Peak China Housing?

China’s real estate market has been a key engine of its sustained economic expansion. This paper argues, however, that even before the COVID-19 shock, a decades-long housing boom had given rise to price misalignments and regional supply-demand mismatches, making an adjustment both necessary and inevitable. Based on input-output analysis and benchmarking against other economies, we estimate the size of China’s real estate–related activities to be 29% of the economy and conclude that the sector is quite vulnerable to a sustained aggregate growth shock.

If one looks at the history of deep systemic financial crises in Western economies, debt-financed housing booms have almost invariably played a central role, especially in the post-World War II era (see Note 1). Nevertheless, it has long been argued that despite China’s truly epic real estate boom over the past three decades, the central government’s ability to tightly monitor the financial system and to resolve insolvencies quickly in the event of a crisis, makes it relatively immune to this kind of problem. This may be true, although given China’s so-far unending housing price boom, the “China-is-different” theory remains an open question.

Several authors have explored the potential implications and risks in China’s housing market, with leading examples including Fang et al. (2015), Chivakul et al. (2015), Glaeser et al. (2017), and Koss and Shi (2018). The general consensus is that although China’s housing price appreciation has been extreme, (an order of magnitude larger than what the United States experienced prior to its 2008 financial crisis), it would take a dramatic and sustained economic slowdown to create widespread instability.

But by and large these studies are based on data that are now somewhat out of date in the landscape of the rapidly evolving Chinese economy. In Rogoff and Yang (2020), we use newly available sources, especially taking advantage of the digitization of China’s statistics that has helped provide both more extensive and more accurate data, to extend and significantly update the earlier work. A central point of our paper is that even if China is indeed immune to a conventional housing-based financial crisis, given the outsized footprint of the real estate sector (which by our broadest metric, we estimate has now reached 29% of GDP), the impact of a significant slowdown in the housing sector on jobs and growth can still be dramatic and sustained.

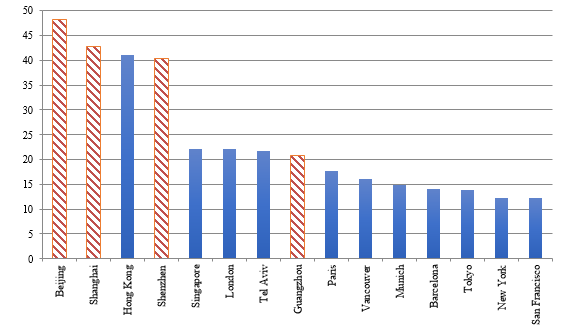

Even with the understanding that housing data are difficult to collect and standardize, and this problem exists throughout the world, comparisons of China to other countries are sobering. Indeed, by international standards, the scale of China’s real estate boom is unprecedented. As Figure 1 illustrates, the home price-to-income ratios (see Note 2) in Beijing, Shanghai, Shenzhen, and Guangzhou place them in the top rung of the world’s most expensive cities. In particular, the price-to-income ratios in Beijing, Shanghai and Shenzhen exceed a multiple of 40 compared to 22 in London and 12 in New York (see Note 3). Of course, such price-to-income ratios might be justified if the expectation is that very fast income growth will continue indefinitely. But even aside from the COVID-19 pandemic, other factors, such as China’s rapidly aging population, a shrinking technological gap with the West, and normal decreasing returns to investment, all suggest that future growth will likely be trending downward in the coming decade.

Figure 1: Home Price-to-Income Ratios in the World’s Major Cities (2018)

This figure shows home price-to-income ratios in Beijing, Shanghai, Hong Kong, Shenzhen, Singapore, Tel Aviv, Guangzhou, Paris, Vancouver, Munich, Barcelona, Tokyo, New York, and San Francisco, respectively.

Source: Rogoff and Yang (2020).

We suggest that even if one sets aside concerns about the risk of a financial crisis, the direct and indirect footprint of the real estate sector in China’s economy has become so large that absorbing a substantial slowdown would significantly impact overall growth even absent any amplification from a financial crisis. The real estate and construction sectors combined account for 20% of GDP, and real estate accounts for 23% of household consumption. Making use of cross-industry correlations derived from China’s recently released (2017) (see Note 4) input-output matrix, we find that the footprint of the real estate sector, broadly construed to include both the production of property and the provision of property-related services has reached 29% of GDP, with industries most heavily affected being construction, manufacture of machinery and equipment etc. (This includes not only first-order input-output effects, but higher-order interactions as a shock to the real estate sector reverberates through the real economy.) Taking the external sector into account lowers our estimate of the footprint of the real estate sector from 29% to 24%.

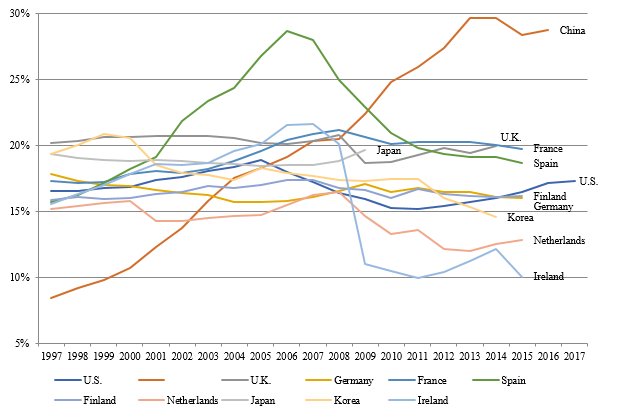

Considering the overall economy-wide impact of a shock to China’s real estate sector, which includes effects on upstream and downstream industries, the real estate sector has become an outsized part of China’s economy. To gauge how this compares to Western economies, we use a similar definition for measuring the real estate sector in other economies to construct Figure 2. As the figure illustrates, China is even more dependent on housing construction than Ireland and Spain were just prior to their financial crises, and far more dependent than the United States prior to its financial crisis in 2008.

Figure 2. Real Estate–Related Activities’ Share of GDP by Country

This figure presents the share of real estate–related activities in total GDP in China, the U.S., the U.K., Germany, France, Spain, the Netherlands, Finland, Ireland, Japan, and Korea.

Source: Rogoff and Yang (2020).

China may be different, but like these economies, it faces deeply adverse demographics and sharply declining trend productivity. It is true that Chinese authorities have enormous administrative power over the value of housing. Not only is there extensive zoning and regulation, but in China, private entities cannot own land, a fact that further underscores just how massive the Chinese real estate explosion has been. Authorities face a delicate balancing act as many of the policies that they could enact to hold up prices (for example, tightening regulations over new home building) might help existing owners. However, by forestalling adjustment in the real economy and exacerbating the already significant misallocation of resources into real estate, such policies may come ultimately at the expense of greater cumulative employment and production declines in the long run.

Could the COVID-19 shock prove to be the adverse growth shock that triggers a housing slowdown that could amplify the challenges facing China’s recovery? So far, this has not been the case: prices are rising in many cities, but we acknowledge that this is a worldwide phenomenon triggered in part by very low global real interest rates. But at the same time, rents have been soft, and the pandemic may have hastened the inevitable long-run trend slowdown of China’s growth. Although prices may be rising in Tier 1 cities, rents have been falling, and it is much too early to say how the crisis will ultimately play out. Overall, if one looks at growing supply-demand imbalances, it is hard to see how China’s housing market will avoid a significant long-run adjustment, which will be challenging to digest even if authorities are successful in averting a financial crisis.

Note 1: Reinhart and Rogoff (2009), Mian and Sufi (2014), Jorda, Schularik, and Taylor (2016).

Note 2: Home price-to-income ratio is calculated as the ratio of median housing price to median household disposable income, expressed as years of income.

Note 3: These comparisons are pre-COVID-19

Note 4: National Bureau of Statistics of China. (2020). China Statistical Yearbook 2019. Available at http://www.stats.gov.cn/tjsj/ndsj/2019/indexch.htm

(Kenneth Rogoff is the Thomas D. Cabot Professor of Public Policy and Professor of Economics at Harvard; Yuanchen Yang, PhD at PBC School of Finance, Tsinghua University.)

References

Chivakul, Mali, W. Raphael Lam, Xiaoguang Liu, Wojciech Maliszewski, and Alfred Schipke. (2015). Understanding Residential Real Estate in China. IMF Working Paper 15/84.

Fang, Hanming, Quanlin Gu, Wei Xiong, Li-An Zhou. (2015). Demystifying the Chinese Housing Boom. NBER Macroeconomics Annual 30(1) 105-166.

Glaeser, Edward, Wei Huang, Yueran Ma, and Andrei Shleifer. (2017). A real estate boom with Chinese characteristics. Journal of Economic Perspectives: 31(1) 93–116.

Jorda, Oscar, Moritz Schularick, and Alan Taylor. (2016). The great mortgaging: Housing finance, crises and business cycles. Economic Policy: 31(85) 107–52.

Koss, Richard and Xinrui Shi. (2018). Stabilizing China’s housing market. IMF Working Paper 18/89.

Mian, Atif and Amir Sufi (2014). House of debt. Chicago, University of Chicago Press.

Reinhart, Carmen M. and Kenneth S Rogoff. (2009). This time is different: Eight centuries of financial folly. Princeton: Princeton University Press.

Rogoff, Kenneth and Yuanchen Yang. (2020). Peak China housing. NBER Working Paper 27697.

Latest

Most Popular

- VoxChina Covid-19 Forum (Second Edition): China’s Post-Lockdown Economic Recovery VoxChina, Apr 18, 2020

- China’s Joint Venture Policy and the International Transfer of Technology Kun Jiang, Wolfgang Keller, Larry D. Qiu, William Ridley, Feb 06, 2019

- China’s Great Housing Boom Kaiji Chen, Yi Wen, Oct 11, 2017

- Wealth Redistribution in the Chinese Stock Market: the Role of Bubbles and Crashes Li An, Jiangze Bian, Dong Lou, Donghui Shi, Jul 01, 2020

- The Dark Side of the Chinese Fiscal Stimulus: Evidence from Local Government Debt Yi Huang, Marco Pagano, Ugo Panizza, Jun 28, 2017

- What Is Special about China’s Housing Boom? Edward L. Glaeser, Wei Huang, Yueran Ma, Andrei Shleifer, Jun 20, 2017

- Privatization and Productivity in China Yuyu Chen, Mitsuru Igami, Masayuki Sawada, Mo Xiao, Jan 31, 2018

- How did China Move Up the Global Value Chains? Hiau Looi Kee, Heiwai Tang, Aug 30, 2017

- Evaluating Risk across Chinese Housing Markets Yongheng Deng, Joseph Gyourko, Jing Wu, Aug 02, 2017

- China’s Shadow Banking Sector: Wealth Management Products and Issuing Banks Viral V. Acharya, Jun Qian, Zhishu Yang, Aug 09, 2017

Facebook

Facebook  Twitter

Twitter  Instagram

Instagram WeChat

WeChat  Email

Email