Structural Change and the Stability of Aggregate Employment in China

In developed countries, aggregate employment has a strong positive correlation with aggregate output, and it is almost as volatile as output. In China, the correlation of aggregate employment and output is close to zero, and the volatility of aggregate employment is very low. We argue that the key to understanding the stability of aggregate employment in China is labor reallocation between the agricultural and non-agricultural sectors, and that the declining relative demand of agricultural goods with income plays an important role in determining the labor reallocation dynamics in both the long run and the short run.

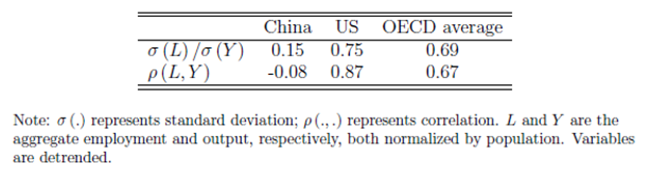

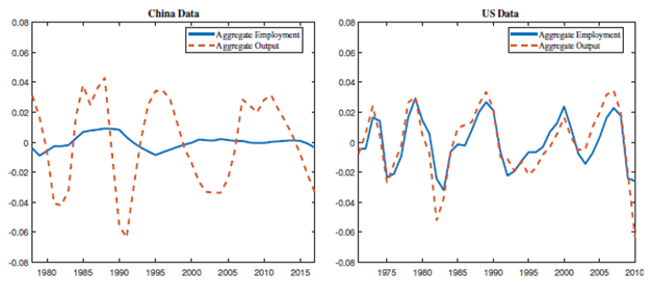

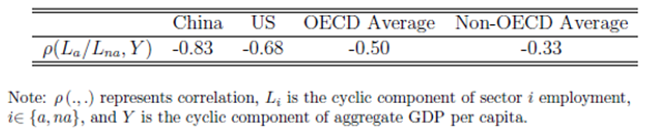

One salient feature of business cycles in developed countries is that aggregate employment has a strong positive correlation with aggregate output and is almost as volatile as output. However, this is not the case in China, where the correlation of the cyclical components of aggregate employment and output is close to zero, and the volatility of aggregate employment is also very low (see Table 1). The difference in aggregate employment fluctuations between China and developed countries is highlighted in Figure 1, which plots the cyclical movements of aggregate employment and output for China and the United States. While aggregate employment closely tracks aggregate output in the United States, it moves very little over the business cycles in China (see Note 1).

Table 1: Aggregate Business Cycle Moments

Figure 1: Cyclical Fluctuations

Why is aggregate employment so stable over the business cycles in China? Some take this as a sign that there are unique institutional constraints that limit the employment variability in China. While it is true that there could be strong employment rigidity in the state-owned enterprises, the labor market for the non-state sector in China is quite flexible—maybe even more flexible than many developed countries due to minimum regulations on hiring and firing workers by non-state firms. Since the non-state sector employment is usually the margin at which aggregate employment adjusts over the business cycles, the institutional constraints on state-sector employment cannot explain the puzzle.

In Yao and Zhu (2021), we argue that labor reallocation between the agricultural and non-agricultural sectors is the key to the stability of aggregate employment in China, and that the income effect (i.e., the decline in the relative demand for agricultural goods with household income) plays an important role in the reallocation. Our argument is motivated by three sets of empirical facts.

Facts on Aggregate Employment Fluctuations and Labor Reallocation

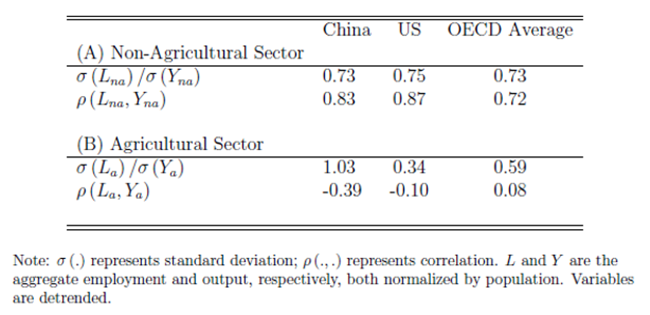

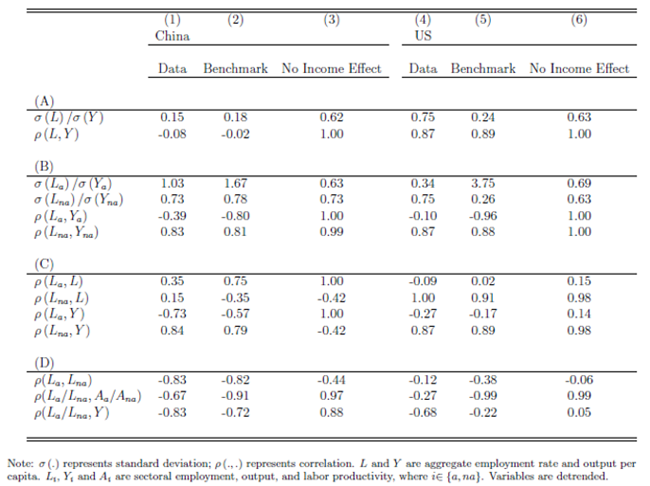

First, at the sectoral level, the cyclical properties of employment in China are similar to those of developed countries. As shown in Table 2, for both China and the OECD countries, the volatility of sectoral employment relative to the volatility of sectoral output is high, and employment and output have a strong positive correlation in the non-agricultural sector. In the agricultural sector, the relative volatility of employment is actually higher in China than in the OECD countries, and the employment-output correlation is low or negative in all the countries.

Table 2: Sector Moments

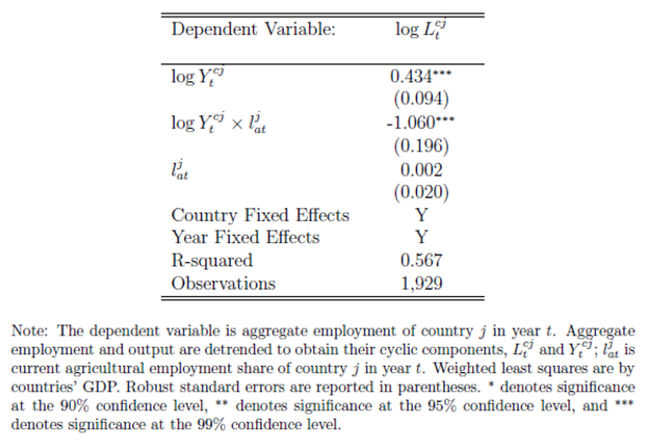

Second, we show that the difference in the correlation of aggregate employment and output between China and the developed countries is explained by the nations’ being in different stages of development. Using panel data of 40 countries from the Groningen Growth and Development Center (GGDC), we regress the cyclical component of aggregate employment on the cyclical component of GDP, the agricultural employment share, and the product of the two. The regression result is reported in Table 3. The positive coefficient on GDP suggests that aggregate employment and output are positively correlated on average. However, the negative coefficient on the interaction between GDP and the agricultural employment share implies that the correlation declines with the agricultural employment share. Since more-developed countries tend to have low agricultural employment shares, they also tend to have high employment-output correlations. China, on the other hand, has a much higher agricultural employment share and therefore much lower employment-output correlation.

Table 3: Structural Change and Aggregate Employment Fluctuations

Third, we find that almost all countries in the GGDC dataset have a ratio of agricultural employment to non-agricultural employment that is negatively correlated with per capita GDP over the business cycles, as shown in Table 4. This fact suggests that the income effect is important for determining labor reallocation between the sectors at the business cycle frequency.

Table 4: Income Effect Over the Business Cycle

Labor Reallocation Dynamics in the Long Run and the Short Run

Given the documented facts, in Yao and Zhu (2021) we construct a two-sector growth model with an income effect and show that the model can account for both China’s sectoral decline of the agricultural employment share in the long run and its labor reallocation and aggregate employment fluctuations in the short run.

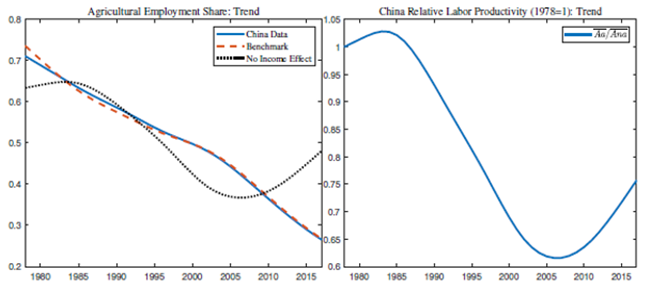

We first calibrate the parameters of our model so that it can account for China's sectoral trend in labor reallocation from agriculture to non-agriculture. Our calibration reveals that the income effect is important in accounting for the long-run structural change in China. As shown in the left panel of Figure 2, a model without the income effect would not match the structural change in China in the long run.

Figure 2: Structural Change: Model and Data

In general, structural change can be driven by both the price effect and the income effect. If agricultural productivity grows faster than non-agricultural productivity in an economy, then the relative price of the agricultural goods declines. Since demand for agricultural goods is generally inelastic, the decline in the relative price will lead to a lower relative demand for agricultural goods and therefore a reallocation of labor from agriculture to non-agriculture. This is the price effect. Structural change can also be driven by the income effect because demand for agricultural goods has low income-elasticity, which implies that the relative demand for agricultural goods declines with income. As shown in the right panel of Figure 2, in China, the relative productivity growth of agriculture exhibits a non-monotonic pattern over time, rising in the early 1980s, declining between the mid-980s and mid-2000s, and finally rising again after 2007. If there is no income effect, then the evolution of China’s agricultural employment share would also be non-monotonic. In the data, however, the share declines monotonically over time. It is therefore necessary to allow for the income effect in accounting for the sectoral decline of the agricultural employment share in China. Our finding of the importance of the income effect in China’s structural change is consistent with the findings of Boppart (2014) and Comin, Lashkari and Mestieri (2021) about structural change in other countries.

We then examine our calibrated model's implications for labor reallocation at the business cycle frequency and its implication for employment fluctuations. We find that our model can indeed account for China's employment fluctua-tions at the sector level and in aggregate, as shown in column (2) in Table 5. The income effect is also important for the model to match China's business cy-cle moments as, without the income effect (as shown in columns (3) and (6) in Table 5), the model cannot generate either the low correlation between aggre-gate employment and output or the negative correlation between relative em-ployment in agriculture and aggregate income in China. Finally, column (5) of the table shows that our model also does a good job at matching the aggregate employment fluctuations in developed countries such as the United States. In summary, our model of labor reallocation implies a low employment-output correlation for China and, at the same time, a high employment-output correla-tion for the United States. The difference in aggregate employment fluctuations between the two countries is due to their different stage of economic develop-ment. For the period we study, 1978–2017, the agricultural employment share averaged 51% in China, but was less than 3% in the United States. Therefore, the labor reallocation between agriculture and non-agriculture has an important dampening effect on aggregate employment fluctuations in China, but a negli-gible effect in the United States.

Table 5: Benchmark Results

Policy Implications and Suggestions

Aggregate employment has always been an important indicator for short-run economic performance for developed countries. However, the low employment-output correlation in China means that the aggregate employment is not a good indicator of the business cycle in China. This finding is important for China’s monetary policy design. In recent years, the Chinese government has emphasized “stabilizing employment” as one of the main objectives of its monetary policy. Our findings suggest that it is non-agricultural employment, not aggregate employment, that should be the target for stabilization policy in China.

Note 1: These puzzling facts about aggregate employment fluctuations in China are present even after we carefully correct for some well-known measurement problems in the official employment and GDP series.

(Wen Yao is an Associate Professor of Economics in the School of Economics and Management, Tsinghua University; Xiaodong Zhu, University of Toronto and Tsinghua University, PBC School of Finance.)

References

Boppart, T., “Structural Change and The Kaldor Facts in a Growth Model with Relative Price Effects and Non-Gorman Preferences,” Econometrica 82 (2014), 2167–2196.

Comin, D., D. Lashkari, and M. Mestieri, “Structural Change with Long-Run Income and Price Effects,” Econometrica, forthcoming.

Yao W. and X.D. Zhu, “Structural Change and Aggregate Employment Fluctuations in China,” International Economic Review, Volume 62, No.1, 2021.

Latest

Most Popular

- VoxChina Covid-19 Forum (Second Edition): China’s Post-Lockdown Economic Recovery VoxChina, Apr 18, 2020

- China’s Great Housing Boom Kaiji Chen, Yi Wen, Oct 11, 2017

- China’s Joint Venture Policy and the International Transfer of Technology Kun Jiang, Wolfgang Keller, Larry D. Qiu, William Ridley, Feb 06, 2019

- The Dark Side of the Chinese Fiscal Stimulus: Evidence from Local Government Debt Yi Huang, Marco Pagano, Ugo Panizza, Jun 28, 2017

- Wealth Redistribution in the Chinese Stock Market: the Role of Bubbles and Crashes Li An, Jiangze Bian, Dong Lou, Donghui Shi, Jul 01, 2020

- What Is Special about China’s Housing Boom? Edward L. Glaeser, Wei Huang, Yueran Ma, Andrei Shleifer, Jun 20, 2017

- Evaluating Risk across Chinese Housing Markets Yongheng Deng, Joseph Gyourko, Jing Wu, Aug 02, 2017

- Privatization and Productivity in China Yuyu Chen, Mitsuru Igami, Masayuki Sawada, Mo Xiao, Jan 31, 2018

- How did China Move Up the Global Value Chains? Hiau Looi Kee, Heiwai Tang, Aug 30, 2017

- China’s Shadow Banking Sector: Wealth Management Products and Issuing Banks Viral V. Acharya, Jun Qian, Zhishu Yang, Aug 09, 2017

Facebook

Facebook  Twitter

Twitter  Instagram

Instagram WeChat

WeChat  Email

Email