How Does Monetary Policy Affect the Asset Management Industry? Evidence from China’s Fund Managers

We conduct a novel systematic textual analysis of the discussion in the quarterly reports of China fund managers, from which we infer their near-term expectations for Chinese monetary policy. We show that this aggregate index of manager expectations performs well as a forecast of Chinese monetary policy, that fund managers act on these expectations, and that correctly anticipating shifts in policy improves fund performance; thus, manager skill is an important determinant of fund returns.

The adoption of unconventional monetary policies over the past decades has made monetary policy much more complicated to understand, thereby increasing the importance of central bank communications and transparency. This makes it important to ask, how does monetary policy affect the asset management industry? Ammer et al. (2020) evaluate implications of this policy communications situation for China fund managers, and hence ultimately for Chinese monetary policy itself. Our starting point is a novel, systematic textual analysis of the qualitative discussion in the quarterly reports of China’s mutual fund managers, which gives rise to a large panel data set (4,571 funds, between 2008 Q3 and 2019 Q1) of mutual fund managers’ near-term expectations about shifts in Peoples Bank of China (PBoC) monetary policy. Each data point is a value between −1 and 1. The expectation measure is positive if a manager expects a tightening of monetary policy, negative if the manager expects an easing, and zero if the manager expects no change. The absolute value reflects the level of certainty and expected magnitude of the monetary policy change. For instance, the expectation measure for “We believe that monetary policy will continue to ease in the second quarter,” a statement taken from Penghua State-owned Corporate Bond Fund’s 2015 Q1 report, is −1.

We find that when mutual fund managers mention specific monetary policy instruments, they refer mostly to the required reserve ratio and the benchmark deposit rate and lending rate. This fact implies that interest rates and required reserve ratio are the key instruments investors look to for judging the stance of monetary policy during the sample periods. Accordingly, we measure shifts in Chinese monetary policy from the direction of change in the required reserve ratio, the benchmark deposit interest rate, and the benchmark lending interest rate.

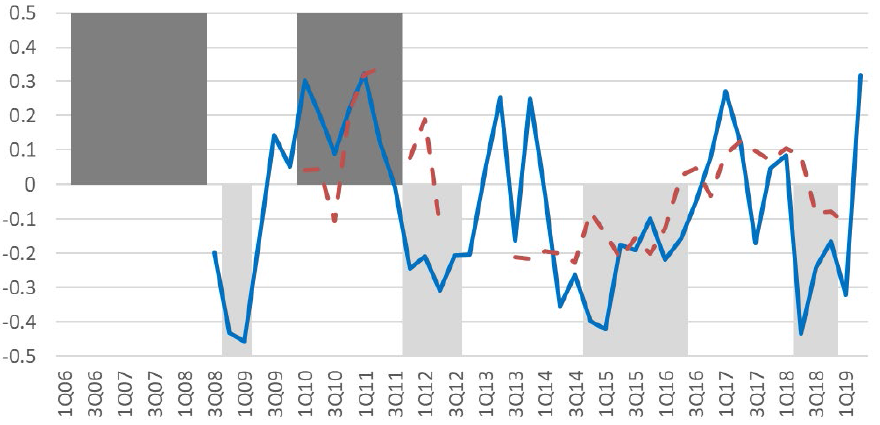

The forecast index constructed as the cross-sectional mean of managers’ expectations does well as a forecast of Chinese monetary policy (Figure 1). For example, the index predicts 49 percent of the variation of changes in the stance of monetary policy in the subsequent quarter, which is more than alternative projections such as the implied forward rates, an unrestricted Taylor rule, and the PBoC Survey of Commercial Bankers. The result is consistent with the presumption that mutual fund managers have strong incentive to form accurate expectations about monetary policy. In addition to the conventional effect of monetary policy on asset prices through the risk-free rate and the risk premium channel [Bernanke and Kuttner (2005)], Chinese monetary policy can have further effects on asset prices through regulatory channels. For example, the issuing rates of corporate bonds cannot be 40 percent higher than benchmark deposit rates. Moreover, fund customers might use fund managers’ reported expectations to gauge their managerial skill. Indeed, we document that the accumulative growth in fund size is positively correlated with the accuracy of managers’ monetary policy expectation, even conditional on funds’ risk-adjusted return.

Note: The solid line is the consensus forecast, measured as the mean of forecast scores across managers. The shaded columns are the monetary policy index constructed with the required reserve ratio, the benchmark deposit interest rate, and the benchmark lending interest rate. The darkly shaded columns indicate periods of tightening. The lightly shaded columns indicate easing periods. Monetary policy is unchanged in periods with no columns.

Monetary policy expectations and portfolio adjustment

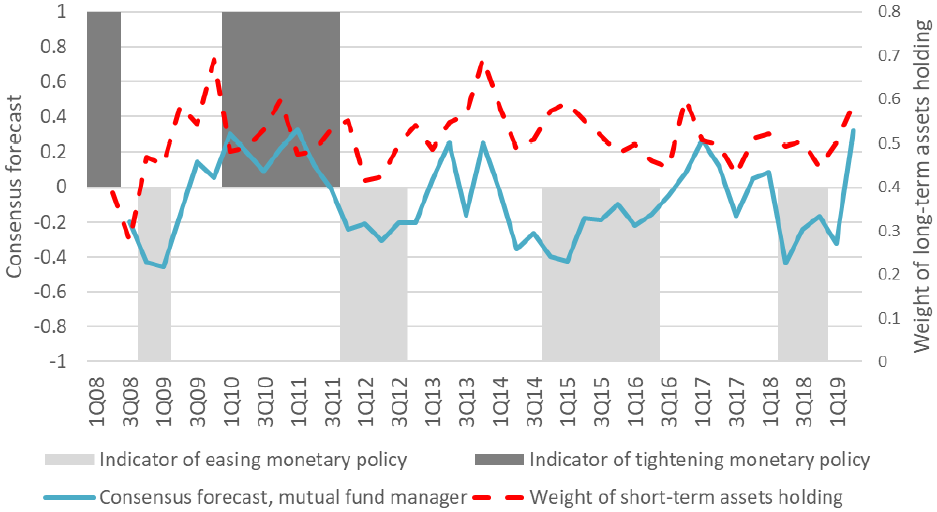

We examine how monetary policy expectations affect financial market participants’ investment decisions by matching the constructed expectation data to mutual fund managers’ investment history. We document that managers of money market funds buy (sell) long-term assets when expecting an easing (tightening) of monetary policy (Figure 2), consistent with the prediction of standard models. This finding provides direct evidence that monetary policy expectations serve as an important factor behind investors’ portfolio choice. It implies that systematic revisions of monetary policy expectations among market participants can induce significant rebalancing of asset holdings at the aggregate sector level [Feroli et al. (2014)], and thus potentially act as a channel of monetary policy transmission.

Note: The dashed curve displays the money market fund consensus forecast measured as the mean of forecast score across money market fund managers. The solid curve is the average weight of short-term asset holding weighted by fund size. Short-term asset is defined as an asset with a maturity less than 60 days. The shaded columns are the monetary policy index.

Characteristics of superior forecasters

While the consensus forecast index is validated as an exceptional predictor of monetary policy, there is substantial heterogeneity of forecast skill, measured by how often managers correctly anticipate shifts in monetary policy. An interesting question is which mutual fund managers best forecast shifts in monetary policy? We find that higher performers tend to manage a larger fund and charge higher management fees, both of which reflect how the market judges their skill. Interestingly, good forecasters also have more years of experience in the asset management industry and are more likely to hold a Ph.D. Both results are consistent with the idea that acquiring the necessary information to optimize investment decisions entails nonnegligible resource input, as first formalized by Grossman and Stiglitz (1980). Finally, Beijing-based fund managers are better forecasters of monetary policy, consistent with managers obtaining an informational advantage from geographical proximity to policy makers.

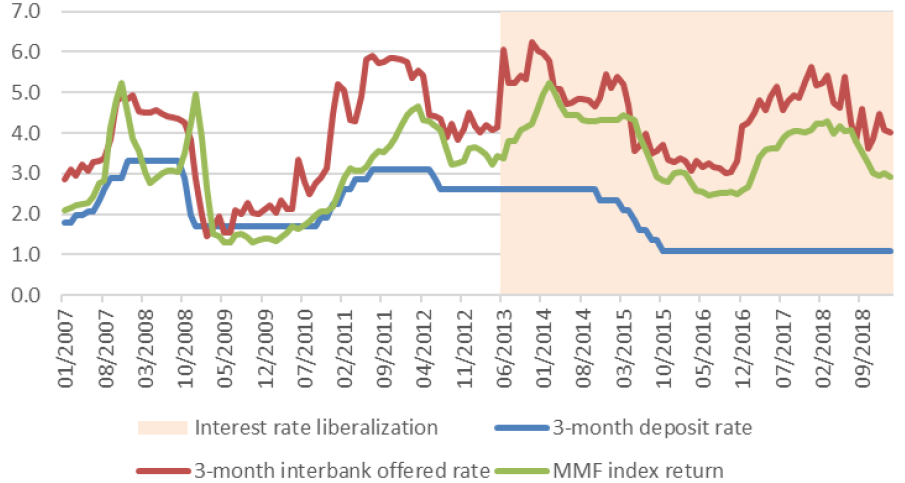

The effect of interest rate liberalization on mutual funds

A crucial change in China’s monetary policy practice in the last two decades is interest rate liberalization, which was a process of the PBoC’s transition from imposing interest rates through administrative orders to influencing market rates by managing its own balance sheet. While previous work has shown that interest rate liberalization has a significant effect on the transmission of monetary policy to the real economy [Liu et al. (2020)], we examine how it affects the mutual fund industry. We find that correct predictions of monetary policy improved money market funds' performance in the period prior to 2013, when market interest rates (such as inter-bank rates), which largely determine money market fund returns, remained in a narrow range around the benchmark deposit rate set by the central bank. After 2013, market interest rates have been less closely connected to benchmark policy interest rates, at least in the short run (Figure 3). Hence, correctly predicting the benchmark policy interest rate did not help the money market funds achieve a superior return in the latter part of the sample. However, it turns out that bond funds typically earn higher returns when their managers correctly predict the near-term direction of monetary policy, regardless of the policy regime. A possible interpretation of this finding is that bond funds invest in relatively long-term assets, whose value is heavily influenced by both the level of policy interest rates and revisions to near-term expectations. In contrast, correct predictions of monetary policy do not improve fund performance for equity funds and mixed funds, consistent with factors other than monetary policy being more important drivers of stock prices.

Note: The blue line is the benchmark three-month deposit rate. The red line is the weighted average of three-month inter-bank offered rates. The green line is the weighted average of money market funds' return. The patched area indicates post-June 2013, after which the market interest rates are allowed to float in a wider range around the benchmark policy rates.

Monetary policy expectations and fund flows

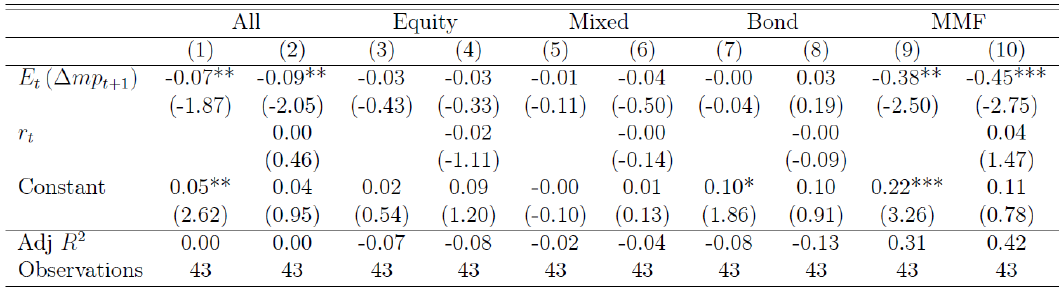

An important question about monetary policy is whether expected shifts induce systematic fund flows. We find significant net inflows to Chinese money market funds associated with near-term prospects for monetary policy easings (Table 1). This is consistent with strategic substitution by yield chasing depositors from bank deposits to money fund shares. Specifically, an easing (tightening) of monetary policy typically widens (narrows) the interest spread between the deposit rate and the money market funds’ yield, due to the loose link between the wholesale bank funding market and the short-term securities market in China. Interestingly, the sign of this relationship is at odds with what is found for banks in most other countries, where the link between wholesale bank funding and the short-term securities markets tends to be much closer, and low rates tend to depress net interest margins [Claessens et al. (2018)]. All else being equal, this substitution mechanism could weaken transmission of Chinese monetary policy to the real economy, because most bank borrowers do not have access to money-market financing. In contrast, there is no significant substitution between bank deposits and bond and equity investments. A possible reason is that bond and equity investments are subject to trading costs, while the trading costs for money market funds are close to zero.

Note: The dependent variables are the net inflow rates to each fund type. Et (mpt+1) is the consensus forecast. Rt is the weighted average of three-month inter-bank offered rates. Data is quarterly from 2008 Q3 to 2019 Q1. *, **, and *** denote significance at the 10%, 5%, and 1% levels, respectively.

(John Ammer is a Senior Economic Project Manager in the International Finance Division at the Federal Reserve Board in Washington, DC; John Rogers is a Senior Adviser in the International Finance Division of the Federal Reserve Board; Gang Wang is an assistant professor of at Shanghai University of Finance and Economics; Yang Yu is an assistant professor of economics at Shanghai University of Finance and Economics.)

References

Ammer, J, J. Rogers, G. Wang, and Y. Yu (2020): “Monetary Policy Expectations, Fund Managers, and Fund Returns: Evidence from China,” Federal Reserve Board, International Finance Discussion Paper 1285, www.federalreserve.gov/econres/ifdp/files/ifdp1285.pdf

Bernanke, B. and K. Kuttner (2005): “What Explains the Stock Market’s Reaction to Federal Reserve Policy?” Journal of Finance, 60, 1221–1257.

Chen, K., J. Ren, and T. Zha (2018a): “The Nexus of Monetary Policy and Shadow Banking in China,” American Economic Review, 108, 3891–3936.

Christensen, J. and S. Kwon (2014): “Assessing Expectations of Monetary Policy,” Federal Reserve Bank of San Francisco Economic Letter.

Claessens, S., N. Coleman, and M. Donnelly (2018): “’Low-For-Long’ Interest Rates and Banks’ Interest Margins and Profitability: Cross-Country Evidence,” Journal of Financial Intermediation, 35, 1–16.

Dincer, N., Eichengreen, B., and Geraats, P. (2019): “Transparency of Monetary Policy in the Postcrisis World,” The Oxford Handbook of the Economics of Central Banking, Oxford University Press, 287.

Feroli, M., A. Kashyap, K. Schoenholtz, and H. Shin, (2014): “Market Tantrums and Monetary Policy,” Chicago Booth Research Paper, 14–09.

Grossman, S. and J. Stiglitz (1980): “On the Impossibility of Informationally Efficient

Markets,” American Economic Review, 70, 393–408.

Jensen, M., and W. Meckling (1976): “Theory of the Firm: Managerial Behavior, Agency Costs and Ownership Structure,” Journal of Financial Economics, 3, 305–360.

Liu, Z., P. Wang, and Z. Xu (2020): “Interest-Rate Liberalization and Capital Misallocations,” American Economic Journal, Macroeconomics (Forthcoming).

Song, Z. and W. Xiong (2018): “Risks in China's Financial System,” Annual Review of Financial Economics, 10, 261–286.

Sun, R. (2018): “A Narrative Indicator of Monetary Conditions in China,” International Journal of Central Banking, 14, 1–42.

Latest

Most Popular

- VoxChina Covid-19 Forum (Second Edition): China’s Post-Lockdown Economic Recovery VoxChina, Apr 18, 2020

- China’s Great Housing Boom Kaiji Chen, Yi Wen, Oct 11, 2017

- China’s Joint Venture Policy and the International Transfer of Technology Kun Jiang, Wolfgang Keller, Larry D. Qiu, William Ridley, Feb 06, 2019

- The Dark Side of the Chinese Fiscal Stimulus: Evidence from Local Government Debt Yi Huang, Marco Pagano, Ugo Panizza, Jun 28, 2017

- Wealth Redistribution in the Chinese Stock Market: the Role of Bubbles and Crashes Li An, Jiangze Bian, Dong Lou, Donghui Shi, Jul 01, 2020

- What Is Special about China’s Housing Boom? Edward L. Glaeser, Wei Huang, Yueran Ma, Andrei Shleifer, Jun 20, 2017

- Evaluating Risk across Chinese Housing Markets Yongheng Deng, Joseph Gyourko, Jing Wu, Aug 02, 2017

- Privatization and Productivity in China Yuyu Chen, Mitsuru Igami, Masayuki Sawada, Mo Xiao, Jan 31, 2018

- How did China Move Up the Global Value Chains? Hiau Looi Kee, Heiwai Tang, Aug 30, 2017

- China’s Shadow Banking Sector: Wealth Management Products and Issuing Banks Viral V. Acharya, Jun Qian, Zhishu Yang, Aug 09, 2017

Facebook

Facebook  Twitter

Twitter  Instagram

Instagram WeChat

WeChat  Email

Email