Shadow Banking: China’s Dual-Track Interest Rate Liberalization

Professors Hao Wang and Hao Zhou, both of Tsinghua University, Honglin Wang formerly of Hong Kong Institute for Monetary Research (HKIMR) and Lisheng Wang of Chinese University of Hong Kong, argue that the shadow banking explosion in China may constitute a dual-track reform mechanism to liberalize the country’s rigid interest rate policy.

China’s interest rate policy is exercised through banks that dominate the country’s financial system and characterized by binding price controls over deposit rates and quantity controls over loan volumes. Shadow banking has experienced explosive growth in China in the last decade. It essentially constitutes a dual-track reform mechanism to liberalize the country’s rigid interest rate policy. Alongside the preexisting controlled bank credit track, the new shadow bank credit track can help to achieve efficiency gains by funding the more productive yet credit-deprived private enterprises (PEs) at market interest rates. Pareto improvement is plausible as the banks and state owned enterprises (SOEs) participate in shadow banking and share the efficiency gains. Full interest rate liberalization may not lead to additional gains in efficiency, as it magnifies bank credit misallocation in favor of the less productive SOEs.

IntroductionChina’s interest rate policy is exercised through banks that dominate the country’s financial system. The policy is characterized by binding price controls over deposit rates and quantity controls over loan volumes (See Note 1). Banks exceedingly prefer to lend to the SOEs, which are less productive than the PEs, to generate safe and sizable profits because loans to the SOEs are implicitly guaranteed by the state. The rigid interest rate policy, fueled by bank credit misallocation, is the root-cause of the structural imbalance and distortions embedded in the Chinese economy. Nevertheless, the interest rate policy has never been fundamentally reformed. Banks and SOEs refuse to reform as they fear losing their privileges of the current system. On the other hand, regulators worry that reform may collectively expose the venerability of the banks and SOEs, resulting in economic instability. How to formulate a pragmatic reform mechanism to achieve a broad consensus presents Chinese decision-makers with a great challenge.

The People’s Bank of China defines shadow banking as the credit intermediation involving entities and activities outside the regular banking sector, which provides liquidity and credit transformation, and can potentially be a source of systemic risk or regulatory arbitrage. Two prominent features distinguish shadow banking practices in China from its Western counterparts: (1) bank dominance; and (2) government endorsement. In China, banks conduct shadow banking business to evade regulatory controls, that is, they raise capital through wealth management products to bypass the deposit rate ceiling and high reserve requirement and subsequently extend trust loans to bypass the regular loan quota. Banks also serve as intermediaries to make entrust loans on behalf of large corporations, mostly SOEs. Banks play the central role in shadow banking transactions and assume the majority of risks and profits. Non-bank institutions are involved to help bypass regulatory restrictions and reduce costs. About two-thirds of the business flow in shadow banking is effectively “bank loans in disguise” (Elliott, Kroeber, and Qiao, 2015).

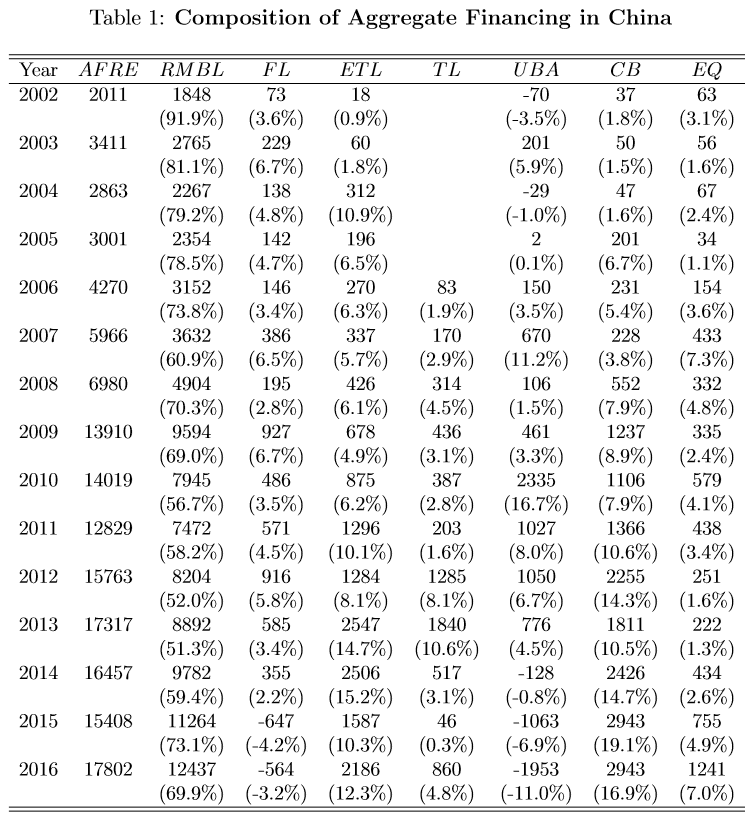

Shadow banking has experienced explosive growth in China since the 2007–2009 global financial crisis. Table 1 shows that the issue sizes of the two primary shadow banking products, entrust loans and trust loans, increased from 270 and 83 billion yuan in 2006 to 2,547 and 1,840 billion yuan in 2013, respectively, constituting 14.7% and 10.6% of total financing to the real economy in 2013, respectively. In contrast, the net issue sizes of corporate debt and equity were 1,811 and 222 billion yuan in 2013, respectively.

In 2008, China launched a 4 trillion yuan stimulus package, mostly in bank credit, to arrest likely economic hard landing during the global financial crisis. Once the economy recovered monetary policy was tightened dramatically to reduce run-away inflation in 2010. Loans to many government-sponsored long-term projects and their follow-up programs could not be rolled over when banks quickly withdrew credit. Fearing that a sudden reduction in bank credit would trigger widespread insolvency and a significant increase in nonperforming loans, banks stepped up with shadow banking operations to offset diminishing bank credit, with implicit and explicit government endorsement.

The Model

We develop a parsimonious yet tractable market equilibrium model to study the implications of shadow banking for interest rate liberalization. Our baseline model, which describes the “dual-track” credit system, consists of four representative agents: households, banks, SOEs, and PEs. The bank channels the households’ capital to the SOEs and PEs under two tracks. The preexisting bank credit track is subject to a binding deposit rate ceiling and loan quota. The bank favors extending cheap bank credit to the SOEs. The new shadow bank credit track channels credit to both the SOEs and PEs, and facilitates credit resale between the SOEs and PEs at market rates. Market equilibrium is established as the agents maximize their respective profit-oriented objective functions and all sectors clear, that is, credit demand exhausts supply.

The model takes different forms in the other two reform stages. Prior to the rise of shadow banking, only the controlled bank credit track existed. Full interest rate liberalization removes the rigid controls over deposit rates and loan volumes imposed on the bank credit track. We contrast and analyze the agents’ profits and overall welfare in different reform stages to shed light on the economic effects of shadow banking from the perspective of financial liberalization.

Model Implications

The dual-track interest rate liberalization can lead to efficiency gains through improvement to credit allocation and reduction in capital idleness. The former channel is unique in China, while the latter channel is common to shadow banking in general. Under the controlled bank credit track, banks ration cheap credit in favor of the less productive SOEs, leaving the more productive PEs insufficiently financed (Brandt and Zhu, 2001; Song, Storesletten, and Zilibotti, 2011). The market track of shadow banking allows the PEs to obtain capital through trust loans and credit resales from SOEs. Shadow bank credit also bypasses the strict lending constraints and high reserve requirements, reducing capital idleness.

Pareto improvement is plausible under the dual-track reform mechanism. The PEs and households benefit unconditionally from interest rate liberalization as they can always choose whether to participate in shadow banking. The banks and SOEs, which are potential reform losers, are now involved in the shadow banking business and are able to share the efficiency gains. The shared gain can entirely compensate their reform losses through properly designed profit sharing.

Full interest rate liberalization that removes the binding deposit rate ceilings and loan quotas may not necessarily lead to additional efficiency gains. As the controls are removed, more capital flows to the traditional bank credit channel and subsequently, to the less productive SOEs. As a result, aggregate output can fall. An additional amount of capital will be idle as the high reserve requirement persists. The evidence suggests that full interest rate liberalization may not achieve its intended goal of gaining additional efficiency if bank credit misallocation persists and the SOEs’ productivity remains unimproved.

Conclusion

Shadow banking provides a pragmatic solution to the question of how to liberalize China’s rigid interest rate policy that underlies the phenomenal structural imbalance and distortions in the Chinese economy. Shadow banking operations can be viewed as banks practicing market-oriented lending under tacit government endorsement. In this sense, shadow banking essentially constitutes a covert effort to liberalize interest rates. China has set full interest rate liberalization as one ultimate goal of its ongoing financial reforms. Market-oriented monetary policy and a regulatory framework need to be established under a fully liberalized credit system. Shadow banking prepares the regulators and economic agents for such a complex transition.

Note 1: The official loan floor rates and deposit ceiling rates were removed in 2013 and 2015, respectively, but the government still effectively controls bank deposit rates. Banks routinely receive formal instructions and informal guidance from the central bank and other regulators. Bank loan quotas remain official and binding today. The government effectively controls major banks through majority shareholding and executive appointment. The bank credit system in China is a controlled system (Brandt and Zhu, 2000).

(Hao Wang, School of Economics and Management, Tsinghua University; Honglin Wang, Former economist at Hong Kong Institute for Monetary Research (HKIMR); Lisheng Wang, Department of Economics, Chinese University of Hong Kong; Hao Zhou, PBC School of Finance and National Institute of Financial Research, Tsinghua University.)

Brandt, Loren, and Xiaodong Zhu, 2000, Redistribution in a Decentralized Economy: Growth and Inflation in China under Reform, Journal of Political Economy, 108(2): 422-439.

Brandt, Loren, and Xiaodong Zhu, 2001, Soft Budget Constraint and Inflation Cycles: A Positive Model of the Macro-Dynamics in China during Transition, Journal of Development Economics, 64(2): 437-457.

Elliott, Douglas, Arthur Kroeber, and Yu Qiao, 2015, Shadow Banking in China: A Primer, Economic Studies at Brookings.

Song, Zheng, Kjetil Storesletten, and Fabrizio Zilibotti, 2011, Growing like China, American Economic Review, 101(1): 196-233.

Latest

YUE Xiangyu

2017/07/29Good try. But 2 problems: 1. This paper ignored that a bit part of RMBL and ETL are to households. 2. The increase of Shadow Banking in China might be the increasing of local goverment financing but not private sector financing.

Most Popular

- VoxChina Covid-19 Forum (Second Edition): China’s Post-Lockdown Economic Recovery VoxChina, Apr 18, 2020

- China’s Great Housing Boom Kaiji Chen, Yi Wen, Oct 11, 2017

- China’s Joint Venture Policy and the International Transfer of Technology Kun Jiang, Wolfgang Keller, Larry D. Qiu, William Ridley, Feb 06, 2019

- The Dark Side of the Chinese Fiscal Stimulus: Evidence from Local Government Debt Yi Huang, Marco Pagano, Ugo Panizza, Jun 28, 2017

- Wealth Redistribution in the Chinese Stock Market: the Role of Bubbles and Crashes Li An, Jiangze Bian, Dong Lou, Donghui Shi, Jul 01, 2020

- Evaluating Risk across Chinese Housing Markets Yongheng Deng, Joseph Gyourko, Jing Wu, Aug 02, 2017

- What Is Special about China’s Housing Boom? Edward L. Glaeser, Wei Huang, Yueran Ma, Andrei Shleifer, Jun 20, 2017

- Privatization and Productivity in China Yuyu Chen, Mitsuru Igami, Masayuki Sawada, Mo Xiao, Jan 31, 2018

- How did China Move Up the Global Value Chains? Hiau Looi Kee, Heiwai Tang, Aug 30, 2017

- China’s Shadow Banking Sector: Wealth Management Products and Issuing Banks Viral V. Acharya, Jun Qian, Zhishu Yang, Aug 09, 2017

Facebook

Facebook  Twitter

Twitter  Instagram

Instagram WeChat

WeChat  Email

Email