Does Import Competition Harm Innovation? Evidence from Firm-level Data in China

Twenty years ago, China’s entering the World Trade Organization (WTO) was a catalyst for its economic development and propelled China into becoming one of the most important economies in the world. But massive import tariff reductions allowed more import competition, which raised concerns that innovation would be curbed. Tuan Luong, from De Montfort University, and his co-authors, Qing Liu, Ruosi Lu, and Yi Lu, discuss the impacts of import competition on domestic innovation. We find that while import competition reduced innovation in China in general, the impact was differential across different types of innovation.

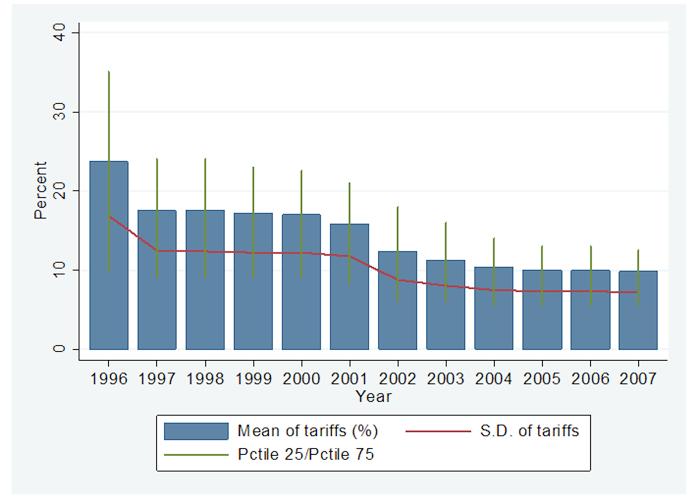

As a requirement for membership in the WTO, China carried out large-scale tariff reductions between 1992 and 1997. Specifically, in 1992, China's (unweighted) average tariff was as high as 42.9%. Shortly after the GATT Uruguay Round negotiations, China substantially reduced its tariffs; the average tariff dropped from 35% in 1994 to around 17% in 1997. Tariffs remained stable after 1997 until China joined the WTO at the end of 2001. At the beginning of 2002, China started to fulfil its tariff reduction responsibilities as a WTO member country. According to the WTO accession agreement, China would largely complete the tariff reduction by 2004, and with a few exceptions, fully complete it by 2010,at which time the average tariffs on agricultural and manufacturing goods would be reduced to 15% and 8.9%, respectively (see Figure 1).

Figure 1: Import Tariffs in China (1996–2007)

There is naturally a concern that trade liberalization will have adverse effects on domestic firms. Free trade opponents often argue that import competition will limit the rents from innovation (Schumpeter, 1942). However, there is the counterargument that innovation would allow the firms to escape competition (Aghion et al., 2005). There are at least two more theories that can be used to rationalize the impacts of import competition on innovation. The first one is the preference theory. According to this theory, import competition threatens the existence of the business. Hence, it prompts the agents responsible for innovation to invest more. The second theory, developed by Bloom et al. (2013), argues that import competition reduces the opportunity costs of the trapped factors that are necessary for innovation activities.

Empirically, the literature provides mixed results of how import competition affects innovation. The rise of Chinese import competition has nuanced effects on firms’ innovation across the world. While innovation soared in Europe (Bloom et al., 2021), it suffered a drop in North America (Autor et al., 2017).

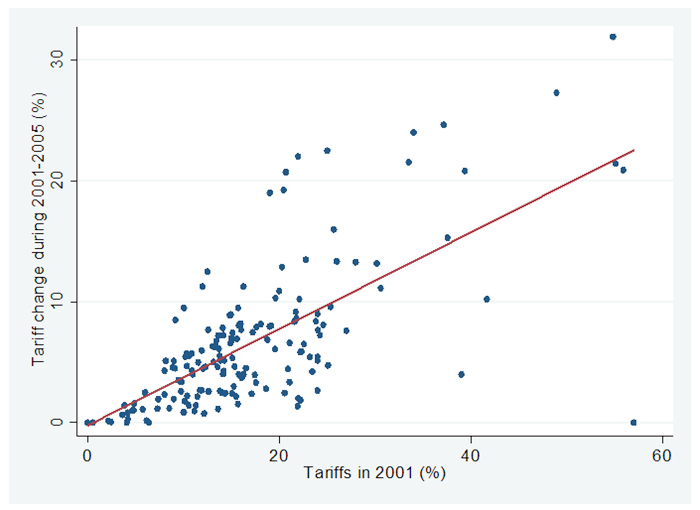

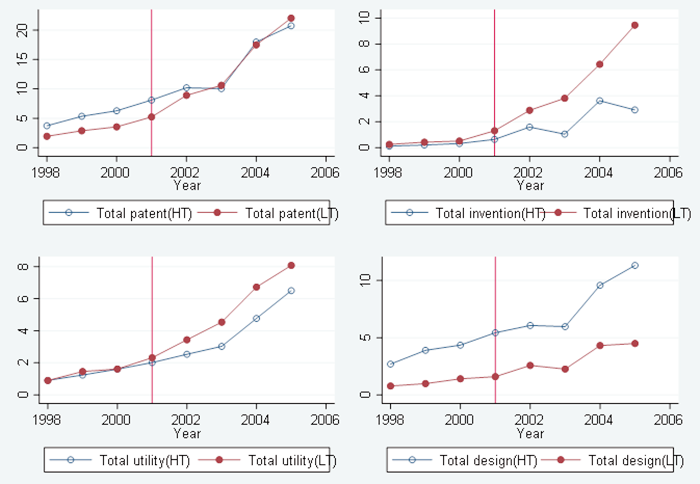

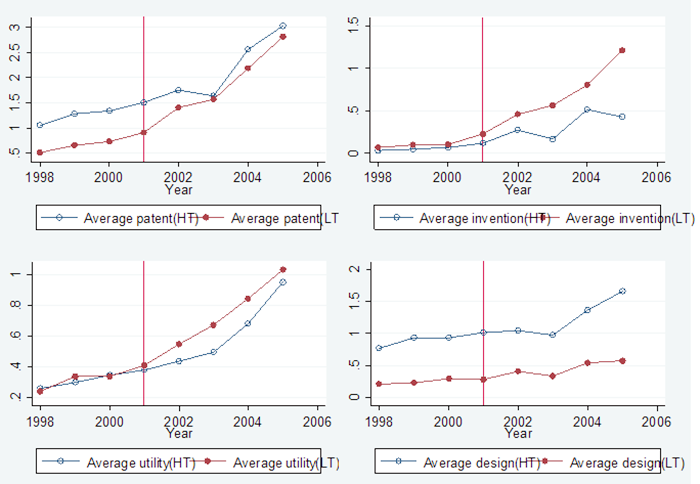

In our paper, we study how import competition influenced innovation on Chinese firms. To achieve this aim, we exploit the fact that industries more protected pre-WTO accession experienced more tariff reductions and hence, faced more import competition (see Figure 2). By matching the Annual Survey of Industrial Firms, the patent filing data obtained from the State Intellectual Property Office of China (SIPO), and the Chinese tariff data from the WTO, we investigate whether the arrival of imported goods reduced innovation in China. The difference in tariff reduction across industries mentioned above allows us to conduct a difference-in-difference (DD) analysis. More specifically, we compare the change of innovative activities in previously more-protected industries (the treatment group) before and after 2001 with the corresponding change in previously more-open industries (the control group) during the same period. Figures 3 and 4 show that there is no systematic difference between the industries before the year 2001, which lays the groundwork for our DD analysis.

Figure 2: The Correlation between Tariffs in 2001 and Tariff Changes in 2001–2005

Figure 3: Time Trends of Innovation for High- and Low-Tariff Industries: Total Patents (1000 of patents)

Figure 4: Time Trends of Innovation for High- and Low-Tariff Industries: Average Number of Patents Per Firm

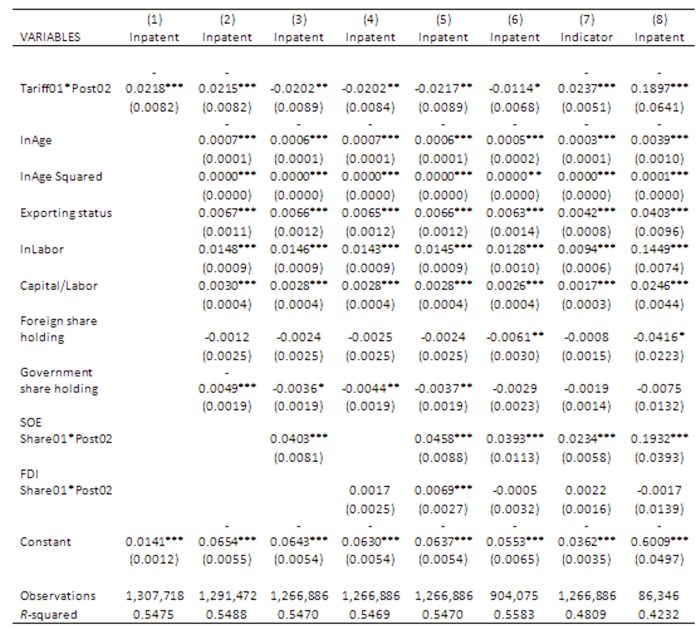

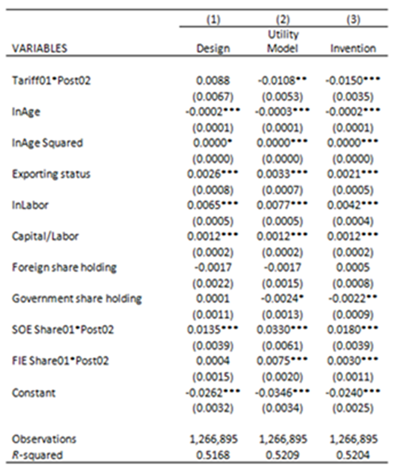

Does import competition reduce firms’ innovation in China? Overall, the answer is positive. We find that firms in industries with higher tariffs in 2001 (the treatment group) innovated less post-WTO accession than firms in industries with lower tariffs in 2001 (the control group) (see Table 1). More interestingly, when we take a closer look, we see differential impacts. Bombardini et al. (2018) show that import competition increased the probability of innovation among the most productive firms in China. We find that import competition reduced the number of invention patents and to some extent, the number of utility patents. However, it raised the number of design patents (see Table 2). Our findings provide evidence to support the preference and spillover theories but they do not support the escape-competition or the trapped-factor models.

Table 1: Main Results

Note: Robust standard errors in parentheses. The tariffs used in column 6 are weighted average tariffs. The Indicator in column 7 takes value 1 if the firm files any patent application in that year, 0 otherwise. In column 8, we use the subsample of firms that ever filed for a patent. *** p<0.01, ** p<0.05, * p<0.1

Table 2: Spillover Effects

Note: Robust standard errors in parentheses * p<0.01, ** p<0.05, * p <0.1

(Qing Liu, National Academy of Development and Strategy, Renmin University of China, China; Ruosi Lu, School of Public Administration, University of International Business and Economics, China; Yi Lu, School of Economics and Management and National Institute for Fiscal Studies, Tsinghua University, China; Tuan Anh Luong is currently a Senior Lecturer at De Montfort University.)

References

Aghion, Philippe, Bloom, Nick, Blundell, Richard, Griffith, Rachel, & Howitt, Peter. 2005. Competition and Innovation: An Inverted-U Relationship. The Quarterly Journal of Economics, 120(2), 701–728.

Autor, David H., Dorn, David, & Hanson, Gordon H. 2016. The China Shock: Learning from Labor-Market Adjustment to Large Changes in Trade. Annual Review of Economics, 8(1), 205–240.

Bloom, Nicholas, Paul M. Romer, Stephen J. Terry, and John Van Reenen. 2013. A Trapped-Factors Model of Innovation. American Economic Review, 103(3): 208–213.

Bloom, Nicholas, Romer, Paul M., Terry, Stephen J., & van Reenen, John. 2021. Trapped Factors and China’s Impact on Global Growth. Economic Journal, 131(633), 156–191.

Bombardini, Matilde, Bingjing Li, and Ruoying Wang. 2018. Import Competition and Innovation: Theory and Evidence from China. Working paper.

Schumpeter, Joseph A. 1942. Capitalism, Socialism, and Democracy. New York, NY: Harper and Brothers.

Latest

Most Popular

- VoxChina Covid-19 Forum (Second Edition): China’s Post-Lockdown Economic Recovery VoxChina, Apr 18, 2020

- China’s Great Housing Boom Kaiji Chen, Yi Wen, Oct 11, 2017

- China’s Joint Venture Policy and the International Transfer of Technology Kun Jiang, Wolfgang Keller, Larry D. Qiu, William Ridley, Feb 06, 2019

- Wealth Redistribution in the Chinese Stock Market: the Role of Bubbles and Crashes Li An, Jiangze Bian, Dong Lou, Donghui Shi, Jul 01, 2020

- The Dark Side of the Chinese Fiscal Stimulus: Evidence from Local Government Debt Yi Huang, Marco Pagano, Ugo Panizza, Jun 28, 2017

- What Is Special about China’s Housing Boom? Edward L. Glaeser, Wei Huang, Yueran Ma, Andrei Shleifer, Jun 20, 2017

- Privatization and Productivity in China Yuyu Chen, Mitsuru Igami, Masayuki Sawada, Mo Xiao, Jan 31, 2018

- Evaluating Risk across Chinese Housing Markets Yongheng Deng, Joseph Gyourko, Jing Wu, Aug 02, 2017

- How did China Move Up the Global Value Chains? Hiau Looi Kee, Heiwai Tang, Aug 30, 2017

- China’s Shadow Banking Sector: Wealth Management Products and Issuing Banks Viral V. Acharya, Jun Qian, Zhishu Yang, Aug 09, 2017

Facebook

Facebook  Twitter

Twitter  Instagram

Instagram WeChat

WeChat  Email

Email