Faking Trade for Capital Control Evasion: Evidence from Dual Exchange Rate Arbitrage in China

We examine whether firms over-report international trade to evade capital controls for foreign exchange arbitrage, by specifically testing whether the aggregate bilateral trade data gap between trading partners is positively (negatively) correlated with the exchange rate spread when the spread is positive (negative). At the disaggregated level, we also employ Benford’s law to detect trade data manipulations. For both cases, we find evidence for dual exchange rate arbitrage activities camouflaged under the trade account in the trade data between the Chinese mainland and Hong Kong.

Capital controls have regained popularity since 2008, following the Federal Reserve’s extraordinary monetary easing over the subprime crisis. Countercyclical capital control policies are generally recommended even for economies with flexible exchange rates to maintain their monetary autonomy and domestic financial market stability (International Monetary Fund, 2012; Rey, 2013; Farhi and Werning, 2014; Korinek, 2018; Davis and Presno, 2017; Wang and Wu, 2018). With the new round of quantitative easing in 2020 to combat the COVID-19 pandemic, many countries may again resort to capital controls in the future to defend their financial markets from dramatic global capital flows.

However, capital controls are not a “free lunch” (Forbes, 2005). As discussed in Mendoza (2016), those policies face many practical implementation challenges, and their effectiveness can be easily undermined by various evasion activities, particularly in countries with weak institutions. Manipulating trade data is perhaps the most notorious activity and is pervasive in many countries with capital controls. However, it is difficult to detect those activities by their very nature, although anecdotal evidence has been widely discussed in the media and academic studies.

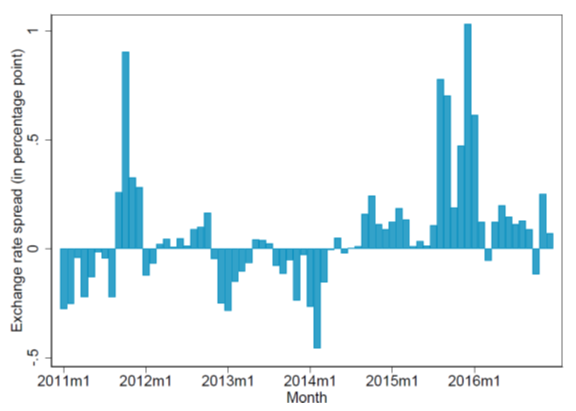

By taking advantage of a unique institutional setting of dual exchange rates for the Chinese renminbi (RMB), in a recent paper, we present theory and empirical evidence that firms manipulate trade data to evade capital controls. In addition to its onshore market in the mainland, China also set up an offshore RMB/USD foreign exchange market in Hong Kong in late 2010 to promote RMB internationalization. The RMB offshore market is relatively market-driven as Hong Kong is an international financial center with high capital mobility, whereas the RMB onshore market is highly regulated by the People’s Bank of China. Since 2011, large and persistent spreads have frequently existed between onshore and offshore RMB-USD exchange rates due to China’s strict capital controls (Figure 1), which incentivized arbitrage activities through fake trade. The empirical research on foreign exchange arbitrage in countries with capital controls is largely held back by the unavailability of reliable market exchange rates. Thus, the dual exchange rates of the RMB offer a unique opportunity to test whether firms manipulate the trade data to evade capital controls for foreign exchange arbitrage.

Figure 1: RMB-USD exchange rate spreads between Hong Kong (offshore, CNH) and the Chinese mainland (onshore, CNY)

A positive spread implies that the RMB is more expensive (relative to the USD) in the onshore market than in the offshore market. The spread is calculated from monthly average exchange rates and the daily spread is even higher (as large as 3% at its peak).

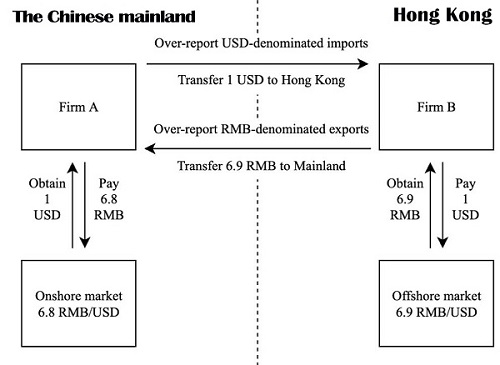

The exchange rate spread is very persistent. It was mainly positive after mid-2014, but mostly negative between 2011 and early 2014 (see Note 1). This makes it possible to arbitrage through faking international trade, which may take time to execute. Figure 2 illustrates the arbitrage mechanism through fake trade for a positive exchange rate spread. Consider a case in which one USD equals 6.9 RMB in Hong Kong and 6.8 RMB in the Chinese mainland. To arbitrage on the dual exchange rates, an exporting firm (Firm A) in the Chinese mainland will buy the USD at the onshore rate (6.8 RMB per dollar) from a bank (e.g., the Bank of China) and transfer the USD to Hong Kong by over-reporting its imports (settled in USD) to Hong Kong. Next, Firm A’s affiliated or partner company in Hong Kong (Firm B) sells the dollar to the market at a higher rate (6.9 RMB per dollar). In the end, Firm A transfers the RMB back to the Chinese mainland by over-reporting its exports (settled in RMB) to Firm B in Hong Kong. In reality, the arbitrage activity may involve multiple companies and mix with genuine international trade to conceal the activity from Customs and other authorities (see Note 2).

The above over-reporting of imports and exports creates trade data discrepancies between the Chinese mainland and Hong Kong, which help us identify such activities in the data. Ideally, the Chinese mainland’s reported imports from Hong Kong should equal the exports reported by Hong Kong and vice versa, after taking into account trade costs and measurement errors. However, large trade data discrepancies generally exist in the bilateral trade data reported by importing and exporting countries for various reasons such as different statistical rules, tariff/tax evasion, and capital control evasion. Previous studies use cross-sectional trade data discrepancies to examine tax/tariff evasion (Fisman and Wei, 2004; Javorcik and Narciso, 2008; Ferrantino et al., 2012). However, the large monthly fluctuations of trade gaps cannot be explained by the tariff/tax evasion as tax and tariff policies change much less frequently. Our paper is the first to document evidence of capital control evasion using time-series properties of trade data discrepancies.

Figure 2: An example of foreign exchange arbitrage through fake trade

We propose a simple model in which firms engage in foreign exchange arbitrage through fake trade as described in Figure 2. Firms face heterogeneous probabilities of being caught and choose the scale of fake trade to maximize their expected profits. From this model, we derive two sets of predictions. Frist, the over-reporting in imports and exports is positively (negatively) correlated with the exchange rate spread when the spread is positive (negative). Second, the above correlations are more pronounced for products that have a lower risk of being detected. The first set of predictions is based on the fact that the optimal level of trade over-reporting depends on the absolute value of foreign exchange spreads in the model: larger spreads between onshore and offshore exchange rates encourage more fake trade. The second prediction is quite intuitive: firms will choose goods for which it is easier to conceal fake trade to avoid penalties from the authorities.

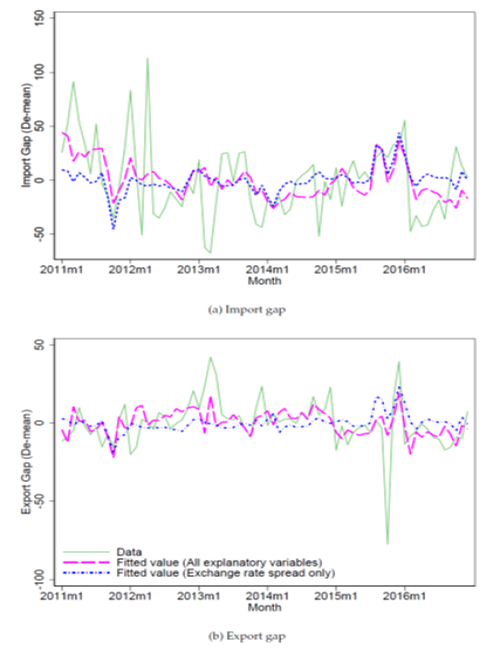

We test the above model predictions by using both the aggregate time-series data of trade and exchange rates and the disaggregated firm-product-level Customs trade data. We find that the RMB-USD exchange rate spreads are important driving forces for the monthly fluctuations of the trade data gap between the Chinese mainland and Hong Kong. Specifically, the over-reporting in imports and exports is negatively correlated with the exchange rate spread before 2014 when the spread was mostly negative, while the correlation becomes positive between 2014 and 2016, when the spread was mostly positive. Our results are both statistically and economically significant. On average, the import and export gaps increase by 34% and 36% of a standard deviation for a one standard deviation increase in the exchange rate spread. The spread explains a large fraction of trade data discrepancies, especially when the spread is large. For instance, according to our estimation, a spread of 0.07 RMB/USD (1% of the exchange rate) in December 2015 induced fake trade of about 7.2 billion USD, which accounts for 27% of the total trade data gap between the Chinese mainland and Hong Kong in that month and 15% of the total trade between the two economies. Figure 3 plots the raw data and fitted values from our model for trade data gaps between the Chinese mainland and Hong Kong. Our results are robust to various extensions and sensitivity analysis.

Figure 3: Raw data and fitted values for the trade data gaps between the Chinese mainland and Hong Kong

It is tricky to empirically test the second prediction as we do not know what products in have a lower risk of being detected by Customs if they are used in fake trade. At the disaggregated level, we adopt the Benford’s law test (BLT) to detect possible trade data manipulations (Barabesi et al., 2018; Cerioli et al., 2019; Demir and Javorcik, 2020). Assuming that firms choose to manipulate the data for goods with a lower probability of being caught, we expect that the products with stronger evidence of data manipulation display stronger correlations between the trade data gaps and the foreign exchange spread as our model predicts.

According to Benford’s law, the leading digits in accounting and economic data follow a certain frequency distribution, while forged data usually do not (Newcomb, 1881; Benford, 1938). Thus, the BLT has been widely used to detect fraud in accounting numbers and economic data. Recently Cerioli et al. (2019) and Demir and Javorcik (2020) show that the BLT is also useful in detecting fraud in large-scale trade data. Based on the 2015 firm-HS 8-digit level disaggregated trade data between the Chinese mainland and Hong Kong, which is very close to transaction-level data, we conduct the BLT for each of the 21 HS sections to identify products prone to manipulation. According to the classification of Rauch (1999), most of the goods that do not conform to Benford’s law (classified as the BLT-rejection (BLTR) group) are found to be intermediate inputs or differentiated goods such as optical and photographic instruments, jewelry and precious metal or stones, electrical equipment, or works of art. In contrast, the goods that pass the BLT (classified as the non-BLTR group) include primary goods such as animal and vegetable products, and products with low value to weight such as textiles, wood, and transportation vehicles. This finding is not surprising as differentiated goods usually have no reference prices and thus it is difficult for Chinese Customs to detect whether the reported trade values of those goods are fraudulent. It is also consistent with Javorcik and Narciso (2008), who find that differentiated products are more likely to be used for tariff evasion than homogeneous goods.

More interestingly, we find that the exchange rate spreads play an important role in driving the monthly fluctuations in the trade gap of the products that do not conform to Benford’s law (the BLTR group), in a manner similar to our main finding on the exchange rate spreads and the aggregate bilateral trade gap: over-reporting in aggregate imports and exports of BLTR-group products is negatively correlated with the exchange rate spread before 2014 when the spread was mostly negative, whereas the correlation becomes positive between 2014 and 2016, when the spread was mostly positive. In contrast, we find no significant relationship between the spreads and the monthly trade gap of other products that fit Benford’s law well (the non-BLTR group). These findings are consistent with the model prediction that the relationship between fake trade and exchange rate spreads is more pronounced for products that are less likely to be detected as fraudulent. Thus, our findings suggest that the “fraudulent” products detected by the BLT may be the vehicle used by arbitrageurs to evade capital controls for foreign exchange arbitrage.

Our paper shreds light on the nature of capital control evasion through the manipulation of international trade data. Capital controls may not be as effective as they are supposed to be due to various capital control evasion activities such as fake trade. However, given its nature, fake trade for capital control evasion is difficult to detect in the data, making it hard to estimate its size, evaluate its costs and find solutions to reduce it. By taking advantage of the special institutional setups between the Chinese mainland and Hong Kong, we document empirical evidence that is consistent with foreign exchange arbitrage through over-reporting the trade between the two economies. Although fake trade is identified through two distinct methods, our results are surprisingly consistent with each other.

Our paper highlights the dilemma faced by policymakers, especially those in emerging markets. Despite various shortcomings and costs, capital control policies have their own merits and are likely to stay in place, especially in emerging markets, in the foreseeable future. Policymakers should keep in mind the unintended consequences when designing such policies. In particular, it is crucial to understand the nature of capital control evasion activities and design mechanism to diminish their adverse effects.

Note 1: The persistent spread also exists in the daily data, making possible the foreign exchange arbitrage through fake trade. The spike in the second half of 2011 was caused by the intensification of eurozone sovereign debt crisis.

Note 2: The arbitrage though fake trade can theoretically involve multiple destinations, for instance over- reporting imports from Hong Kong and simultaneously over-reporting exports to South Korea. However, that will increase arbitrage costs such as tariffs.

(Renliang Liu is currently a Ph.D. Candidate in Economics at Gordon S. Lang School of Business and Economics, University of Guelph, Canada; Liugang Sheng, Department of Economics, the Chinese University of Hong Kong; Jian Wang is an Associate Professor of Economics at The Chinese University of Hong Kong.)

References

Barabesi, Lucio, Andrea Cerasa, Andrea Cerioli, and Domenico Perrotta, “Goodness-of-fit testing for the Newcomb-Benford law with application to the detection of customs fraud,” Journal of Business & Economic Statistics, 2018, 36 (2), 346–358.

Cerioli, Andrea, Lucio Barabesi, Andrea Cerasa, Mario Menegatti, and Domenico Perrotta, “Newcomb–Benford law and the detection of frauds in international trade,” Proceedings of the National Academy of Sciences, 2019, 116 (1), 106–115.

Davis, Scott J. and Ignacio Presno, “Capital controls and monetary policy autonomy in a small open economy,” Journal of Monetary Economics, 2017, 85, 114–130.

Demir, Banu and Beata Javorcik, “Trade policy changes, tax evasion and Benford’s law,” Journal of Development Economics, 2020, 144, 102456.

Farhi, Emmanuel and Ivan Werning, “Dilemma not trilemma? Capital controls and exchange rates with volatile capital flows,” IMF Economic Review, 2014, 62 (4), 569–605.

Ferrantino, Michael J, Xuepeng Liu, and ZhiWang, “Evasion behaviors of exporters and importers: Evidence from the US–China trade data discrepancy,” Journal of International Economics, 2012, 86 (1), 141–157.

Fisman, Raymond and Shang-JinWei, “Tax rates and tax evasion: Evidence from “missing imports” in China,” Journal of Political Economy, 2004, 112 (2), 471–496.

Forbes, Kristin J., “The microeconomic evidence on capital controls: No free lunch,” NBER Working Paper, 2005, No. 11372.

International Monetary Fund, “The liberalization and management of capital flows: An institutional view,” IMF Policy Papers, 2012.

Javorcik, Beata S and Gaia Narciso, “Differentiated products and evasion of import tariffs,” Journal of International Economics, 2008, 76 (2), 208–222.

Korinek, Anton, “Regulating capital flows to emerging markets: An externality view,” Journal of International Economics, 2018, 111, 61–80.

Mendoza, Enrique G., “Macroprudential policy: Promise and challenges,” NBER Working Paper No. 22868, 2016.

Rauch, James E, “Networks versus markets in international trade,” Journal of International Economics, 1999, 48 (1), 7–35.

Rey, Helene, “Dilemma not trilemma: The global financial cycle and monetary policy independence,” Jackson Hole Symposium on Economic Policy, 2013, pp. 284–333.

Wang, Jian and Jason Wu, “The dilemma and international macroprudential policy: Is capital flow management effective?” Manuscript, The Chinese University of Hong Kong, Shenzhen and Hong Kong Monetary Authority, 2018.

Latest

Most Popular

- VoxChina Covid-19 Forum (Second Edition): China’s Post-Lockdown Economic Recovery VoxChina, Apr 18, 2020

- China’s Joint Venture Policy and the International Transfer of Technology Kun Jiang, Wolfgang Keller, Larry D. Qiu, William Ridley, Feb 06, 2019

- China’s Great Housing Boom Kaiji Chen, Yi Wen, Oct 11, 2017

- Wealth Redistribution in the Chinese Stock Market: the Role of Bubbles and Crashes Li An, Jiangze Bian, Dong Lou, Donghui Shi, Jul 01, 2020

- The Dark Side of the Chinese Fiscal Stimulus: Evidence from Local Government Debt Yi Huang, Marco Pagano, Ugo Panizza, Jun 28, 2017

- What Is Special about China’s Housing Boom? Edward L. Glaeser, Wei Huang, Yueran Ma, Andrei Shleifer, Jun 20, 2017

- Privatization and Productivity in China Yuyu Chen, Mitsuru Igami, Masayuki Sawada, Mo Xiao, Jan 31, 2018

- Evaluating Risk across Chinese Housing Markets Yongheng Deng, Joseph Gyourko, Jing Wu, Aug 02, 2017

- How did China Move Up the Global Value Chains? Hiau Looi Kee, Heiwai Tang, Aug 30, 2017

- China’s Shadow Banking Sector: Wealth Management Products and Issuing Banks Viral V. Acharya, Jun Qian, Zhishu Yang, Aug 09, 2017

Facebook

Facebook  Twitter

Twitter  Instagram

Instagram WeChat

WeChat  Email

Email