy government presence (see, e.g., Xiong 2018; Brunnermeier, Sockin, and Xiong 2022). Local governments, which play a significant role in China’s investment-driven economy, have encountered debt problems in the past few years. Restricted from directly issuing municipal bonds, local governments in China rely on local government financing vehicles (LGFV) to raise off-budget funding in the shadow banking system (for instance, see Ang, Bai, and Zhou 2018; Chen et al. 2018; Chen et al. 2020). Since the 4 trillion yuan stimulus package in 2009, Chinese local governments have accumulated a debt balance of 34.4 trillion yuan as of 2016, as estimated by the International Monetary Fund, and a staggering 94 trillion yuan as of 2022, according to Goldman Sachs. While existing literature has investigated the substantial risks brought by soaring local government debt (e.g., Huang, Pagano, and Panizza 2020; Chen et al., 2020), few studies have examined the deleveraging of government debts. When local governments become financially constrained, who bears the cost?

Containing Subnational Debt

In a recent working paper titled “Government Deleveraging and Non-SOE Liquidity Squeeze: Evidence from Subnational Debt and Government Contractors,” we investigate the impact of government deleveraging on supplier firms exploiting China’s 2017 top-down deleveraging policy. This policy targeted the shadow banking sector and called for “lifetime responsibility” on local officials regarding the LGFV debt problem, substantially reducing the off-budget borrowing capacity of local governments. As shown in Figure 1, the fraction of municipal corporate bonds (MCB) for rolling over debts increased substantially in 2017.

Figure 1: Local governments’ debt rollover pressure after the deleveraging policy in 2017

We hand-collect a unique dataset combining local government procurement contracts and publicly listed firms in China between 2014 and 2019. This purpose-built dataset helps us identify business connections between firms and local governments. This cross-sectional variation in firms’ preexisting business relationships with local governments, combined with the deleveraging policy shock, enables us to test the causal impact of government deleveraging on contractors in a difference-in-differences framework.

We find that government contractors with preexisting procurement contracts are more likely to experience liquidity shortages (such as increases in accounts receivable and decreases in cash holdings) than non-contractors after the deleveraging, suggesting a negative financial spillover of government deleveraging through the trade credit channel. We find no similar impacts on firms’ accounts payable and inventories, suggesting limited ability to further pass down the liquidity shock. Additionally, the liquidity squeeze impact is more pronounced in provinces with heavier debt rollover pressures in shadow bank financing. Our findings are consistent with the hypothesis that financially constrained local governments essentially finance their expenditures by delaying contract payments to government contractors.

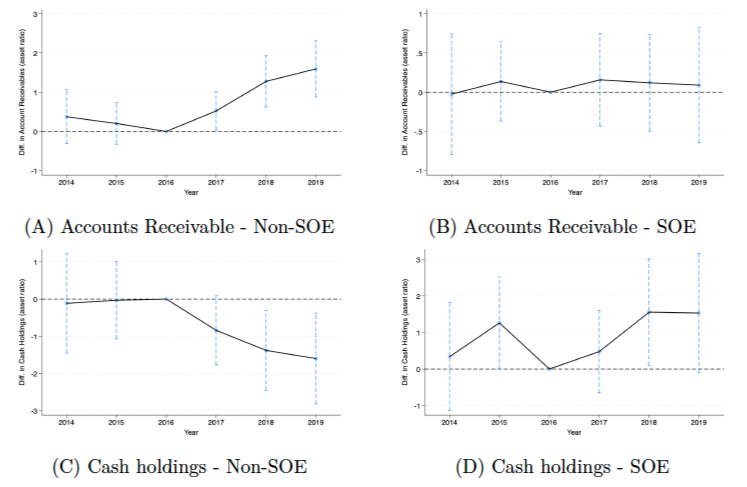

Furthermore, the payment delay seems to be selective. As shown in Figure 2, the liquidity squeeze impact is largely muted among SOEs, implying the privileges enjoyed by SOEs relative to private firms to negotiate with local governments and obtain external funding. Hence, we demonstrate a new mechanism of allocation inefficiencies where political factors amplify existing financial distortions, implying a pecking order of the government’s selective payment defaults favoring more politically connected firms.

Figure 2: Liquidity squeeze among non-SOE government contractors

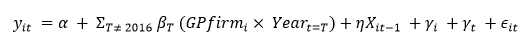

Notes: This figure plots the dynamic effect of government deleveraging on supplier firms' accounts receivable and cash holdings for non-SOE and SOE subsamples. We report coefficients estimated using the following regression:

where Yit denotes the outcome variable, which is ARit (accounts receivable divided by total assets) in Panels A and B and Cashit (cash holdings divided by total assets) in Panels C and D. GPfirmi denotes listed firms that obtained government procurement orders during 2014–2016 (pre-policy period). Year denotes dummies for a specific year. Xit-1 are control variables including firm size (Size), financial leverage (Leverage), fixed assets (Fixedassets, divided by total assets), total revenue (Revenue, divided by total assets), the annual growth rate of total revenue (Revenuegrowth), the shareholding ratio of top 10 major shareholders (Top10Share) and proportion of independent directors (IDPdirector). γi and γtdenote firm and year fixed effects, respectively. ϵit represents the error term. The 95% confidence intervals are adjusted for firm-level clustering.

Notably, our sample of publicly listed firms is only a fraction of government contractors, many of which are small- and medium-sized enterprises (SME). Due to data limitations, we cannot analyze this impact. However, one can reasonably argue that SMEs, with fewer external financing options and less bargaining power, will face a more severe selective default problem. Hence, our results using the listed firm sample should be interpreted as a lower bound of the actual adverse effect. Another caveat is that MCB issuances and LGFV debts may not capture overall local government debts. Since there is no publicly available data on bank loans to LGFVs, we cannot directly rule out the possibility that local governments use alternative financing options, such as bank loans, to compensate for the decreases in bond financing. In this case, our estimated coefficients also represent a lower bound.

Liquidity squeeze has real impacts on non-SOE government contractors by reducing their business profitability, inducing more share-pledging activities, and increasing the probability of ownership changes. The liquidity deterioration of non-SOE contractors leads to changes in firms’ ownership structure: compared to those of non-contractors, controlling shareholders of government contractors are more likely to pledge their shares for financing and end up losing a larger fraction of their shares, while the ratio of state-owned shares increases more among government contractors. Our results are corroborated by recent trends in China, where state ownership is resurgent (e.g., Fang et al. 2022; Allen et al. 2022).

Conclusion and Future Research

Overall, our results show that business connections with the government sour into a heavy burden on government contractors when local governments face debt rollover pressures in the post-deleveraging period. Our findings resonate with research on financial contagion through inter-firm supply chains (Boissay and Gropp 2013; Jacobson and von Schedvin 2015; Costello 2020; Maksimovic and Yook 2022), where large firms borrow from their smaller suppliers lead during bank credit tightening (Murfin and Njoroge 2014) and suppliers exposed to bank financing decline during the financial crisis pass this liquidity shock to their downstream customers (Costello 2020). We also expand the research scope of government procurement literature, which mainly focuses on the ex ante bidding and contracting features of procurement contracts (Mironov and Zhuravskaya 2016; Palguta and Pertold 2017; Coviello and Gagliarducci 2017; Decarolis et al. 2020; Lewis-Faupel et al. 2016; Brogaard, Denes, and Duchin 2021). While these studies highlight the lucrativeness and benefits of government contracts ex ante, our paper demonstrates the potential risks and downsides of doing business with indebted governments regarding ex post payments.

Our paper underscores the complexity of deleveraging policies in the context of financial distortions and weak legal institutions. A sustainable deleveraging policy, therefore, requires leveling the playing field between SOEs and non-SOEs, which includes improving judiciary independence and legal institutions. Furthermore, our results show that shocks in the public sector can be amplified through firms’ business relationships with the government, thus leading to worse corporate performance and potentially amplifying boom-bust cycles in the economy at large. These results have general implications for other countries facing government debt problems, fiscal austerity, and sovereign default risks. We leave these topics for future research.

References

Allen, Franklin, Junhui Cai, Xian Gu, Jun Qian, Linda Zhao, and Wu Zhu. 2022. “Centralization or Decentralization? The Evolution of State-Ownership in China.” Social Science Research Network Working Paper 4283197. https://dx.doi.org/10.2139/ssrn.4283197.

Ang, Andrew, Jennie Bai, and Hao Zhou. 2023. “The Great Wall of Debt: Real Estate, Political Risk, and Chinese Local Government Financing Cost.” Journal of Finance and Data Science 9: 100098. https://doi.org/10.1016/j.jfds.2023.100098.

Boissay, Frederic, and Reint Gropp. 2013. “Payment Defaults and Interfirm Liquidity Provision.” Review of Finance 17 (6): 1853–94. https://doi.org/10.1093/rof/rfs045.

Brogaard, Jonathan, Matthew Denes, and Ran Duchin. 2021. “Political Influence and the Renegotiation of Government Contracts.” Review of Financial Studies 34 (6): 3095–3137. https://doi.org/10.1093/rfs/hhaa093.

Brunnermeier, Markus K., Michael Sockin, and Wei Xiong. 2022. “China’s Model of Managing the Financial System.” Review of Economic Studies 89 (6): 3115–53. https://doi.org/10.1093/restud/rdab098.

Chen, Kaiji, Jue Ren, and Tao Zha. 2018. “The Nexus of Monetary Policy and Shadow Banking in China.” American Economic Review 108 (12): 3891–936. https://doi.org/10.1257/aer.20170133.

Chen, Zhuo, Zhiguo He, and Chun Liu. 2020. “The Financing of Local Government in China: Stimulus Loan Wanes and Shadow Banking Waxes.” Journal of Financial Economics 137 (1): 42–71. https://doi.org/10.1016/j.jfineco.2019.07.009.

Costello, Anna M. 2020. “Credit Market Disruptions and Liquidity Spillover Effects in the Supply Chain.” Journal of Political Economy 128 (9): 3434–68. https://doi.org/10.1086/708736.

Coviello, Decio, and Stefano Gagliarducci. 2017. “Tenure in Office and Public Procurement.” American Economic Journal: Economic Policy 9 (3): 59–105. https://doi.org/10.1257/pol.20150426.

Decarolis, Francesco, Raymond Fisman, Paolo Pinotti, and Silvia Vannutelli. 2020. “Rules, Discretion, and Corruption in Procurement: Evidence from Italian Government Contracting.” National Bureau of Economic Research Working Paper No. 28209. https://doi.org/10.3386/w28209.

Fang, Hanming, Jing Wu, Rongjie Zhang, and Li-An Zhou. 2022. “Understanding the Resurgence of the SOEs in China: Evidence from the Real Estate Sector.” National Bureau of Economic Research Working Paper No. 29688. https://doi.org/10.3386/w29688.

Hu, Jiayin, Songrui Liu, Yang Yao, and Zhu Zong. 2022. “Government Deleveraging and Non-SOE Liquidity Squeeze: Evidence from Subnational Debt and Government Contractors.” Social Science Research Network Working Paper 4296428. https://doi.org/10.2139/ssrn.4296428.

Huang, Yi, Marco Pagano, and Ugo Panizza. 2020. “Local Crowding-Out in China.” The Journal of Finance 75 (6): 2855–98. https://doi.org/10.1111/jofi.12966.

Jacobson, Tor, and Erik von Schedvin. 2015. “Trade Credit and the Propagation of Corporate Failure: An Empirical Analysis.” Econometrica 83 (4): 1315–71. https://doi.org/10.3982/ECTA12148.

Lewis-Faupel, Sean, Yusuf Neggers, Benjamin A. Olken, and Rohini Pande. 2016. “Can Electronic Procurement Improve Infrastructure Provision? Evidence from Public Works in India and Indonesia.” American Economic Journal: Economic Policy 8 (3): 258–83. https://doi.org/10.1257/pol.20140258.

Maksimovic, Vojislav, and Youngsuk Yook. 2022. “Trade Credit, Demand Shocks, and Liquidity Management.” Social Science Research Network Working Paper 4294190. https://doi.org/10.2139/ssrn.4294190.

Mironov, Maxim, and Ekaterina Zhuravskaya. 2016. “Corruption in Procurement and the Political Cycle in Tunneling: Evidence from Financial Transactions Data.” American Economic Journal: Economic Policy 8 (2): 287–321. https://doi.org/10.1257/pol.20140188.

Murfin, Justin, and Ken Njoroge. 2014. “The Implicit Costs of Trade Credit Borrowing by Large Firms.” Review of Financial Studies 28 (1): 112–145. https://doi.org/10.1093/rfs/hhu051.

Palguta, Ján, and Filip Pertold. 2017. “Manipulation of Procurement Contracts: Evidence from the Introduction of Discretionary Thresholds.” American Economic Journal: Economic Policy 9 (2): 293–315. https://doi.org/10.1257/pol.20150511.

Xiong, Wei. 2018. “The Mandarin Model of Growth.” National Bureau of Economic Research Working Paper No. 25296. https://doi.org/10.3386/w25296.

Latest

Most Popular

- VoxChina Covid-19 Forum (Second Edition): China’s Post-Lockdown Economic Recovery VoxChina, Apr 18, 2020

- China’s Great Housing Boom Kaiji Chen, Yi Wen, Oct 11, 2017

- China’s Joint Venture Policy and the International Transfer of Technology Kun Jiang, Wolfgang Keller, Larry D. Qiu, William Ridley, Feb 06, 2019

- The Dark Side of the Chinese Fiscal Stimulus: Evidence from Local Government Debt Yi Huang, Marco Pagano, Ugo Panizza, Jun 28, 2017

- Wealth Redistribution in the Chinese Stock Market: the Role of Bubbles and Crashes Li An, Jiangze Bian, Dong Lou, Donghui Shi, Jul 01, 2020

- Evaluating Risk across Chinese Housing Markets Yongheng Deng, Joseph Gyourko, Jing Wu, Aug 02, 2017

- What Is Special about China’s Housing Boom? Edward L. Glaeser, Wei Huang, Yueran Ma, Andrei Shleifer, Jun 20, 2017

- Privatization and Productivity in China Yuyu Chen, Mitsuru Igami, Masayuki Sawada, Mo Xiao, Jan 31, 2018

- How did China Move Up the Global Value Chains? Hiau Looi Kee, Heiwai Tang, Aug 30, 2017

- China’s Shadow Banking Sector: Wealth Management Products and Issuing Banks Viral V. Acharya, Jun Qian, Zhishu Yang, Aug 09, 2017

Facebook

Facebook  Twitter

Twitter  Instagram

Instagram WeChat

WeChat  Email

Email