Growing Apart: Declining Within- and Across-Village Risk Sharing in Rural China

Previous research has shown a substantial increase in income inequality between rural and urban China as well as across and within regions in China during its growth process. Focusing on rural China, we provide further evidence that the formal and informal mechanisms that previously protected households against unanticipated income changes weakened considerably from the late 1980s to the late 2000s, especially those that help to insure against village-level aggregate income risk. Our analysis points to factors such as declining collective productive activities and increased migration as potential explanations for the weakening of within-village consumption insurance, and fiscal decentralization, which led to more fiscal self-reliance at the local level, as a potential explanation for the erosion of insurance against village-aggregate risk.

The Changing Economic Landscape of Villages in China

Using the China Health and Nutrition Survey (CHNS), a household-level panel of income and consumption from about 150 rural villages in China from 1989 to 2009, we first confirm the main economic trends widely understood about rural China in our sample. We document that rural households in our sample experienced rapid income and consumption growth during this period, with the average household income tripling and consumption doubling. Moreover, we show three broad trends in sectoral composition, industrial ownership composition, and central-local fiscal relationships.

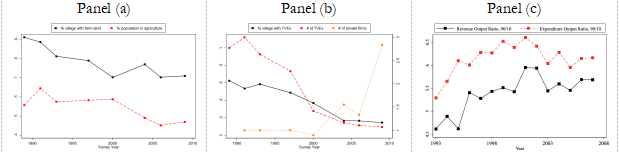

Trend 1. There was a gradual but steady shift out of the agricultural sector into the industrial sector. This process of industrialization is reflected in our sample, in that 90% of our villages had farmland and 55% of the working age population worked on a farm in 1989, while in 2009 only 70% of the villages had farmland and 45% of the working age population worked on a farm (Figure 1, panel a).

Trend 2. The dominance of township and village enterprises (TVEs) rose and fell during the economic transition. Rural industrialization was first pioneered by TVEs, which were enterprises owned by local township and village governments and yet allowed to respond to market forces that were gradually introduced. However, they soon lost out to private firms that were newly allowed in the market. In our sample, we observe a clear decreasing time trend in the number of TVEs per village, and a contrasting increasing time trend in the number of private firms per village, especially in the 2000s (Figure 1, panel b).

Trend 3. The changing central-local fiscal relation led to increasing disparity in fiscal resources across local governments. With the 1994 Tax Reform, which centralized tax revenues from local governments but also left fiscal responsibilities to local governments, local governments became increasingly self-reliant in financing public expenditures. Given the highly unbalanced regional economic development across China, disparities in local fiscal revenues and expenditures between richer and poorer counties increased. This is illustrated in the increasing time trend, especially in the 1990s and early 2000s, in the 90-10 ratio of county-level revenue-to-output and expenditure-to-output ratios (Figure 1, panel c)..

Figure 1: Changes in Agriculture, Industrial, and Public Sectors, Rural China

Note: Panels (a) and (b) are based on the CHNS sample and panel (c) is based on the county-level fiscal balance sheet sample from the EPS China database.

In panel (b), the number ofTVEs per village is normalized to one in 1989 and the number of private enterprises per village is normalized to one in 1991 (right axis), the first wave in which this information is collected. Panel (c) shows, by year, the 90-10 ratio of county-level fiscal revenue to output ratio and of county-level local fiscal expenditure to output ratio.

The Evolution of Consumption Insurance in Rural China

While the aforementioned tests suggest the presence of incomplete insurance, they do not distinguish between shocks of different durations and sources. To complement these results, we apply the methodology developed in Attanasio, Meghir, and Mommaerts (2018) to decompose income shocks along two dimensions: permanent versus transitory shocks and village-aggregate versus idiosyncratic shocks. This allows us to estimate how shocks of different nature affect consumption. For example, one would expect households to have more means, private or public, to insure their consumption against idiosyncratic shocks than against village-aggregate shocks since within village insurance mechanisms (such as informal transfers between households) could help with the former shock but not the latter.

We find that there is large scope for within-village risk sharing: close to 60% of permanent income shocks and 90% of transitory income shocks are idiosyncratic and thus insurable within a village. We also find that all types of income shocks were well insured in the early years of our sample period, but that this insurance deteriorated by the end of our sample period, particularly for aggregate shocks. Specifically, compared to the near-perfect insurance achieved in the 1990s, as much as 60% of village-aggregate permanent income shocks and around 20% of idiosyncratic transitory shocks were passed onto consumption in the 2000s. Consumption equivalent calculations imply that the welfare cost of these changes was on the order of 0.5% to 1.5% of consumption. Moreover, this welfare cost is almost entirely driven by the erosion of insurance as opposed to an increase in income risk, and most of this insurance effect is due to changes in insurance against village-aggregate permanent shocks.

Potential Mechanisms Behind the Decline in Insurance

To explore the decline of across-village insurance, we investigate the changing role of the central government by directly measuring intergovernmental transfers using data from county fiscal balance sheets from 1993 to 2007. We find that county government tax revenue and spending increasingly co-vary with output over time, while transfer programs, which were set up for insurance and redistribution purposes, become less negatively correlated over time. These findings suggest that the intergovernmental fiscal transfer programs put in place after the 1994 Tax Reform became less progressive over the course of economic transition and led to a decrease in insurance provision against shocks that impact local communities. With rising regional inequality, local governments were left to themselves for insurance, which made village aggregate income risk increasingly difficult to insure.Conclusion

The case of rural China offers valuable lessons to other transition economies. Our analysis confirms that the amount of risk-sharing depends on the economic and policy environment. In developed countries, strong private insurance contracts and public insurance systems (e.g., unemployment insurance programs) play a prominent role in insuring income risk and partially protecting people in a volatile world. In less developed countries with little access to formal insurance, informal risk sharing plays a larger role, typically within smaller groups such as villages. Therefore, the level of risk sharing that occurs in agrarian or collective economies may no longer be effective or sustainable when pro-growth market incentives are introduced. The story of rural China is a portrait of such transition and reveals important challenges along the path to industrialization. For China, how to better integrate rural areas into social insurance and social welfare institutions remains a key policy question in the quest for common prosperity.

Attanasio, Orazio, Costas Meghir, and Corina Mommaerts. 2018. “Insurance in Extended Family Networks.” Cowles Foundation discussion paper no. 1996R. https://cowles.yale.edu/sites/default/files/files/pub/d19/d1996-r.pdf.

Attanasio, Orazio, Costas Meghir, Corina Mommaerts, and Yu Zheng. 2021. “Growing Apart: Declining Within- and Across-Locality Insurance in Rural China.” SSRN working paper. https://ssrn.com/abstract=3960237.

Benjamin, Dwayne, Loren Brandt, John Giles, and Sangui Wang. 2008. “Income Inequality During China’s Economic Transition.” In China’s Great Economic Transformation, edited by Loren Brandt and Thomas G. Rawski, chapter 18. New York: Cambridge University Press.

Cai, Hongbin, Yuyu Chen, and Li-An Zhou. 2010. “Income and Consumption Inequality in Urban China: 1992–2003,” Economic Development and Cultural Change 58 (3). https://doi.org/10.1086/650423.

Khan, Azizur Rahman, and Carl Riskin. 1998. “Income and Inequality in China: Composition, Distribution, and Growth of Household Income, 1988 to 1995.” China Quarterly 154: 221–53. https://doi.org/10.1017/S0305741000002022.

Meng, Xin. 2004. “Economic Restructuring and Income Inequality in Urban China.” Review of Income and Wealth 50 (3): 357–79. https://doi.org/10.1111/j.0034-6586.2004.00130.x.

Meng, Xin, Robert Gregory, and Youjuan Wang. 2005. “Poverty, Inequality, and Growth in Urban China, 1986– 2000.” Journal of Comparative Economics 33 (4): 710–29. https://doi.org/10.1016/j.jce.2005.08.006.

Latest

Most Popular

- VoxChina Covid-19 Forum (Second Edition): China’s Post-Lockdown Economic Recovery VoxChina, Apr 18, 2020

- China’s Great Housing Boom Kaiji Chen, Yi Wen, Oct 11, 2017

- China’s Joint Venture Policy and the International Transfer of Technology Kun Jiang, Wolfgang Keller, Larry D. Qiu, William Ridley, Feb 06, 2019

- The Dark Side of the Chinese Fiscal Stimulus: Evidence from Local Government Debt Yi Huang, Marco Pagano, Ugo Panizza, Jun 28, 2017

- Wealth Redistribution in the Chinese Stock Market: the Role of Bubbles and Crashes Li An, Jiangze Bian, Dong Lou, Donghui Shi, Jul 01, 2020

- What Is Special about China’s Housing Boom? Edward L. Glaeser, Wei Huang, Yueran Ma, Andrei Shleifer, Jun 20, 2017

- Evaluating Risk across Chinese Housing Markets Yongheng Deng, Joseph Gyourko, Jing Wu, Aug 02, 2017

- Privatization and Productivity in China Yuyu Chen, Mitsuru Igami, Masayuki Sawada, Mo Xiao, Jan 31, 2018

- How did China Move Up the Global Value Chains? Hiau Looi Kee, Heiwai Tang, Aug 30, 2017

- China’s Shadow Banking Sector: Wealth Management Products and Issuing Banks Viral V. Acharya, Jun Qian, Zhishu Yang, Aug 09, 2017

Facebook

Facebook  Twitter

Twitter  Instagram

Instagram WeChat

WeChat  Email

Email