Credit Constraints and Fraud Victimization: Evidence from a Representative Chinese Household Survey

How and why do household credit constraints affect fraud victimization when households face fraud schemes? Using the urban sample of a novel nationally representative data set on fraud victimization and household finance, we find that households facing credit constraints are associated with a higher probability of becoming fraud victims and suffer from higher economic losses from frauds than households not facing such constraints. Further analyses show that the personal discount rate and the need for social network expansion are critical pathways via which credit constraints affect fraud victimization.

Fraud victimization has profound economic and social implications. With the widespread leakage of private information and ever-evolving fraud schemes, people frequently encounter these schemes. Millions of people are victimized by fraud and suffer enormous economic losses every year. A Federal Trade Commission survey reveals that 15.9 percent of U.S. respondents were victims of fraud in 2017. The direct monetary costs incurred by victimization could reach $50 billion per year (Brenner et al., 2020).

The issue is of greater importance in developing countries. In China, for instance, fraud incidents have grown at an annual rate of 20 to 30 percent in the past decade. According to a report by the Chinese government, nearly half of internet users encountered fraud schemes in 2018, and 28 percent of them suffered economic losses. Based on judicial data (China Judicial Documents), 32 percent of cybercrime is fraud, and it involved 46,000 fraudsters during 2016–2018 (see Note 1).

Previous research, mostly in criminology and the financial advisory industry, has examined the behavioral patterns of fraud offenders (Dimmock and Gerken, 2012; Egan et al., 2019). Behind the commonly encountered phone calls and emails are well-trained fraudsters in criminal organizations with sophisticated technologies. Those organizations are armed with details about potential victims and “scripts” instructing fraudsters on how to persuade potential victims to buy their stories and transfer money. However, it remains unclear why potential fraud victims actually become victimized. In our recent working paper (Gao et al., 2020), we investigate fraud victimization from the perspective of household financial conditions. Specifically, how and why do household credit constraints affect fraud victimization when households are faced with fraud schemes?

We rely on data from the Chinese Household Finance Survey (CHFS), conducted by the Survey and Research Center for China Household Finance in Southwestern University of Finance and Economics. This survey started in 2011 with a sample of 8,438 households covering 25 provinces in both urban and rural China. The CHFS sample size is enlarged every other year with a new survey wave. The most recent survey wave was conducted with 40,000 households in 2019. We use Wave 3 (CHFS-III) in 2015 because this is the only wave with nationally representative information on fraud victimization.

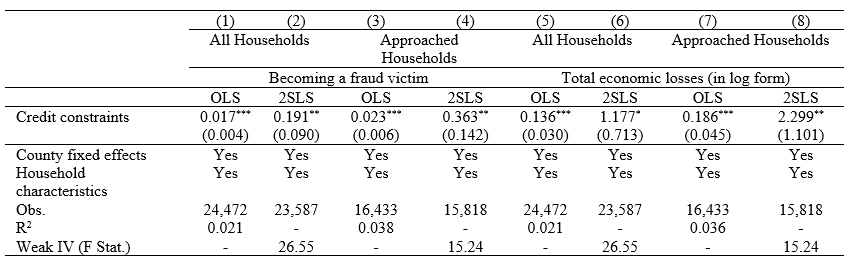

Using the urban sample of the CHFS-III, we find that a key determinant of who becomes a victim is that the household is facing credit constraints. Credit constraints happen when there are frictions in the supply of capital and individuals are unable to obtain sufficient loans from banks or other institutions (Hurst and Lusardi, 2004; Farre-Mensa and Ljungqvist, 2016). We consider a household as being credit-constrained if the household: (1) needs a loan, but has been rejected by banks or other credit institutions; (2) is unable to obtain sufficient loans from banks or other credit institutions; or (3) did not apply for loans because they have no collateral, or due to the complex paperwork, outstanding loans, or likelihood of being rejected. As shown in Table 1, the OLS estimation results indicate that being credit-constrained is associated with 2.3 percentage point increase in the probability of becoming a victim and 20.4 percent (that is, e0.186-1) increase in the total amount of subsequent economic losses for those being approached.

It is possible that unobserved characteristics (such as personality and self-control) can affect both credit constraints and fraud victimization. It is also possible that fraud victimization may increase the probability of being credit-constrained. To estimate the causal impact of credit constraints on fraud victimization, we exploit a household’s exposure to a nationwide Property Privatization Reform and its access to local formal finance as exogenous shifters of credit constraints, as they capture both the demand- and supply-side effect on households’ credit constraints. In the 1990s, China implemented an unexpected nationwide housing privatization reform that allowed urban residents to purchase and privately own the state-owned housing in which they lived. Because the purchase price was subsidized and lower than market price, and private housing can be used as collateral to obtain loans from financial institutions, privatized housing led to an exogenous increase in household wealth and loosened household financial constraints (Wang, 2012). Meanwhile, local bank density is a good indicator for access to formal bank finance. Living in an area with a higher density of bank branches can foster access to credit and decrease the likelihood of credit constraints (Rossi and Trucchi, 2016). The key identifying assumption is that the property privatization reform and bank density affect fraud victimization only through household credit constraints, conditional on the county fixed effects and the covariates. The instrumental-variable estimation results confirm that credit constraints lead to a higher probability of fraud victimization and higher subsequent economic losses.

Table 1: Credit Constraints and Fraud Victimization (OLS & 2SLS)

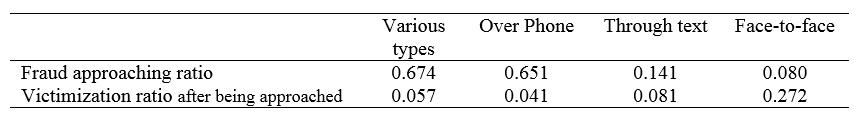

Fraud victimization involves two steps: being approached and subsequently being victimized. Table 2 shows the patterns of fraud approach and differences in the probability of victimization across various patterns in urban China. To account for the possibility that being approached is not random and the probability that being approached and being victimized are jointly determined by unobservables, we further implement the Heckman selection model, where we employ the e-commerce coverage as the exogenous variation that determines the probability of being approached by fraudsters. Through the internet and big data technology, fraudsters can target individuals more precisely based on leaked private information from telecom operators or online shopping websites. It is therefore plausible that living in a community with higher use of e-commerce is associated with a higher probability of one’s private information being leaked and being approached by fraudsters. In practice, we employ the average amount of online shopping expenditure at the community level to proxy for use of e-commerce. Our main findings remain robust.

Table 2: Fraud Approaching and Victimization

We further rule out the confounding effect of information acquisition and financial literacy on fraud outcomes. As credit-constrained households may fail to acquire anti-fraud information released by banks or other credit institutions, a natural concern is that it may be the anti-fraud information acquisition, rather than facing credit constraints, that causes fraud victimization. Furthermore, a higher level of financial literacy helps people better understand financial products and distinguish legitimate investment projects from fraud schemes. The estimated impact of credit constraints on fraud victimization may thus be confounded by financial literacy. To address these concerns, we add indicators of information acquisition and financial literacy in the main model. The coefficients of the newly added indicators are mostly statistically insignificant, while the coefficient of the credit constraints is similar to our main results, indicating that at least, neither information acquisition nor financial literacy fully explain the link between credit constraints and fraud victimization.

Analyses on potential mechanisms suggest that the personal discount rate (impatience) and the need to expand one’s social network are important pathways through which credit constraints affect fraud victimization. Borrowing constraints can shape people’s preferences on current versus future consumption (Harrison et al., 2002). Credit constraints may lead to a higher discount rate in the future and thus make people more prone to believe well-disguised fraud schemes that promise an egregious return within a short period. In practice, similar to previous literature, we infer the discount rate by examining illiquid accounts of households. Both OLS and 2SLS estimation results show that credit constraints lead to a lower probability of having an illiquid account, a lower value of illiquid asset, and a lower ratio of illiquid asset in total asset. Households with credit constraints thus have significantly higher discount rates than households without credit constraints. In addition, to obtain social collateral, households with severe credit constraints would engage in activities to expand their social networks (Karlan et al., 2009); more social interaction itself, along with the associated behavior changes such as emphasis on cooperative behavior, could make them more susceptible to becoming victims. The OLS and 2SLS estimation results show that credit-constrained households are indeed more likely to use informal credit. Perhaps to facilitate the necessary social connections needed in informal borrowing, credit-constrained household spend more on commuting and telephone services and are more likely to behave cooperatively.

We believe our study has implications for anti-fraud policy. Current policies on combating fraud victimization emphasize anti-fraud campaigns and increasing financial literacy. More generally in the case of containing crimes, strengthening law enforcement and improving the legal environment have been thought to be effective to thwart crimes (Ehrlich, 1996; Di Tella and Schargrodsky, 2004). We provide a complementary perspective and evidence that policies focusing on the provision of financial services and credit to households may be as important. When encountering credit-related fraud schemes, sufficient access to credit provided to households would greatly reduce the risk of exposure to fraud schemes and allow these households to exhibit more patience—or be less subject to the temptation of quick payoffs.

Note 1: Source: https://www.secrss.com/articles/15226

(Nan Gao, Zhongnan University of Economics and Law; Yuanyuan Ma, Zhongnan University of Economics and Law; Lixin Colin Xu, World Bank.)

References

Brenner, L., Meyll, T., Stolper, O., and Walter, A. (2020). Consumer Fraud Victimization and Financial Well-Being. Journal of Economic Psychology, 76, 102243.

Dimmock, Stephen G., William C. Gerken. (2012). Predicting Fraud by Investment Managers. Journal of Financial Economics, 105(1), 153–173.

Di Tella, R., Schargrodsky, E. (2004). Do Police Reduce Crime? Estimates Using the Allocation of Police Forces after a Terrorist Attack. American Economic Review, 94(1), 115–133.

Egan, Mark, Gregor Matvos, and Amit Seru. (2019). The Market for Financial Adviser Misconduct. Journal of Political Economy, 127(1): 233–295.

Ehrlich, I. (1996). Crime, Punishment, and the Market for Offenses. Journal of Economic Perspectives, 10(1), 43–67.

Farre-Mensa, J., & Ljungqvist, A. (2016). Do Measures of Financial Constraints Measure Financial Constraints? The Review of Financial Studies, 29(2), 271–308.

Gao, Nan, Ma, Yuanyuan, Xu, and Lixin Colin Xu. (2020). Credit Constraints and Fraud Victimization: Evidence from a Representative Chinese Household Survey. Policy Research Working Paper, No. 9460 https://openknowledge.worldbank.org/handle/10986/34693.

Harrison, G. W., Lau, M. I., and Williams, M. B. (2002). Estimating Individual Discount Rates in Denmark: A Field Experiment. American Economic Review, 92(5), 1606–1617.

Hurst, E., & Lusardi, A. (2004). Liquidity Constraints, Household Wealth, and Entrepreneurship. Journal of Political Economy, 112(2), 319–347.

Karlan, D., Mobius, M., Rosenblat, T., and Szeidl, A. (2009). Trust and Social Collateral. The Quarterly Journal of Economics, 124(3), 1307–1361.

Rossi, M., & Trucchi, S. (2016). Liquidity Constraints and Labor Supply. European Economic Review, 87, 176–193.

Wang, S. Y. (2012). Credit Constraints, Job Mobility, and Entrepreneurship: Evidence from a Property Reform in China. Review of Economics and Statistics, 94(2), 532–551.

Latest

Most Popular

- VoxChina Covid-19 Forum (Second Edition): China’s Post-Lockdown Economic Recovery VoxChina, Apr 18, 2020

- China’s Great Housing Boom Kaiji Chen, Yi Wen, Oct 11, 2017

- China’s Joint Venture Policy and the International Transfer of Technology Kun Jiang, Wolfgang Keller, Larry D. Qiu, William Ridley, Feb 06, 2019

- The Dark Side of the Chinese Fiscal Stimulus: Evidence from Local Government Debt Yi Huang, Marco Pagano, Ugo Panizza, Jun 28, 2017

- Wealth Redistribution in the Chinese Stock Market: the Role of Bubbles and Crashes Li An, Jiangze Bian, Dong Lou, Donghui Shi, Jul 01, 2020

- What Is Special about China’s Housing Boom? Edward L. Glaeser, Wei Huang, Yueran Ma, Andrei Shleifer, Jun 20, 2017

- Evaluating Risk across Chinese Housing Markets Yongheng Deng, Joseph Gyourko, Jing Wu, Aug 02, 2017

- Privatization and Productivity in China Yuyu Chen, Mitsuru Igami, Masayuki Sawada, Mo Xiao, Jan 31, 2018

- How did China Move Up the Global Value Chains? Hiau Looi Kee, Heiwai Tang, Aug 30, 2017

- China’s Shadow Banking Sector: Wealth Management Products and Issuing Banks Viral V. Acharya, Jun Qian, Zhishu Yang, Aug 09, 2017

Facebook

Facebook  Twitter

Twitter  Instagram

Instagram WeChat

WeChat  Email

Email