The Long-Run Trend of Residential Investment in China

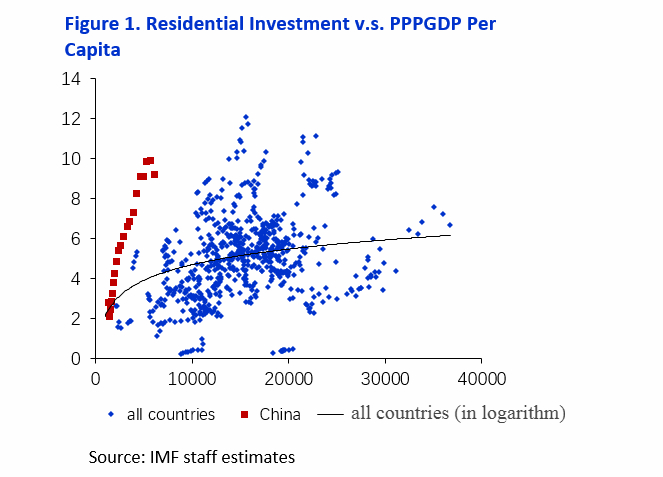

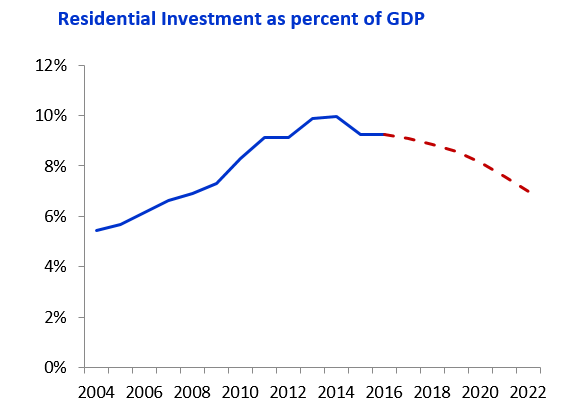

Residential investment has been a key growth engine for China in the last two decades. Total housing investment grew from about 4 percent of GDP in 1997 to a peak of 15 percent of GDP in 2014, with residential investment accounting for more than two-thirds of it. Our analysis indicates that structural changes in the Chinese economy that led to rebalancing toward consumption, as well as the liberalization of mortgage markets, were the key drivers of rising residential investment as a share of GDP. We project that residential investment will moderate from the current level of 9 percent of GDP to around 6 percent by 2024, and its contribution to real GDP growth will decline gradually from currently about one-half percent of GDP to slightly negative over this period. The decline reflects the projected slower pace of rebalancing in China and the increase in labor costs due to the country’s demographic changes.

Given these dynamics, it is important to understand why residential investment has outpaced the overall GDP growth in China since 2004, and how the envisaged slowdown in housing growth will shape the country’s overall economic growth for decades to come. In Ding and Lian (2018), we developed a two-step approach to study the factors that may affect the residential investment to GDP ratio. In the first step, we designed an accounting decomposition that links residential investment to variables representing the demand for housing services and the cost of residential structures. In the second step, we examined how structural factors (urbanization, housing market speculation, and mortgage credit cycles) can make residential investment deviate from a benchmark in which households spend a fixed share of their consumption on residential structures, and conducted cross-national analyses to pin down the elasticity of the deviation to such structural factors.

Our approach is in line with a strand of housing cycle literature that highlights the role of housing demand in explaining house price fluctuation (Iacoviello and Neri 2010; Liu, Wang, and Zha 2013; and Lian 2019). These studies consider a change in the share of housing consumption in total consumption as a channel for primitive shocks to influence house prices. However, no study has provided cross-national evidence on why the share can change over time. One obstacle is that it is not possible to directly measure the housing consumption of owner-occupied homes (see Note 1).

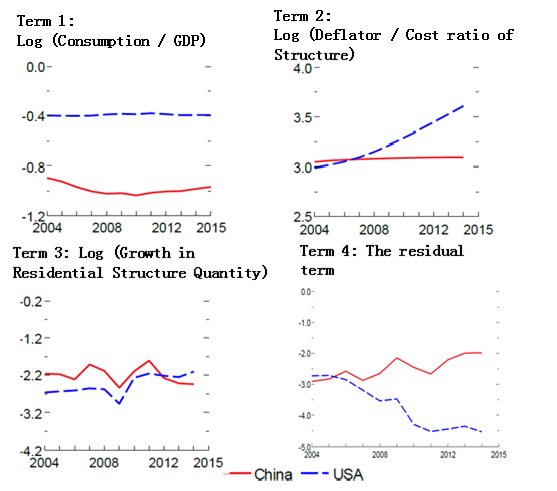

Our accounting decomposition methodology can overcome this obstacle and reveal how housing consumption as a share of total consumption may change over time, and how the changing share can further affect the residential investment to GDP ratio. The theoretical foundation of this decomposition can be seen by considering an economy in which a representative household produces housing services by using land and structures as inputs and the production function takes a Cobb-Douglas form. If the share of housing services consumption in total consumption is constant, changes in the residential investment to GDP ratio would be entirely driven by (1) consumption as share of GDP, (2) a deviation of residential structure price from its user-cost (as residential structures are durable goods), and (3) the growth of total consumption relative to that of structure user-cost (which affects the stock of residential structures). The thinking is straightforward: residential investment is equal to the sum of the depreciation of existing structures and the change in residential structure stock. The Cobb-Douglas production function assumption ensures that households spend a fixed share of their consumption on residential structures. Therefore, if the residential investment to GDP ratio deviates from the sum of these three components (the deviation is defined as a residual term in our model), it implies that the share of housing services in total consumption is not constant, or the production function is not Cobb-Douglas, or there are other factors, such as speculation in the housing market and urbanization, that are not captured by the decomposition.

There are several reasons why this residual term matters in China’s context. First, there could be pent-up demand for housing due to the underdevelopment of the country’s mortgage markets. Housing services consumption as a share of total consumption can be small if mortgages are not sufficiently accessible, because owning a home is expensive: it not only provides shelter, but also has a “shadow” value of relaxing tight borrowing constraints. The gradual liberalization of mortgage markets since 2004 could have led the residual term to rise over time. Second, ongoing urbanization in China makes housing services increasingly dependent on land rather than residential structures (imagine tighter zoning restrictions making new construction more difficult and thus increasing the share of land value in housing services). On the one hand, the rising cost of land can put downward pressure on residential investment. On the other hand, newly arriving migrants to cities create additional demand for housing construction. Therefore, the overall effects through the urbanization channel are ambiguous. Third, speculative investment based on the expectation of future house prices can also drive residential investment to go above the current demand for housing services (Choi et al 2014).

By using this accounting decomposition framework, we can put China’s residential investment dynamics into perspective through a comparison to the United States. From 2004 to 2016, the US experienced a sharp decline in residential investment as a share of GDP. Decomposition of the ratio indicates that the different dynamics between China and the US mostly came from the residual term.

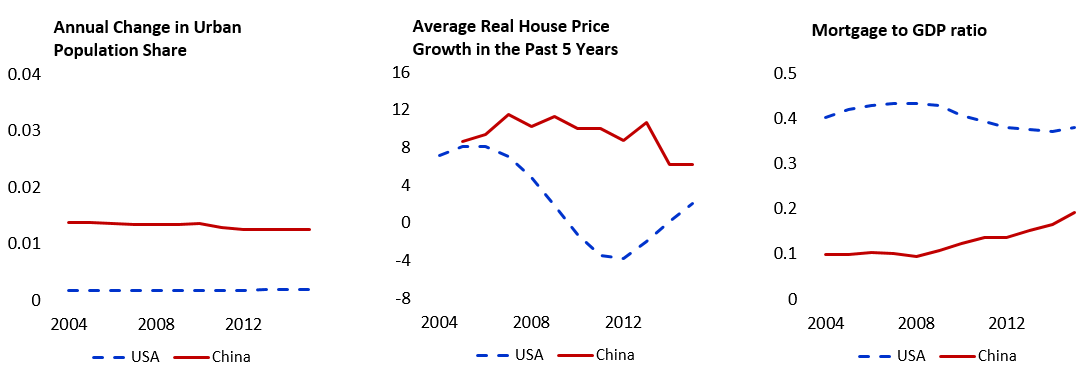

To understand the drivers of the residual term, in the second step we used cross-national analyses to show how the residual term may be related to structural factors, including the mortgage credit to GDP ratio, the share of urban population, its change, and the average house price growth in the past five years (as a proxy of speculation in housing markets). We conducted a panel regression using a sample of countries between 1980 and 2016 to examine this relationship. The regression results suggest that the mortgage credit to GDP ratio is a robust variable to predict the residual term, while the other structural factors are not as robust (see Note 2).

This two-step approach allowed us to provide some tentative answers to what may have caused the rapid increase in the ratio of residential investment to GDP in China since 2004. First, housing speculation and urbanization played limited roles in explaining China’s residential investment boom. This conclusion is drawn from a combination of four observations: (1) the residual term plays an important role in explaining the housing investment boom; (2) the pace of urbanization (as a proxy of the impact of new migrants on residential investment), however, has been fairly stable during this period; (3) the average house price growth rate in the past five years (as a proxy of housing market speculation) has also been stable and even declined somewhat at the end of the period; (4) as mentioned earlier, the relationship between the residual term and urbanization or the average house price growth in the past five years is not very robust.

Therefore, we can attribute China’s residential investment boom to two main factors: (1) the rebalancing of the Chinese economy towards consumption, as indicated by the decomposition analysis, and (2) the liberalization of the country’s mortgage markets, which helped meet the pent-up demand for housing and raise housing services consumption as a share of total consumption. It is noteworthy that rebalancing towards consumption also led consumption growth to be in tandem with the strong increase in the user-cost of housing. We highlight this channel because slower consumption growth and a continued rise in the user-cost of housing are the key reasons for us to predict that the residential investment to GDP ratio will decline in China going forward (see Note 3).

Based on the envisaged structural change of the Chinese economy over the long run, we project China’s residential investment to GDP ratio to gradually moderate to the pre-boom level over the medium term. Residential investment’s contribution to GDP growth would decline gradually from currently about one-half percent of GDP to -0.1 percent over this period. As noted earlier, a key driver of this decline is the projected moderation of consumption growth relative to the growth of the costs of residential structures (represented by the third term in the decomposition equation). This reflects the diminishing “base” effects as consumption growth is projected to moderate from 14 percent during the residential investment boom in 2010–15 to less than 9 percent by 2024, as well as rising labor costs due to population aging and reduced working-age population. In particular, the real user cost of structures is assumed to grow at around 5 percent between 2019 and 2029, which would be slightly lower than the average of 5.4 percent between 2009 and 2018 (see Note 4). The slower rebalancing dominates the direct positive impact of rebalancing (the projected further increase in consumption as a share of GDP) on residential investment, represented by the first term in the decomposition equation.

Note 1: The underlying method adopted by the national income and product account to impute it has been criticized by several studies (Prescott 1997; Gordon and Van Goethem 2005; and Díjaz and Luengo-Prado 2008).

Note 2: In Ding and Lian (2018) we did not find mortgage credit to be an important factor to explain the residual term. This result changed after we updated the database.

Note 3: According to Bentolila and Saint-Paul (2003), the construction sector has the highest labor share among all industries, and if wage cost grows faster than that of labor productivity, it can drive up the unit labor cost.

Note 4: This assumption implies that the labor income share in China will be broadly stable between 2019 and 2029.

(Ding Ding and Weicheng Lian are economists at the International Monetary Fund.)

References

Bentolila, Samuel, and Gilles Saint-Paul. 2003. “Explaining Movements in the Labor Share.” The B. E. Journal of Macroeconomics 3, no. 1: 1–33.

https://ideas.repec.org/a/bpj/bejmac/vcontributions.3y2003i1n9.html

Chivakul, Mali, W.Raphael Lam, Xiaoguang Liu, Wojciech Maliszewski, and Alfred Schipke. 2015. “Understanding Residential Real Estate in China.” IMF Working Paper No. 15/84.

https://www.imf.org/~/media/external/pubs/ft/wp/2015/wp1584.ashx

Choi, Hyun-Soo, Harrison Hong, and Jose Scheinkman. 2014. “Speculating on Home Improvements.” Journal of Financial Economics 111, no. 3: 609–24.

https://doi.org/10.1016/j.jfineco.2013.11.011

Davis, Morris, and Jonathan Heathcote. 2007. “The Price and Quantity of Residential Land in the United States.” Journal of Monetary Economics 54, no. 8: 2595–2620.

https://doi.org/10.1016/j.jmoneco.2007.06.023

Das, Mitali and Papa N’Diaye. 2013. “Chronicle of a Decline Foretold: Has China Reached the Lewis Turning Point?” IMF Working Paper No. 13/26.

https://www.imf.org/en/Publications/WP/Issues/2016/12/31/Chronicle-of-a-Decline-Foretold-Has-China-Reached-the-Lewis-Turning-Point-40281

Díaz, Antonia, and María José Luengo-Prado. 2008. “On the user cost and homeownership.” Review of Economic Dynamics 11, no. 3: 584-613.

https://doi.org/10.1016/j.red.2007.12.002

Ding, Ding, Xiaoyu Huang, Tao Jin and W. Raphael Lam. 2017. “Assessing China’s Residential Real Estate Market.” IMF Working Paper No. 17/248.

https://www.imf.org/en/Publications/WP/Issues/2017/11/16/Assessing-Chinas-Residential-Real-Estate-Market-45337

Ding, Ding, and Weicheng Lian. 2018. “The Long-Run Trend of Residential Investment in China.” IMF Working Paper No. 18/261.

https://www.imf.org/en/Publications/WP/Issues/2018/12/07/The-Long-Run-Trend-of-Residential-Investment-in-China-46367

Fang, Hanming, Quanlin Gu, Wei Xiong, and Li-An Zhou. 2016. “Demystifying the Chinese Housing Boom.” NBER Macroeconomics Annual 30, no. 1: 105–66.

https://doi.org/10.1086/685953

Garriga, Carlos, Aaron Hedlund, Yang Tang, and Ping Wang. 2017. “Rural-Urban Migration, Structural Transformation, and Housing Markets in China.” NBER Working Paper No. 23819.

https://www.nber.org/papers/w23819

Gordon, Robert J., and Todd VanGoethem. A Century of Housing Shelter Prices. 2005. “Is There a Downward Bias in the CPI?.” NBER Working Paper No. 11776.

https://www.nber.org/papers/w11776

Iacoviello, Matteo, and Stefano Neri. 2010. “Housing Market Spillovers: Evidence from an Estimated DSGE Model.” American Economic Journal: Macroeconomics 2, no. 2: 125–64.

https://doi.org/10.1257/mac.2.2.125

Lian, Weicheng. 2019. “Fundamental and Speculative Demands for Housing.” IMF Working Paper No. 19/63.

https://www.imf.org/en/Publications/WP/Issues/2019/03/19/Fundamental-and-Speculative-Demands-for-Housing-46659

Liu, Zheng, Pengfei Wang, and Tao Zha. 2013. “Land‐price Dynamics and Macroeconomic Fluctuations.” Econometrica 81, no. 3: 1147-1184.

https://doi.org/10.3982/ECTA8994

Prescott, Edward C. 1997. "On defining real consumption." Federal Reserve Bank of St. Louis Review 79, no. 3: 47.

https://research.stlouisfed.org/publications/review/1997/05/01/on-defining-real-consumption

Latest

Most Popular

- VoxChina Covid-19 Forum (Second Edition): China’s Post-Lockdown Economic Recovery VoxChina, Apr 18, 2020

- China’s Great Housing Boom Kaiji Chen, Yi Wen, Oct 11, 2017

- China’s Joint Venture Policy and the International Transfer of Technology Kun Jiang, Wolfgang Keller, Larry D. Qiu, William Ridley, Feb 06, 2019

- The Dark Side of the Chinese Fiscal Stimulus: Evidence from Local Government Debt Yi Huang, Marco Pagano, Ugo Panizza, Jun 28, 2017

- Wealth Redistribution in the Chinese Stock Market: the Role of Bubbles and Crashes Li An, Jiangze Bian, Dong Lou, Donghui Shi, Jul 01, 2020

- What Is Special about China’s Housing Boom? Edward L. Glaeser, Wei Huang, Yueran Ma, Andrei Shleifer, Jun 20, 2017

- Evaluating Risk across Chinese Housing Markets Yongheng Deng, Joseph Gyourko, Jing Wu, Aug 02, 2017

- Privatization and Productivity in China Yuyu Chen, Mitsuru Igami, Masayuki Sawada, Mo Xiao, Jan 31, 2018

- How did China Move Up the Global Value Chains? Hiau Looi Kee, Heiwai Tang, Aug 30, 2017

- China’s Shadow Banking Sector: Wealth Management Products and Issuing Banks Viral V. Acharya, Jun Qian, Zhishu Yang, Aug 09, 2017

Facebook

Facebook  Twitter

Twitter  Instagram

Instagram WeChat

WeChat  Email

Email