The Collateral Channel of Monetary Policy: Evidence from China

As a quasi-natural experiment to estimate the causal impact of the collateral-based unconventional monetary policy, we exploit the expansion of the collateral for the Medium-Term Lending Facility (MLF) in the interbank bond market on June 1, 2018 by the People’s Bank of China. We also consider that many bonds are dual-listed in a largely segmented exchange market. We find that the policy reduced the spreads of the newly collateralizable, dual-listed bonds in the treatment market (the interbank market) by 42–62 basis points, compared to those in the control market (the exchange market). We also find that there is a pass-through effect from the secondary market to the primary market: the spreads of the new issuance of treated bonds in the interbank market were reduced by 54 basis points.

Since the 2008 global financial crisis, central banks have widely deployed collateral-based monetary policy (involving quantitative easing or QE) to inject liquidity into targeted sectors. For instance, the U.S. Federal Reserve Board (Fed) launched the Term Asset-Backed Securities Loan Facility (TALF) in late November 2008, through which the Fed lent up to $1 trillion to financial markets against collaterals of asset-backed securities (ABS) and loans guaranteed by the Small Business Administration. The European Central Bank launched the Long-Term Refinancing Operations (LTROs) to reduce sovereign bond spreads and inject liquidity into the market, where it provides low interest-rate funding to Eurozone banks collateralized by sovereign debt.

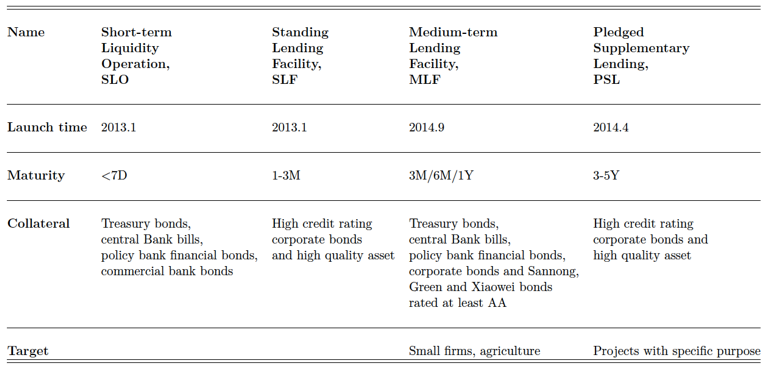

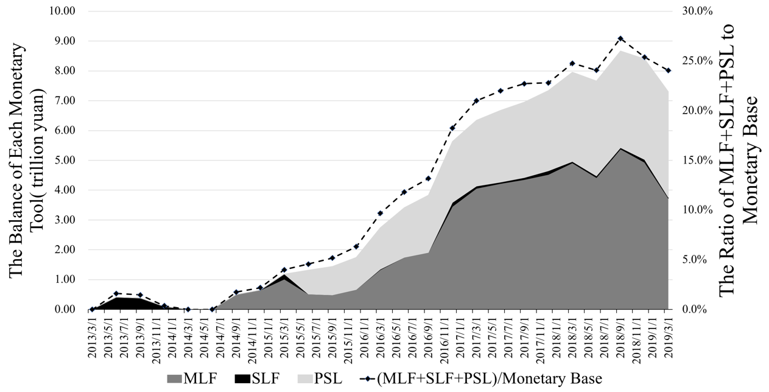

The People’s Bank of China (PBoC) introduced collateral-based monetary policy tools, namely Short-term Liquidity Operation (SLO), Standing Lending Facility (SLF), MLF and Pledged Supplementary Lending (PSL), between 2013 and 2014 (see Table 1). Since their launch, these collateral-based lending facilities have experienced rapid growth. At the end of 2018, the balance of MLF, SLF and PSL accounted for about 25 percent of China's monetary base (see Figure 1).

These unconventional monetary policy tools differ from traditional monetary policy tools, as they aim to adjust not only interest rates but also the leverage ratios by changing the haircut or margin of underlying collateral. Haircut is the difference between the current market value of an asset and the value ascribed to that asset for purposes of loan collateral. For example, a bond not eligible as collateral has a 100 percent haircut rate. Making it eligible as collateral for lending facilities with a 20 percent haircut rate allows the investor to borrow up to 80 percent of the bond’s market value. The leverage is 1/haircut, which is equal to 5 in this case. Geanakoplos (2010) shows that decreasing a haircut rate increases asset value. Chen et al. (2018) provides evidence for the relationship between haircut and asset prices. The intuition is that higher asset-based leverage allows the asset demand to better reflect optimists’ beliefs, and thus those beliefs push up asset prices. Ashcraft et al. (2011) further show that collateral-based monetary policy, by reducing the haircut rate of assets, can (1) increase the prices of collateral assets and reduce financing costs and (2) increase the supply of collateral and ease the financial constraints of financial institutions.

Table 1: Collateral-Based Monetary Policy Tools of People’s Bank of China before 2018

Note: The collaterals this table documents are eligible assets for the corresponding monetary policy tools as of 2018.

Figure 1: Balance of PBoC’s Collateral-Based Lending Facilities

Note: Authors calculated these statistics according to data reported by PBoC, obtained from WIND, as of May 30th 2019.

Despite the rich theoretical literature, it is difficult to empirically identify the causal effects of collateral-based monetary policy on the financial system and real economy due to the lack of policy counterfactuals. In this study, we address the problem using a triple-difference empirical design, by exploiting a unique feature of China’s bond market and a policy intervention by China’s Central Bank.

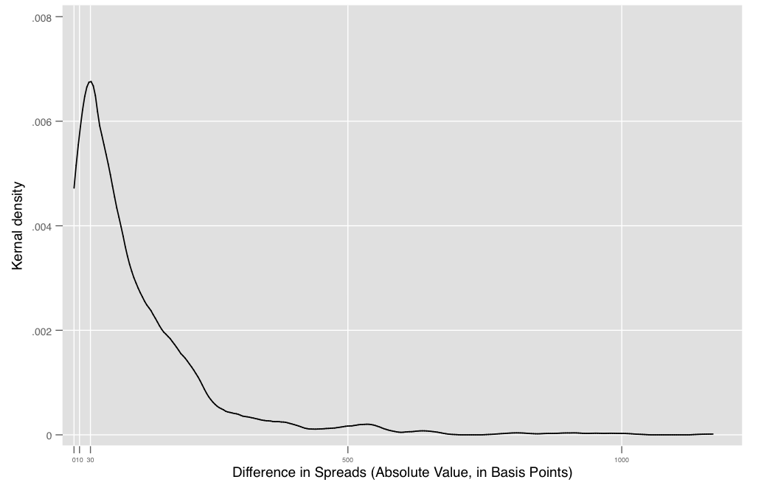

The unique feature of China’s bond market is that most corporate bonds are dual-listed in two trading platforms: the interbank market and the exchange market. These two platforms are subject to different regulations and differentially affected by monetary policy interventions; and most importantly, they are largely segmented due to difficulties in arbitrage. As a result, even though the dual-listed bonds have exactly the same fundamentals, they can have different prices (or spreads) in the two markets, due to different liquidity in the two markets (see Figure 2 for the evidence of the spread difference of the dual-listed bonds in the two markets).

Figure 2: Kernel Distribution of Absolute Difference between Spreads of Dual-Listed Bonds in Interbank Market and Exchange Market: Secondary Market

We exploit a quasi-natural experiment in China to address the lack of counterfactuals. MLF is a monetary policy tool that allows eligible commercial banks and policy banks to borrow from PBoC with collaterals. On June 1, 2018, the PBoC for the first time made (1) corporate bonds; (2) bonds issued by small and micro firms (Xiaowei Bonds); (3) bonds to support the green economy (Green Bonds); and (4) financial bonds serving agriculture and rural areas (Sannong Bonds) that are rated AA or higher eligible as collateral for a Medium-term Lending Facility (MLF). Prior to the expansion, MLF only accepts Treasury bonds, central bank bills, policy bank financial bonds, municipal bonds, and AAA corporate bonds as collateral. Importantly, the policy only applies to targeted bonds in the interbank market, but not to the same dual-listed bonds in the exchange market. This enables us to take a triple-difference approach to identify the effects of the policy. By comparing the change in the difference in spreads between newly eligible bonds and other bonds in the interbank market before and after the shock, with the difference of spreads of dual-listed eligible bonds and other bonds in exchange market as counterfactuals, we can identify the causal effect of the collateral-based policy on bond prices.

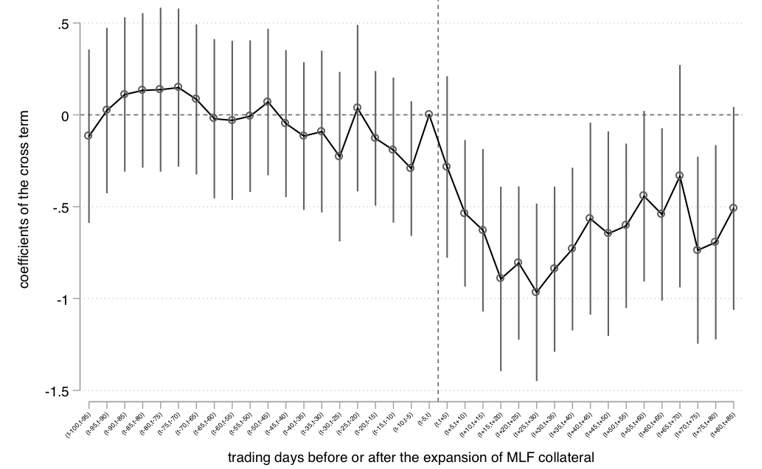

The Effect on Bonds in the Secondary Market

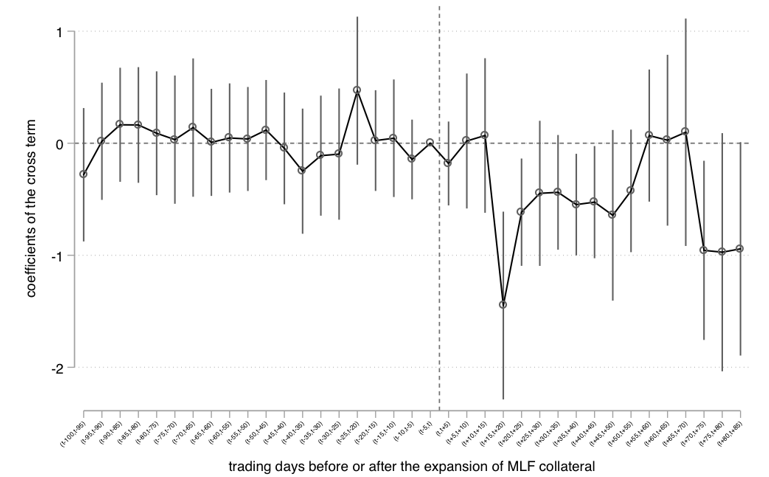

We use daily bond transaction data from Jan. 1 to Sept. 30, 2018 obtained from WIND to identify the effect of the expansion of MLF collateral in the secondary bond market. We find that the collateral-based monetary policy effectively decreases the spreads of the treated bonds in the interbank market. The policy leads to an average reduction of the spreads of the newly collateralizable bonds by 42–62 basis points (bps)—which is about 13–20 percent of the mean spreads—in the interbank market compared to the dual-listed bonds in the exchange market (see Figure 3 for parallel trend analysis of the policy effect).

Interestingly, we also find that the funding cost reduction in the interbank market is not restricted to the newly collateral-eligible bonds; in fact, the overall funding cost of the interbank market falls in general due to generally more available collateral in the market.

Note: Figure 3 plots the 5-day change in spreads of bonds in secondary market before and after the MLF policy on June 1st, 2018, ceteris paribus. Each dot in the window [t-5 + 5k, t + 5k] stands for the point estimate of coefficient of DDD term. The vertical whisk around the point is the associated 95 percent confidence interval. The point in the window [t-5, t] is normalized to 0. Panel (a) presents result from regression using a sample of AA, AA+, and AAA enterprise bonds and financial bonds. Panel (b) presents results from regression using dual-listed bonds. For details of sample construction, please refer to our paper.

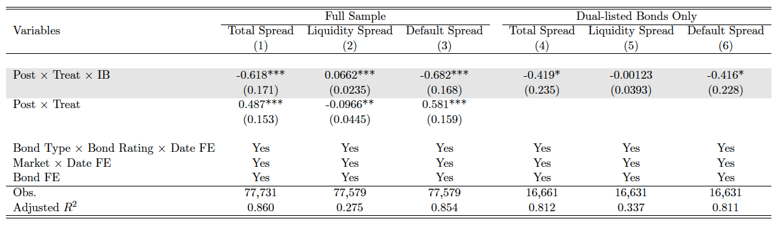

Liquidity Spread and Default Spread

We further decompose the bond spread into liquidity risk premium and default risk premium, and find that the reduction in the spreads of the treated bonds in the interbank market is mostly attributed to a reduction in the perceived default risk instead of the market liquidity risk (see Table 2). This is consistent with the leverage theory from Geanakoplos (2010), which argues that a lower haircut of the collateral increases the leverage of the optimists, who holds beliefs of lower default risk; since these optimists are marginal buyers, their higher leverage ratio can push up asset prices. It is also consistent with the view that the treated bonds are less likely to default because the funding costs of rolling over these bonds are now lower.

Table 2: Liquidity Spread vs. Default Spread in the Secondary Market

Pass-Through to Primary Market

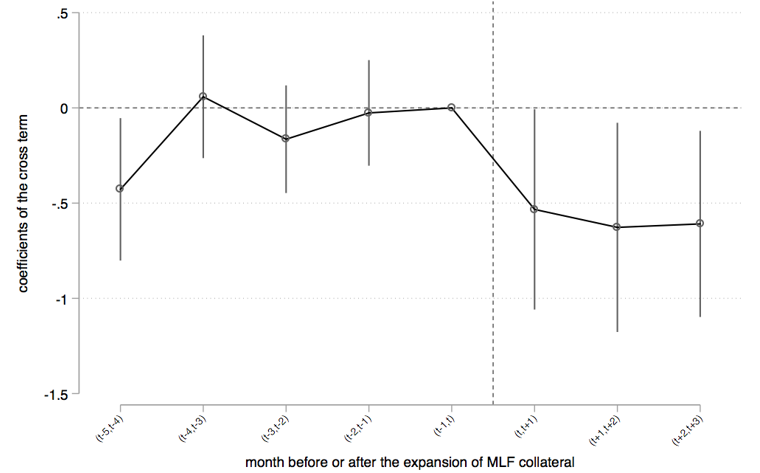

We also analyze the pass-through effect of the secondary market policy shock to the primary market (new issuance market). We use bond issuance data at day level from January 1, 2018 to August 31, 2018, obtained from WIND to identify the effect of the expansion of MLF collateral in the primary market.

We find that making the treated bonds collateral-eligible for MLF in the interbank (secondary) market also reduces their spreads at issuance in the interbank market by 53.8 basis points, ceteris paribus. That is, the pass-through rate is between approximately 85 percent and as high as more than 100 percent. Since the spread reduction of the newly issued collateral-eligible bonds reflects a reduction in the funding cost of new real investments, our estimated high pass-through rate to the primary bond issuance market thus indicates a real effect of the collateral-based monetary policy.

Figure 4: Parallel Trend and Dynamic Effects in the Primary Market

Shopping for Venue

The reduction of bond spreads in the primary market implies reduction of funding costs for the firms issuing the targeted bonds in the interbank market compared to those in the exchange market. An additional implication is that, to the extent that bond issuers have a choice of which market—the interbank market or the exchange market—to issue their bonds, we may expect that eligible firms would take advantage of the policy and issue bonds in the interbank market. We call this phenomenon “shopping for venue.”

Using bond issuance data from Jan. 1 to Dec. 31, 2018, we find that after June 1, 2018 the odds of bonds being issued in the interbank market relative to that in the exchange market for treated bonds went up by over 60 percent, compared with controlled bonds.

Policy Implications

The findings in this paper suggest that collateral-based monetary policy affects both the financial market and the real economy. Collateral-based monetary policy provides more policy space alongside the traditional interest rate policy. To achieve better execution of the new tools, the central bank can manage a collateral basket. By changing the eligibility and haircuts of the collateral in the basket (intensive margin) and changing the composition of the collateral in the basket (extensive margin), central banks can better navigate and moderate financial cycles and business cycles.

(Hanming Fang, University of Pennsylvania and the National Bureau of Economic Research; Yongqin Wang, School of Economics, Fudan University; Xian Wu is currently Ph.D. student at University of Wisconsin - Madison.)

References

Ashcraft, Adam, Nicolae Garleanu and Lasse Heje Pedersen, L. H. (2011). Two monetary tools: Interest rates and haircuts. NBER Macroeconomics Annual, 25(1), 143–180.

Chen, Hui, Zhuo Chen, Zhiguo He, Jinyu Liu, and Rengming Xie (2018). Pledgeability and asset prices: Evidence from the Chinese corporate bond markets. University of Chicago, Becker Friedman Institute for Economics Working Paper (2018-82).

Fang, Hanming, Yongqin Wang, and Xian Wu (2020). The collateral channel of monetary policy: Evidence from China, NBER Working Paper No. 26792.Geanakoplos, John (2010). The leverage cycle. NBER macroeconomics annual, 24(1), 1–66.

Latest

Most Popular

- VoxChina Covid-19 Forum (Second Edition): China’s Post-Lockdown Economic Recovery VoxChina, Apr 18, 2020

- China’s Joint Venture Policy and the International Transfer of Technology Kun Jiang, Wolfgang Keller, Larry D. Qiu, William Ridley, Feb 06, 2019

- China’s Great Housing Boom Kaiji Chen, Yi Wen, Oct 11, 2017

- Wealth Redistribution in the Chinese Stock Market: the Role of Bubbles and Crashes Li An, Jiangze Bian, Dong Lou, Donghui Shi, Jul 01, 2020

- The Dark Side of the Chinese Fiscal Stimulus: Evidence from Local Government Debt Yi Huang, Marco Pagano, Ugo Panizza, Jun 28, 2017

- What Is Special about China’s Housing Boom? Edward L. Glaeser, Wei Huang, Yueran Ma, Andrei Shleifer, Jun 20, 2017

- Privatization and Productivity in China Yuyu Chen, Mitsuru Igami, Masayuki Sawada, Mo Xiao, Jan 31, 2018

- Evaluating Risk across Chinese Housing Markets Yongheng Deng, Joseph Gyourko, Jing Wu, Aug 02, 2017

- How did China Move Up the Global Value Chains? Hiau Looi Kee, Heiwai Tang, Aug 30, 2017

- China’s Shadow Banking Sector: Wealth Management Products and Issuing Banks Viral V. Acharya, Jun Qian, Zhishu Yang, Aug 09, 2017

Facebook

Facebook  Twitter

Twitter  Instagram

Instagram WeChat

WeChat  Email

Email