Throwing Good Money after Bad: Zombie Lending and the Supply Chain Contagion of Firm Exit

Zombie lending to downstream firms does not reduce the exit likelihood of upstream firms. Worse, it distorts efficiency-based firm exit in upstream industries. The exit distortion effect works through the trade credit chain and is more profound in industries with stricter financial constraints and tighter supply chain connections.

We base our empirical investigation on a comprehensive firm-level dataset for the 1998–2007 period. Following Caballero, Hoshi, and Kashyap (2008) and Fukuda and Nakamura (2011), we define an unprofitable firm—that is, a firm with earnings before interest and taxes (EBIT) less than the hypothetical risk-free interest payment—that receives subsidized credit or evergreen lending as a “zombie firm.” A zombie firm has an economic net worth below zero, but continues to operate and remains able to repay the debt because of the banks’ capital sufficiency concerns and the government’s desire to avoid mass firm failures (Peek and Rosengren 2005). Identifying zombie lending enables us to directly test whether the liquidity injection into customer firms can save supplier firms from the propagation of business failure.

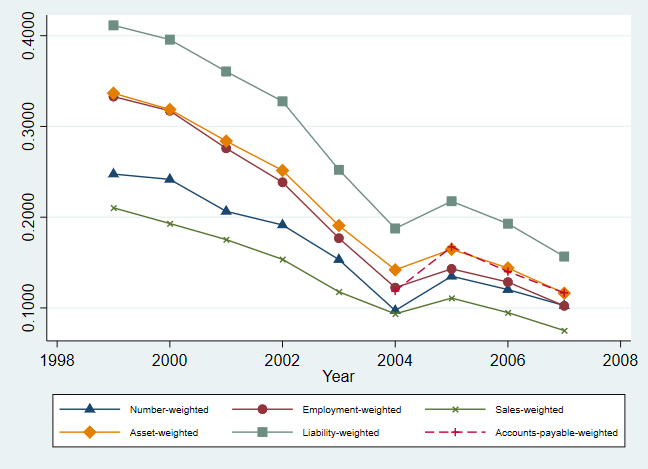

Figure 1 describes the yearly distribution of zombie firms in our sample and presents several measures based on different weighting methods. The proportion of zombie firms is highest at the beginning of our sample period and declines with the process of state-owned enterprise (SOE) privatization that began in the mid-1990s. Over the years, the liability-weighted proportion of zombie firms is the highest, and the sales-weighted proportion of zombie firms is the lowest. That is, zombie firms consume more credit while performing worse than healthy firms.

Baseline Findings: Zombie Lending Cannot Stop Supply Chain Contagion of Firm Exit and, Worse, It Distorts Efficiency-Based Firm Exit

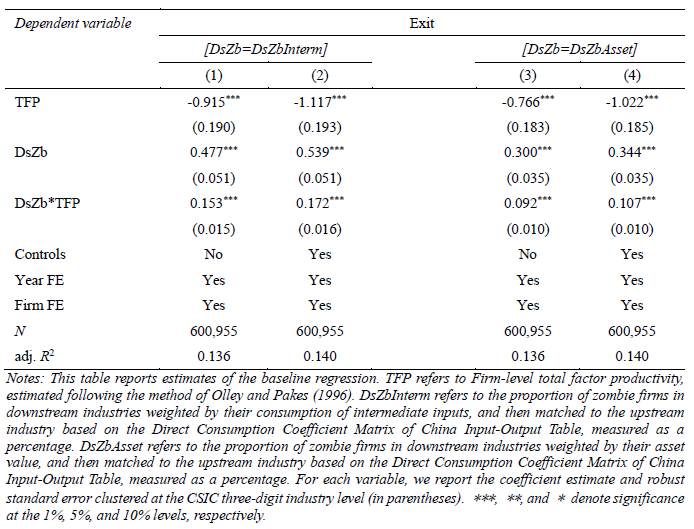

Table 1 presents the baseline results. We find that government intervention throws good money after bad not only by misallocating credit, but also by incurring the efficiency loss of distorted firm exit. We find that a larger proportion of downstream zombie firms significantly increases the exit likelihood of an upstream firm. In addition, firms with higher productivity suffer more from this adverse effect. These findings imply that bailouts of customer firms cannot save supplier firms from the propagation of business failure. Worse, downstream credit misallocation significantly distorts efficiency-based firm exit in upstream industries. According to Schumpeter’s (1934) creative destruction theory, a growth-promoting process of industrial mutation involves the destruction of the old one and the creation of a new one. Efficiency-based firm exits are essential to revolutionizing the economic structure. Thus, such exit distortion has critical implications for aggregate economic growth.

Discussions on Potential Confounding Factors

Three potentially important confounding factors may also lie behind the link between the proportion of downstream zombie firms and upstream firm exit. The first is common shocks that hit firms operating in industries along a supply chain or located in the same region. We adopt several identification strategies to deal with this endogeneity issue. In the baseline regression, we control for the proportion of zombie firms in the same industry of the supplier’s province to incorporate contemporaneous industrial and regional factors related to credit misallocation. We use industry-level clustering to control for correlation within the industry (Petersen 2009) and run additional tests with industry-by-year fixed effects and province-by-year fixed effects to control for time-variant industry and regional shocks.

The second concern is the endogenous matching between low-quality suppliers and low-quality customers. Following Jacobson and von Schedvin (2015), we use supplier fixed effects to mitigate the problem of static endogenous matching. To address a more challenging dynamic matching concern that changes within-firm yet over time, we focus our interpretation of outcomes on the interaction term between total factor productivity (TFP) and the proportion of downstream zombie firms (DsZb) and find a pattern opposite to that predicted by dynamic matching. Moreover, the cross-sectional results based on suppliers’ dependence on the long-term supplier-customer relationships indicate that rematching, if it exists, mitigates supply chain exit contagion rather than driving the propagation of failures.

The third confounding factor is potential reverse causality. Inspired by the trade literature (Bastos, Silva, and Verhoogen 2018; Nunn and Qian 2014; Park et al. 2010), we construct a lagged instrumental variable (IV) by interacting the initial proportion of SOEs in each downstream industry with the lagged national average of SOEs’ leverage ratio and run 2SLS regressions. The interaction instrument varies by firm and time, which allows us to control for firm and year fixed effects. We can state the exclusion restriction for the interaction instrument as follows: any mechanism through which the propensity of downstream bailouts affects the supplier exit is constant across time and can be controlled by firm fixed effects; any mechanism causing supplier exit to vary with SOE credit sufficiency affects firms homogenously and can be controlled by year fixed effects. Throughout, our results are consistent with the notion that downstream corporate bailouts impose a distortion on upstream efficiency-based firm exit.

Role of Trade Credit in the Supply Chain Contagion Effect on Firm Exit

Following previous studies (Boissay and Gropp 2013, Jacobson and von Schedvin 2015, Kiyotaki and Moore 2002), we investigate the role of trade credit in the supply chain contagion effect on firm exit. First, we find that the proportion of downstream zombie firms substantially increases the value of accounts receivable in upstream firms. It suggests that the delayed bankruptcy of unprofitable downstream firms not only costs credit injection, but also imposes a liquidity burden on supplier firms. Next, we find that a larger accounts receivable increases firms’ likelihood of exit and distorts efficiency-based firm exits. Moreover, the trade credit channel explains a large part of the contagion effect of zombie lending to downstream firms. These results support the channel effect of the trade credit chain in the supply chain contagion of firm exits.

Consistent with the argument of Kiyotaki and Moore (2002) that financially constrained creditors are more exposed to supply chain contagion, we find that financially constrained firms are more vulnerable to the exit distortion caused by zombie lending to downstream firms because they are less able to absorb the adverse trade-credit shocks created by downstream zombie firms. In addition, compared to firms with a broad customer base, firms with sales concentrated in a few downstream industries suffer more from supply chain contagion. Also, supply chain contagion is more severe in industries with higher innovation intensity, as they face a higher switching cost in changing their customer industries. These results are consistent with Fabbri and Klapper’s (2016) finding that suppliers with weak bargaining power vis-à-vis their customers are more vulnerable in the trade credit chain.

Policy Implications and Suggestions

Our paper contributes to the great Keynes-Hayek debate on the role of the market and government. We show that government intervention to prevent the propagation of a single sector’s failure will bring about an even more significant efficiency loss. Such an intervention throws good money after bad not only by misallocating credit, but also by incurring the efficiency loss of distorted firm exit. Although unexpected market shocks, such as the 2008 financial crisis and the COVID-19 pandemic, may justify bailouts as a temporary solution, in the long run, government should terminate its intervention and let the market play its natural selection role. In addition, our paper contributes to the understanding of China’s economic growth by supplying new micro-evidence of resource misallocation coupled with government intervention and shows that the Chinese economy could develop further through the elimination of inefficient credit allocation.

Yun Dai, Lingnan College, Sun Yat-sen University; Xuchao Li, Center for Economic Development Research, Wuhan University; Dinghua Liu, Center for Economic Development Research, Wuhan University; Jiankun Lu, School of Public Finance and Taxation, Zhejiang University of Finance and Economics.

References

Acemoglu, Daron, Vasco M. Carvalho, Asuman Ozdaglar, and Alireza Tahbaz‐Salehi. 2012. “The Network Origins of Aggregate Fluctuations.” Econometrica 80 (5): 1977–2016. https://doi.org/10.3982/ECTA9623.

Bastos, Paulo, Joana Silva, and Eric Verhoogen. 2018. “Export Destinations and Input Prices.” American Economic Review 108 (2): 353–92. https://doi.org/10.1257/aer.20140647.

Boissay, Frederic, and Reint Gropp. 2013. “Payment Defaults and Interfirm Liquidity Provision.” Review of Finance 17 (6): 1853–94. https://doi.org/10.1093/rof/rfs045.

Caballero, Ricardo J., Takeo Hoshi, and Anil K. Kashyap. 2008. “Zombie Lending and Depressed Restructuring in Japan.” American Economic Review 98 (5): 1943–77. https://doi.org/10.1257/aer.98.5.1943.

Dai, Yun, Xuchao Li, Dinghua Liu, and Jiankun Lu. 2021. “Throwing Good Money After Bad: Zombie Lending and the Supply Chain Contagion of Firm Exit.” Journal of Economic Behavior and Organization 189 (September): 379–402. https://doi.org/10.1016/j.jebo.2021.06.042

Fabbri, Daniela, and Leora F. Klapper. 2016. “Bargaining Power and Trade Credit.” Journal of Corporate Finance 41 (December), 66–80. https://doi.org/10.1016/j.jcorpfin.2016.07.001.

Fukuda, Shin-ichi, and Jun-ichi Nakamura. 2011. “Why Did “Zombie” Firms Recover in Japan?” World Economy 34 (7): 1124–37. https://doi.org/10.1111/j.1467-9701.2011.01368.x.

Jacobson, Tor, and Erik von Schedvin. 2015. “Trade Credit and the Propagation of Corporate Failure: An Empirical Analysis.” Econometrica 83 (4): 1315–71. https://doi.org/10.3982/ECTA12148.

Kiyotaki, Nobuhiro, and John Moore. 2002. “Balance-Sheet Contagion.” American Economic Review 92 (2): 46–50. https://doi.org/10.1257/000282802320188989.

Kydland, Finn E., and Edward C. Prescott. 1977. “Rules Rather than Discretion: The Inconsistency of Optimal Plans.” Journal of Political Economy 85 (3): 473–92. https://doi.org/10.1086/260580.

Nunn, Nathan, and Nancy Qian. 2014. “US Food Aid and Civil Conflict.” American Economic Review 104 (6): 1630–66. https://doi.org/10.1257/aer.104.6.1630.

Park, Albert, Dean Yang, Xinzheng Shi, and Yuan Jiang. 2010. “Exporting and Firm Performance: Chinese Exporters and the Asian Financial Crisis.” Review of Economics and Statistics 92 (4): 822–42. https://doi.org/10.1162/REST_a_00033.

Peek, Joe, and Eric S. Rosengren. 2005. “Unnatural Selection: Perverse Incentives and the Misallocation of Credit in Japan.” American Economic Review 95 (4): 1144–66. https://doi.org/10.1257/0002828054825691.

Petersen, Mitchell A. 2009. “Estimating Standard Errors in Finance Panel Data Sets: Comparing Approaches.” Review of Financial Studies 22 (1): 435–80. https://doi.org/10.1093/rfs/hhn053.

Schumpeter, Joseph A. 1934. The Theory of Economic Development. Boston: Harvard University Press. https://doi.org/10.4324/9781315135564

We base our empirical investigation on a comprehensive firm-level dataset for the 1998–2007 period. Following Caballero, Hoshi, and Kashyap (2008) and Fukuda and Nakamura (2011), we define an unprofitable firm—that is, a firm with earnings before interest and taxes (EBIT) less than the hypothetical risk-free interest payment—that receives subsidized credit or evergreen lending as a “zombie firm.” A zombie firm has an economic net worth below zero, but continues to operate and remains able to repay the debt because of the banks’ capital sufficiency concerns and the government’s desire to avoid mass firm failures (Peek and Rosengren 2005). Identifying zombie lending enables us to directly test whether the liquidity injection into customer firms can save supplier firms from the propagation of business failure.

Figure 1 describes the yearly distribution of zombie firms in our sample and presents several measures based on different weighting methods. The proportion of zombie firms is highest at the beginning of our sample period and declines with the process of state-owned enterprise (SOE) privatization that began in the mid-1990s. Over the years, the liability-weighted proportion of zombie firms is the highest, and the sales-weighted proportion of zombie firms is the lowest. That is, zombie firms consume more credit while performing worse than healthy firms.

Figure 1. The proportion of zombie firms in China by year for the 1999–2007 period

Note: Number-weighted proportions of zombie firms are represented by triangles, employment-weighted proportions are represented by dots, sales-weighted proportions are represented by crosses, asset-weighted proportions are represented by diamonds, liability-weighted proportions are represented by squares, and accounts-payable-weighted proportions (data available after the year 2004) are represented by crosses with a dotted line.Baseline Findings: Zombie Lending Cannot Stop Supply Chain Contagion of Firm Exit and, Worse, It Distorts Efficiency-Based Firm Exit

Table 1 presents the baseline results. We find that government intervention throws good money after bad not only by misallocating credit, but also by incurring the efficiency loss of distorted firm exit. We find that a larger proportion of downstream zombie firms significantly increases the exit likelihood of an upstream firm. In addition, firms with higher productivity suffer more from this adverse effect. These findings imply that bailouts of customer firms cannot save supplier firms from the propagation of business failure. Worse, downstream credit misallocation significantly distorts efficiency-based firm exit in upstream industries. According to Schumpeter’s (1934) creative destruction theory, a growth-promoting process of industrial mutation involves the destruction of the old one and the creation of a new one. Efficiency-based firm exits are essential to revolutionizing the economic structure. Thus, such exit distortion has critical implications for aggregate economic growth.

Table 1: The Impact of Zombie Lending to Downstream Firms on Upstream Firm Exit

Discussions on Potential Confounding Factors

Three potentially important confounding factors may also lie behind the link between the proportion of downstream zombie firms and upstream firm exit. The first is common shocks that hit firms operating in industries along a supply chain or located in the same region. We adopt several identification strategies to deal with this endogeneity issue. In the baseline regression, we control for the proportion of zombie firms in the same industry of the supplier’s province to incorporate contemporaneous industrial and regional factors related to credit misallocation. We use industry-level clustering to control for correlation within the industry (Petersen 2009) and run additional tests with industry-by-year fixed effects and province-by-year fixed effects to control for time-variant industry and regional shocks.

The second concern is the endogenous matching between low-quality suppliers and low-quality customers. Following Jacobson and von Schedvin (2015), we use supplier fixed effects to mitigate the problem of static endogenous matching. To address a more challenging dynamic matching concern that changes within-firm yet over time, we focus our interpretation of outcomes on the interaction term between total factor productivity (TFP) and the proportion of downstream zombie firms (DsZb) and find a pattern opposite to that predicted by dynamic matching. Moreover, the cross-sectional results based on suppliers’ dependence on the long-term supplier-customer relationships indicate that rematching, if it exists, mitigates supply chain exit contagion rather than driving the propagation of failures.

The third confounding factor is potential reverse causality. Inspired by the trade literature (Bastos, Silva, and Verhoogen 2018; Nunn and Qian 2014; Park et al. 2010), we construct a lagged instrumental variable (IV) by interacting the initial proportion of SOEs in each downstream industry with the lagged national average of SOEs’ leverage ratio and run 2SLS regressions. The interaction instrument varies by firm and time, which allows us to control for firm and year fixed effects. We can state the exclusion restriction for the interaction instrument as follows: any mechanism through which the propensity of downstream bailouts affects the supplier exit is constant across time and can be controlled by firm fixed effects; any mechanism causing supplier exit to vary with SOE credit sufficiency affects firms homogenously and can be controlled by year fixed effects. Throughout, our results are consistent with the notion that downstream corporate bailouts impose a distortion on upstream efficiency-based firm exit.

Role of Trade Credit in the Supply Chain Contagion Effect on Firm Exit

Following previous studies (Boissay and Gropp 2013, Jacobson and von Schedvin 2015, Kiyotaki and Moore 2002), we investigate the role of trade credit in the supply chain contagion effect on firm exit. First, we find that the proportion of downstream zombie firms substantially increases the value of accounts receivable in upstream firms. It suggests that the delayed bankruptcy of unprofitable downstream firms not only costs credit injection, but also imposes a liquidity burden on supplier firms. Next, we find that a larger accounts receivable increases firms’ likelihood of exit and distorts efficiency-based firm exits. Moreover, the trade credit channel explains a large part of the contagion effect of zombie lending to downstream firms. These results support the channel effect of the trade credit chain in the supply chain contagion of firm exits.

Consistent with the argument of Kiyotaki and Moore (2002) that financially constrained creditors are more exposed to supply chain contagion, we find that financially constrained firms are more vulnerable to the exit distortion caused by zombie lending to downstream firms because they are less able to absorb the adverse trade-credit shocks created by downstream zombie firms. In addition, compared to firms with a broad customer base, firms with sales concentrated in a few downstream industries suffer more from supply chain contagion. Also, supply chain contagion is more severe in industries with higher innovation intensity, as they face a higher switching cost in changing their customer industries. These results are consistent with Fabbri and Klapper’s (2016) finding that suppliers with weak bargaining power vis-à-vis their customers are more vulnerable in the trade credit chain.

Policy Implications and Suggestions

Our paper contributes to the great Keynes-Hayek debate on the role of the market and government. We show that government intervention to prevent the propagation of a single sector’s failure will bring about an even more significant efficiency loss. Such an intervention throws good money after bad not only by misallocating credit, but also by incurring the efficiency loss of distorted firm exit. Although unexpected market shocks, such as the 2008 financial crisis and the COVID-19 pandemic, may justify bailouts as a temporary solution, in the long run, government should terminate its intervention and let the market play its natural selection role. In addition, our paper contributes to the understanding of China’s economic growth by supplying new micro-evidence of resource misallocation coupled with government intervention and shows that the Chinese economy could develop further through the elimination of inefficient credit allocation.

Yun Dai, Lingnan College, Sun Yat-sen University; Xuchao Li, Center for Economic Development Research, Wuhan University; Dinghua Liu, Center for Economic Development Research, Wuhan University; Jiankun Lu, School of Public Finance and Taxation, Zhejiang University of Finance and Economics.

References

Acemoglu, Daron, Vasco M. Carvalho, Asuman Ozdaglar, and Alireza Tahbaz‐Salehi. 2012. “The Network Origins of Aggregate Fluctuations.” Econometrica 80 (5): 1977–2016. https://doi.org/10.3982/ECTA9623.

Bastos, Paulo, Joana Silva, and Eric Verhoogen. 2018. “Export Destinations and Input Prices.” American Economic Review 108 (2): 353–92. https://doi.org/10.1257/aer.20140647.

Boissay, Frederic, and Reint Gropp. 2013. “Payment Defaults and Interfirm Liquidity Provision.” Review of Finance 17 (6): 1853–94. https://doi.org/10.1093/rof/rfs045.

Caballero, Ricardo J., Takeo Hoshi, and Anil K. Kashyap. 2008. “Zombie Lending and Depressed Restructuring in Japan.” American Economic Review 98 (5): 1943–77. https://doi.org/10.1257/aer.98.5.1943.

Dai, Yun, Xuchao Li, Dinghua Liu, and Jiankun Lu. 2021. “Throwing Good Money After Bad: Zombie Lending and the Supply Chain Contagion of Firm Exit.” Journal of Economic Behavior and Organization 189 (September): 379–402. https://doi.org/10.1016/j.jebo.2021.06.042

Fabbri, Daniela, and Leora F. Klapper. 2016. “Bargaining Power and Trade Credit.” Journal of Corporate Finance 41 (December), 66–80. https://doi.org/10.1016/j.jcorpfin.2016.07.001.

Fukuda, Shin-ichi, and Jun-ichi Nakamura. 2011. “Why Did “Zombie” Firms Recover in Japan?” World Economy 34 (7): 1124–37. https://doi.org/10.1111/j.1467-9701.2011.01368.x.

Jacobson, Tor, and Erik von Schedvin. 2015. “Trade Credit and the Propagation of Corporate Failure: An Empirical Analysis.” Econometrica 83 (4): 1315–71. https://doi.org/10.3982/ECTA12148.

Kiyotaki, Nobuhiro, and John Moore. 2002. “Balance-Sheet Contagion.” American Economic Review 92 (2): 46–50. https://doi.org/10.1257/000282802320188989.

Kydland, Finn E., and Edward C. Prescott. 1977. “Rules Rather than Discretion: The Inconsistency of Optimal Plans.” Journal of Political Economy 85 (3): 473–92. https://doi.org/10.1086/260580.

Nunn, Nathan, and Nancy Qian. 2014. “US Food Aid and Civil Conflict.” American Economic Review 104 (6): 1630–66. https://doi.org/10.1257/aer.104.6.1630.

Park, Albert, Dean Yang, Xinzheng Shi, and Yuan Jiang. 2010. “Exporting and Firm Performance: Chinese Exporters and the Asian Financial Crisis.” Review of Economics and Statistics 92 (4): 822–42. https://doi.org/10.1162/REST_a_00033.

Peek, Joe, and Eric S. Rosengren. 2005. “Unnatural Selection: Perverse Incentives and the Misallocation of Credit in Japan.” American Economic Review 95 (4): 1144–66. https://doi.org/10.1257/0002828054825691.

Petersen, Mitchell A. 2009. “Estimating Standard Errors in Finance Panel Data Sets: Comparing Approaches.” Review of Financial Studies 22 (1): 435–80. https://doi.org/10.1093/rfs/hhn053.

Schumpeter, Joseph A. 1934. The Theory of Economic Development. Boston: Harvard University Press. https://doi.org/10.4324/9781315135564

Latest

Most Popular

- VoxChina Covid-19 Forum (Second Edition): China’s Post-Lockdown Economic Recovery VoxChina, Apr 18, 2020

- China’s Great Housing Boom Kaiji Chen, Yi Wen, Oct 11, 2017

- China’s Joint Venture Policy and the International Transfer of Technology Kun Jiang, Wolfgang Keller, Larry D. Qiu, William Ridley, Feb 06, 2019

- The Dark Side of the Chinese Fiscal Stimulus: Evidence from Local Government Debt Yi Huang, Marco Pagano, Ugo Panizza, Jun 28, 2017

- Wealth Redistribution in the Chinese Stock Market: the Role of Bubbles and Crashes Li An, Jiangze Bian, Dong Lou, Donghui Shi, Jul 01, 2020

- Evaluating Risk across Chinese Housing Markets Yongheng Deng, Joseph Gyourko, Jing Wu, Aug 02, 2017

- What Is Special about China’s Housing Boom? Edward L. Glaeser, Wei Huang, Yueran Ma, Andrei Shleifer, Jun 20, 2017

- Privatization and Productivity in China Yuyu Chen, Mitsuru Igami, Masayuki Sawada, Mo Xiao, Jan 31, 2018

- How did China Move Up the Global Value Chains? Hiau Looi Kee, Heiwai Tang, Aug 30, 2017

- China’s Shadow Banking Sector: Wealth Management Products and Issuing Banks Viral V. Acharya, Jun Qian, Zhishu Yang, Aug 09, 2017

Facebook

Facebook  Twitter

Twitter  Instagram

Instagram WeChat

WeChat  Email

Email