Bond for Employment: Evidence from China

How does labor risk affect corporate bond financing? Using the unique institutional feature of government regulations in China, we provide robust evidence that firms with a larger employment size have significantly better access to bond credit. This effect is more pronounced in times of local labor market deterioration or economic slowdown, for low-skill intensive industries, or in places with career-driven government officials. Our results are not driven by differential financial constraints or information frictions. We further show that the employment bias allocates bond credit toward under-performing large employers and the performance-enhancing benefits of bond issuance diminishes with employment size.

Recent advancement in finance and employment literature (e.g., Adelino, Ma, and Robinson 2017; Chodorow-Reich 2014; Benmelech, Frydman, and Papanikolaou 2019) provides evidence that financial frictions have important consequences on employment. By contrast, due to data limitation, endogeneity considerations, or confounding factors, consensus has not been reached on how labor frictions affect firms’ strategic bargaining or risk hedging motive of financing decisions (e.g., Simintzi, Vig, and Volpin 2015; Lin, Schmid, and Xuan 2018; Favilukis, Lin, and Zhao 2020; Pagano 2020). In our recent working paper (Huang, Lin, and Ye 2022), we aim to examine how, under the unique institutional feature of China’s government regulations, labor risks affect firms’ access to bond credit and the consequence on the real economy.

China’s corporate bond market has experienced explosive growth over the last two decades. Understanding how this rapidly changing and increasingly important market works thus is a research topic of great importance (Chen et al. 2022). A prominent feature of China’s corporate bond market is that, before the implementation of the registration-based system in 2020, bond issuance was subject to direct government approval. As is well-documented in the literature, an important objective of Chinese governments at various levels is to protect employment so as to maintain social stability. Employment concerns have long played a crucial role in shaping resource allocation and economic reform process in China (e.g., Wei and Wang 1997; Lau, Qian, and Roland 2000; Ru 2018; Bai, Liu, and Yao 2020). Meanwhile, studies of the Chinese corporate bond market find large issuance overpricing in China, resulting in substantial savings in interest costs for corporate bond issuers. The yields on high quality (AAA rated) corporate bonds of all types, for example, are even lower than the prime rate on bank loans of comparable maturities (e.g., Lin and Milhaupt 2017; Ding, Xiong, and Zhang 2022). Having access to the corporate bond market is thus a privilege in China.

Motivated by these existing findings, we investigate whether, ceteris paribus, governments tilt bond issuance approvals toward firms with a large employment size to help achieve their social objectives. In addition, we explore whether employment concerns matter more for issuance during periods of worsening labor market conditions or economic slowdowns, in industries with a higher concentration of low-skilled workers, or in places where government officials have a stronger career incentive. Moreover, we are also interested in examining whether such political economy considerations bias the efficiency of bond credit allocation.

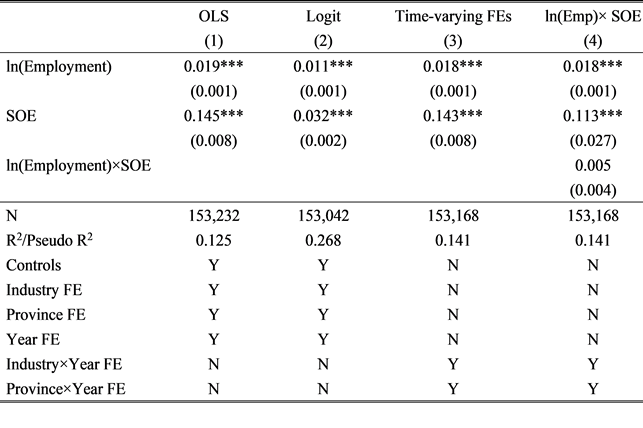

To carry out our empirical analysis, we manually merged two databases—the Dealogic database and the China part of the Orbis database—to construct a large firm-year panel that covers the years 2006 to 2015. Table 1 reports our basic results. The dependent variable is a binary indicator that takes on the value of one if a firm had bond issuance in a certain year, and zero otherwise. Regardless of the empirical specifications used, the estimated coefficient on employment (in natural log) is always positive and statistically significant at the 1% level, indicating indicate that firms with a larger employment size have a significantly higher likelihood of bond issuance. A battery of sensitivity analyses suggest that our finding is unlikely to be driven by a demand effect (i.e., firms with a large employment have a higher demand for bond issuance due to the existence of fixed issuing cost or better growth opportunities). We show that our result is neither due to firm-level difference in ownership type, asset size, financial constraints, or growth opportunity, nor induced by various shocks at the national, provincial or industry level.

Table 1. Basic Results

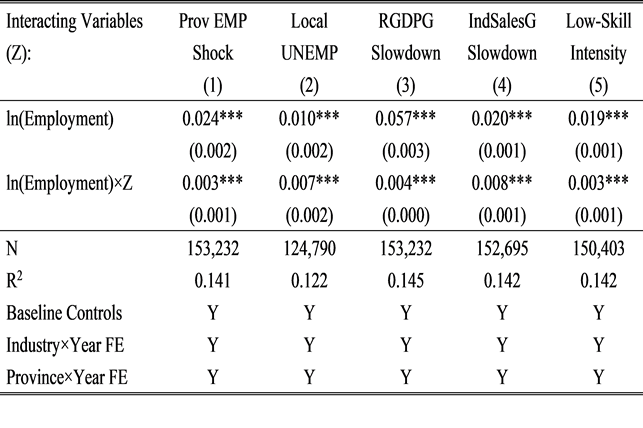

To provide more support to the political economy determinant of bond issuance, we also explore a set of heterogeneities in the employment effect. Relying on a Bartik-type local employment shock and various indicators of local economic conditions, we show in Table 2 that the effect of employment is more pronounced when local labor market conditions deteriorate (columns 1 and 2), when economic growth slows (columns 3 and 4), and in industries with a higher concentration of low-skilled workers (column 5). We also provide evidence that the effect of employment is stronger in prefectures where local government officials have a stronger career incentive to maintain social stability.

Table 2. Exploring

Heterogeneity

Next, we make efforts to further rule out the possibility that our finding of the employment’s effect on bond issuance may be driven by the differential financial constraints or information frictions faced by firms. Our results suggest that neither financial nor information frictions account for employment bias in corporate bond issuance.

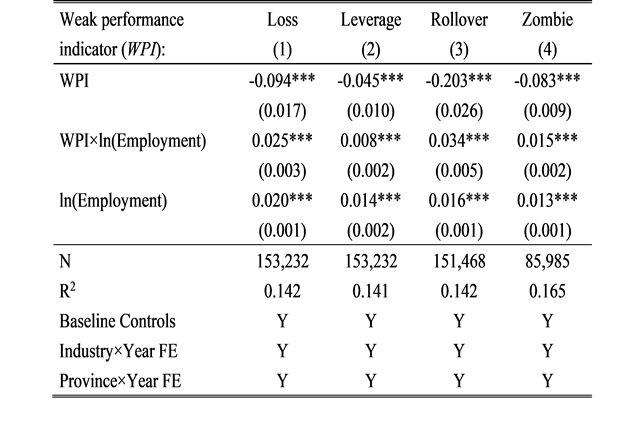

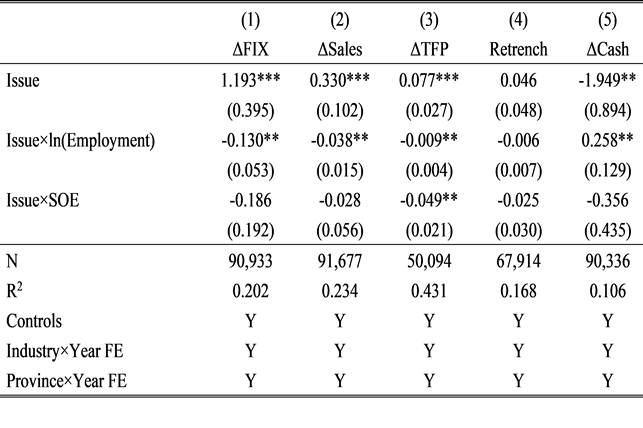

Finally, we investigate the potential implications for the efficiency of financial resource allocation associated with employment favoritism in bond issuance. We first document that firms with a larger employment size are associated with a significantly lower total factor productivity. Our analysis of firms’ pre-issuance performance in Table 3 further demonstrates that underperforming firms can have a higher chance of bond issuance as long as their employment size is sufficiently large. Moreover, our assessment of firms’ post-issuance performance based on the matched sample in Table 4 also indicates that the beneficial effects of bond issuance on firm’s investment, sales, and productivity are significantly attenuated for large employers and that larger employers are more likely to hoard cash following bond issuance. We take these results as being indicative of potential inefficiency in bond credit allocation arising from employment favoritism in bond issuance.

Table 3. Underperformance, Employment, and the Likelihood of Issuance

Table 4. Post-Issuance Performance in a Matched Sample

From a policy perspective, our evidence indicates that, under the approval system, government political considerations of employment protection can be an important determinant of firms’ access to bond financing in China. Furthermore, employment favoritism in bond issuance results in inefficiency in bond credit allocation.

(Yi Huang, Fudan University; Shu Lin, Chinese University of Hong Kong; Haichun Ye, Chinese University of Hong Kong, Shenzhen)

References

Adelino, Manuel, Song Ma, and David Robinson. 2017. “Firm Age, Investment Opportunities, and Job Creation.” Journal of Finance 72: 999–1038. https://doi.org/10.1111/jofi.12495.

Bai, Chong-En, Qing Liu, and Wen Yao. 2020. “Earnings Inequality and China’s Preferential Lending Policy.” Journal of Development Economics 145: 102477. https://doi.org/10.1016/j.jdeveco.2020.102477.

Benmelech, Efraim, Carola Frydman, and Dimitris Papanikolaou. 2019. “Financial Frictions and Employment during the Great Depression.” Journal of Financial Economics 133 (3): 541–63. https://doi.org/10.1016/j.jfineco.2019.02.005.

Chen, Hui, Zhuo Chen, Zhiguo He, Jinyu Liu, and Rengming Xie. 2022. “Pledgeability and Asset Prices: Evidence from the Chinese Corporate Bond Markets.” SSRN Working Paper. http://dx.doi.org/10.2139/ssrn.3295202

Chodorow-Reich, Gabriel. 2014. “The Employment Effects of Credit Market Disruptions: Firm-Level Evidence from the 2008–9 Financial Crisis.” Quarterly Journal of Economics 129 (1): 1–59. https://doi.org/10.1093/qje/qjt031,

Ding, Yi, Wei Xiong, and Jinfan Zhang. 2022. “Issuance Overpricing in China’s Corporate Bond Market.” Journal of Financial Economics 144 (1): 328–46. https://doi.org/10.1016/j.jfineco.2021.06.010.

Favilukis, Jack, Xiaoji Lin, and Xiaofei Zhao. 2020. “The Elephant in the Room: The Impact of Labor Obligations on Credit Markets.” American Economic Review 110 (6): 1673–1712. https://doi.org/10.1257/aer.20170156.

Huang, Yi, Shu Lin, and Haichun Ye. 2022. “Bond for Employment: Evidence from China.” SSRN Working Paper. http://dx.doi.org/10.2139/ssrn.4275468.

Lau, Lawrence J., Yingyi Qian, and Gerard Roland. 2000. “Reform without Losers: An Interpretation of China’s Dual-Track Approach to Transition.” Journal of Political Economy 108 (1): 120–43. https://doi.org/10.1086/262113.

Lin, Li-Wen, and Curtis J. Milhaupt. 2017. “Bonded to the State: A Network Perspective on China’s Corporate Debt Market.” Journal of Financial Regulation 3: 1–39. https://doi.org/10.1093/jfr/fjw016.

Lin, Chen, Thomas Schmid, and Yuhai Xuan. 2018. “Employee Representation and Financial Leverage.” Journal of Financial Economics 127 (2): 303–24. https://doi.org/10.1016/j.jfineco.2017.12.003.

Pagano Marco. 2020. “Risk Sharing Within the Firm: A Primer.” Foundations and Trends® in Finance 12 (2): 117-198.

http://dx.doi.org/10.1561/0500000059.

Ru, Hong. 2018. “Government Credit, a Double-Edged Sword: Evidence from the China Development Bank.” Journal of Finance 73 (1): 275–316. https://doi.org/10.1111/jofi.12585.

Simintzi, Elena, Vikrant Vig, and Paolo Volpin. 2015. “Labor Protection and Leverage.” Review of Financial Studies 28 (2): 561–91. https://doi.org/10.1093/rfs/hhu053.

Wei, Shang-Jin, and Tao Wang. 1997. “The Siamese Twins: Do State-Owned Banks Favor State-Owned Enterprises in China?” China Economic Review 8 (1): 19–29. https://doi.org/10.1016/S1043-951X(97)90010-9.

Latest

Most Popular

- VoxChina Covid-19 Forum (Second Edition): China’s Post-Lockdown Economic Recovery VoxChina, Apr 18, 2020

- China’s Great Housing Boom Kaiji Chen, Yi Wen, Oct 11, 2017

- China’s Joint Venture Policy and the International Transfer of Technology Kun Jiang, Wolfgang Keller, Larry D. Qiu, William Ridley, Feb 06, 2019

- The Dark Side of the Chinese Fiscal Stimulus: Evidence from Local Government Debt Yi Huang, Marco Pagano, Ugo Panizza, Jun 28, 2017

- Wealth Redistribution in the Chinese Stock Market: the Role of Bubbles and Crashes Li An, Jiangze Bian, Dong Lou, Donghui Shi, Jul 01, 2020

- What Is Special about China’s Housing Boom? Edward L. Glaeser, Wei Huang, Yueran Ma, Andrei Shleifer, Jun 20, 2017

- Evaluating Risk across Chinese Housing Markets Yongheng Deng, Joseph Gyourko, Jing Wu, Aug 02, 2017

- Privatization and Productivity in China Yuyu Chen, Mitsuru Igami, Masayuki Sawada, Mo Xiao, Jan 31, 2018

- How did China Move Up the Global Value Chains? Hiau Looi Kee, Heiwai Tang, Aug 30, 2017

- China’s Shadow Banking Sector: Wealth Management Products and Issuing Banks Viral V. Acharya, Jun Qian, Zhishu Yang, Aug 09, 2017

Facebook

Facebook  Twitter

Twitter  Instagram

Instagram WeChat

WeChat  Email

Email