Picking Winners? Government Subsidies and Firm Productivity in China

We investigate the relationship between the allocation of government subsidies and total factor productivity for Chinese listed firms. We find little evidence that the Chinese government consistently “picks winners.” Firms’ ex ante productivity is negatively correlated with subsidies received by firms, and subsidies appear to have a negative impact on firms’ ex post productivity growth throughout our data window, 2007 to 2018. These findings suggest that China’s increasingly prescriptive industrial policies may have had limited success in promoting productivity.

Each year, governments worldwide spend an enormous amount of money subsidizing businesses. The principal economic rationale for these policies is to address a market failure (Schwartz and Clements 1999). The problem, however, is that giving firms taxpayers’ money is often not an effective remedy for market failures. Misdirected government subsidies can actually cause even more market distortions. As Paul Krugman (1983) noted, “… in economics two wrongs do not make a right.”

In a recent working paper (Branstetter, Li, and Ren 2022), we try to peek into the black box of government subsidies to businesses in the context of China. These subsidies have caused considerable controversy, both internationally and domestically. Many countries have criticized China for playing favorites with indigenous Chinese firms when giving out subsidies (Haley and Haley 2013). They argue that Chinese governments’ preference for indigenous firms gives them an unfair advantage over foreign companies in the race to dominate the technological frontier of the future. Within China itself, government subsidies to firms remain equally controversial. While supporters argue that corporate subsidies are necessary for China to upgrade its industries, critics say that the Chinese government’s strong preference for large, state-owned enterprises and national champions puts private companies as well as small and midsize enterprises at a disadvantage.

We try to shed light on these debates by exploiting a heretofore underutilized source of firm-level data. Since 2007, companies listed on China’s stock exchanges have been required to disclose all direct government subsidies received, along with a brief description of the nature of these subsidies. Using Google BERT, along with manual validation, we categorize these subsidies into seven groups according to the text in the annual reports describing their purpose. We then relate these subsidies to firms’ productivity and other firm-level characteristics. Specifically, we explore the following questions:

1) Which firms are more likely to get higher subsidies—those with higher productivity or lower productivity?2) Does the receipt of subsidies, especially those related to R&D and innovation or industrial and equipment upgrading, raise firms’ productivity in subsequent years?

3)Alternatively, does the receipt of subsidies raise employment?

Method

We conduct a two-stage analysis: in the first stage, we estimate standard Cobb-Douglas production functions separately by industry, and compute total factor productivity (TFP) for each firm in each year. In the second stage, we seek to understand the relationship between government subsidies and firm productivity in China by running the following regressions:

1)To explore which firms are likely to get more subsidies, we regress subsidies received by listed firms in each year on lagged TFP estimates and control for other firm characteristics that might be important determinants of subsidy allocation.

2)To investigate whether receipt of a subsidy improves the receiving firm’s ex post productivity or employment, we regress TFP and employment on subsidies received by the firm in the most recent three years, controlling for factors that might affect these measures as well as firm and year fixed effects.

Findings

1.General picture

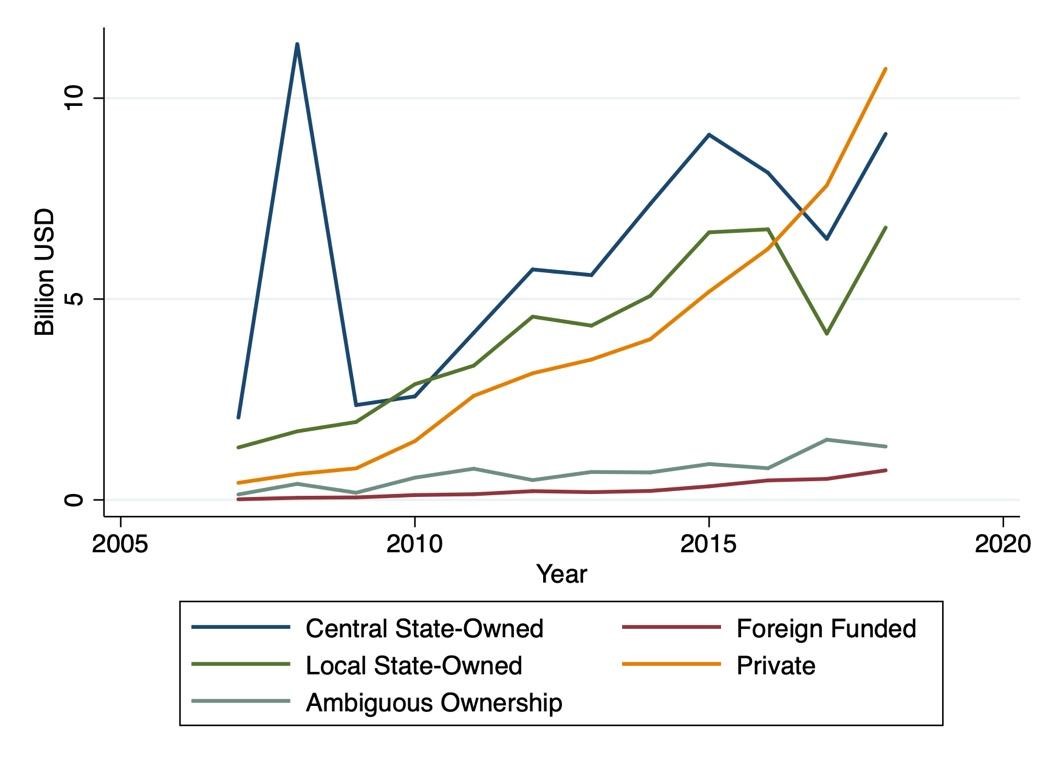

Figure 1 shows the direct subsidy distribution of our sample by firm ownership types. The surge in subsidies to state-owned enterprises in 2008 reflects part of the Chinese government’s aggressive fiscal response to the beginning of the global financial crisis (Lardy 2019). As one can see, government subsidies have generally increased over the past decade, the bulge in 2008 notwithstanding.

Figure 1. Direct Subsidy Distribution by Firm Ownership Over Time

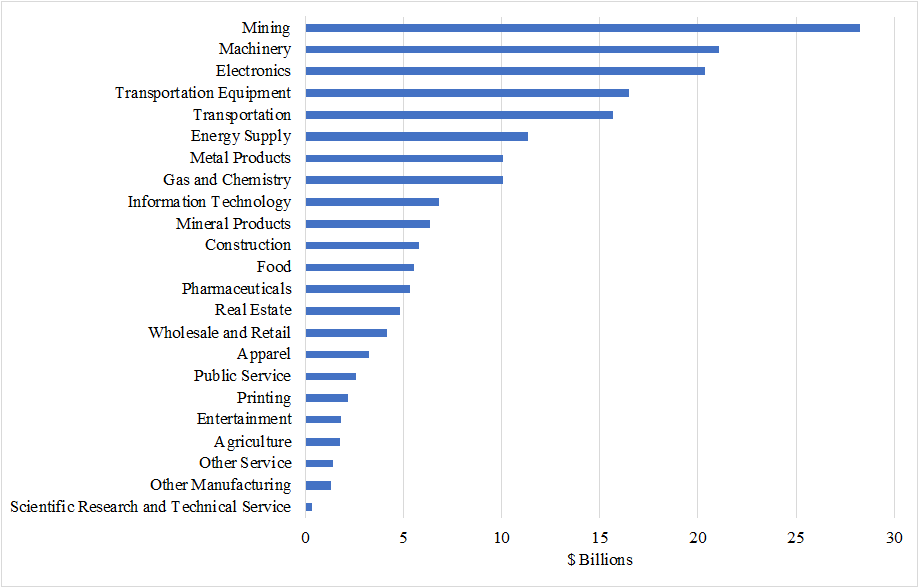

Figure 2 shows the total subsidy received by firms in broadly defined industries, ranked from highest to lowest.

Figure 2. Total (Direct) Subsidies Received by Industries from 2007 to 2018

2.Regression results

Are firms with higher productivity more likely to get more subsidies? The answer is no. In general, we find a negative correlation between subsidies and lagged TFP that is statistically significant at the 5% level in most specifications. There appears to be a robust positive correlation between subsidies and firm size, as measured by the firm’s total assets. The relationship between subsidies and net profit is also positive and significant at the 5% significance level for private firms. These results suggest that, overall, subsidies are given to larger and more profitable, but less productive firms.

Further digging into this question by regressing different types of subsidies on TFP and other firm characteristics, we find that subsidies given out under the name of R&D, innovation promotion, and industrial and equipment upgrading appear to be positively associated with lagged total assets, lagged net profit, and lagged employment, but not lagged TFP.

Is receiving a subsidy correlated with subsequent growth in recorded TFP? The answer is no. At a total subsidy level, subsidies appear to have a negative and statistically significant impact on TFP. Across different subsidy types, it appears that even subsidies that are closely related to productivity, i.e., R&D, innovation promotion, and industrial and equipment upgrading subsidies, do not contribute to productivity growth.

Is receiving a subsidy correlated with an increase in employment? The answer is complicated. Current subsidies appear to have a positive impact on current employment levels while one-year lagged subsidies seem to have a negative impact, potentially indicating that firms might be strategically manipulating employment numbers to get subsidies—temporarily increasing hiring during the period of receiving subsidies and then cutting back during the next period. Using employment stabilization and promotion subsidies as a dependent variable, we find that while one-year lagged employment stabilization and promotion-related subsidies are no longer statistically significant, current employment stabilization and promotion-related subsidies’ positive effect remains significant at the 5% level.

Conclusion

We find little evidence that the Chinese government picks winners. Subsidies tend to flow to less productive firms rather than more productive firms. Overall, the receipt of direct government subsidies is negatively correlated with subsequent firm productivity growth over the course of our data window, 2007 to 2018. Even subsidies given out by government in the name of R&D, innovation promotion, or industrial and equipment upgrading show no statistically significant positive effect on subsequent firm productivity growth. There is more robust evidence that subsidies support slightly higher levels of employment, at least temporarily. This is consistent with the view that political and social considerations might outweigh efficiency considerations in the allocation of direct subsidies in China. In the long run, this approach is unlikely to promote the kind of significant productivity improvements the Chinese economy will need to maintain growth in the face of an aging population, a declining workforce, and mounting evidence of diminishing returns to capital investment.

References

Branstetter, Lee G., Guangwei Li, and Mengjia Ren. 2022. “Picking Winners? Government Subsidies and Firm Productivity in China.” NBER Working Paper No. 30699. https://doi.org/10.3386/w30699.

Haley, Usha C. V., and George T. Haley. 2013. Subsidies to Chinese Industry: State Capitalism, Business Strategy, and Trade Policy. New York: Oxford University Press.

Krugman, Paul R. 1983. “Targeted Industrial Policies: Theory and Evidence.” Proceedings of the Jackson Hole Economic Policy Symposium, Jackson Hole, Wyoming: 123–55. https://www.kansascityfed.org/Jackson%20Hole/documents/3913/1983-S83KRUGM.pdf.

Lardy, Nicholas R. 2019. The State Strikes Back: The End of Economic Reform in China? Washington, DC: Peterson Institute for International Economics.

Schwartz, Gerd, and Benedict Clements. 1999. “Government Subsidies.” Journal of Economic Surveys 13 (2): 119–48. https://doi.org/10.1111/1467-6419.00079.

Latest

Most Popular

- VoxChina Covid-19 Forum (Second Edition): China’s Post-Lockdown Economic Recovery VoxChina, Apr 18, 2020

- China’s Great Housing Boom Kaiji Chen, Yi Wen, Oct 11, 2017

- China’s Joint Venture Policy and the International Transfer of Technology Kun Jiang, Wolfgang Keller, Larry D. Qiu, William Ridley, Feb 06, 2019

- The Dark Side of the Chinese Fiscal Stimulus: Evidence from Local Government Debt Yi Huang, Marco Pagano, Ugo Panizza, Jun 28, 2017

- Wealth Redistribution in the Chinese Stock Market: the Role of Bubbles and Crashes Li An, Jiangze Bian, Dong Lou, Donghui Shi, Jul 01, 2020

- What Is Special about China’s Housing Boom? Edward L. Glaeser, Wei Huang, Yueran Ma, Andrei Shleifer, Jun 20, 2017

- Evaluating Risk across Chinese Housing Markets Yongheng Deng, Joseph Gyourko, Jing Wu, Aug 02, 2017

- Privatization and Productivity in China Yuyu Chen, Mitsuru Igami, Masayuki Sawada, Mo Xiao, Jan 31, 2018

- How did China Move Up the Global Value Chains? Hiau Looi Kee, Heiwai Tang, Aug 30, 2017

- China’s Shadow Banking Sector: Wealth Management Products and Issuing Banks Viral V. Acharya, Jun Qian, Zhishu Yang, Aug 09, 2017

Facebook

Facebook  Twitter

Twitter  Instagram

Instagram WeChat

WeChat  Email

Email