Data, Collateral, and Implications for the Credit Cycle

The use of massive amounts of data by large technology firms (big techs) to assess firms’ creditworthiness could reduce the need for collateral in credit markets. Using a unique dataset of more than 2 million Chinese firms that received credit from both an important big tech firm (Ant Group) and traditional commercial banks, we find that a greater use of big tech credit—granted on the basis of machine learning and big data —could reduce the importance of collateral and potentially weaken the financial accelerator mechanism.

Collateral is used in debt contracts to mitigate agency problems arising from asymmetric information. Banks usually require their borrowers to pledge tangible assets, such as real estate, to lessen ex ante adverse selection problems or as a way to reduce ex post frictions, such as moral hazard (Aghion and Bolton 1997; Holmström and Tirole 1997). The use of collateral is more widespread for opaque firms, such as small and medium-sized enterprises (SMEs). It is common for SME owners to pledge their homes to finance their firms (Bahaj et al. 2020). According to a recent survey by the Financial Stability Board (2019), 90% of bank loans to SMEs in the US are collateralised, compared with 82% in Switzerland and 65% in Canada. This drops to 53% in China, where many SMEs lack basic documentation and are geographically remote from bank branches (OECD 2019).

With the development of fintech, especially the entry of large technology firms (big techs) into financial services, nontraditional data play an increasingly important role in credit assessment for SMEs (BIS 2019; Frost et al. 2019). The business model of big techs rests on enabling direct interactions among a large number of users. An essential by-product of their business is the large stock of user data. Data are used as an input to offer a range of services that exploit natural network effects, generating further user activity. Increased user activity then completes the circle, as it generates yet more data. The mutually reinforcing data-network-activity (DNA) feedback loop helps big tech firms identify the characteristics of their clients and offer them financial services that best suit their needs.

The combination of massive amounts of data and network effects may allow big techs to mitigate the information and incentive problems that are traditionally addressed by posting collateral. This could significantly advance financial inclusion and improve firms’ performance (see Luohan Academy 2019). It could also affect the financial accelerator mechanism, by which developments in financial markets and asset prices amplify the effects of changes on the real economy. Collateral is often blamed for amplifying the business cycle, through the so-called collateral channel (Bernanke and Gertler 1989). However, if data replaces collateral in a firm’s credit assessment, what are the implications for the procyclicality of credit and more generally for the financial accelerator mechanism?

To answer these questions, Gambacorta et al (2020) use a unique dataset that compares the characteristics of loans granted by MYbank, one of the brands under Ant Group, with loans supplied by traditional Chinese banks. In particular, we analyse a random sample of more than 2 million Chinese firms, which obtained credit between January 2017 and April 2019. The sample contains not only firms on Alibaba’s e-commerce platforms (online firms), but also those that use more traditional business channels (such as shops and offline firms). The latter use the Alipay app for mobile payments, through the so-called Quick Response (QR) code, but are not fully integrated into the e-commerce platform. From Ant Group, we obtain detailed information on credit supplied by MYbank and firm characteristics at a monthly frequency. In particular, we have access to credit data (quantity and price), vendor transaction volumes, and their network score. The latter measures users’ centrality in the network and is based on their payments history and social interactions in the Alipay ecosystem. In particular, we can compare three different types of credit: big tech credit (typically short term and not collateralised), secured bank credit (such as mortgages), and unsecured bank credit (typically credit lines with a contractual form very similar to big tech credit).

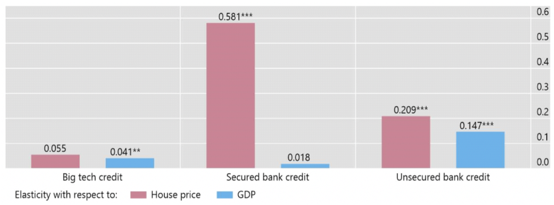

Figure 1 reports the elasticity of the three different forms of credit to house prices (in red) and local GDP (in blue). Looking at the red bars, the elasticity of big tech credit to house prices is 0.055. That of unsecured bank credit is almost four times higher (0.209) and that of secured bank credit is ten times higher (0.58) than that of big tech credit. This is not surprising because secured bank credit includes mortgages that are typically collateralised. Turning to the reaction of credit to the real business cycle, the elasticity of unsecured bank credit to GDP at the city level is more than three times higher (0.147) than that of big tech credit (0.041). Overall, big tech credit is less responsive to house price and local GDP conditions than bank credit, even if of very similar contractual characteristics.

Figure 1. Elasticity of credit with respect to house prices and GDP

Note: The figure reports the coefficient of three different regressions (one for each credit type) in which the log of credit is regressed with respect to the log of house prices at the city level, the log of GDP at the city level, and a complete set of time dummies. Significance level: ** p<0.05; *** p<0.01.

Source Gambacorta et al (2020).

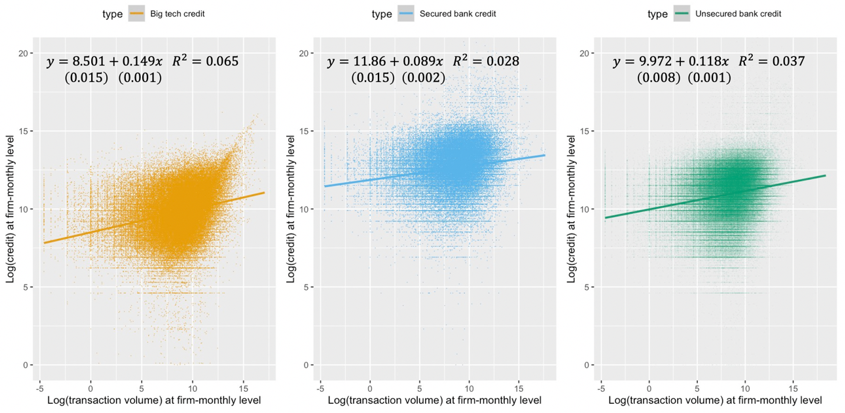

By contrast, big tech credit is more responsive than bank credit to changes in borrower specific conditions. Figure 2 reports the unconditional elasticity between the three forms of credit and transaction volume, which proxy a borrower’s business conditions, for a random sample of 100,000 firms served by both MYbank and traditional commercial banks. The elasticity is 0.15 for big tech credit, 0.09 for secured bank credit, and 0.12 for unsecured bank credit. This is in line with the intuition that big tech use of platform data makes credit provision more responsive to the firm’s business conditions.

Figure 2. Elasticity between credit and transaction volumes

Note: Based on a random sample of 100,000 firms served by both MYbank and traditional banking. The dots in the figure indicate the log of credit use (y-axis) and the log of transaction volume (x-axis) at the firm-month level. The left-hand panel plots big tech credit, the middle panel plots secured credit, and the right-hand panel plots unsecured bank credit. Linear trend lines are reported in the graphs, together with 95% degree of confidence bands. Standard errors in brackets.

Source Gambacorta et al (2020).

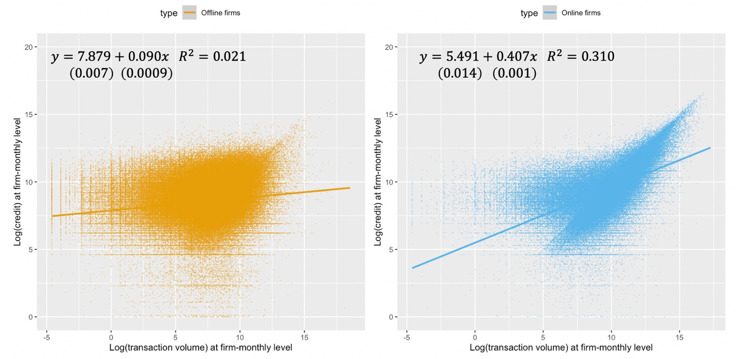

The elasticity between big tech credit and transaction volumes is different when we compare online firms (those operating on the ecommerce platform) and offline firms (such as shops or restaurants). The elasticity is 0.090 for offline borrowers and 0.407 for online borrowers (see Figure 3). The difference reflects the fact that big tech firms are better able to efficiently collect and process information from online lenders that are integrated in the big tech ecosystem. When the firm does business in its ecommerce platform, the big tech has access to a richer set of additional data to be combined with traditional transaction volumes obtained from payments.

Figure 3. Elasticity between big tech credit and transaction volume: offline firms vs. online firms

Note: Based on a 100,000 random sample of firms that received credit by MYbank. The dots in the figure indicates the log of credit use (y-axis) and the log of transaction volume (x-axis) at the firm-month level. The left-hand panel plots credit to offline firms and the right hand panel plots credit to online firms. Linear trend lines are reported in both graphs, together with 95% degree confidence bands. Standard errors in brackets.

Source Gambacorta et al (2020).

In summary, these results show that big tech credit is less procyclical and reacts less to house prices and changes in local GDP conditions. At the same time, big tech credit responds more quickly to changes in borrower-specific characteristics, especially if the firm is well integrated in the big tech ecosystem.

Big tech credit is growing fast and could soon become macroeconomically relevant in many jurisdictions (Cornelli et al. 2020). The implication for the function of the financial intermediation mechanism could be important. If big tech credit is less procyclical and responds less to asset prices, this could reduce the effectiveness of the financial accelerator mechanism, and reduce financial booms. Big tech credit is indeed less dependent on the financial cycle than traditional bank credit. This could have relevant effects for the stability of SME financing. For example, while bank credit could be tightened or made more expensive in response to a negative shock to asset prices, big tech credit to SMEs should be less affected. Moreover, big tech credit seems to correlate with local GDP conditions only for offline vendors, while firms operating on the e-commerce platform are not influenced by local economic activity and are less subject to local demand shocks. This does not mean that big tech credit will not move over the cycle, but it will be more subject to firm-specific shocks, or shocks that affect firms’ conditions simultaneously. In particular, big tech credit (especially to online firms) is more sensitive to the actual performance of SME borrowers and reacts by more in case of a deterioration of firm-specific characteristics. For a more complete assessment, it will be important to evaluate the different reaction of big tech and bank credit over a full financial and business cycle.

The views in this paper are those of the authors only and do not necessarily reflect those of the Bank for International Settlements or Ant Group.

(Leonardo Gambacorta, Bank for International Settlements; Yiping Huang, Institute of Digital Finance and National School of Development, Peking University; Zhenhua Li, Ant Group; Han Qiu, Institute of Digital Finance and National School of Development, Peking University.)

References

Aghion, Philippe, and Patrick Bolton. 1997. “A Theory of Trickle-Down Growth and Development.” Review of Economic Studies 64 (2): 151–72. https://doi.org/10.2307/2971707.

Bahaj, Saleem, Angus Foulis, and Gabor Pinter. 2020. “Home Values and Firm Behavior.” American Economic Review 110 (7): 2225–70. https://doi.org/10.1257/aer.20180649.

Bank for International Settlements. 2019. “Big Tech in Finance: Opportunities and Risks.” BIS Annual Economic Report, June 23, 2019. https://www.bis.org/publ/arpdf/ar2019e3.pdf.

Bernanke, Ben, and Mark Gertler. 1989. “Agency Costs, Net Worth, and Business Fluctuations.” American Economic Review 79 (1): 14–31. https://www.jstor.org/stable/1804770.

Cornelli, Giulio, Jon Frost, Leonardo Gambacorta, Raghavendra Rau, Robert Wardrop, and Tania Ziegler. 2020. “Fintech and Big Tech Credit: A New Database.” BIS Working Paper No. 887. https://www.bis.org/publ/work887.pdf.

Financial Stability Board. 2019. “Evaluation of the Effects of Financial Regulatory Reforms on Small and Medium-Sized Enterprise (SME) Financing,” Report to the G20, November 29, 2019. https://www.fsb.org/wp-content/uploads/P291119-1.pdf.

Frost, Jon, Leonardo Gambacorta, Yi Huang, Hyun Song Shin, and Pablo Zbinden. 2019. “BigTech and the Changing Structure of Financial Intermediation.” Economic Policy 34 (100): 761–99. https://doi.org/10.1093/epolic/eiaa003.

Gambacorta, Leonardo, Yiping Huang, Zhenhua Li, Han Qiu, and Shu Chen. 2020. “Data vs. Collateral.” BIS Working Paper No. 881. https://www.bis.org/publ/work881.pdf.

Holmström, Bengt, and Jean Tirole. 1997. “Financial Intermediation, Loanable Funds, and the Real Sector.” Quarterly Journal of Economics 112 (3): 663–91. https://doi.org/10.1162/003355397555316.

Luohan Academy. 2019. Digital Technology and Inclusive Growth. Hangzhou: Luohan Academy. https://gw.alipayobjects.com/os/antfincdn/DbLN6yXw6H/Luohan_Academy-Report_2019_Executive_Summary.pdf.

Organisation for Economic Cooperation and Development (OECD). 2019. Financing SMEs and Entrepreneurs 2019: An OECD Scoreboard. Paris: OECD Publishing. https://doi.org/10.1787/fin_sme_ent-2019-en.

Latest

Most Popular

- VoxChina Covid-19 Forum (Second Edition): China’s Post-Lockdown Economic Recovery VoxChina, Apr 18, 2020

- China’s Joint Venture Policy and the International Transfer of Technology Kun Jiang, Wolfgang Keller, Larry D. Qiu, William Ridley, Feb 06, 2019

- China’s Great Housing Boom Kaiji Chen, Yi Wen, Oct 11, 2017

- Wealth Redistribution in the Chinese Stock Market: the Role of Bubbles and Crashes Li An, Jiangze Bian, Dong Lou, Donghui Shi, Jul 01, 2020

- The Dark Side of the Chinese Fiscal Stimulus: Evidence from Local Government Debt Yi Huang, Marco Pagano, Ugo Panizza, Jun 28, 2017

- What Is Special about China’s Housing Boom? Edward L. Glaeser, Wei Huang, Yueran Ma, Andrei Shleifer, Jun 20, 2017

- Privatization and Productivity in China Yuyu Chen, Mitsuru Igami, Masayuki Sawada, Mo Xiao, Jan 31, 2018

- Evaluating Risk across Chinese Housing Markets Yongheng Deng, Joseph Gyourko, Jing Wu, Aug 02, 2017

- How did China Move Up the Global Value Chains? Hiau Looi Kee, Heiwai Tang, Aug 30, 2017

- China’s Shadow Banking Sector: Wealth Management Products and Issuing Banks Viral V. Acharya, Jun Qian, Zhishu Yang, Aug 09, 2017

Facebook

Facebook  Twitter

Twitter  Instagram

Instagram WeChat

WeChat  Email

Email