From Wall Street to Hong Kong:The Value of Dual Listing for China Concept Stocks

The recent cross-border regulation tensions between the US and China have exposed many US-listed China Concepts Stocks to substantial delisting risks, forcing them to pursue dual listings on the Hong Kong Stock Exchange. We quantify the economic value of dual-listing, using the SEC’s adoption of the final amendments implementing mandates of the Holding Foreign Companies Accountable Act on December 2, 2021, as a natural experiment. We estimate that CCS with pre-shock dual-listing status on average have 14.88% higher returns than their peers listed only on the US exchanges during a three-month period after the shock, which equals a USD 8 billion increase in market capitalization relative to the average market capitalization of USD 54 billion.

The US equity market has long been regarded as the best venue for foreign firms to list their shares overseas. Academics, as well as practitioners, have argued that listing in the US offers foreign firms many benefits such as lower capital costs, a larger shareholder base, better investor protection, higher liquidity, and prestige (see, e.g., Reese and Weisbach 2002; Tsang, Yang, and Zheng 2022). In contrast to these well-documented benefits, the costs of listing in the US, mainly considered to be regulatory burdens of the US Securities and Exchange Commission (SEC) reporting and compliance requirements, are often viewed as negligible.

The recent tension between US and Chinese regulators over the inspection of auditors for China-based issuers in the US capital market highlights a novel but important regulatory risk faced by foreign companies. The key dispute is centered on whether the Public Company Accounting Oversight Board (PCAOB), with authorization from the Sarbanes-Oxley Act (SOX) of 2002, can inspect China-based audit firms located in their home jurisdictions, where granting access to the PCAOB would be regarded as a breach of national sovereignty and in conflicts with local laws. After years of unsuccessful negotiations between the two countries’ regulators, the Holding Foreign Companies Accountable Act (HFCAA) was finally passed and signed into law by President Donald Trump on December 18, 2020, followed by the SEC’s release of the final amendments implementing the HFCAA mandates on December 2, 2021. Under the law, US-listed Chinese companies would be banned from trading and eventually delisted from US exchanges if the PCAOB were not able to conduct on-site inspection and have full access to audit working papers for three consecutive years.

Partially in response to these regulatory conflicts and to compete with global exchanges, the Hong Kong Stock Exchange (HKEX) made a series of reforms on its listing rules, with the first and most important of these taking effect on April 30, 2018. These reforms greatly relax the HKEX’s original listing requirements on firm size, profit, and voting rights structure, and establish a secondary listing route for Chinese Concepts Stocks (CCS) listed on US exchanges. As a result, many US-listed Chinese issuers began to seek dual-listings status on HKEX to mitigate the potential negative shock if they were delisted from US exchanges.

In our paper, Chen, Hu, Xi, and Zhu (2022), we quantify the economic value of HKEX dual-listing status. Specifically, we follow a difference-in-differences approach that estimates the return difference between US-listed CCS with and without the HKEX dual-listing status around the SEC’s final amendments implementing mandates of the HFCAA on December 2, 2021. We further employ multiple approaches to address the endogeneity concern that dual-listed CCS may be fundamentally different from US-listed-only CCS. Lastly, while dual-listed CCS perform better than those US-listed-only peers, they still underperform similar HK-listed-only stocks, underscoring the detrimental effects of the SEC’s policy shock on the market value of CCS despite their Hong Kong backup.

Chinese Concepts StocksAlong with China’s phenomenal economic growth in the past three decades, Chinese companies have emerged as important players in the global capital markets. Due to stringent IPO requirements in the domestic China A-share market, among other reasons, many Chinese firms have chosen to list their equity shares overseas, mostly in Hong Kong and the United States. Despite occasional ups and downs, there is a general upward trend in CCS IPOs over the past two decades. Since the first overseas IPO by the Chinese firm Brilliance China Automotive in 1992, CCS have successfully raised more than USD 500 billion overseas as of 2021/12.

U.S.-China Cross-Border RegulationIn response to a number of major corporate and accounting scandals, the PCAOB was created in 2002 as one of the regulatory consequences of the Sarbanes-Oxley Act. As a nonprofit corporation under the guidance and approval of the SEC, the primary responsibility of the PCAOB is to oversee auditors of public companies. Over the past two decades, the PCAOB has reached cooperative agreements with regulators in more than 50 foreign jurisdictions. These agreements allow the PCAOB and foreign regulators to conduct on-site inspections and request audit working papers of public companies that are listed on each other’s exchanges. However, after years of negotiation, the PCAOB has been unable to reach cooperative agreements with mainland China and Hong Kong (to the extent that audit clients operate in mainland China), which eventually triggered the delisting crisis of US-listed CCS starting from 2020.

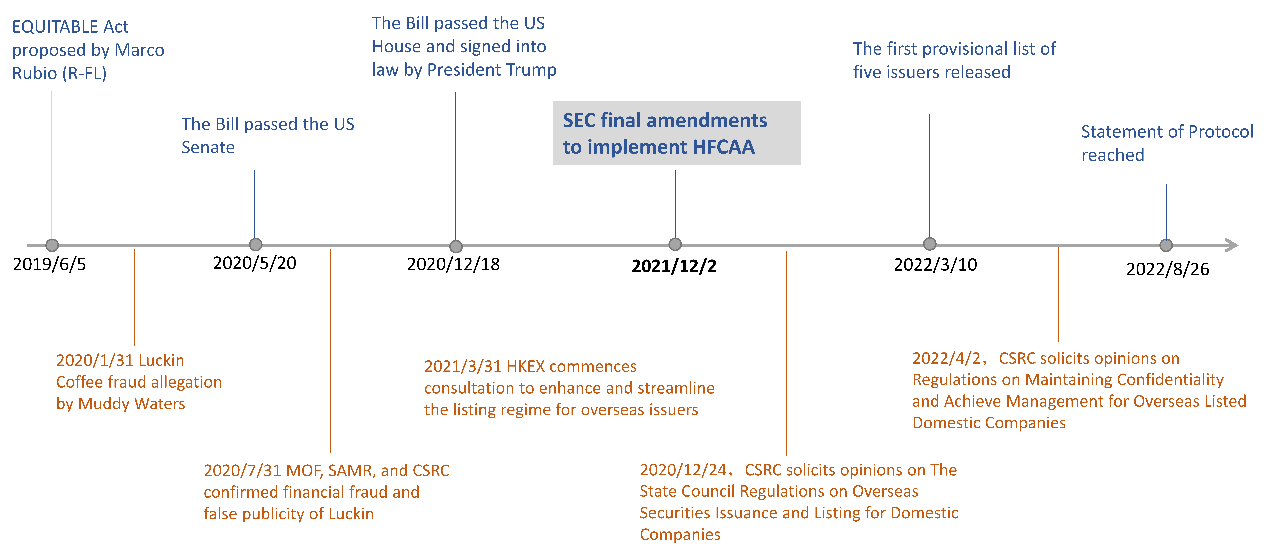

Amid a backdrop of increasingly heightened scrutiny of US-listed Chinese companies, the HFCAA was proposed to address restrictions China has placed on the PCAOB’s ability to inspect or investigate PCAOB-registered public accounting firms that provide audit services for CCS. Figure 1 presents the timeline of important events regarding the HFCAA. Our policy shock is the SEC announcement of the final amendments of the mandates required by the HFCAA on December 2, 2021. The release of the final amendments indicates that the HFCAA has advanced from the legislative process to the implementation phase, showing a clear schedule to delist Chinese firms from US securities exchanges and the over-the-counter markets by 2024, if not earlier.

Figure 1. Timeline of the HFCAA

In our DID design, the policy shock date is set on 2021/12/2, when the SEC finalized the amendments to implement the HFCAA. Our sample period is from 2021/9/4 to 2022/3/3, a six-month window around the policy shock. The dependent variables are daily cumulative excess returns (CER) or cumulative abnormal returns (CAR). The treated group includes dual-listed CCS as of 2021/12/1, right before the policy shock, and the control group contains US-listed-only CCS. We include daily macro-related control variables, i.e., the TED spread, the Hong Kong Hang Seng Index return, and VIX. We obtain positive and statistically significant dual-listing premia with magnitudes ranging from 8.39% to 14.88% depending on the model specification. In terms of the economic magnitude of our estimates, the estimated dual-listing premium transfers to the market capitalization differences of USD 4.51~8.00 billion and 0.18~0.33 billion for CCS with and without the dual-listing status.

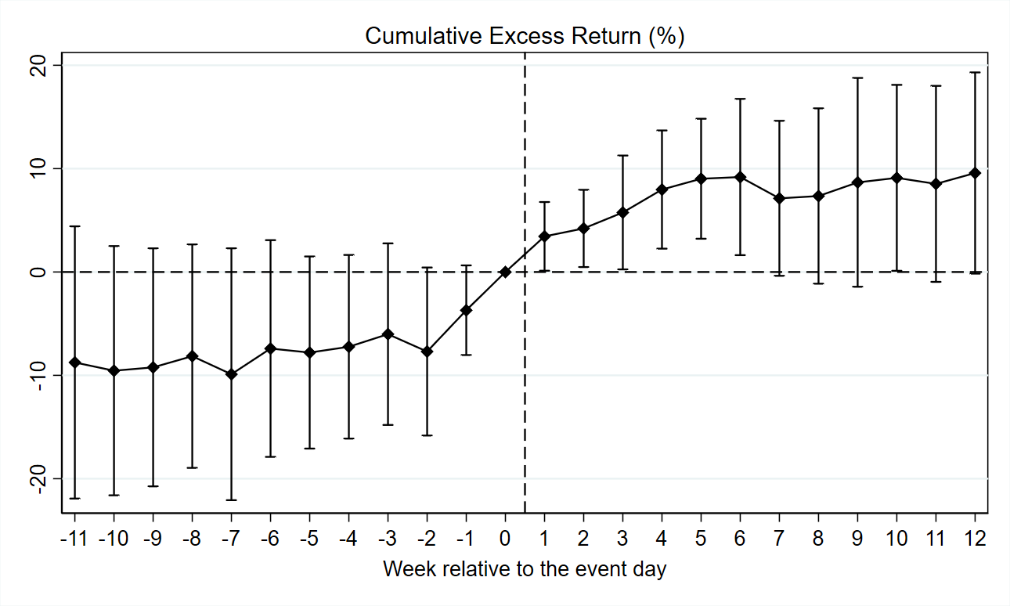

Figure 2: Dynamic treatment effects of the policy shock. This figure plots the estimated coefficients along with their confidence intervals calculated from standard errors clustered by firm in the DID specification. The dependent variable is the cumulative excess return. Treated firms include US-listed CCS with HKEX dual listing as of 2021/12/1 and control firms include US-listed CCS without HKEX dual listing as of 2021/12/1. We add controls including TED spread, the Hong Kong market return, and VIX. The sample period from 2021/9/4 to 2022/3/3 is divided into 22 seven-day subperiods from k = −10 to k = 11 and two subperiods, i.e., k = −11 and k = 12 for the rest. We also add firm fixed effects and three-dimension interactive fixed effects across industry, size, and week. The point estimate immediately before the event date is normalized to zero. The dotted line indicates the event on 2021/12/2.

Figure 2 plots the estimates of dynamic treatment effects along with the associated 95% confidence intervals, where the coefficient immediately before the event date is normalized to zero. After the policy shock that the SEC started implementation of HFCAA, returns for CCS with HKEX dual-listing status are significantly larger than those of US-listed-only ones. The market reaction is instant after the event and becomes even larger several weeks later. Thus, the effect is not transitory or caused by panic-induced selling.

Alternative Treatment and Control GroupsOne obvious endogeneity concern for our exercise is that the HKEX dual-listed CCS are different in nature than those without dual-listing status. As a result, exposures to other unobservable market-wide shocks are larger for the control group and the HFCAA implementation amplifies the difference in sensitivity. To further investigate how such possibility affects our results, we use alternative control and treated groups for the DID estimations.

Specifically, we rely on one useful institutional detail: according to HKEX Listing Rules, only qualified US-listed CCS can seek dual listing, either secondary listing or dual-primary listing, on the Hong Kong exchange. Using these qualification rules, we further divide the control group into two subgroups, i.e., firms that are not HK-listed but qualified for dual listing (Group 2) and firms that are unqualified for dual listing (Group 3); we indicate the treatment group of dual-listed CCS as Group 1.

The results show that Group 1 CCS earn 13.43% larger Fama-French three-factor adjusted returns than Group 2, suggesting that it is indeed the dual-listing status, not some latent firm characteristics, that is valuable for global investors. We also examine the effect of qualification by including both Groups 1 and 2 as treated and Group 3 as control. As expected, we find a smaller magnitude as the value of being qualified is not equivalent to that of already being dual-listed.

Compare with HKEX-Listed-Only CCSLastly, we compare the market performance of dual-listed CCS with similar HKEX-listed-only CCS to examine the impact of the policy shock on the Hong Kong market. For dual-listed CCS, even though their HKEX listing status provides critical protection, losing access to the US capital market would still have a significant impact on them given the central role of the US in the global financial markets. The HKEX-listed-only CCS, on the other hand, are not directly affected by the policy shock since they are not under US jurisdiction. Indeed, we find that the dual-listed CCS perform statistically and economically worse than their matched HKEX-listed-only peers, with a magnitude of -10% to -7% depending on the model specification. That is, while dual-listed CCS experience smaller adverse impact than those listed only in the US market, they still underperform their peers that are listed only on the Hong Kong exchange.

ConclusionWe quantify the economic value of dual listing on international exchanges by exploiting a policy shock targeting US-listed Chinese stocks. We find that those dual-listed CCS have on average 14.88% higher cumulative returns, or USD 8 billion in market capitalization, than their peers without dual-listing status during a three-month period after the policy shock. The results are robust to a battery of confounding effects and subsamples. Our findings underscore the regulatory risk faced by firms listed abroad, a type of risk that is often overlooked in the literature but could have a significant economic impact in the current international context.

References

Carcello, Joseph V., Brian Todd Carver, and Terry L. Neal. 2011. “Market Reaction to the PCAOB’s Inability to Conduct Foreign Inspections.” Working Paper. https://dx.doi.org/10.2139/ssrn.1911388.

Chen, Zhuo, Grace Xing Hu, Ziqiong Xi, and Xiaoquan Zhu. 2022. “From Wall Street to Hong Kong: The Value of Dual Listing for China Concept Stocks.” Working Paper. https://dx.doi.org/10.2139/ssrn.4293637.

Gipper, Brandon, Christian Leuz, and Mark Maffett. 2019. “Public Oversight and Reporting Credibility: Evidence from the PCAOB Audit Inspection Regime.” Review of Financial Studies 33 (10): 4532–79. https://doi.org/10.1093/rfs/hhz149.

Gu, Tracy, Yiqi Jiang, and Dan Simunic. Forthcoming. “The Value of the PCAOB’s International Audit Oversight on US Listed Foreign Companies: Evidence from an Initial Enforcement Breakdown.” Journal of Contemporary Accounting and Economics. https://doi.org/10.1016/j.jcae.2022.100349.

Kim, Yongtae, Lixin Nancy Su, Gaoguang Stephen Zhou, and Xindong Kevin Zhu. 2020. “PCAOB International Inspections and Merger and Acquisition Outcomes.” Journal of Accounting and Economics 70 (1): 101318. https://doi.org/10.1016/j.jacceco.2020.101318.

Reese, William A., and Michael S. Weisbach. 2002. “Protection of Minority Shareholder Interests, Cross-Listings in the United States, and Subsequent Equity Offerings.” Journal of Financial Economics 66 (1): 65–104. https://doi.org/10.1016/S0304-405X(02)00151-4.

Tsang, Albert, Nan Yang, and Lingyi Zheng. 2022. “Cross-Listings, Antitakeover Defenses, and the Insulation Hypothesis.” Journal of Financial Economics 145 (1): 259–76. https://doi.org/10.1016/j.jfineco.2021.08.003.

Latest

Most Popular

- VoxChina Covid-19 Forum (Second Edition): China’s Post-Lockdown Economic Recovery VoxChina, Apr 18, 2020

- China’s Great Housing Boom Kaiji Chen, Yi Wen, Oct 11, 2017

- China’s Joint Venture Policy and the International Transfer of Technology Kun Jiang, Wolfgang Keller, Larry D. Qiu, William Ridley, Feb 06, 2019

- The Dark Side of the Chinese Fiscal Stimulus: Evidence from Local Government Debt Yi Huang, Marco Pagano, Ugo Panizza, Jun 28, 2017

- Wealth Redistribution in the Chinese Stock Market: the Role of Bubbles and Crashes Li An, Jiangze Bian, Dong Lou, Donghui Shi, Jul 01, 2020

- What Is Special about China’s Housing Boom? Edward L. Glaeser, Wei Huang, Yueran Ma, Andrei Shleifer, Jun 20, 2017

- Evaluating Risk across Chinese Housing Markets Yongheng Deng, Joseph Gyourko, Jing Wu, Aug 02, 2017

- Privatization and Productivity in China Yuyu Chen, Mitsuru Igami, Masayuki Sawada, Mo Xiao, Jan 31, 2018

- How did China Move Up the Global Value Chains? Hiau Looi Kee, Heiwai Tang, Aug 30, 2017

- China’s Shadow Banking Sector: Wealth Management Products and Issuing Banks Viral V. Acharya, Jun Qian, Zhishu Yang, Aug 09, 2017

Facebook

Facebook  Twitter

Twitter  Instagram

Instagram WeChat

WeChat  Email

Email