Government-Directed Urban Growth, Firm Entry, and Industrial Land Prices in Chinese Cities

We examine the effect of large-scale administrative reorganization in China, where counties are annexed into cities to accommodate urban growth. Using nationwide data on land-lease transactions, we find that annexation raises industrial land prices in the annexed counties by 7%, but does not reduce land prices in neighboring counties and central cities. We show that the annexed counties experience increases in firm entry and investment, offering a plausible mechanism for the effect on industrial land prices.

Many countries, both developed and developing, are experiencing rapid urban expansion. In some societies, this phenomenon is referred to as “urban sprawl” with negative connotations, because unconstrained expansion of cities is believed to have undesirable consequences. For this reason, many governments have tried to curb urban growth by charging development impact fees, setting urban growth boundaries, or implementing other policies.

In this study, we draw attention to a different role of government in the urbanization process: guiding and facilitating urban expansion via annexation. We highlight this practice in the context of China. China has five levels of government: national, provincial, prefectural, county/district, and township. Prefectures consist of a central city, which is divided into municipal districts, and surrounding counties. County governments have more autonomy compared to municipal districts, but municipal districts have a stronger financial relationship with the prefecture government in the central city. In the past three decades, central cities have experienced rapid population and economic growth. One way to accommodate this growth has been through the annexation of counties into central cities, which has become a salient feature of China’s urbanization process during the past two decades. Annexation plans must be approved by the provincial government and the State Council, and we therefore refer to this expansion through approved annexation as government-directed urban growth.

As one would expect, annexation is not simply a reassignment of jurisdictional authority and responsibilities; it also signals the direction of future development. Consider the decision process of a potential entrepreneur who is weighing the pros and cons of starting a manufacturing firm in a specific suburban county. While setting up the firm now has the advantage of making some profit right away, it is taking a substantial risk. If future urban development mainly happens in an alternative suburban county, committing the investment now gets the firm stuck in an unfavorable location. Therefore, postponing the business investment has some option value and is particularly attractive when there is uncertainty about future urban growth. In a situation like this, annexation of a suburban county into the central city provides a strong signal that future urban expansion is most likely to occur in the annexed county. This reduces uncertainty and induces entrepreneurs to immediately invest in the annexed county. In a sense, annexation acts like a “development guarantee,” implying that demand for industrial land will increase in the annexed county right after the annexation, with more firm births and new investment observed. In this paper, we empirically verify these predictions.

We use data from various sources. Public information from the website of China’s Ministry of Civil Affairs indicates which cities have annexed which counties at what times. Data on industrial land parcels and lease transactions are scraped from the LandChina website maintained by Ministry of Natural Resources. We also use data from statistical yearbooks and the State Administration for Market Regulation as controls and for ancillary analysis. Availability of land lease transactions data and gradual annexation of counties in the 2010s dictate that we focus our analysis on the 2010–2019 period.

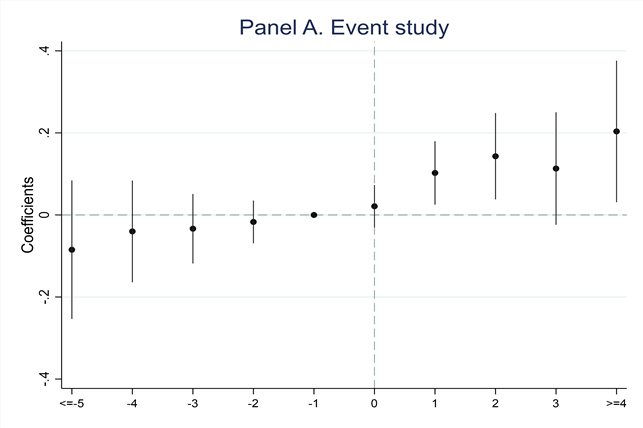

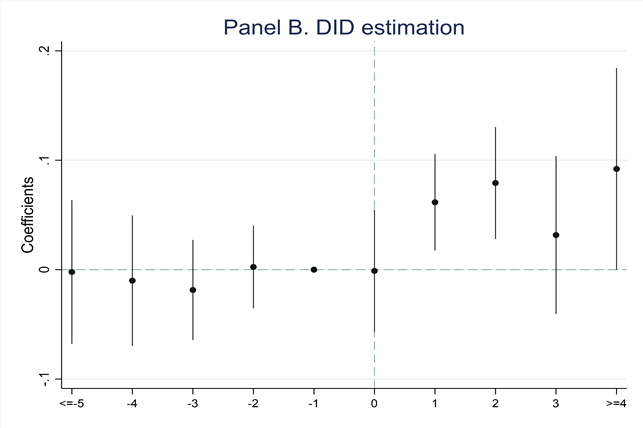

Figure 1: Dynamic effects of annexation on industrial land prices

Notes: This figure plots the coefficients of year distance indicators in the land price regressions, using one year prior to annexation as the reference year. The dots represent the values of estimated coefficients, and the vertical lines represent the 95 percent confidence intervals. Panels A and B plot the coefficients of year-distance indicators estimated from the event study using observations from the treated counties and, alternatively, the DID approach using observations from both the treated and control counties, respectively.

We first look at how annexation affects industrial land prices, applying two different approaches. First, we use data from the annexed county only and identify the effect by comparing industrial land prices before and after annexation. Second, we employ a difference-in-differences method, using as controls counties that are adjacent to the central city but not annexed. Here we identify the effect of annexation by comparing the changes in industrial land prices in treated (i.e., annexed) vs. control counties before and after the annexation. These two methods produce quite similar estimates. Both show that annexation raises industrial land prices in the annexed counties by about 7%. Figure 1 shows the dynamic effects of annexation on industrial land prices in different years relative to the event year, with panels A and B corresponding to the two different approaches.

Using the same specifications, we further show that annexed counties also experience increases in firm births and fixed-asset investments, offering a plausible mechanism for the effect on industrial land prices. That is, as we hypothesized, annexation induces business entries, which in turn bid up industrial land prices. One naturally wonders whether the annexed counties benefitted at the cost of competing regions. Using similar specifications, we find that annexation does not reduce industrial land prices in neighboring counties or central cities. This suggests that the effect in annexed counties represents a net increase in economic activities (due to reduced uncertainty) rather than a relocation of economic activities.

We perform a range of ancillary analysis to explore heterogeneity and probe mechanisms behind our findings. Most interestingly, we find that the effect of annexation on industrial land prices is more pronounced if the central city has a larger economy, or a higher economic or population density. We also show that higher land prices are not due to a differential use of land lease auctions, which were adopted in both annexed and control counties, in step with a national reform.

Our land transaction dataset provides a wealth of information to examine the impacts of government-directed urban expansion in China. Similar urban growth policies are widely used across developing countries but have been understudied in the literature. Our results offer a comprehensive picture of how directed urban growth affects local industrial development in a large and important country. Nevertheless, there is still much more to be done. For instance, it would be useful to determine what specifically encouraged firm entry in annexed counties. While our motivating model emphasizes the benefits of expected infrastructure improvement and reduced uncertainty following annexation, alternative explanations exist. It is also possible that entrepreneurs anticipate enhanced agglomeration economies (resulting from better-coordinated urban and industrial planning after annexation) or an increased labor supply (as a result of the annexed county becoming more attractive to migrants). Empirically disentangling these different channels is likely to be a fruitful investigation, which we leave for future research.

References

https://wordpress.clarku.edu/juzhang/files/2023/03/DUGDraft3-14-23.pdf.

Latest

Most Popular

- VoxChina Covid-19 Forum (Second Edition): China’s Post-Lockdown Economic Recovery VoxChina, Apr 18, 2020

- China’s Great Housing Boom Kaiji Chen, Yi Wen, Oct 11, 2017

- China’s Joint Venture Policy and the International Transfer of Technology Kun Jiang, Wolfgang Keller, Larry D. Qiu, William Ridley, Feb 06, 2019

- The Dark Side of the Chinese Fiscal Stimulus: Evidence from Local Government Debt Yi Huang, Marco Pagano, Ugo Panizza, Jun 28, 2017

- Wealth Redistribution in the Chinese Stock Market: the Role of Bubbles and Crashes Li An, Jiangze Bian, Dong Lou, Donghui Shi, Jul 01, 2020

- Evaluating Risk across Chinese Housing Markets Yongheng Deng, Joseph Gyourko, Jing Wu, Aug 02, 2017

- What Is Special about China’s Housing Boom? Edward L. Glaeser, Wei Huang, Yueran Ma, Andrei Shleifer, Jun 20, 2017

- Privatization and Productivity in China Yuyu Chen, Mitsuru Igami, Masayuki Sawada, Mo Xiao, Jan 31, 2018

- How did China Move Up the Global Value Chains? Hiau Looi Kee, Heiwai Tang, Aug 30, 2017

- China’s Shadow Banking Sector: Wealth Management Products and Issuing Banks Viral V. Acharya, Jun Qian, Zhishu Yang, Aug 09, 2017

Facebook

Facebook  Twitter

Twitter  Instagram

Instagram WeChat

WeChat  Email

Email