FinTech Adoption and Household Risk-Taking

China has experienced a rapid increase in FinTech penetration in the form of offline digital payments over the past decade. Using unique account-level data on consumption, investments, and FinTech usage from the Ant Group, we find that FinTech can lower investment barriers and help households move toward optimal risk-taking. Inferring individuals’ risk tolerance from their consumption volatility, we find that individuals who are more risk tolerant benefit more from FinTech advancement. Examining the enhancement in risk-taking across geographical locations, we find that cities with low financial service coverage benefit the most from FinTech penetration.

Over the past decade, widespread adoption of financial technology (FinTech) has been breaking down many of the traditional barriers faced by households and reshaping household finance practices. Increasingly, activities central to household finance—consumption, investments, and payments, are taking place on FinTech platforms, where, via mobile apps, individuals can fulfill their financial service needs almost instantaneously regardless of the place or time. For example, in China, mutual fund distributions via FinTech platforms grew from non-existent in 2012 to capturing an estimated 30% of the total market share currently, and digital payments, which began in 2004, have now permeated the entire country, with each street vendor eager to accept Alipay or WeChat Pay.

Using account-level data from the Ant Group that allows us to track the consumption, investments, and FinTech adoption for 50,000 randomly selected Alipay customers over the period of January 2017 to March 2019, we study how FinTech adoption can lower investment barriers and help improve household risk-taking. An important question in the study of household finance is why households have low participation rates in risky assets. Explanations for this under-risk-taking include a lack of financial education, physical costs such as money and time, and psychological costs such as familiarity and trust. Compared with traditional venues, the technological efficiency of FinTech platforms can significantly reduce some of the physical costs. Their brand recognition and the repeated use of FinTech apps by individuals (e.g., via digital payments) may very well help lower the psychological barriers by building familiarity and trust. Over the long run, FinTech apps can also serve as effective venues for promoting financial literacy.

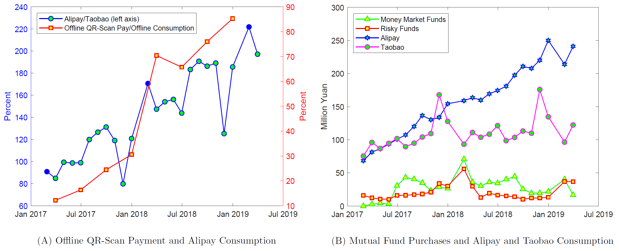

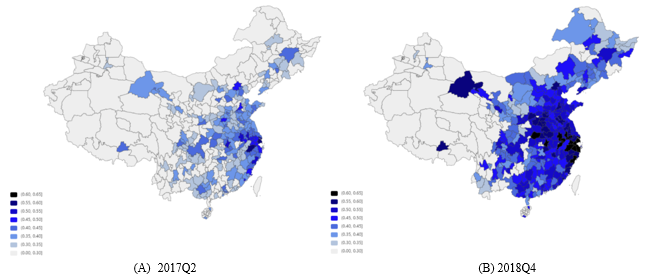

An ideal test of FinTech's impact on risk-taking would involve tracking each individual's migration onto the FinTech platforms with records of their risk-taking behavior both on and off platforms. Absent such ideal data, we use the FinTech adoption measure to mimic that migration. Over our sample period, from January 2017 to March 2019, China experienced a rapid increase in FinTech penetration in the form of offline QR-code scanning payment, which Alipay pioneered in China. As shown in Graph A of Figure 1, over the span of just two years, this form of payment exploded from 0.6 trillion yuan in Q1 of 2017 to 7.2 trillion yuan in Q4 of 2018 (see Note 1). The same trend is captured in our data via the rapid increase in the use of Alipay: the ratio of Alipay to Taobao consumption increased from 90% in January 2017 to 197% in March 2019. According to Graph B of Figure 1, over the same time span, online Taobao consumption was itself increasing, but it was “yesterday's technology.” In 2018 in China, the FinTech savviness of an individual was captured not by their online consumption, but by FinTech’s penetration of their offline consumption. Hence, we use an Alipay consumption fraction, calculated as Alipay/(Alipay+Taobao), as a variable ranging in value from zero to one to capture each individual’s FinTech adoption. Figure 2 shows the geographical distribution of FinTech adoption in 2017Q2 and 2018Q4. We find significant variations in FinTech adoption across cities in China and over time, owing to the gradual spread of the new technology from Hangzhou to inner China during our sample period.

Figure 1. FinTech in China

Note: Alipay and Taobao consumption data are aggregated across 50,000 randomly sampled individuals. Data on Offline QR-Scan Pay and Offline Consumption are from the National Bureau of Statistics. Monthly mutual fund purchases are from the Ant Group's investment platform.

Figure 2. Geographic Distribution of FinTech Adoption

Note: Graphs A and B show the geographic distribution of city-level FinTech penetration at 2017Q2 and 2018Q4 respectively. City FinTech adoption is the average fraction of consumption paid via Alipay digital payments out of total consumption for individuals in a city.

To measure risk-taking, we use each individual’s mutual-fund purchases, redemptions, and holdings accomplished through the Ant Group's investment platform. Through the one-stop Alipay app, investors can purchase and redeem nearly the entire universe of mutual funds in China with a few taps on their mobile phone (see Note 2). We measure three aspects of individuals’ risk-taking: risky asset participation, risky shares, and portfolio volatility. In particular, for all individuals in our sample, “risky participation” is a zero-one variable measuring their participation in non-money–market funds, which include bond funds, mixed funds, equity funds, index funds, QDII funds, and gold funds. For active investors in our sample (see Note 3), we further construct their “risky shares,” which are the portfolio weights on the non-money–market funds and their “portfolio volatility” from monthly returns to their mutual fund holdings.

Individual FinTech Adoption and Risk-Taking

Using FinTech adoption to explain the cross-individual variation in risk-taking, we find that all three risk-taking measures are positive and significantly related to FinTech adoption. Quantitatively, our regression- based analysis suggests that moving the FinTech adoption measure from zero to one corresponds to an increase of 13.6% in risky participation, a 14% increase in risky shares, and a 0.52% increase in portfolio volatility, where the average participation rate in our sample is 37.5%, the average risky portfolio weight is 45%, and the average monthly portfolio volatility is 1.77%. In addition to exploring this cross-individual variation in FinTech adoption, we also follow the same individual and measure their change in FinTech adoption from 2017 to 2018. Consistently, we find a significantly positive relation between changes in FinTech adoption and changes in risk-taking.

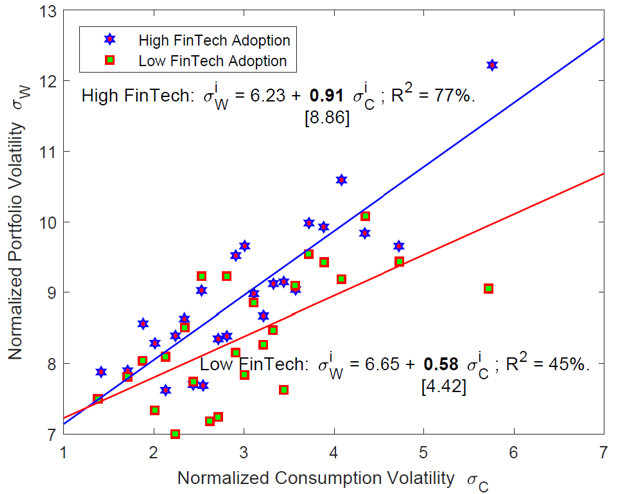

Figure 3. Individual FinTech Adoption and Optimal Risk-Taking

Note: We double-sort all individuals into 2× 25 groups based on their FinTech adoption and consumption growth volatility and report the relation between risk-taking and consumption growth volatility for the high and low FinTech adoption groups respectively.

Our empirical results indicate that FinTech adoption fosters risk-taking. But to what extent is our result driven by risk aversion, given that FinTech-savvy investors tend to be more risk-tolerant? In the classic Merton (1971) framework, an investor must choose how much to consume and must allocate their wealth between a risky asset and a risk-free asset so as to maximize expected utility. A high-risk averter prefers a steadier flow of consumption at a lower level of expected return. Following Merton (1971), where the optimal consumption volatility is linear in risk tolerance, we infer individuals' risk tolerance from their consumption growth volatility. Figure 3 shows that individuals with more volatile consumption, hence higher risk tolerance, invest more in risky assets. More interestingly, the enhancement of FinTech adoption on risk-taking increases with risk tolerance; that is, while FinTech adoption fosters risk-taking for all individuals, it is the investors who are more risk-tolerant who benefit more from the advancement of FinTech. Importantly, individual consumption volatility and portfolio volatility line up closely to the 45-degree line, suggesting that FinTech enables investors who are more risk-tolerant, who were otherwise more constrained in the absence of FinTech, to pursue their optimal risk-taking.

City FinTech Penetration and Risk-Taking

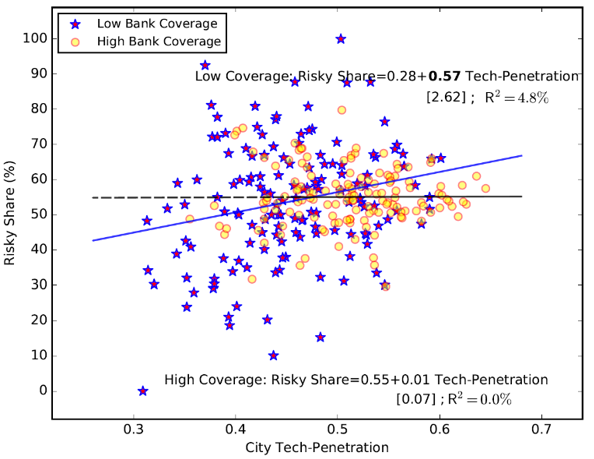

We further explore a second and equally interesting cross-sectional variation—the FinTech penetration across geographical locations in China. During our sample period, there was a gradual penetration of Alipay into different Chinese cities, with coastal areas surrounding the Any Group’s headquarters (Hangzhou) leading the way. This serves as a natural experiment for us to examine the extent to which FinTech can help lower investment barriers and foster risk-taking. Of particular interest to us are those cities in China underserved by banks, as individuals living in such cities stand to benefit the most from FinTech adoption. Indeed, this is what we find. As shown in Figure 4, we find a positive and significant relation between city-level FinTech penetration and risk-taking, and the relation is stronger for cities with below-median bank coverage. In addition to exploring the level of city FinTech penetration, we also track the change in city FinTech penetration from 2017 to 2018 and examine its impact on change in city risk- taking; we find consistent evidence. This finding indicates that FinTech could provide a complementary role to traditional financial institutions in the provision of financial services.

Figure 4. City FinTech Penetration and Risk-Taking

Our study of FinTech adoption on individual risk-taking sheds light on the potential benefit of tech firms in the provision of financial services. The current wave of FinTech development is different from the introduction of the internet in the early 2000s (see Note 4). Instead of serving as tools or facilitators for conventional financial institutions, the big techs now leverage their huge client bases, low operational costs, and extremely convenient user interfaces (e.g., mobile apps), to deliver financial products and services directly to individual investors. The FinTech platforms are reshaping the household finance at a fundamental level. Our finding on how FinTech can benefit individuals who are less served by traditional banks has important implications for the future of FinTech. For emerging-market countries with less-developed financial infrastructures, FinTech platforms can help fill the vacuum left open by the traditional financial services [e.g., Badarinza et al. (2019)].

Note 1: https://www.statista.com/statistics/1019344/china-offline-code-scanning-payment-transaction-value/

Note 2: According to Hong, Lu and Pan (2019), the function of Alipay app as a FinTech platform for mutual fund distribution was already well-developed before 2017. The incremental mutual fund purchases in our sample period cannot be attributed to sudden availability of such a function. In other words, the availability of mutual fund distributions and the rising use of digital payments did not occur simultaneously in our sample period.

Note 3: “Active user” is defined as a user with at least 100 RMB total purchases during our sample period from January 2017 to March 2019. We obtain 28,393 users for the “active user” sample.

Note 4: See Barber and Odean (2002), Choi et al. (2002), and Bogan (2008) on how the internet affects individual risk- taking.

(Claire Yurong Hong, Shanghai Advanced Institute of Finance, Shanghai Jiao Tong University; Xiaomeng Lu, Shanghai Advanced Institute of Finance, Shanghai Jiao Tong University; Jun Pan, Shanghai Advanced Institute of Finance, Shanghai Jiao Tong University and CAFR.)

References

Badarinza, C., Balasubramaniam, V. and Ramadorai, T. (2019). The Household Finance Landscape in Emerging Economies. Annual Review of Financial Economics 11, 109–129.

Barber, B.M. and Odean, T. (2002). Online Investors: Do the Slow Die First? Review of Financial Studies 15(2), 455–488.

Bogan, V. (2008). Stock Market Participation and the Internet. Journal of Financial and Quantitative Analysis, 191–211.

Choi, J.J., Laibson, D. and Metrick, A. (2002). How Does the Internet Affect Trading? Evidence from Investor Behavior in 401(k) Plans. Journal of Financial Economics 64(3), 397–421.

Frost, J. et al (2019). BigTech and the Changing Structure of Financial Intermediation. Economic Policy 34 (100), 961-799.

Goldstein, I., Jiang, W. and Karolyi, G.A. (2019). To FinTech and Beyond. Review of Financial Studies 32(5), 1647–1661.

Hong, C. Y., Lu, X., and Pan, J. 2020. FinTech Platforms and Mutual Fund Distribution (No. w26576). National Bureau of Economic Research.

Philippon, T. (2018). The FinTech Opportunity. Working Paper.

Latest

Most Popular

- VoxChina Covid-19 Forum (Second Edition): China’s Post-Lockdown Economic Recovery VoxChina, Apr 18, 2020

- China’s Great Housing Boom Kaiji Chen, Yi Wen, Oct 11, 2017

- China’s Joint Venture Policy and the International Transfer of Technology Kun Jiang, Wolfgang Keller, Larry D. Qiu, William Ridley, Feb 06, 2019

- The Dark Side of the Chinese Fiscal Stimulus: Evidence from Local Government Debt Yi Huang, Marco Pagano, Ugo Panizza, Jun 28, 2017

- Wealth Redistribution in the Chinese Stock Market: the Role of Bubbles and Crashes Li An, Jiangze Bian, Dong Lou, Donghui Shi, Jul 01, 2020

- Evaluating Risk across Chinese Housing Markets Yongheng Deng, Joseph Gyourko, Jing Wu, Aug 02, 2017

- What Is Special about China’s Housing Boom? Edward L. Glaeser, Wei Huang, Yueran Ma, Andrei Shleifer, Jun 20, 2017

- Privatization and Productivity in China Yuyu Chen, Mitsuru Igami, Masayuki Sawada, Mo Xiao, Jan 31, 2018

- How did China Move Up the Global Value Chains? Hiau Looi Kee, Heiwai Tang, Aug 30, 2017

- China’s Shadow Banking Sector: Wealth Management Products and Issuing Banks Viral V. Acharya, Jun Qian, Zhishu Yang, Aug 09, 2017

Facebook

Facebook  Twitter

Twitter  Instagram

Instagram WeChat

WeChat  Email

Email