Outward FDI and Domestic Input Distortions: Evidence from Chinese Firms

A recent study shows that domestic input distortions faced by private firms in China have generated extra incentives for those firms to invest and produce abroad. This finding helps explain an astonishing increase in China’s outward foreign direct investment (FDI) flows since the financial crisis.

The sharp increase in outward FDI from developing countries in the past decade has been phenomenal, and this is especially true for China. The UNCTAD World Investment Report (UNCTAD 2015) shows that outward FDI flows from developing economies have already accounted for more than 33 percent of overall FDI flows, up from 13 percent in 2007. Furthermore, despite a 16 percent decrease in global FDI flows in 2014, MNCs from developing economies invested almost US$468 billion abroad in 2014, an increase of 23 percent over the previous year. As the largest developing country in the world, China has seen a stark increase in its outward FDI flows in the past decade. In 2015, China’s outward FDI reached the level of 9.9 percent of the world’s total FDI flows, which made China the second largest home country of FDI outflows globally. In addition, manufacturing outward FDI from China is becoming more important in the country’s total outward FDI flows. Its share in China’s total outward FDI has increased from 9.9 percent in 2012 to 18.3 percent in 2016. In sum, patterns of China’s manufacturing outward FDI flows need to be explored, given the country’s importance for the world economy.

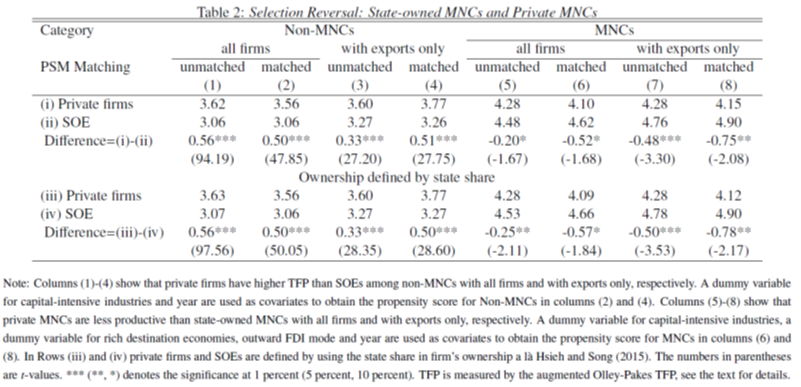

A paper published in the November 2019 issue of the Economic Journal by Cheng Chen, Wei Tian, and Miaojie Yu investigates the patterns of China’s outward FDI of manufacturing firms, through the lens of domestic input market distortions. Our research shows that, on average, privately owned Chinese manufacturing multinational companies are less productive than those that are in the hands of the state, as shown by Table 2 of our paper. This is true despite the fact that private, non-multinational manufacturing companies are, on average, more productive than those owned by the state.

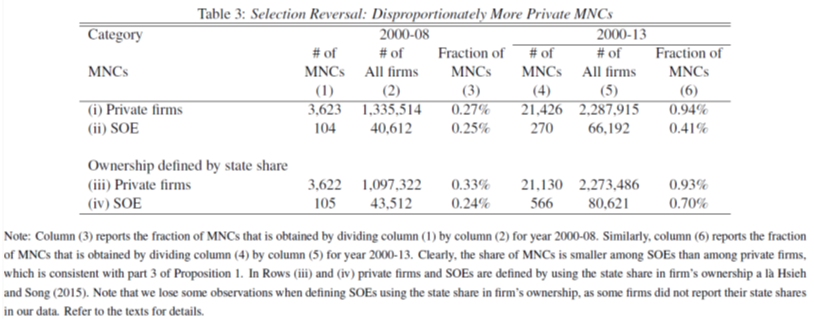

Also, compared to private firms, the fraction of firms that undertake outward FDI is smaller among state-owned enterprises, as shown in the table below (Table 3 of the paper). What’s surprising about this is that state-owned enterprises are much larger than private firms in China, and larger firms are more likely to become multinational companies. They also receive substantial support from the Chinese government to invest abroad.

To understand these findings, we build a model to highlight two economic forces determining outward FDI: institutional arbitrage and selection reversal. We assume that private firms pay a higher rental price on land and capital when producing domestically, compared with state-owned companies. However, all firms pay the same prices on inputs when they produce abroad.

The model shows that Chinese private firms pay higher costs when borrowing money and renting land in the domestic market, because of government interventions in financial markets and the national ownership of land in China. However, when private firms produce abroad, at least part of the gap in input prices ceases to exist as the financial and land markets in foreign economies are not controlled by the Chinese government.

As a result, there is an extra incentive for private firms to invest and produce abroad, since they can circumvent the input market distortion that exists only domestically by becoming multinational companies (institutional arbitrage). Since they receive an extra benefit by producing abroad, the incentive to become a multinational company is higher. This leads to less selection into the outward FDI market for private firms (selection reversal). This explains why there are disproportionately fewer multinational companies among state-owned enterprises than among private firms and why private multinationals are less productive than those owned by the state.

(Cheng Chen, Clemson University; Wei Tian is a tenured associate professor in School of Economics, Peking University; Miaojie Yu, National School of Development, Peking University.)

References

Chen, Cheng, Wei Tian, and Miaojie Yu. 2019. “Outward FDI and Domestic Input Distortions: Evidence from Chinese Firms.” Economic Journal 129 (624): 3025–57. https://www.doi.org/10.1093/ej/uez034.

Ministry of Commerce of China and National Bureau of Statistics of China. 2006, 2008, 2012, 2015 and 2016. “Statistical Bulletin of China’s Outward Foreign Direct Investment.” Ministry of Commerce of China and National Bureau of Statistics of China. http://english.mofcom.gov.cn/article/statistic/foreigninvestment/?3.

United Nations Conference on Trade and Development (UNCTAD). 2015. “World Investment Report: Reforming International Investment Governance.” UNCTAD, Geneva. https://unctad.org/webflyer/world-investment-report-2015.

Latest

Most Popular

- VoxChina Covid-19 Forum (Second Edition): China’s Post-Lockdown Economic Recovery VoxChina, Apr 18, 2020

- China’s Great Housing Boom Kaiji Chen, Yi Wen, Oct 11, 2017

- China’s Joint Venture Policy and the International Transfer of Technology Kun Jiang, Wolfgang Keller, Larry D. Qiu, William Ridley, Feb 06, 2019

- The Dark Side of the Chinese Fiscal Stimulus: Evidence from Local Government Debt Yi Huang, Marco Pagano, Ugo Panizza, Jun 28, 2017

- Wealth Redistribution in the Chinese Stock Market: the Role of Bubbles and Crashes Li An, Jiangze Bian, Dong Lou, Donghui Shi, Jul 01, 2020

- What Is Special about China’s Housing Boom? Edward L. Glaeser, Wei Huang, Yueran Ma, Andrei Shleifer, Jun 20, 2017

- Evaluating Risk across Chinese Housing Markets Yongheng Deng, Joseph Gyourko, Jing Wu, Aug 02, 2017

- Privatization and Productivity in China Yuyu Chen, Mitsuru Igami, Masayuki Sawada, Mo Xiao, Jan 31, 2018

- How did China Move Up the Global Value Chains? Hiau Looi Kee, Heiwai Tang, Aug 30, 2017

- China’s Shadow Banking Sector: Wealth Management Products and Issuing Banks Viral V. Acharya, Jun Qian, Zhishu Yang, Aug 09, 2017

Facebook

Facebook  Twitter

Twitter  Instagram

Instagram WeChat

WeChat  Email

Email