Is China Becoming a Service Economy?

We document a process of rapid tertiarization of the Chinese economy since 2005. We estimate total factor productivity through different methodologies and find that productivity has increased faster in services than in the manufacturing sector in recent years. Within the service sector, both consumer and producer services exhibit high productivity growth. Our findings alleviate concerns that the growing share of employment and value added in the service sector be a symptom of an incipient Baumol’s disease that could jeopardize the sustainability of future economic growth.

Since the onset of economic reforms in the 1980s, and following the process of liberalization in the 1990s, the most salient trait of Chinese economic development has been the swift industrialization that has transformed China into the largest industrial power worldwide (Song, Storesletten, and Zilibotti 2011). But the booming manufacturing sector may have obscured a more subtle change: China is currently undergoing a rapid tertiarization process. Namely, service industries are growing as a share of GDP at the expense of both agriculture and manufacturing. Rapid tertiarization could be a symptom of incipient Baumol’s disease: that is, as Chinese consumers get richer owing to increased productivity in manufacturing, they demand more luxury goods and services. This would be a bad omen for future growth in China. If the share of the service sector grows but the productivity of this sector is intrinsically stagnant, average GDP growth is destined to slow down. Baumol’s disease is already a primary concern for mature economies (see, for example, Duernecker, Herrendorf, and Valentinyi 2017 and 2018). However, the concern is also spreading to China in the wake of the recent economic slowdown, as officially acknowledged by Liu He, the Chinese vice premier, in a keynote speech at the World Internet Conference on September 26, 2021.

Yet, the importance and potential complexity of the tertiarization process are still underappreciated. Most of the existing economic research focuses on the manufacturing sector and its dynamics. This is partly due to data availability. China has a detailed census of manufacturing firms as well as a National Business Survey that covers all manufacturing plants above a threshold size. There is no comparable survey for service firms. Moreover, measuring productivity in the service sector is notoriously difficult.

Recent Trends in China’s Service Sector

In a recent paper (Chen et al, forthcoming), we provide an anatomy of China’s growing service sector. Using official statistics on sectoral aggregates, we document the rapid growth of service industries providing inputs to the industrial sector, which we label producer services. However, producer services are not the only driver of tertiarization. We also observe a boom in consumer services, i.e., the service industries that improve consumers’ access to goods (e.g., retail or restaurants) or provide services that are directly consumed by households (e.g., recreation, health, community services). In contrast, we do not find that government-provided services (public services) play a key role in China’s tertiarization process. More importantly, we document significantly higher growth in productivity in producer services and consumer services relative to the industrial and secondary sector. This observation alleviates concerns about the risk of Baumol’s disease in the Chinese economy.

Specifically, we document the following trends:

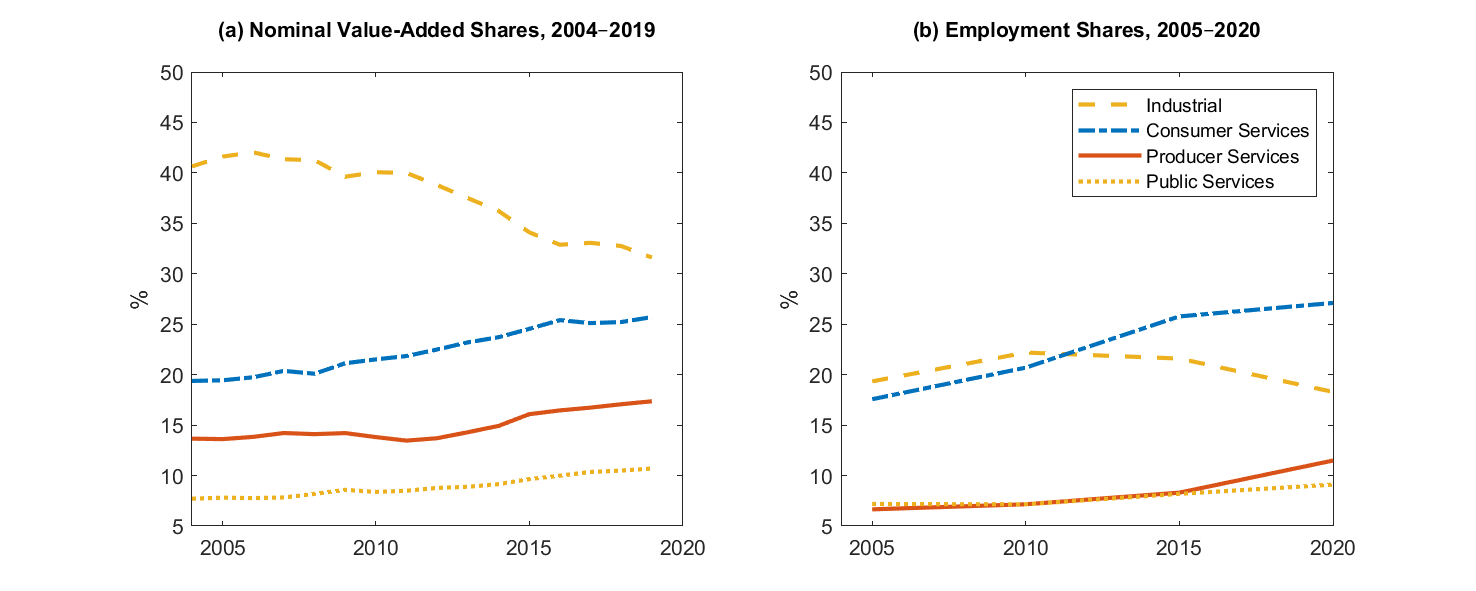

1. The tertiary sector is expanding relative to the secondary and industrial sectors in terms of both value-added and employment shares (see Figure 1).

2. The three subsectors of the tertiary sector we constructed—producer services, consumer services, and public services—feature fairly balanced growth in terms of value-added (see panel (a) of Figure 1). However, the employment shares of consumer services grew faster than those of producer and public services (see panel (b) of Figure 1).

3. The relative prices of all services grew over time.

4. Skill upgrading has been stronger in the service sector (especially for producer services, but also for consumer services) than in the industrial and construction sectors.

5. During 2005-15, productivity has grown more quickly in the consumer and producer service sectors than in the industrial sector. The results are robust to different methods of estimating productivity growth, including the procedure proposed by Fan, Peters, and Zilibotti (2022) that gets around measurement issues for the price index of services.

Figure 1. Sectoral Value-Added Shares and Employment

Shares

Methodology

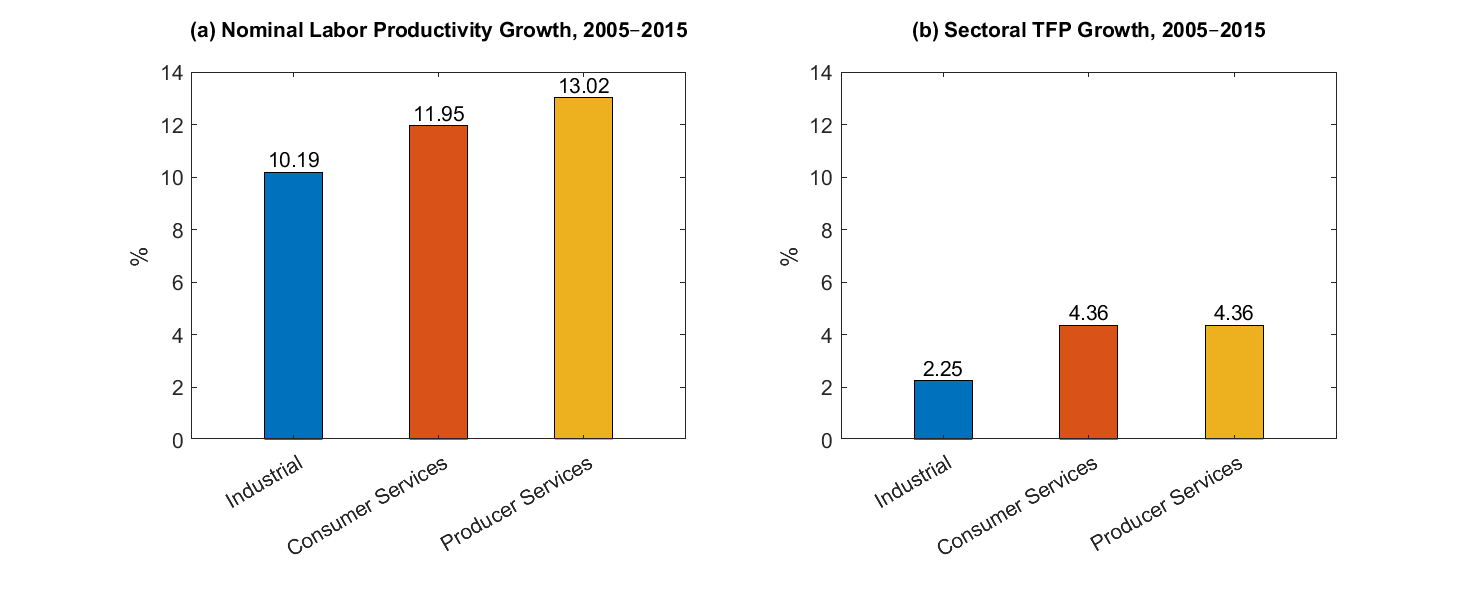

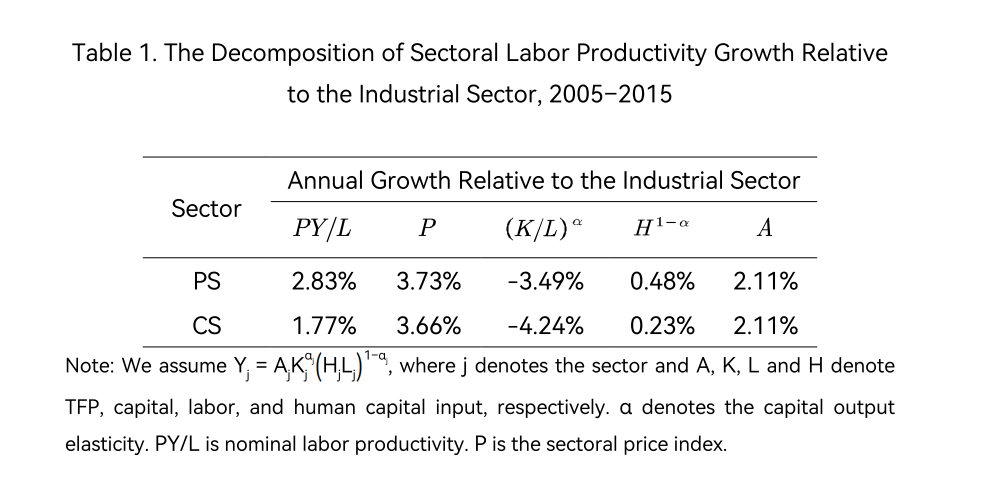

We postulate a set of sectoral production functions and decompose the growth rate of nominal labor productivity into the growth rates of the sectoral price level, sectoral total factor productivity (TFP), and factor inputs—a weighted average of the growth rates of the capital-labor ratio and human capital. As usual, we cannot directly measure TFP and we calculate it as a residual.We start with nominal labor productivity (see panel (a) of Figure 2). Both producer services (13%) and consumer services (12%) have higher growth in nominal labor productivity than the industrial sector (10%). In Table 1, we express sectoral labor productivity as the differences between producer services or consumer services and the industrial sector. An important part of the nominal differences is explained by changes in relative prices. However, this is not the whole story. Service industries also experience less capital deepening and (as an offsetting force) higher growth in human capital input. Ultimately—perhaps surprisingly—we find TFP growth in both producer services (4.4%) and consumer services (4.4%) to exceed TFP growth in the industrial sector (2.3%) (see panel (b) of Figure 2). The gap is similar in the case of consumer services and producer services (+2.1% annually).

Figure 2. Sectoral Nominal Labor Productivity and TFP

Growth, 2005–2015

Figure 2. Sectoral Nominal Labor Productivity and TFP

Growth, 2005–2015

Table 1. The Decomposition of Sectoral Labor Productivity Growth Relative to the Industrial Sector, 2005–2015

The joint observation of higher sectoral TFP growth in service industries and an increase over time in the relative price of services suggests a potentially important role of nonhomothetic demand. Namely, services appear to be luxuries. However, we also document an important role for supply factors. Even though services (especially producer services) already had the highest human capital intensity in 2005, they also experienced high growth in this input. This suggests that service industries were the main destination for the increasingly educated Chinese labor force. Last but not least, TFP growth has been high in services—even higher than in the industrial sector. This finding runs against the traditional view that the ultimate driver of the development process is the growth of productivity in manufacturing, while tertiarization is a corollary of development that merely results from income effects. It is instead in line with the findings of Fan, Peters, and Zilibotti (2022) for India between 1987 and 2011. Human capital and TFP growth jointly account for a differential annual growth in value-added per worker of +2.7% for producer services and +2.4% for consumer services. These gaps partially offset the lower physical investment in service industries.

A New Stage of Development?.

Overall, our findings suggest that China’s development process has entered a new stage in which services and the domestic market play a significantly more important role than in the past. If tertiarization is no mere consequence of rapid income growth, but a result of productivity growth in services, the growth process can prove resilient to Baumol’s disease.

Should we expect this trend to continue? The growing tension in international relations is likely to raise barriers to international trade. This might further speed the ongoing structural transformation by enhancing the importance of the domestic market and nontradable goods. The consolidation of an urban middle class is also likely to sustain growing demand for services in the coming years. Recent research from Beerli et al (2020) shows that demand forces are an important driver of the direction of technical change. Thus, the growing demand for services will likely trigger additional productivity growth in the service sector. Moreover, to the extent these services are local in nature, the benefits of growth can become even more skewed in favor of large cities. Finally, service-led growth is likely to reduce pressure on natural resources and environmental damage relative to growth solely driven by industrial production.

References

Beerli, Andreas, Franziska. J. Weiss, Fabrizio Zilibotti, and Josef Zweimüller. 2020. “Demand Forces of Technical Change Evidence from the Chinese Manufacturing Industry.” China Economic Review 60, 101157. https://doi.org/10.1016/j.chieco.2018.03.003.

Chen, Wei, Xilu Chen, Chang-Tai Hsieh, and Zheng Michael Song. 2019. “A Forensic Examination of China's National Accounts.” Brookings Papers on Economic Activity (Spring): 77–127. https://www.brookings.edu/wp-content/uploads/2019/03/ChenEtAl_web.pdf.

Chen, Xilu, Guangyu Pei, Zheng Michael Song, and Fabrizio Zilibotti. “Tertiarization Like China.” Annual Review of Economics 15 (forthcoming).

Duernecker, Georg, Berthold Herrendorf, and Ákos Valentinyi. 2017. “Structural Change within the Service Sector and the Future of Baumol’s Disease.” CEPR Discussion Paper No. DP12467. https://ssrn.com/abstract=3082293.

Duernecker, Georg, Berthold Herrendorf, and Ákos Valentinyi. 2018. Structural Change and the Productivity Slowdown. VoxEU, May 16, 2018. https://cepr.org/voxeu/columns/structural-change-and-productivity-slowdown.

Fan, Tianyu, Michael Peters, and Fabrizio Zilibotti. 2022. “Growing Like India: The Unequal Effects of Service-Led Growth.” NBER Working Paper No. 28551. https://doi.org/10.3386/w28551.

Fang, Lei, and Berthold Herrendorf. 2021. “High-Skilled Services and Development in China.” Journal of Development Economics 151 (June), 102671. https://doi.org/10.1016/j.jdeveco.2021.102671.

Guo, Kaiming, Jing Hang, and Se Yan. 2021. “Servicification of Investment and Structural Transformation: The Case of China.” China Economic Review 67 (June), 101621. https://doi.org/10.1016/j.chieco.2021.101621.

Liao, Junmin. 2020. “The Rise of the Service Sector in China.” China Economic Review 59 (February), 101385. https://doi.org/10.1016/j.chieco.2019.101385.

Lu, Ming, Xican Xi, and Yuejun Zhong. 2022. “Urbanization and the Rise of Services: Evidence from China.” Working Paper.

Song, Zheng, Kjetil Storesletten, and Fabrizio Zilibotti. 2011. “Growing Like China.” American Economic Review 60 (101): 196–233. https://doi.org/10.1257/aer.101.1.196.

Latest

Most Popular

- VoxChina Covid-19 Forum (Second Edition): China’s Post-Lockdown Economic Recovery VoxChina, Apr 18, 2020

- China’s Great Housing Boom Kaiji Chen, Yi Wen, Oct 11, 2017

- China’s Joint Venture Policy and the International Transfer of Technology Kun Jiang, Wolfgang Keller, Larry D. Qiu, William Ridley, Feb 06, 2019

- The Dark Side of the Chinese Fiscal Stimulus: Evidence from Local Government Debt Yi Huang, Marco Pagano, Ugo Panizza, Jun 28, 2017

- Wealth Redistribution in the Chinese Stock Market: the Role of Bubbles and Crashes Li An, Jiangze Bian, Dong Lou, Donghui Shi, Jul 01, 2020

- What Is Special about China’s Housing Boom? Edward L. Glaeser, Wei Huang, Yueran Ma, Andrei Shleifer, Jun 20, 2017

- Evaluating Risk across Chinese Housing Markets Yongheng Deng, Joseph Gyourko, Jing Wu, Aug 02, 2017

- Privatization and Productivity in China Yuyu Chen, Mitsuru Igami, Masayuki Sawada, Mo Xiao, Jan 31, 2018

- How did China Move Up the Global Value Chains? Hiau Looi Kee, Heiwai Tang, Aug 30, 2017

- China’s Shadow Banking Sector: Wealth Management Products and Issuing Banks Viral V. Acharya, Jun Qian, Zhishu Yang, Aug 09, 2017

Facebook

Facebook  Twitter

Twitter  Instagram

Instagram WeChat

WeChat  Email

Email