The Effect of the China Connect

We study the effect on Chinese firms of the Shanghai (Shenzhen)–Hong Kong Stock Connect. The Connect, introduced in the mid-2010s by the government, provided important capital account liberalization. It created a channel for cross-border equity investments into a select set of Chinese stocks while the overall capital controls policy remained in place. Using a difference-in-difference approach, we find that mainland Chinese firm-level investment is negatively affected by contractionary US monetary policy shocks and that firms in the Connect are more adversely affected than those that remained outside of it. These effects are economically large, robust, and stronger for firms with higher leverage, higher dependence on equity financing, a higher share of foreign sales, and those operating in the non-tradable sector, which is all consistent with a financial channel or balance sheet effect. Because firms would try to stay out of the Connect if increased sensitivity to external shocks were the only effect, we broaden our analysis. We find that firms in the Connect hold more cash, enjoy lower financing costs, and earn higher profits than unconnected firms. The implications of our results contribute to the debate on capital controls.

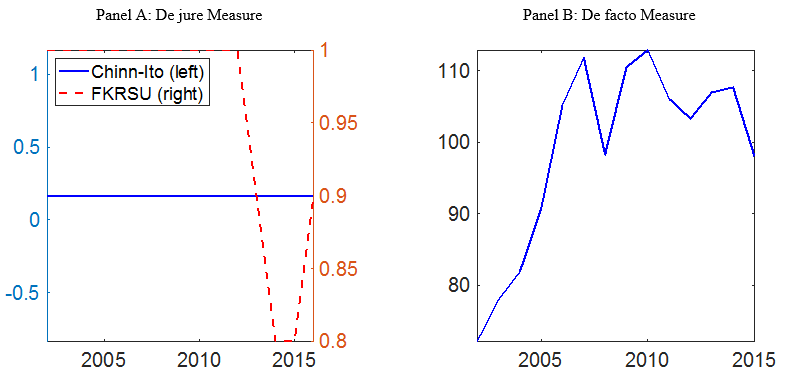

The Shanghai–Hong Kong “Stock Connect” program allows residents of the Chinese mainland, Hong Kong, and other foreign countries to trade eligible stocks listed on other markets through exchange and clearinghouses in their home markets. This program, announced in April 2014 and begun in November 2014 for the Shanghai market, is regarded as a major step toward internationalizing China’s security markets. The program was extended to the Shenzhen exchange in 2016. The Shanghai (Shenzhen)–Hong Kong Stock Connect (“Connect” henceforth) is a natural experiment in equity market liberalization that took place amid an overall capital controls policy in China that remained unchanged. Figure 1 shows both a de jure and de facto measure of Chinese overall capital account restrictions. Clearly, the overall policy is very persistent and has not changed significantly in recent decades.

Figure 1: Chinese Capital Account Restrictions

Note:The figure plots de jure and de facto measures for Chinese capital account policies. Panel A plots the de jure measure from Chinn and Ito (2006) and Fernandez, Rebucci, and Uribe (2015). For Chinn-Ito indexes, a higher value means a higher level of capital account openness, where for Fernandez et al. (2015) index a higher value means a lower level of capital account openness. Panel B plots the de facto measure, i.e. the sum of gross stocks of foreign assets and liabilities as a ratio to GDP. Data come from Lane and Milesi-Ferretti (2007).

Importantly, the Connect allows certain stocks to be eligible to foreign investors while other stocks are restricted and remain available only to domestic investors. This therefore presents a natural experiment on which to study the effect of the Connect on Chinese firms and to jointly test hypotheses concerning spillover effects from external shocks and the efficacy of capital controls policy.

The highly influential literature on the Global Financial Cycle recommends the use of capital controls to create an effective wall against external shocks for emerging markets [IMF (2012); Jeanne et al. (2012); Rey (2015); Miranda-Agrippino and Rey (2019)]. This recommendation emerges from three findings: (1) the global financial cycle is large, (2) the cycle is primarily caused by shocks to US monetary policy, and (3) capital controls effectively shield the real and financial sides of emerging market economies. However, the empirical evidence for the effectiveness of capital controls is mixed [Magud et al. (2018); Rebucci and Ma (2019); Erten et al. (2018)]. It is difficult to reach more consensus because the policy is usually endogenous and sticky: many countries implement capital controls at the same time as adverse events occur and do not change the capital controls frequently. Unlike nationwide capital controls reforms documented in other papers [Henry (2000a, 2000b, 2003) and Bekaert et al. (2005) for example], the Connect program in China provides a clean policy experiment to establish causal relationships.

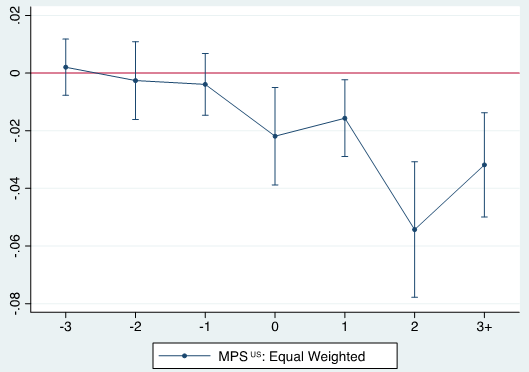

The main hypothesis we investigate is that, if capital controls can curb the effect of external shocks, then Chinese corporate investment in the Connect—with less protection from inland capital controls—will be more sensitive to external shocks than unconnected firms. Our proxy for external shocks is the US monetary policy shocks series used by Rogers et al. (2018), which we use along with quarterly firm-level investment of listed companies in China. Consistent with the hypothesis, we find that firms are more negatively affected by US monetary policy shocks after trading their shares became an option for foreigners through the Connect. Figure 2 shows that corporate investments are more sensitive to US monetary policy shocks once they are included in the Connect. A one percent unexpected increase in the US monetary policy shock reduces corporate investment by 0.02 percent on average for firms included in the Connect compared to firms not in the Connect, after controlling for investment opportunities and economic conditions. In terms of economic magnitudes, it translates into a reduction of 2.8% of average investment rates. Furthermore, those effects are strong and long-lasting for connected firms. Cross-sectional evidence suggests that firms with relatively weaker financial conditions, i.e. with a higher leverage, are affected more. Moreover, the results also support the existence of a financial channel (a balance sheet effect), given that firms that rely more on equity financing for investment, operating in the non-tradables sector or with a higher share of foreign sales, are important drivers of our results.

Figure 2: Corporate Investment Sensitivity to MPSUS

Note: The figure plots corporate investment sensitivity to MPSUS of connected firms relative to unconnected firms, i.e. the coefficient estimates with a 95 % confidence interval from the estimation in the paper. Time 0 is the year when the firms are selected into the China Connect.

Our second hypothesis is that, if this increased sensitivity of Chinese corporate investment to external shocks was the only effect of the Connect, firms would lobby (or act) to remain out of the Connect. Because we do not observe such behavior, we investigate additional effects of the Connect on Chinese firms. We establish that firms in the Connect raise more cash (by 3.7 % on average), enjoy lower financing costs (by 0.3% on average), and earn higher net income on equity (ROE) and assets (ROA) (by 14.7 % and 4.3% on average respectively), relative to firms outside of the Connect.

Our empirical findings have strong policy implications. The shock emphasized in the literature on Global Financial Cycles—US monetary policy shocks—has an important spillover effect that works through the opening of the domestic Chinese stock market. The shock can spill over even with a very tight overall capital controls policy. Nevertheless, our results indicate that a capital controls policy is still effective in curbing the shock’s negative impact on Chinese corporate investment, thus preserving some degree of monetary policy independence relative to fully open capital markets.

Disclaimer: The views in this paper are solely the responsibility of the authors and should not be interpreted as reflecting the views of the Board of Governors of the Federal Reserve System or of any other person associated with the Federal Reserve System.

(Chang Ma, Fanhai International School of Finance, Fudan University; John Rogers, Fanhai International School of Finance, Fudan University; Sili Zhou, Faculty of Business Administration, University of Macau.)

References

Bekaert, G., Harvey, C.R. and Lundblad, C., 2005. Does financial liberalization spur growth? Journal of Financial Economics, 77(1), .3–55. https://www.sciencedirect.com/science/article/pii/S0304405X04002193

Chinn, M.D. and Ito, H., 2006. What matters for financial development? Capital controls, institutions, and interactions. Journal of Development Economics, 81(1), 163–192. https://www.sciencedirect.com/science/article/pii/S0304387805001409

Erten, B., Korinek, A. and Ocampo, J.A., 2019. Capital controls: Theory and evidence, Journal of Economic Literature, forthcoming.

Fernández, A., Rebucci, A. and Uribe, M., 2015. Are capital controls countercyclical? Journal of Monetary Economics, 76, 1–14. https://www.sciencedirect.com/science/article/pii/S0304393215000914

Henry, P.B., 2000a. Do stock market liberalizations cause investment booms? Journal of Financial Economics, 58(1–2), 301–334. https://www.sciencedirect.com/science/article/pii/S0304405X00000738

Henry, P.B., 2000b. Stock market liberalization, economic reform, and emerging market equity prices. The Journal of Finance, 55(2), 529–564. https://onlinelibrary.wiley.com/doi/abs/10.1111/0022-1082.00219

Henry, P.B., 2003. Capital-account liberalization, the cost of capital, and economic growth. American Economic Review, 93(2), 91–96. https://www.aeaweb.org/articles?id=10.1257/000282803321946868

IMF 2012. The liberalization and management of capital flows: An institutional view. http://www.scielo.org.co/scielo.php?script=sci_arttext&pid=S0124-59962013000100010

Jeanne, O., Subramanian, A. and Williamson, J., 2012. Who needs to open the capital account. Peterson Institute.

Lane, P.R. and Milesi-Ferretti, G.M., 2007. The external wealth of nations Mark II: Revised and extended estimates of foreign assets and liabilities, 1970–2004. Journal of international Economics, 73(2), 223–250. https://www.sciencedirect.com/science/article/pii/S0022199607000591

Magud, N. E., Reinhart, C.M., and Rogoff, K.S., 2018. Capital controls: Myth and reality, Annals of Economics and Finance, 19, 1–47.

Miranda-Agrippino, S. and Rey, H., 2015. US monetary policy and the global financial cycle (No. w21722). National Bureau of Economic Research. https://www.nber.org/papers/w21722

Rebucci, A. and Ma, C., 2019. Capital controls: A brief survey of the new literature, Manuscript.

Rey, H., 2015. Dilemma not trilemma: the global financial cycle and monetary policy independence (No. w21162). National Bureau of Economic Research. https://www.nber.org/papers/w21162

Rogers, J.H., Scotti, C. and Wright, J.H., 2018. Unconventional monetary policy and international risk premia. Journal of Money, Credit and Banking, 50(8), 1827–1850. https://onlinelibrary.wiley.com/doi/abs/10.1111/jmcb.12511

Latest

Most Popular

- VoxChina Covid-19 Forum (Second Edition): China’s Post-Lockdown Economic Recovery VoxChina, Apr 18, 2020

- China’s Joint Venture Policy and the International Transfer of Technology Kun Jiang, Wolfgang Keller, Larry D. Qiu, William Ridley, Feb 06, 2019

- China’s Great Housing Boom Kaiji Chen, Yi Wen, Oct 11, 2017

- Wealth Redistribution in the Chinese Stock Market: the Role of Bubbles and Crashes Li An, Jiangze Bian, Dong Lou, Donghui Shi, Jul 01, 2020

- The Dark Side of the Chinese Fiscal Stimulus: Evidence from Local Government Debt Yi Huang, Marco Pagano, Ugo Panizza, Jun 28, 2017

- What Is Special about China’s Housing Boom? Edward L. Glaeser, Wei Huang, Yueran Ma, Andrei Shleifer, Jun 20, 2017

- Privatization and Productivity in China Yuyu Chen, Mitsuru Igami, Masayuki Sawada, Mo Xiao, Jan 31, 2018

- Evaluating Risk across Chinese Housing Markets Yongheng Deng, Joseph Gyourko, Jing Wu, Aug 02, 2017

- How did China Move Up the Global Value Chains? Hiau Looi Kee, Heiwai Tang, Aug 30, 2017

- China’s Shadow Banking Sector: Wealth Management Products and Issuing Banks Viral V. Acharya, Jun Qian, Zhishu Yang, Aug 09, 2017

Facebook

Facebook  Twitter

Twitter  Instagram

Instagram WeChat

WeChat  Email

Email