Overpricing in China’s Corporate Bond Market

In China’s corporate bond market, the yield spread of newly issued bonds at their first secondary-market trade is on average 5.35 bps higher than the issuance spread. This overpricing is robust across bond issuances with different credit ratings, maturities, issuance types, and issuer status. Evidence suggests that competition among underwriters drives this overpricing through two specific channels—either through rebates to participants in issuance auctions or through direct auction bidding by the underwriters for themselves or their clients.

Pricing in the primary markets of securities such as stocks and bonds reflects the efficiency of these markets and directly concerns issuers, investors, and regulators. The extensive literature on this important topic has found substantial evidence of underpricing in equity IPOs, e.g., Ritter (1987), Ritter and Welch (2002), and Ljungqvist (2007). The literature often attributes this underpricing to premiums offered by issuers to compensate investors for the risks related to asymmetric information and adverse selection they face in purchasing IPOs. While the literature on the issuance pricing of corporate bonds is not as developed and is less conclusive, it mostly finds evidence of underpricing in corporate bond markets of developed economies and attributes the underpricing to asymmetric information faced by bond investors, e.g. Cai, Helwege and Warga (2007), Goldstein and Hotchkiss (2009), and Helwege and Kleiman (1998). Is underpricing a universal phenomenon in security issuance, especially in security markets of emerging economies, which tend to have different institutional environments and underwriting mechanisms from the United States?

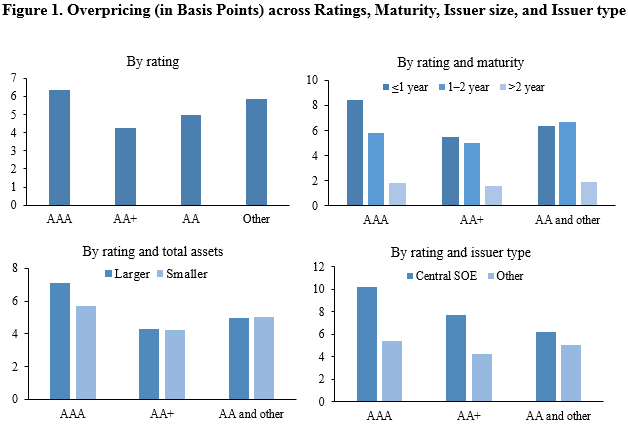

Our recent study, Ding, Xiong and Zhang (2019), analyzes this issue in China’s corporate bond market. Specifically, we examine the pricing of non-financial debt securities issued in 2015–2018 in the interbank market. In sharp contrast to pricing in the U.S. corporate bond market, we uncover strong evidence of overpricing in China’s corporate bond market. The yield spread of a bond at its first secondary-market trade is, on average, 5.35 bps higher than its yield spread at the bond issuance, relative to the yield of a Treasury bond with similar maturity. Given the total issuance size in our sample of about 17 trillion RMB and an average bond maturity of 1.7 years, this overpricing implies substantial savings of around 4 billion RMB for bond issuers each year. Figure 1 summarizes the overpricing across ratings, maturity, issuer size, and issuer type. The figure indicates that this overpricing is robust across bonds and issuers with different characteristics.

Why is pricing so different in China’s corporate market? It is ultimately driven by the institutional setting of this market. Asymmetric information between issuers and investors is less of a concern, with banks serving as the major investors and underwriters in the market. Their underwriting activities make them well-informed of market conditions and the risks of individual bond issuers. The low default rate in China’s bond market further alleviates the adverse selection problem, which is the key mechanism driving underpricing of security issuances in developed economies.

What has caused the pervasive overpricing in China’s corporate bond market? Our main hypothesis is that competition among underwriters for underwriting business has led them to drive up the issuance price. Consistent with this hypothesis, we find that a higher yield spread in the issuance of a bond (i.e., lower pricing) than the benchmark predicts a higher probability of the underwriter’s being fired by the issuer from underwriting its future bond issuance. This finding directly links overpricing with underwriters’ incentives.

To formally test the hypothesis, we identify two specific channels through which underwriters can influence the issuance price. In China’s interbank market, there are typically one or two licensed underwriters, which are mostly commercial banks, who underwrite a bond issuance through a single-price auction. Only qualified institutions can bid in the auction, and bonds are allocated to the highest bidders. The underwriters are not only responsible for attracting qualified institutions to participate in the auction, but can also bid for themselves and their clients who are not qualified to directly bid.

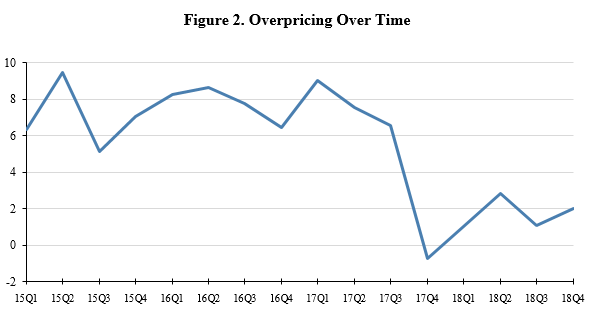

This policy shock provides an opportunity to test the causal relationship between the rebate and overpricing, as implied by our main hypothesis, by using a difference-in difference analysis to examine how the drop in issuance overpricing varied across different issuers and underwriters. As central state-owned enterprises (SOEs) are giant firms with central government guarantees, they are more valuable than other firms, causing more intense competition among underwriters for their bond underwriting business. Consistent with this notion, we find that after the underwriter rebate ban, the drop in overpricing is significantly greater for bonds issued by central SOEs than those issued by other firms. Furthermore, we also find that the drop in overpricing is significantly smaller for bond issuances underwritten by the top four banks, which are the largest underwriters in the interbank market. This finding is consistent with the notion that these top underwriters face less competition and thus have less incentive to use rebates in bond issuance. These significant difference-in-difference results support that underwriter rebates served as an important channel for underwriters to drive up bond issuance prices.

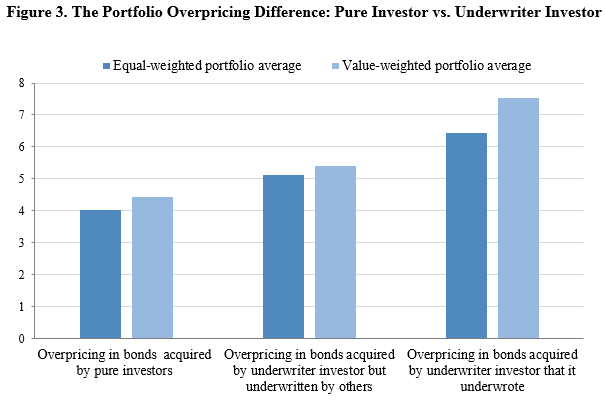

Interestingly, issuance overpricing remained significant even after the ban on underwriter rebates caused the overpricing to drop substantially. This observation motivates our analysis of the second channel—underwriters’ direct bidding in an auction. By bidding more aggressively, underwriters can directly drive up the bond issuance price. Interestingly, underwriters on average acquired 42% of the bond issuances in our sample. Figure 3 reports the average overpricing in three portfolios of newly issued bonds: 1) new bonds acquired by qualified investors, 2) new bonds acquired by licensed underwriters but not underwritten by themselves, and 3) new bonds acquired by a licensed underwriter that underwrites the bond itself. Overpricing in Portfolio 3 is significantly higher than that in Portfolios 1 and 2. This difference contradicts an argument that underwriters acquire new bonds to take advantage of their private information about the bonds they underwrite. Instead, it supports our main hypothesis that underwriters bid in issuance auctions to drive up prices (see Note 1).

(Yi Ding, the School of Management and Economics, the Chinese University of Hong Kong, Shenzhen; Wei Xiong, Department of Economics, Princeton University; Jinfan Zhang, the School of Management and Economics, the Chinese University of Hong Kong, Shenzhen.)

References:

Cai, Nianyun, Jean Helwege and Arthur Warga, 2007, Underpricing in the corporate bond market, Review of Financial Studies 20, 2021–2046.

Ding, Yi, Wei Xiong and Jinfan Zhang, 2019. Overpricing in China’s corporate bond market, Working paper, The Chinese University of Hong Kong, Shenzhen and Princeton University.

Goldstein, Michael A. and Edith S. Hotchkiss, 2007, Dealer behavior and the trading of newly issued corporate bonds, AFA 2009 San Francisco meetings paper.

Helwege, Jean and Paul Kleiman, 1998, The pricing of high-yield debt IPOs, Journal of Fixed Income 8, 61.

Ljungqvist, Alexander 2007, Chapter 7 - IPO Underpricing, Handbook of Empirical Corporate Finance, Elsevier, Pages 375–422.

Ritter, Jay R., 1987, The costs of going public. Journal of Financial Economics 19, 269–282.

Ritter, Jay R. and Ivo Welch, 2002, A review of IPO activity, pricing, and allocations, Journal of Finance 57, 1795–1828.

Latest

Most Popular

- VoxChina Covid-19 Forum (Second Edition): China’s Post-Lockdown Economic Recovery VoxChina, Apr 18, 2020

- China’s Great Housing Boom Kaiji Chen, Yi Wen, Oct 11, 2017

- China’s Joint Venture Policy and the International Transfer of Technology Kun Jiang, Wolfgang Keller, Larry D. Qiu, William Ridley, Feb 06, 2019

- The Dark Side of the Chinese Fiscal Stimulus: Evidence from Local Government Debt Yi Huang, Marco Pagano, Ugo Panizza, Jun 28, 2017

- Wealth Redistribution in the Chinese Stock Market: the Role of Bubbles and Crashes Li An, Jiangze Bian, Dong Lou, Donghui Shi, Jul 01, 2020

- What Is Special about China’s Housing Boom? Edward L. Glaeser, Wei Huang, Yueran Ma, Andrei Shleifer, Jun 20, 2017

- Evaluating Risk across Chinese Housing Markets Yongheng Deng, Joseph Gyourko, Jing Wu, Aug 02, 2017

- Privatization and Productivity in China Yuyu Chen, Mitsuru Igami, Masayuki Sawada, Mo Xiao, Jan 31, 2018

- How did China Move Up the Global Value Chains? Hiau Looi Kee, Heiwai Tang, Aug 30, 2017

- China’s Shadow Banking Sector: Wealth Management Products and Issuing Banks Viral V. Acharya, Jun Qian, Zhishu Yang, Aug 09, 2017

Facebook

Facebook  Twitter

Twitter  Instagram

Instagram WeChat

WeChat  Email

Email